Major breadth thrust signal, plus central bank policy, bank losses, last week's rally, and crypto inflows

The Sandbox Daily (11.6.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Zweig Breadth Thrust

assessing central bank policy

bank losses on available-for-sale securities hits new low in Q3

sharp cross-asset relief rally

6 consecutive weeks of net positive crypto flows

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.37% | S&P 500 +0.18% | Dow +0.10% | Russell 2000 -1.29%

FIXED INCOME: Barclays Agg Bond -0.50% | High Yield -0.40% | 2yr UST 4.941% | 10yr UST 4.647%

COMMODITIES: Brent Crude +0.35% to $85.19/barrel. Gold -0.74% to $1,984.4/oz.

BITCOIN: +0.47% to $35,024

US DOLLAR INDEX: +0.26% to 105.289

CBOE EQUITY PUT/CALL RATIO: 0.54

VIX: -0.13% to 14.89

Quote of the day

“Habits are like financial capital – forming one today is an investment that will automatically give out returns for years to come.”

- Shawn Achor, The Happiness Advantage

Zweig Breadth Thrust

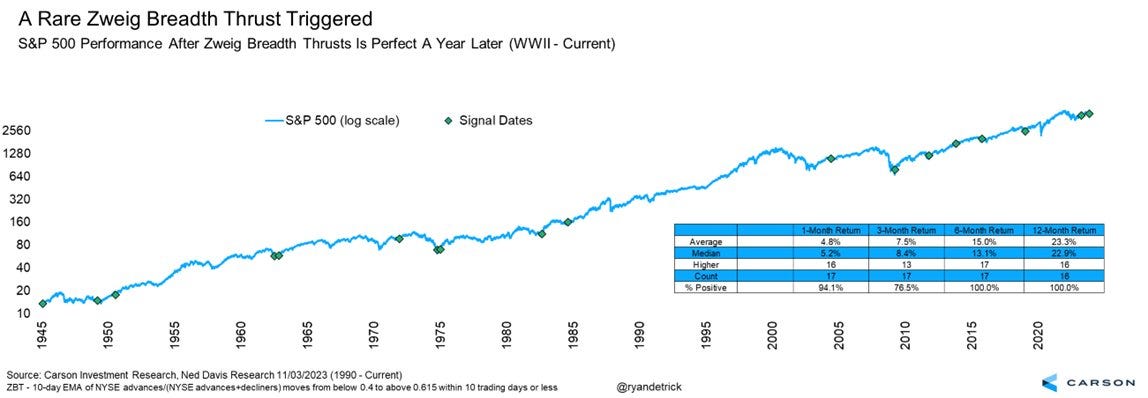

A breadth thrust is a technical indicator which determines market momentum, often signaling the start of a potential new uptrend.

A specific breadth indicator – the Zweig Breadth Thrust (ZBT) – just triggered on Friday last week.

A ZBT occurs when the 10-day exponential moving average of the NYSE Percentage of Up Issues rises from below 40% (indicating an oversold market) to above 61.5% within 10 days. In plain English, the Advance-Decline numbers suddenly go from not so good to REALLY good in a short amount of time.

ZBT’s are a very rare occurrence and possess a good track record of coming in the vicinity of major lows – higher 12 months later after every signal since World War II.

And one thing we know from experience is that breadth thrusts are NOT evidence of exhaustion.

In fact, it’s quite the opposite. We regularly see clusters of breadth thrusts near the beginning of new uptrends, and early in Bull Markets.

Source: Ryan Detrick, McClellan Financial Publications, SentimenTrader

Assessing central bank policy

Last week, we saw three major central banks – the Federal Reserve, Bank of England, and Norges Bank – all keep rates unchanged at their respective policy meetings, collectively reiterating the message that most of the tightening is now behind us. Specific to the Federal Reserve, the Fed acknowledged the “pretty significant progress” in taking inflation lower but kept its guidance for “additional policy firming.”

Since the peak in cumulative hikes across Developed Market central banks observed in September 2022, the breadth and the speed of rate tightening has been declining with no hikes being delivered at the October policy meetings:

Despite different timings in initiating the current hiking cycle, the order of magnitude of the rate hikes has been similar across the Developed Markets board, with policy rates being raised between 400 and 550bps.

As central banks have mostly reached the peak of their tightening cycle, the focus has clearly shifted to the evolution of the easing cycle many expect to begin late spring / early summer of 2024. This in spite of the broad message from central banks that support the higher-for-longer narrative and pushes back against premature rates cuts.

Source: J.P. Morgan Markets

Large institution losses on available-for-sale securities hits new low in Q3

Accumulated other comprehensive income (AOCI), which captures changes in the value of banks' available-for-sale (AFS) securities portfolios, fell $15.77 billion sequentially to negative $170.29 billion in the 3rd quarter across the 15 largest publicly traded U.S. banks. The previous low was negative $165.86 billion in the 3rd quarter of 2022.

Banks generally expect about 35% to 40% of their negative AOCI to wear off by the end of 2024 as bonds mature.

Source: S&P Global Market Intelligence

Sharp cross-asset relief rally

Last week was characterized by a broad and sharp rally across most asset classes.

Both equities and bonds moved up by a 2x standard deviation move – one of the sharpest weekly rallies in both asset classes over the past 20 years.

Source: Goldman Sachs Global Investment Research

6 consecutive weeks of net positive crypto flows

Reflecting an increasingly positive investor sentiment, digital asset investment products attracted $261 million in inflows, marking the sixth consecutive week of such inflows and pushing the year's total to $767 million, surpassing last year's figure ($736M).

The majority of these funds were allocated to Bitcoin ($229 million), while Ethereum received $17.5 million in inflows and Solana saw an additional $10.8 million flow in.

Source: CoinShares

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Good stuff. Pithy and straight to the point.