Mag 7 and the circadian rhythms of life

The Sandbox Daily (8.7.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Mag 7 and the circadian rhythms of life

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.32% | S&P 500 -0.08% | Russell 2000 -0.29% | Dow -0.51%

FIXED INCOME: Barclays Agg Bond -0.08% | High Yield -0.10% | 2yr UST 3.722% | 10yr UST 4.242%

COMMODITIES: Brent Crude -0.85% to $66.32/barrel. Gold +0.98% to $3,467.2/oz.

BITCOIN: +1.93% to $117,320

US DOLLAR INDEX: -0.07% to 98.108

CBOE TOTAL PUT/CALL RATIO: 0.86

VIX: -1.19% to 16.57

Quote of the day

“Your life does not get better by chance; it gets better by change.”

- Jim Rohn

Mag 7 and the circadian rhythms of life

Love it or hate it, it’s the Mag 7 and everyone else. The S&P 493 – the other 493 companies within the benchmark – simply can’t compete.

It won’t always be this way.

Like most of life, things come and go.

As a kid growing up in the Chicago suburbs, you had to gush over Michael Jordan and the Chicago Bulls throughout the 1990s. So many good teams and players – Pistons, Knicks, Ewing, Malone, Barkley – just couldn’t get it done. Then, Jordan retired and the NBA suffered through an identity crisis similar to the PGA Tour once Tiger was done.

The Beatles owned the 60s, transforming rock & roll music and monopolizing the charts. For much of the decade, they cornered the billboard charts with multiple top-10 singles and albums simultaneously – despite incredible creativity and performances elsewhere. But, McCartney ditched the band in the April 1970 and in came classic rock (awesome) and disco (whoops!).

The Golden Age of Cinema saw rise to a few key studio houses, ushering in a wave of iconic stars (Humphrey Bogart, Cary Grant, Rita Hayworth) and marking significant technological advancements in filmmaking. Today, no one under the age of 25 can muster up the names of even one or two major studios.

Life moves in waves.

Momentum builds, crowns are adorned as the trend dominates, and then a disruptive kernel upends the status quo – resetting the cycle and reminding us that nearly everything in life is temporary.

We’re caught in the circadian rhythms of life.

But right now, in this moment, the trend is your friend and it’s wrong to fight the Mag 7.

A simple show-and-tell demonstration for those at home:

The story is performance because at the end of the day, as JC likes to say, only price pays. The Magnificent 7 aren’t just driving the bus – they built it, filled it with cash, and left the S&P 493 chasing fumes.

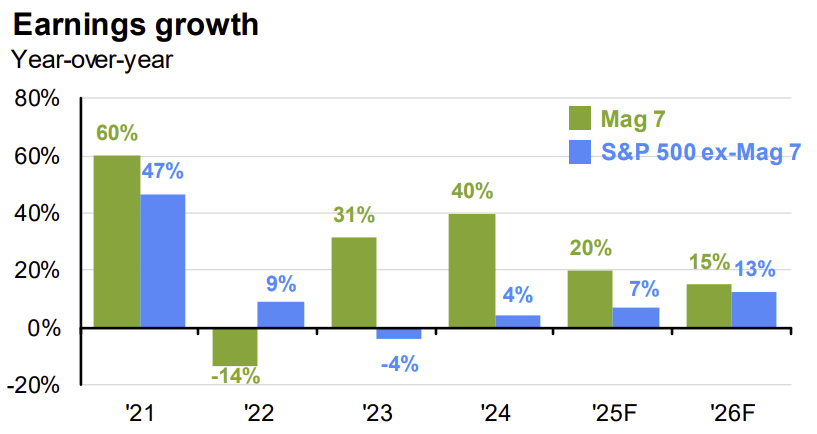

It’s important to remind ourselves the Mag 7’s dominance isn’t hype – it’s basic math. At its core, the stock market is a long-term weighing machine and what it weighs most is earnings. While prices can swing on sentiment or idiosyncratic developments, stocks over time tend to follow the direction of earnings growth because a company’s ability to generate profit ultimately drives its value.

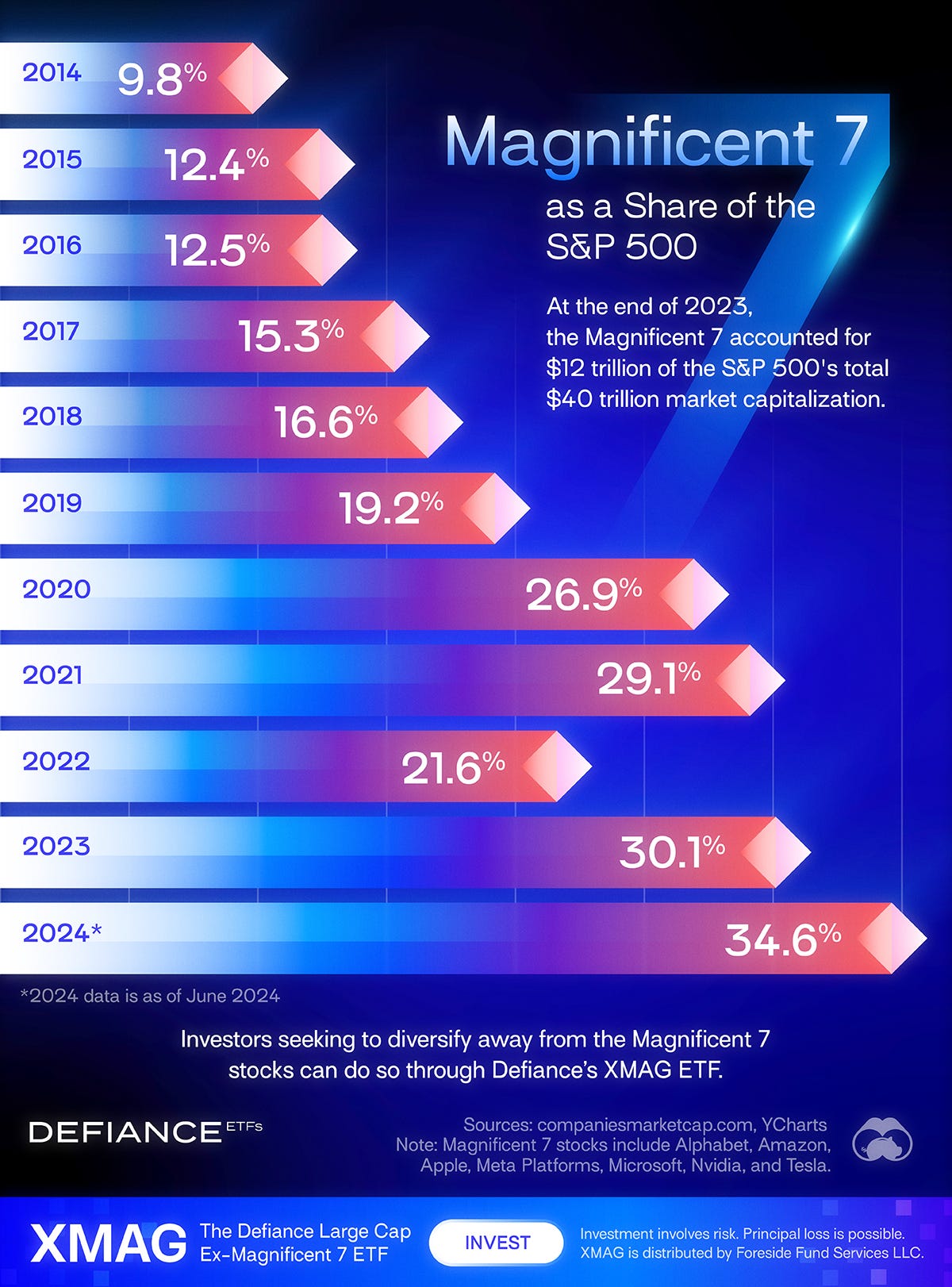

Despite the S&P 500 index consisting of 500 companies, the Mag 7’s importance to investor portfolios cannot be understated because of its proportionate share of gains contributed to the index in recent years. Over the last decade, the market capitalization of these 7 stocks has grown by nearly 800%. This compares to 150% for the broader benchmark.

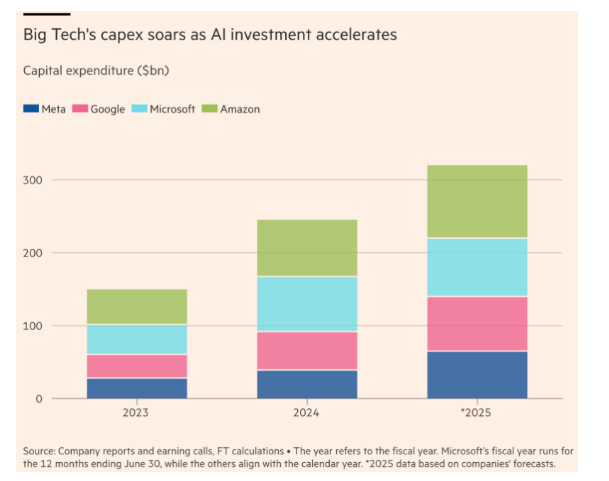

In the last two years alone, we’re looking at a double in AI CapEx investment across these four companies alone.

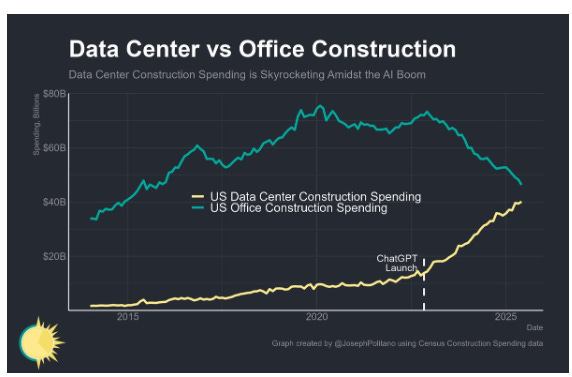

Data Centers are the skeletal backbone of AI and cloud infrastructure. As an investment category/product, appetite for Infrastructure Funds has exploded as investors position themselves ahead of the Data Center story. With skyrocketing demand for power, connectivity, and cooling systems, infrastructure – once a sleepy, yield-focused sector – is now seen as a front-row seat to the digital economy’s next explosive growth wave.

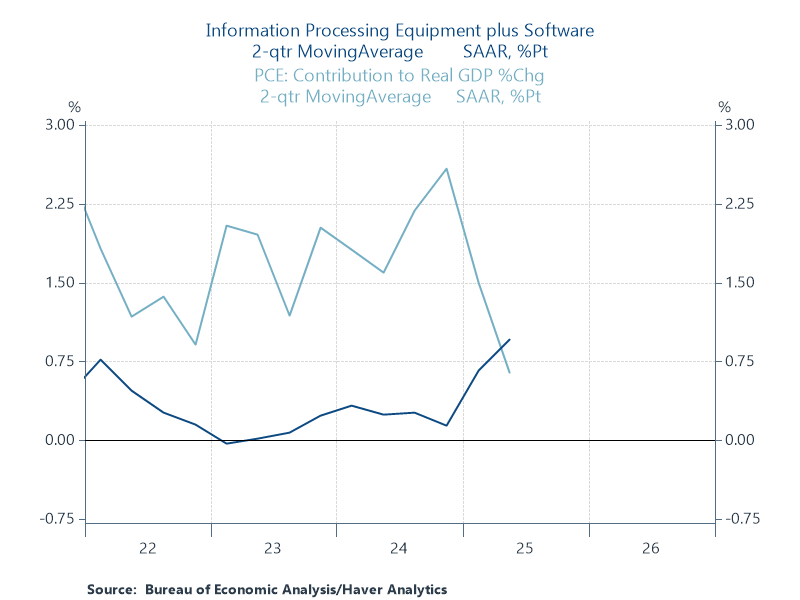

I’ve saved the best one for last. As Neil Dutta of RenMac explains: “So far this year, AI capex, which we define as information processing equipment plus software has added more to GDP growth than consumers' spending.” Now in plain English: AI spending (dark blue line) is contributing more U.S. economic growth than consumer spending (light blue line), which is ~70% of our total economy.

Even as we see a softening in the economy in 2025, the disconnect between Wall Street and Main Street has grown, where a slowing (but not contracting economy) is still adequate for these tech hyper-scaler growth stocks, which are less impacted by tariffs and the timing of rate cuts.

So, the market concentration that we might otherwise worry about, in this case, is helpful for the stock market, as the >30% in the Mag 7 remains in better shape than the remaining S&P 493.

The Mag 7 can continue to benefit from the AI capex cycle, while the other 493 can take the bigger brunt from economic slowdown and inflation, either in the form of lower margins or cost-cutting measures like layoffs.

Sources: YCharts, JPMorgan Guide to the Markets, Visual Capitalist, Financial Times, Apricitas Economics, RenMac

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Chart 1 is visual delight testiment to why they are mag7