Mag 7 payments to shareholders, plus interest on your cash, inflation, and bankruptcies

The Sandbox Daily (11.21.2024)

** Quick programming note before we begin. **

The Sandbox Daily will be off next week for family travel and Thanksgiving. Expect the newsletter to resume its normal schedule on Monday, December 2nd.

Welcome, Sandbox friends.

Today’s Daily discusses:

Mag 7 shareholder payments

interest-bearing cash investments

higher inflation getting priced into bond markets

U.S. bankruptcies YTD surge past pandemic high

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.65% | Dow +1.06% | S&P 500 +0.53% | Nasdaq 100 +0.36%

FIXED INCOME: Barclays Agg Bond -0.05% | High Yield +0.04% | 2yr UST 4.353% | 10yr UST 4.424%

COMMODITIES: Brent Crude +1.94% to $74.22/barrel. Gold +0.75% to $2,671.7/oz.

BITCOIN: +3.89% to $98,112

US DOLLAR INDEX: +0.36% to 107.069

CBOE EQUITY PUT/CALL RATIO: 0.80

VIX: -1.69% to 16.87

Quote of the day

“Success is walking from failure to failure with no loss of enthusiasm.”

- Winston Churchill

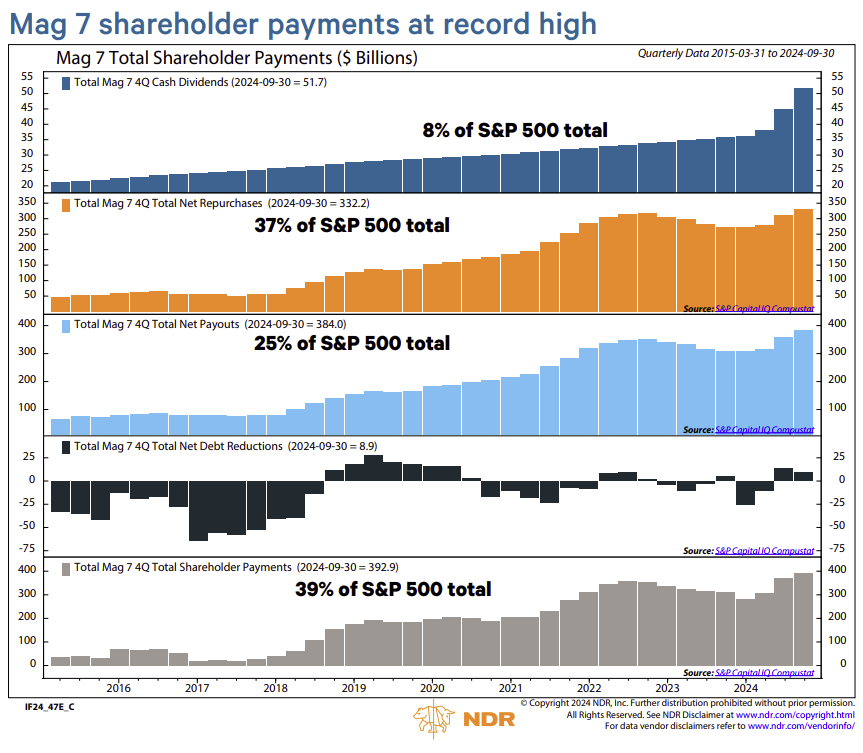

Mag 7 shareholder payments

Greater capital investment has not prevented the Mag 7 from returning capital to shareholders, underscoring the sheer magnitude of the group’s cash flow and strength of their balance sheets.

Dividend payouts jumped to almost $52 billion over the last four quarters, as Meta and Alphabet have recently initiated cash payouts to shareholders. Dividends from the Mag 7 alone now represent 8% of the total for the S&P 500 index.

The group’s preferred payout method, though, remains share buybacks, with the four-quarter total reaching a record high of $332 billion, just shy of 40% of the total for the S&P 500.

Source: Ned Davis Research

Cash yields

If you are sitting on excess cash reserves, do not think your bank is looking out for you and paying you a competitive market rate.

Please don’t let your hard-earned cash sit in a Savings or Checking account earning the national average of a scandalously low 0.5%, when you can earn 4-5% in High Yield Savings accounts, Money Market Funds, short-term U.S. Treasury bills, and Certificates of Deposits (CDs).

This is one of the quickest ways you can earn (mostly risk-free) money.

Source: J.P. Morgan Markets

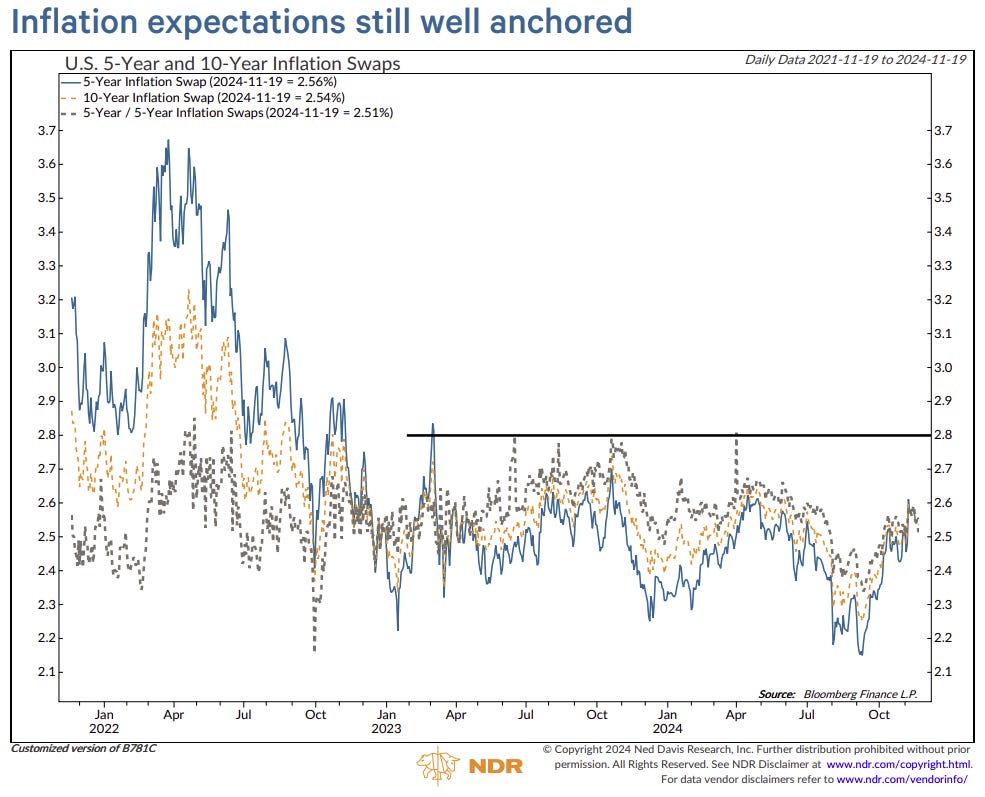

Higher inflation getting priced into bond markets

As investors ramp up bets that President-Elect Donald Trump’s economic policies such as tax cuts and tariffs will apply upward inflationary price pressures, Treasury yields have been surging higher as a result.

Price action on a possible resurgence in U.S. inflation can be shown by the one-year inflation swap rate ramping higher from a low of 2.20% in early September to its current level of 2.70%.

The price action has parallels to the aftermath of the 2016 election, when Trump’s victory sent inflation expectations surging and bonds sliding.

Widening the aperture beyond just the recent move over the last few months (chart above) does show inflation expectations remain contained over a longer period (chart below), for now.

Although inflation expectations have recently moved higher, they still remain below 2.8%. A move above those levels would take out the highs of the past two years and would be concerning.

Higher inflation expectations could potentially complicate the Fed’s ability to cut rates back to their long-run neutral rate. That’s the policy side to consider.

On the other side, for the average American, we know from exit polls that the 2024 election was, to some extent, a referendum on inflation. Voters were upset with years of higher prices, and they vented voted their wrath on incumbent Democrats, right or wrong.

Source: Ned Davis Research, Johns Hopkins University, NBC News

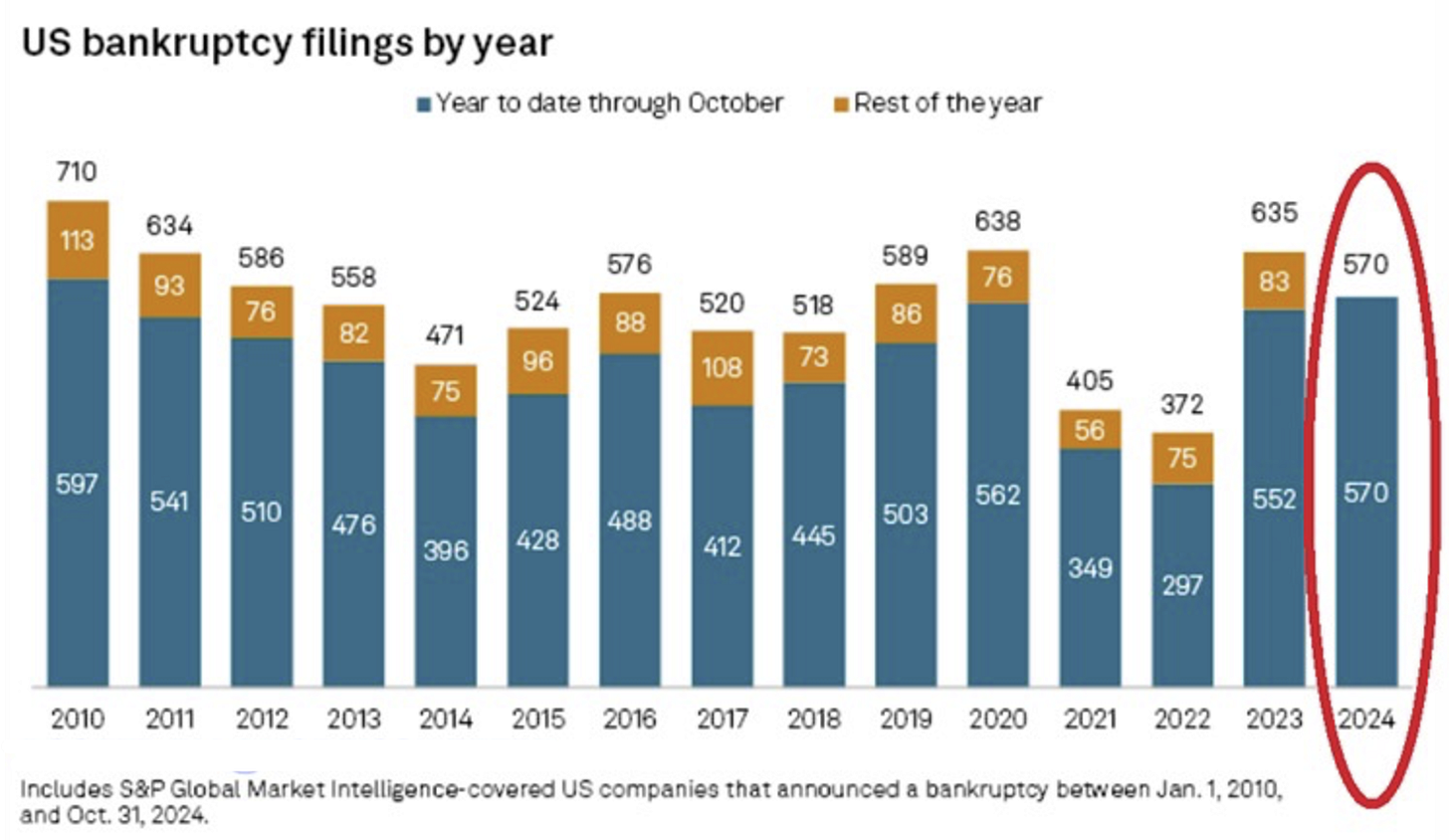

U.S. bankruptcies YTD surge past pandemic high

U.S. bankruptcies through October month-end are higher this year than every year since 2010, which includes the pandemic closures of 2020.

570 large U.S. companies have filed for bankruptcy year-to-date.

The pace of filings have been steadily increasing throughout 2024, per S&P Global Market Intelligence’s reporting.

After the spike in the total number of bankruptcy filings suffered in 2023, this trend does not seem to be cooling.

In fact, it’s quite the opposite.

Source: S&P Global Market Intelligence

That’s all for today.

Blake Millard, CFA

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: