Looking for long opportunities outside the United States

The Sandbox Daily (2.19.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

setup for Chinese equities

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 +0.24% | Dow +0.16% | Nasdaq 100 +0.05% | Russell 2000 -0.34%

FIXED INCOME: Barclays Agg Bond +0.14% | High Yield +0.08% | 2yr UST 4.271% | 10yr UST 4.533%

COMMODITIES: Brent Crude +0.44% to $76.17/barrel. Gold +0.11% to $2,952.2/oz.

BITCOIN: +1.47% to $96,564

US DOLLAR INDEX: +0.10% to 107.162

CBOE TOTAL PUT/CALL RATIO: 0.76

VIX: -0.52% to 15.27

Quote of the day

“I asked God for flowers and He gave me rain.”

- Proverb

Setup for Chinese equities comes into focus

Macro trade ideas are wonderful ponds to go fishing, in that the setups 1) have a reasonable chance of occurring and 2) remain out-of-consensus views / go against general market positioning to provide added convexity.

For years now, investors have held a negative view on China and correctly so.

So much so the China weighting in the MSCI Emerging Markets ETF dropped from 40% exposure to 25% over the last five years.

From an economic perspective, China faces a mountain of challenges:

the property market is an absolute mess sinking under the weight of its own debt

a shrinking population and aging demographics that inevitably will lead to a reduction in potential growth, which some have projected to be 2-4% per annum over the next ten or twenty years

foreign tariffs, trade restrictions, and receding globalization have caused excess capacity, leading to weaker pricing power

debt burdens of local governments remain elevated

high youth unemployment/ underemployment are limiting consumption and contributing to an underfunded pension system

From a market perspective, China has been underwhelming:

the property market – the traditional source of wealth and saving – has plunged

equities are middling at best

bonds have performed fine but sovereign yields are now sub-2%

little to no yield on cash

can’t legally invest in Bitcoin

limited amount of money you can get out of the country legally

the only real solution has been to buy gold and other physical assets, which has helped push gold and other commodity prices to higher

And yet, the temptation for Chinese equities – specifically its tech and tech-adjacent stocks – has some traders salivating because the setup checks so many “opportunity” boxes.

Don’t fight the trend/momentum of the market.

The MSCI China Index is down -40% on a total return basis in USD from its peak on February 17, 2021. But, since the low in January 2024, the Chinese market is up 50% compared to 28% for the U.S.!

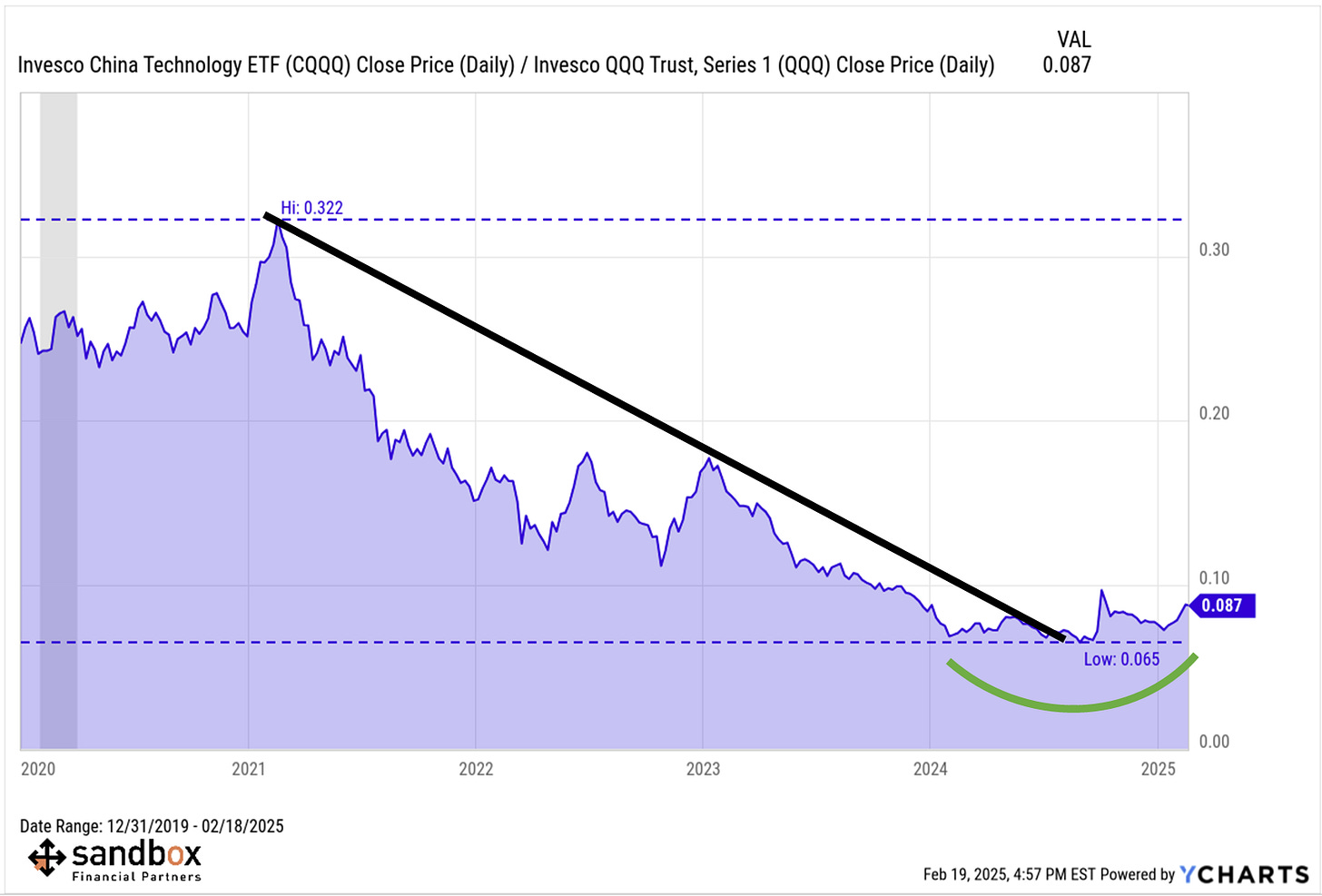

Similarly, Chinese Tech has underperformed U.S. Tech since the February 2021 peak but has outperformed over the past year. The relative performance appears to have put in a bottom over the last year, as shown in the chart below.

Don’t fight trends in monetary policy.

The People’s Bank of China (PBOC) has been easing monetary policy, starting with the bazooka last September. In addition to a lower prime rate and continued reductions in the reserve requirement ratio, which remains well above those of developed economies, yields are low on an absolute basis.

Don’t fight the government.

The government has provided a steady stream of economic stimulus and supportive measures for the equity market. Equities are the only asset class capable of funding the pension system. In January, Chinese authorities told state-owned insurance companies and mutual funds to invest more in stocks. More measures are on the way.

Stay disciplined.

Investors interested in this trade must be patient. While sentiment is at a bearish extreme and positioning is light and short interest is moving higher, these primary trend reversals don’t happen overnight. They often unfold over longer time frames.

Also, Chinese government officials can change the casino rules overnight and without notice. They’ve done so many times and they will do so again.

Implement trailing stops underneath to limit losses in case events don’t unfold in a straight line.

Beware of the crowd at extremes.

China has been labeled “uninvestable.” Foreign direct investment (FDI) has been negative. Record portfolio inflows in October were followed by record outflows in November. Pessimism toward Chinese equities has been high for years.

As a result, Chinese equity valuations are less than half those for the U.S. using several traditional equity valuation metrics.

When investors find the rare setups in which you can marry favorable fundamentals and technicals together, these are the opportunities one has to seriously consider.

And, as history has shown time and time again, when China outperforms, it really outperforms.

Source: Strategas, YCharts, Ned Davis Research, Goldman Sachs, All Star Charts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: