Low volatility good for stocks, plus economic strength, AI on power demand, and 🧁 weekend sprinkles 🧁

The Sandbox Daily (5.17.2024)

Welcome, Sandbox friends.

Hope everyone had a better day than the Louisville Metro Police Department – yikes! Not every day do police mistakenly arrest the world’s #1 golfer on his way to a private golf club competing for a major championship. "I feel like my head is still spinning," Scheffler said after carding a -5 in Round 2 to finish T-4. "I did spend some time stretching in a jail cell – that was a first for me.” 😂🤣

Today’s Daily discusses:

how can low volatility be constructive?

why is the economy still so strong?

is AI already boosting U.S. power demand?

weekend sprinkles

Let’s dig in.

Markets in review

EQUITIES: Dow +0.34% | S&P 500 +0.12% | Russell 2000 -0.03% | Nasdaq 100 -0.06%

FIXED INCOME: Barclays Agg Bond -0.32% | High Yield +0.01% | 2yr UST 4.827% | 10yr UST 4.422%

COMMODITIES: Brent Crude +0.83% to $83.96/barrel. Gold +1.43% to $2,419.5/oz.

BITCOIN: +2.19% to $66,847

US DOLLAR INDEX: +0.03% to 104.497

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: -3.46% to 11.99

Quote of the day

“Investing is a psychological game. A suboptimal strategy you can live with and execute is better than an optimal one you can't.”

- William Bernstein in The Intelligent Asset Allocator

How can low volatility be constructive?

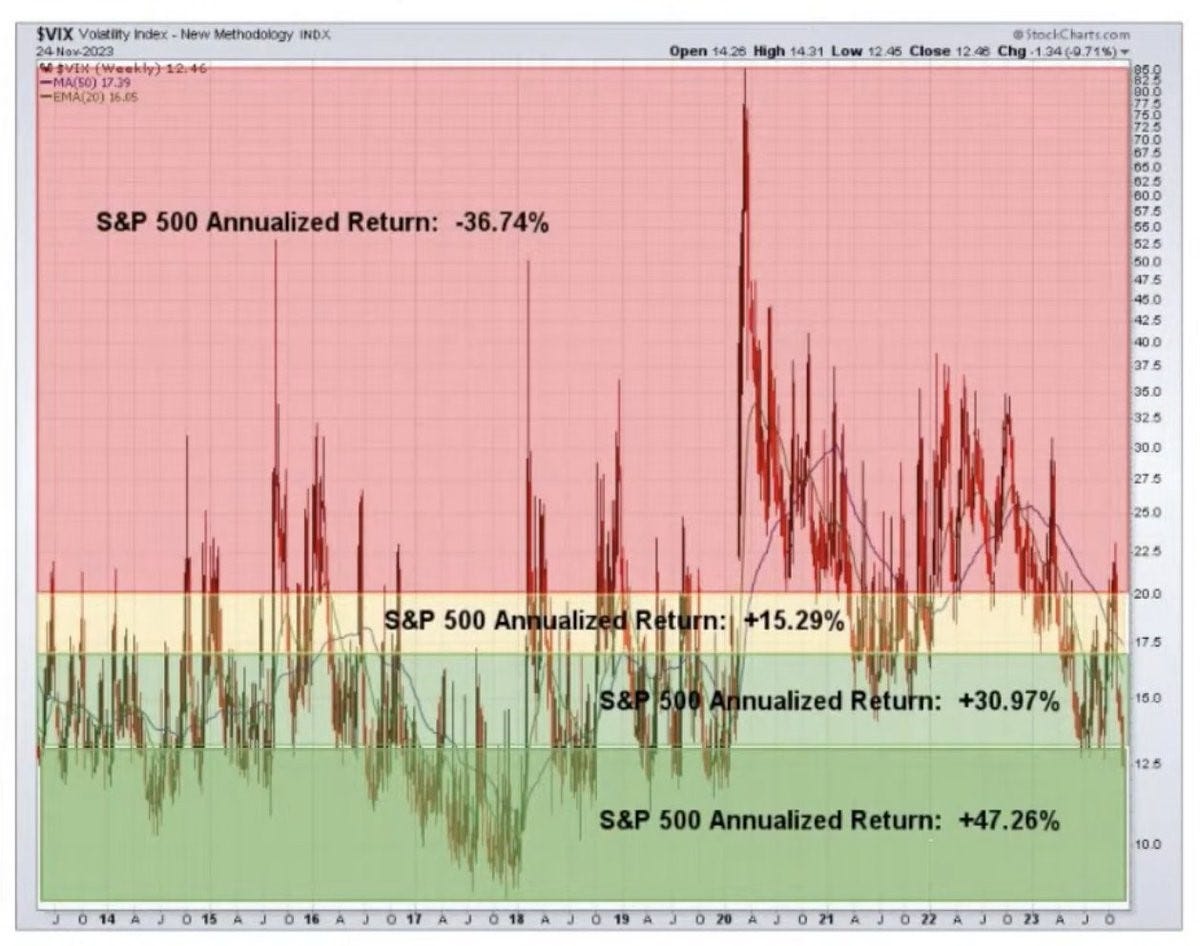

Historically, when the CBOE Market Volatility Index (VIX) is low, the S&P 500 produces its strongest forward returns.

Daily sub-13 VIX closes – such as those we’ve experienced on and off over the last 6 months – produce annualized returns of +47%, markedly higher than any other volatility environment.

Who would’ve thought when volatility was low – i.e. greater certainty around price – that market’s perform constructively on a go forward basis.

Source: Seth Golden

Why is the economy still so strong?

There are several reasons why the economy continues to show its resilience despite everything thrown at it over the last 5 years. One undisputable fact that must be acknowledged is the reduced interest rate sensitivity of liabilities outstanding, despite higher rates around the globe.

While the largest borrowing market in the United States is mortgages, 40% of homeowners don’t have one.

For those that financed their home with a mortgage, roughly half of those homeowners have an interest rate locked in below 4%.

Moving beyond the consumer, most businesses during COVID termed out their debt at very low levels. With the Investment Grade market having grown from $3 trillion in 2009 to $9 trillion today, the interest-rate sensitivity of corporate America has declined.

Consumers and firms shielded themselves from higher interest rates prior to this synchronous rate hiking cycle, which made the economy less sensitive to higher interest rates. With this backdrop, it is not surprising that inflation and labor costs remain high.

Source: Torsten Slok

Is AI already boosting U.S. power demand?

The price of electricity is surging, having risen by ~8% annually over the last 3 years.

Going back to 1950, there have only been 3 other price increases of a similar magnitude. The electricity inflation in 1973 and the early 1980s was related to the surging oil price due to our relationship with Iran. The cycle that peaked in 2008 occurred when the price of crude oil briefly touched $150 a barrel, and natural gas was over $14.

The current inflationary cycle is unique, driven by electricity demand rather than surging input prices. In fact, the price of natural gas is near a 30-year low of $2.75. Natural gas is the predominant energy source used in electricity generation.

Investors are focused on how AI and data centers may boost power demand over the next decade, after U.S. demand stagnated for much of the last three decades.

Goldman Sachs expects U.S. power consumption growth to accelerate sharply to an annual average 2.4% pace in 2022-2030, boosted by data centers, AI, and EVs. Such an acceleration in power demand growth to a faster pace than GDP growth would be significant because it has not occurred over the last 30 years. Specifically, across the most recent three business cycles ending in 1992-2023, U.S. power consumption growth averaged 1.6 percentage points below U.S. real GDP growth.

“Utility stocks are suddenly white hot, thanks largely to artificial intelligence’s thirst for electricity. Investors accustomed to thinking of the sector as sleepy and safe need to realize the game has changed,” says Jason Zweig of the Wall Street Journal.

Source: Mike Zaccardi, Goldman Sachs Global Investment Research, Jason Zweig

Weekend sprinkles

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

The Irrelevant Investor – Why investors love being scared (Michael Batnick)

TKer – The state of the stock market in 18 charts (Sam Ro)

The Alchemy of Money – The algorithm behind Jim Simons’s success (Frederik Gieschen)

Genuine Impact – What happens when gold, US bond yields, and the US dollar rise together? (Substack)

Books

Charles Duhigg – Supercommunicators: How to Unlock the Secret Language of Connection (Amazon)

Podcasts

Smartless – Hosts Jason Bateman, Sean Hayes, and Will Arnett are joined by Larry David (Spotify, Apple Podcasts)

Masters in Business – Host Barry Ritholtz is joined by Savita Subramanian (Spotify, Apple Podcasts)

Movies

American Fiction – Jeffrey Wright, John Ortiz, and Sterling K. Brown (IMDB)

Drive – Ryan Gosling, Carey Mulligan, Bryan Cranston (IMDB)

Music

Taylor Swift feat. Bon Iver – Exile (Long Pond Studio Sessions) (Spotify, Apple Music)

fun. – All Alright (Spotify, Apple Music)

Razorlight – In the Morning (Spotify, Apple Music)

deadmau5 – Aural Psynapse (Spotify, Apple Music)

Lupe Fiasco feat. John Legend – Never Forget You (Spotify, Apple Music)

Pop Culture

Today’s best Scottie Scheffler memes (Trung Phan)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.