Loss aversion, plus micro-caps, global central banks, ChatGPT, wage growth, and state taxes

The Sandbox Daily (5.4.2023)

Welcome, Sandbox friends.

May the 4th be with you!

Today’s Daily discusses:

loss aversion

micro-caps on life support

global central bank update

ChatGPT’s growth rate is bonkers

wage growth for job-stayers vs. job-changers

which states have the lowest taxes?

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.37% | S&P 500 -0.72% | Dow -0.86% | Russell 2000 -1.18%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield -0.29% | 2yr UST 3.788% | 10yr UST 3.377%

COMMODITIES: Brent Crude +0.28% to $72.53/barrel. Gold +1.06% to $2,058.5/oz.

BITCOIN: +1.26% to $28,906

US DOLLAR INDEX: +0.08% to 101.425

CBOE EQUITY PUT/CALL RATIO: 0.75

VIX: +9.54% to 20.09

Quote of the day

“Life NEVER gets easier…. you just get BETTER at dealing with the BullShit.”

- Ice T

Loss aversion

No one likes losing. In fact, we’ll do almost anything to avoid it.

Behavioral finance calls this loss aversion.

The logic? We're so averse to losing that we feel the pain of loss more acutely than the pleasure of gain.

Something to consider when managing portfolio risk, especially when a trade or position starts working against you.

Source: Carl Richards, Management Study Guide

Micro caps on life support

The riskiest parts of the market are avoiding a major break down, at least for now.

If micro caps lose this key level of polarity (blue horizontal bar below), it could be a harbinger of what's to come next for risk assets.

The iShares Micro-Cap ETF (IWC) is down ~18% since the recent peak of $121.88 just two short months ago on February 2nd.

Source: Honeystocks

Global central bank update

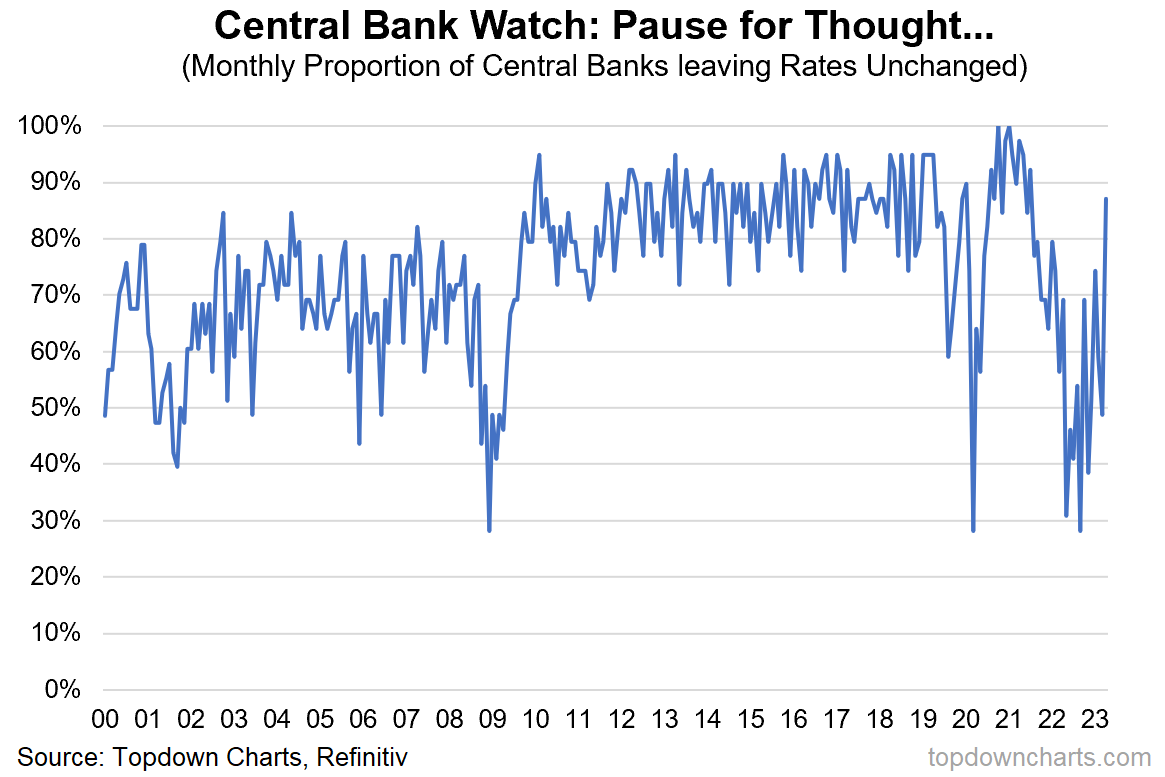

Have we seen the peak in hawkishness from central banks?

The chart below tracks the proportion of central banks who left interest rates unchanged during the most recent month, meaning they neither cut nor hiked rates. This data series tracks 39 central banks across developed and emerging markets representing ~90% of world’s GDP.

In April, at just under 90%, it reached the highest level since mid-2021 – the period in time when macro policy pivoted and the global synchronization of rate hikes began.

This would suggest the bulk of tightening is most likely behind us as inflationary pressures begin to ease-off and recession risks come into focus. But a “pause” is the key operating word for now; “cuts” are premature at this point, unless market instability warrants an easing in policy conditions.

Source: Topdown Charts

ChatGPT’s growth rate is bonkers

OpenAI’s ChatGPT reached 100 million users in 2 months.

Let me repeat that: 100 million people signed up for an AI chatbot just 2 months after launch.

This is the fastest growth rate of any product to hit massive scale in history. Reviewing the chart below, it is running laps around other game-changing products and technologies that have redefined the landscape over the last 20 years.

Analysts believe the viral launch of ChatGPT will give OpenAI and its anchor investor, Microsoft, a first-mover advantage against all other Artificial Intelligence companies, including Google.

“In 20 years following the internet space, we cannot recall a faster ramp in a consumer internet app,” UBS analysts wrote in the note

Source: The Daily Shot

Wage growth for job-stayers vs. job-changers

Yesterday, the private payrolls firm ADP released their monthly employment report.

The change in annual pay for job-stayers in April was +6.7% year-over-year, down from +6.9% in March and the lowest since December 2021.

The change in annual pay for job-changers in April was +13.2% YoY, down from +14.2% in March and the lowest since November 2021.

Wage inflation remains quite high but is starting to roll over, albeit slowly. The turnover rate in companies will remain elevated as long as the average job-changer is still commanding double digit wage gains.

Source: ZeroHedge

Which states have the lowest taxes?

Always interesting to see the latest update on total tax burden to individuals per state.

Seeing tax burdens as a percentage of personal income cuts through the noise of analyzing tax rates.

Looking at this data from different angles provides key insights, including the fact that states without income tax don't necessarily have the lowest tax burdens. They make up for it with high taxes on what people buy on or the property they own. Plus, states shift many taxes from residents to visitors and tourists via sales and other taxes.

Understanding how your state taxes people and corporations, compared to the services it provides residents, can give a sense of what a state prioritizes.

Source: USA Facts

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.