Market breadth deteriorates, plus auto loan delinquencies rise and CD opportunities

The Sandbox Daily (10.4.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

market has bad breadth

auto loan delinquency rates hook higher

exploring CDs

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.45% | S&P 500 +0.81% | Dow +0.39% | Russell 2000 +0.11%

FIXED INCOME: Barclays Agg Bond +0.70% | High Yield +0.51% | 2yr UST 5.054% | 10yr UST 4.733%

COMMODITIES: Brent Crude -5.29% to $86.12/barrel. Gold -0.28% to $1,836.4/oz.

BITCOIN: +1.29% to $27,709

US DOLLAR INDEX: -0.22% to 106.761

CBOE EQUITY PUT/CALL RATIO: 0.80

VIX: -6.07% to 18.58

Quote of the day

“Success is the ability to move from failure to failure without losing your enthusiasm.”

- Winston Churchill, Prime Minister

Market has bad breadth

Stocks bottom when breadth is at its worst.

The percentage of S&P 500 index names above their 20-, 50-, and 200-day moving averages (DMA) has now fallen to the lowest levels of the year, despite the broader averages having held intermediate-term trendline support.

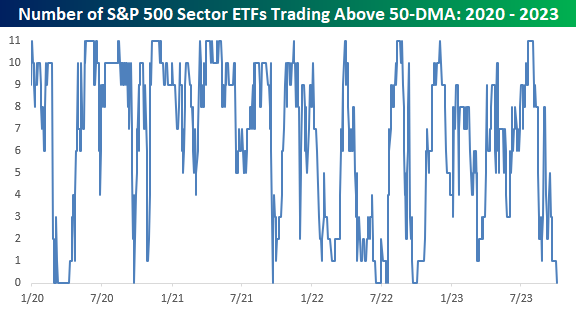

At the sector level, the percentage of S&P 500 sector ETFs trading above their 50-day moving averages is down to 0% – that’s 11 for 11 sectors all stuck below their respective 50-DMAs. Not good.

Drilling down into the S&P 500 index constituents themselves, the amount of stocks trading above their 50-daily moving average at ~8% is now the lowest since the June and October 2022 bottoms, both prominent lows in this cycle. Also not good.

When the index’s percentage of stocks trading above their 50-DMA violates that crucial 10% level (as in right now), it often signals a buying opportunity. Not always, but the hit rate exceeds 55% across all 3 time horizons below.

Breadth is extremely low which has caused the investor positioning pendulum to swing wildly the other way, with equity outflows reflecting fear over the past week.

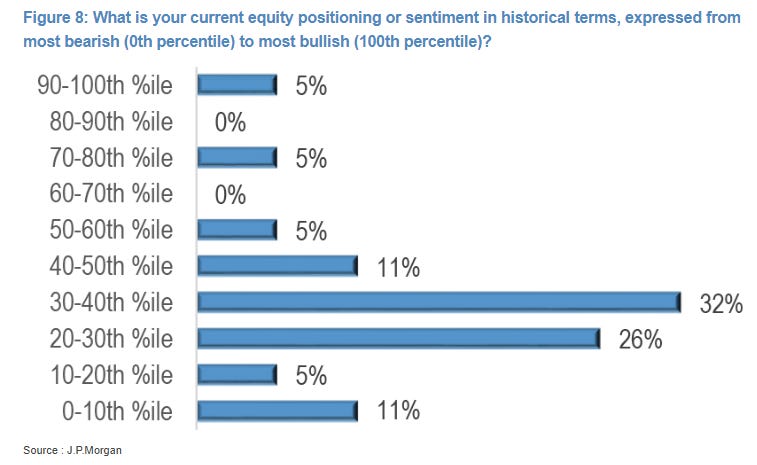

Institutional clients of J.P. Morgan continue to express their view on markets as very light on equity allocations, which has been deteriorating for weeks:

This suggests that stocks appear close to a near-term bottom, approaching oversold conditions when buyers start poking their heads up.

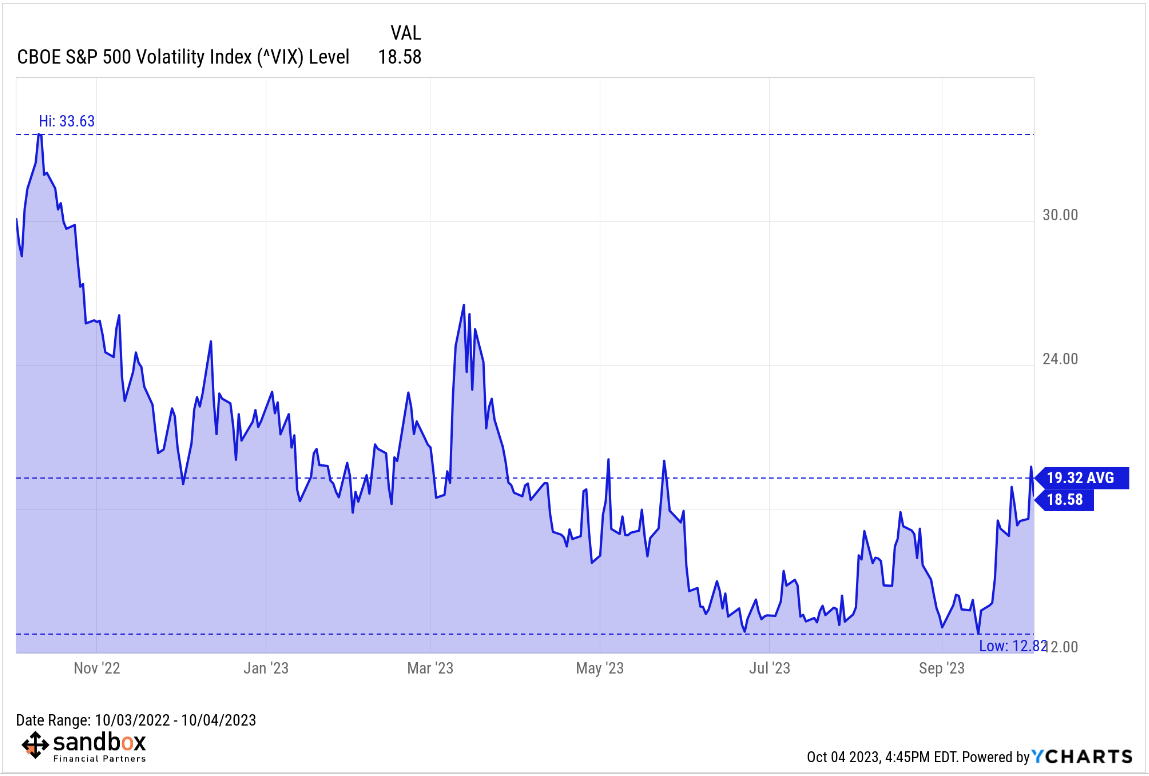

Investors, however, are still waiting for that prominent VIX spike, which is trending higher but remains under an important psychological level of 20.

Bottom line: downtrends remain intact and momentum and breadth are downward sloping, but nearing short-term extreme levels.

Source: Fundstrat, Bespoke Investment Group, J.P. Morgan Markets

Auto loan delinquency rates hook higher

Some see the resurgence in auto loan delinquencies as an early warning of broader economic distress.

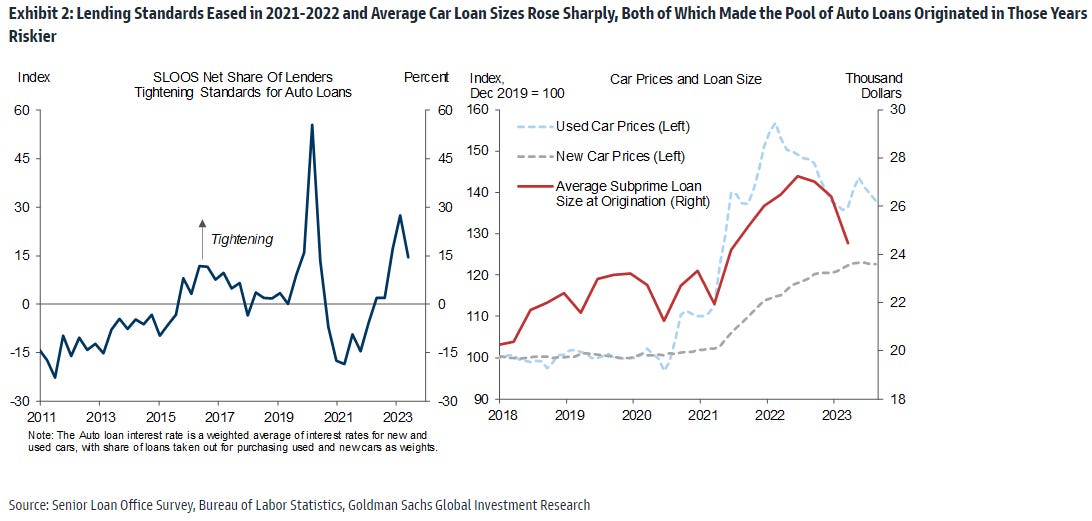

The subprime delinquency rate reached 4.1% in August 2023, which now stands moderately above the pre-pandemic trend and at roughly the high-water mark set in late 2008.

The subprime auto delinquency rate can rise for two different reasons:

It can rise for compositional reasons if loans originated become riskier, either because existing lenders loosen their standards or because new lenders that tend to make riskier loans enter the market.

It can also rise if negative income shocks and the deterioration of household balance sheets reduce a borrower’s ability to pay.

Source: Goldman Sachs Global Investment Research

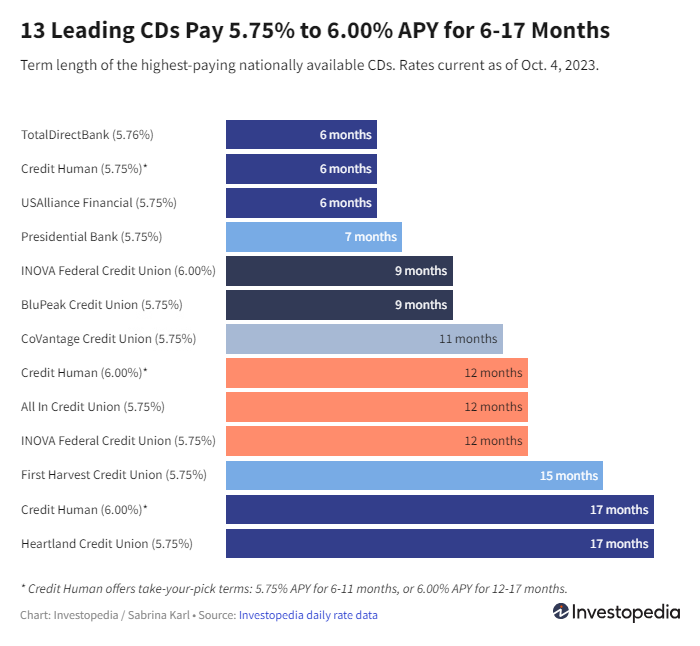

Exploring CDs

Certificates of Deposit (CD) is a financial product offered by banks and credit unions whereby an investor deposits a lump sum of money for a fixed period, typically ranging from a few months to several years, at a predetermined interest rate. In return, the financial institution guarantees the return of the principal amount – with FDIC insurance up to $250,000 per person – along with accrued interest when the CD matures.

CDs have been an afterthought for over a decade, until institutions started offering competitive yields thanks to the Federal Reserve raising interest rates over the last 18 months:

Here is the general range of quoted yields based on tenor:

Why do investors consider CDs? Here are a few simple reasons:

Safety: CDs are one of the safest investment options available as they are typically insured up to a certain limit by the FDIC (for banks) or the NCUA (for credit unions). This assurance provides peace of mind against potential losses.

Predictable Returns: CDs offer a fixed interest rate for the entire term, ensuring predictable returns. This stability can be attractive, especially when compared to more volatile investments like stocks or bonds.

Diversification: CDs can be part of a diversified investment portfolio, allowing investors to balance higher-risk assets with low-risk, income-generating opportunities.

Source: Bankrate, Investopedia

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Love your briefings. I find it interesting, because it is necessary, that there is a need to explain what a CD is to investors. Boy do I feel old. 😂