Maintaining perspective amid recession fears

The Sandbox Daily (3.10.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

maintaining perspective amid recession fears

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -2.08% | S&P 500 -2.70% | Russell 2000 -2.72% | Nasdaq 100 -3.81%

FIXED INCOME: Barclays Agg Bond +0.48% | High Yield -0.38% | 2yr UST 3.887% | 10yr UST 4.217%

COMMODITIES: Brent Crude -1.71% to $69.18/barrel. Gold -0.71% to $2,893.3/oz.

BITCOIN: -5.26% to $79,196

US DOLLAR INDEX: +0.12% to 103.961

CBOE TOTAL PUT/CALL RATIO: 0.90

VIX: +19.21% to 27.86

Quote of the day

“Believe you can and you’re halfway there.”

- Theodore Roosevelt

Finding perspective amid recession fears

Today, many investors are feeling understandably overwhelmed by the current news cycle.

The administration is moving quickly with their “flood the zone” strategy, designed to keep those opposed to executive orders and policy actions constantly recalibrating and lacking any firm sense of direction. These tactics have made it increasingly difficult to separate the sound from the noise.

The rising uncertainties have caused the stock market to stumble after a strong January, with the S&P 500 and Nasdaq wiping out all post-election gains and now negative for the year.

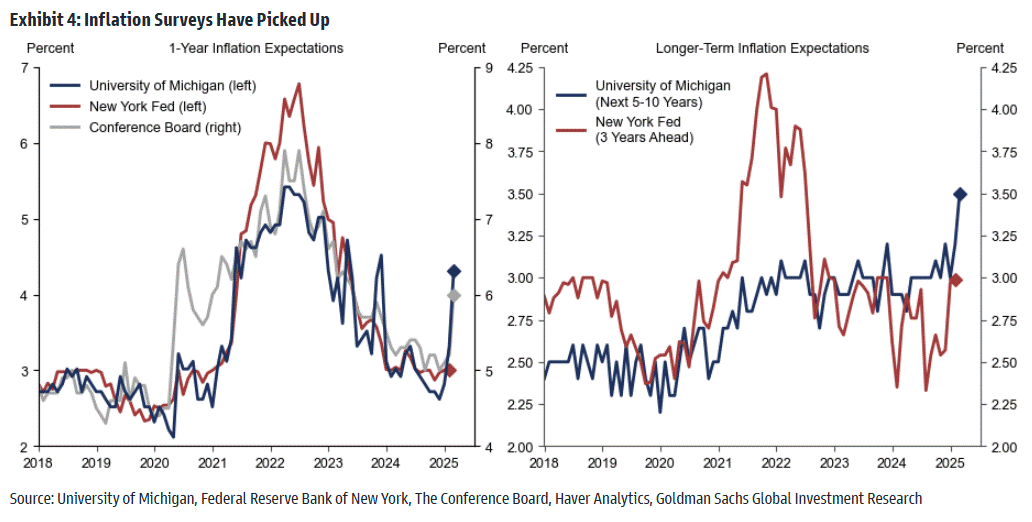

While tariffs have garnered the most attention, investors are also concerned about mixed economic signals – including weak consumer confidence, upticks in inflation expectations, government worker layoffs, and more.

Some are now wondering if there will be a recession, and President Trump did not rule out the possibility in yesterday’s interview with Maria Bartiromo.

So, how can investors maintain perspective in this challenging market and economic environment?

While the economy and stock market are not the same thing, they influence one another in important ways. When economic growth is strong, corporate earnings tend to grow which can boost share prices, and vice versa. Similarly, stock and bond markets can sometimes serve as a leading indicator for the broader economy since they reflect the forecasts of millions of investors.

This does not mean that the market is always correct.

It’s important to remember that some investors and economists have been predicting a recession for nearly three years. Just a year ago, many believed a recession would be imminent due to inflation. Even academic indicators of recession, such as the “inverted yield curve” or the “Sahm Rule,” have not proven to be reliable this time around.

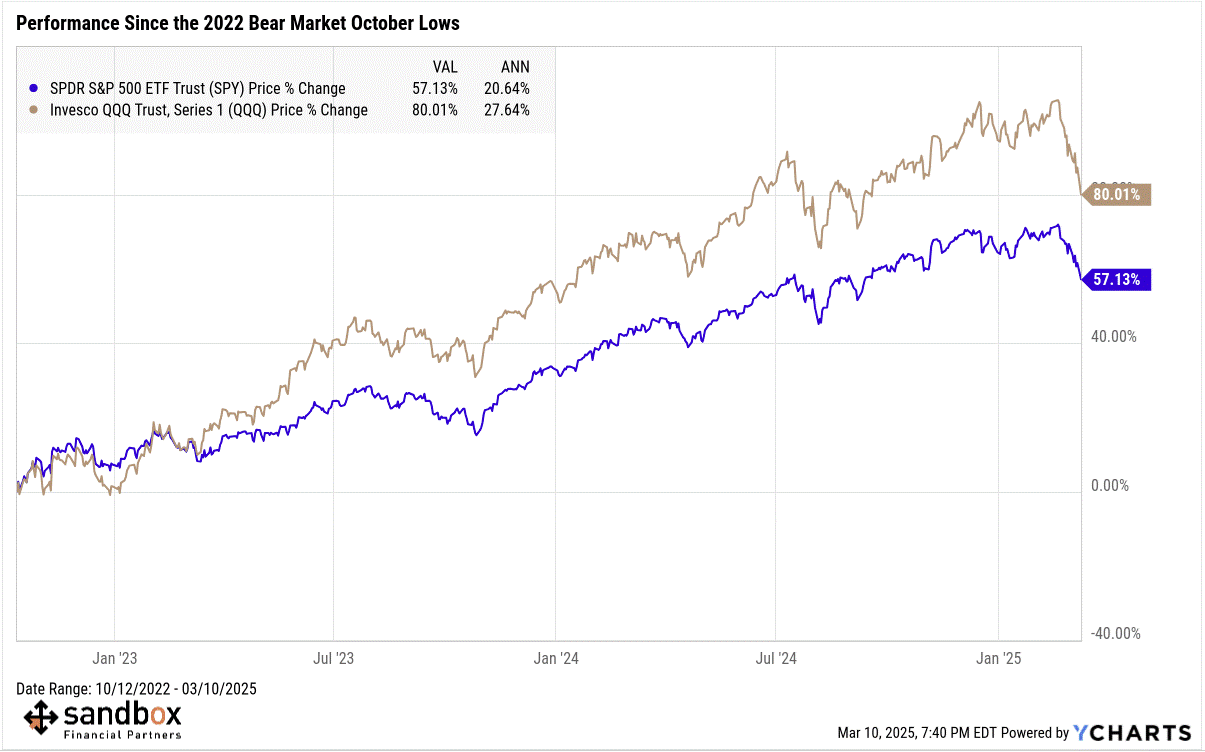

Instead, not only has the economy grown steadily in the past few years, markets have also performed well. Despite the current pullback, the S&P 500 has gained nearly 60% since the market bottom in late 2022, while the Nasdaq has risen 80%.

Of course, like a stopped clock that happens to be right twice a day, there will eventually be a recession.

Historical examples show that predicting the timing of economic downturns is difficult. Investing based on the assumption of an economic downturn can lead to suboptimal financial decisions, which is why it’s important to build portfolios that focus on long-term goals rather than near-term uncertainties.

And make no mistake, recession fears are rising.

Historically, recessions occur when the business cycle enters its later stages, or external shock takes place (think a banking crisis or oil shock). The current business cycle has shown some signs of slowing but has not contracted just yet – although the GDP Nowcast for Q1 from the Atlanta Fed recently flipped negative.

A possible trade war represents an outside shock to consumers, businesses, and global supply chains.

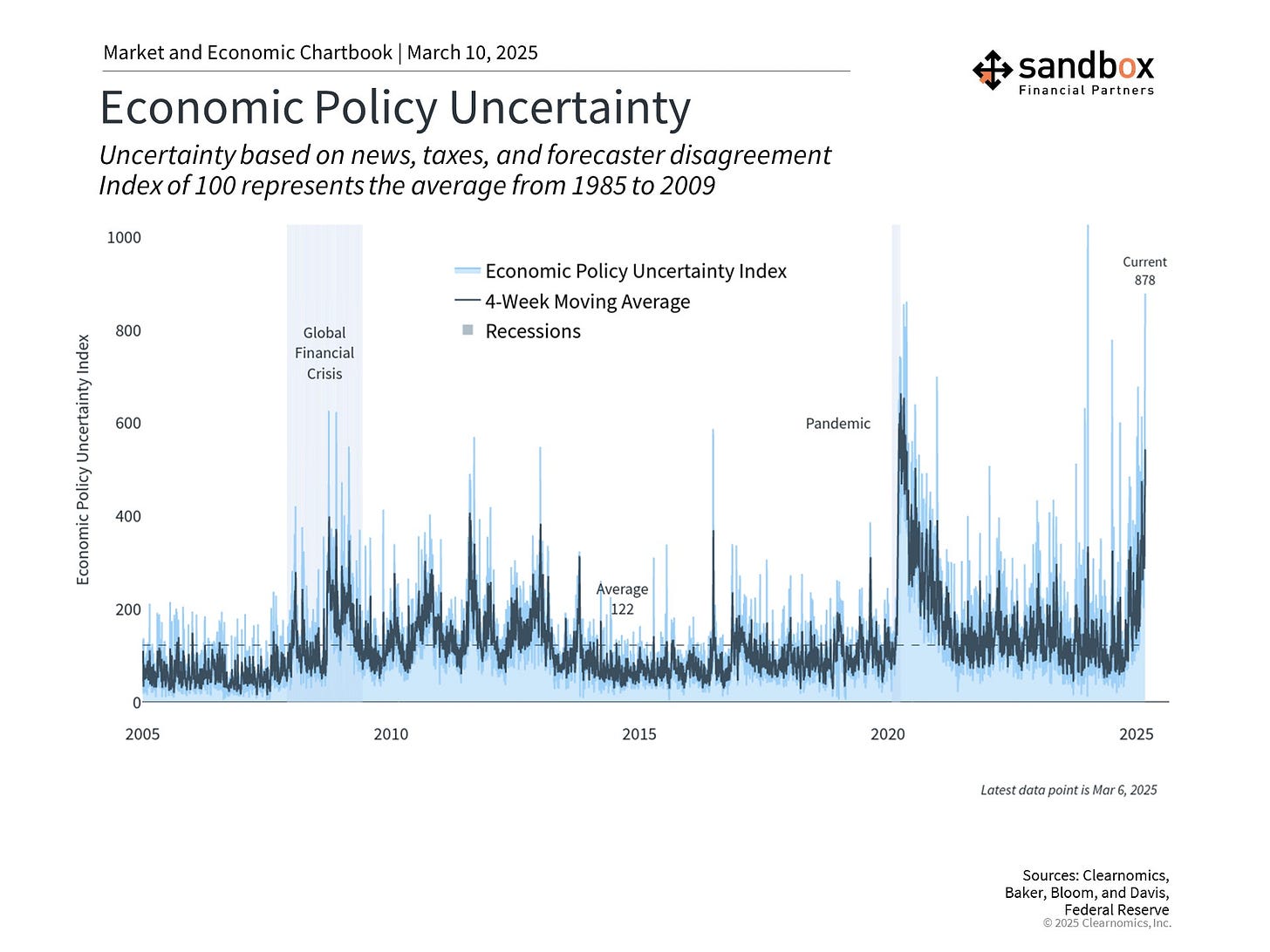

The administration has said there may be a period of short-term "turbulence" in the economy. Even if tariffs do not directly harm growth, they have created an environment of uncertainty. Prolonged uncertainty damages confidence and slows demand.

The administration has acted more swiftly with broad tariffs compared to President Trump’s first term, making the outcome harder to predict. Only time will tell if tariffs reach rates not seen since the 1930s, or if agreements with major trading partners will be reached.

It’s important to remember that tariffs are often used as a negotiating tactic for broader policy objectives. In the past, market reactions to tariff announcements were more dramatic than their actual economic impact. In 2018, the market fell as tariffs were implemented, but earnings growth was still strong and GDP was almost 3% that year.

While this uncertainty may be uncomfortable and has led to larger market swings, it’s in periods of economic strength that policy shifts can be most easily absorbed.

Beyond tariffs, the economic data is causing concern, including rising inflation expectations. This has translated into feelings of deep pessimism about their financial situation in the coming years.

Finally, some remain worried about growing fractures in the labor market, although employment figures remain remarkably resilient on balance. While federal workers account for ~ 2% of the workforce, there is concern of DOGE ripple effects on the private sector and job growth overall.

The irony is that markets have forgotten about the reasons for their post-election optimism: the possibility of pro-growth policies around manufacturing, energy, tax cuts, and deregulation.

While the thought of a recession can be unpleasant, it’s important to remember that periods of slower economic growth are a natural part of the business cycle. Forecasts are not always correct, and even when they are, markets do not always behave in expected ways.

While the past is no guarantee of the future, the market declines and subsequent sharp recoveries in 2020 and 2022 are recent examples of situations where markets can quickly change their tune.

Similarly, short-term market pullbacks are a natural part of investing. As the chart below shows, the S&P 500 experiences pullbacks on a regular basis, even as it has risen in the long run.

Bottom line?

The possibility of a recession is back on investors’ minds. While tariffs have increased uncertainty and some economic data has been mixed, history shows that staying invested through challenging periods is the best way for long-term investors to achieve their financial goals. Drawdowns are perfectly normal and provide excellent entry points for long-term capital.

Sources: Clearnomics, YCharts, SoFi, JPMorgan, Goldman Sachs

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

Fact: "Drawdowns are perfectly normal and provide excellent entry points for long-term capital."