Market returns following historic volatility spikes, plus the window of hikes-to-cuts and Deep Risk vs. Shallow Risk

The Sandbox Daily (8.7.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

VIX endured one if its biggest 3-day spikes on record

from hikes to cuts

Deep Risk vs. Shallow Risk

Let’s dig in.

Markets in review

EQUITIES: Dow -0.60% | S&P 500 -0.77% | Nasdaq 100 -1.16% | Russell 2000 -1.41%

FIXED INCOME: Barclays Agg Bond -0.30% | High Yield +0.19% | 2yr UST 3.987% | 10yr UST 3.954%

COMMODITIES: Brent Crude +2.71% to $78.55/barrel. Gold -0.23% to $2,426.1/oz.

BITCOIN: -2.86% to $54,945

US DOLLAR INDEX: +0.22% to 103.196

CBOE EQUITY PUT/CALL RATIO: 0.72

VIX: +0.51% to 27.85

Quote of the day

“Volatility is not only common, it’s necessary. A good dose of higher VIX creates the pause that refreshes. It shakes out the weak investors and sets up a return premium for those of us who can withstand the annoyance.”

- Rick Ferri, CFA in Learning to Love Volatility

VIX endured one if its biggest 3-day spikes on record

From Wednesday last week to Monday of this week, the market had a lot to digest – most of which was disappointing for market participants.

It all started July 31st when the Federal Reserve, given ample data in hand and the opportunity to cut interest rates, decided to forego the medicine many sought in the wake of weeks and months of downside economic surprises. Then came the weak manufacturing and jobless claims data on Thursday. On Friday, it was the July payrolls turn to dishearten investors. Over the weekend, we learned the bombshell news that Warren Buffett trimmed nearly half of his massive stake in Apple during the 2nd quarter. With the powder keg ready, it was Japan, its central bank, and the steady-Eddie yen currency that gaslit a vortex of selling pressure that left many disheartened and afraid.

The result? The VIX Index spiked to a historic level that was only matched by Black Monday in 1987, the Global Financial Crisis in 2008, and the covid-19 pandemic in 2020.

The VIX Index spiked from 16.4 on Thursday to 38.6 on Monday, marking only the 4th time on record that the volatility gauge more than doubled over three trading days.

The chart below shows that the S&P 500 index has tumbled during the VIX spikes. Over the following weeks, it has rebounded and retested the lows. All four times the S&P 500 broke the low from the original VIX spikes, but six months later, it was up three out of four times by a median of 11.2%.

Source: Ned Davis Research

From hikes to cuts

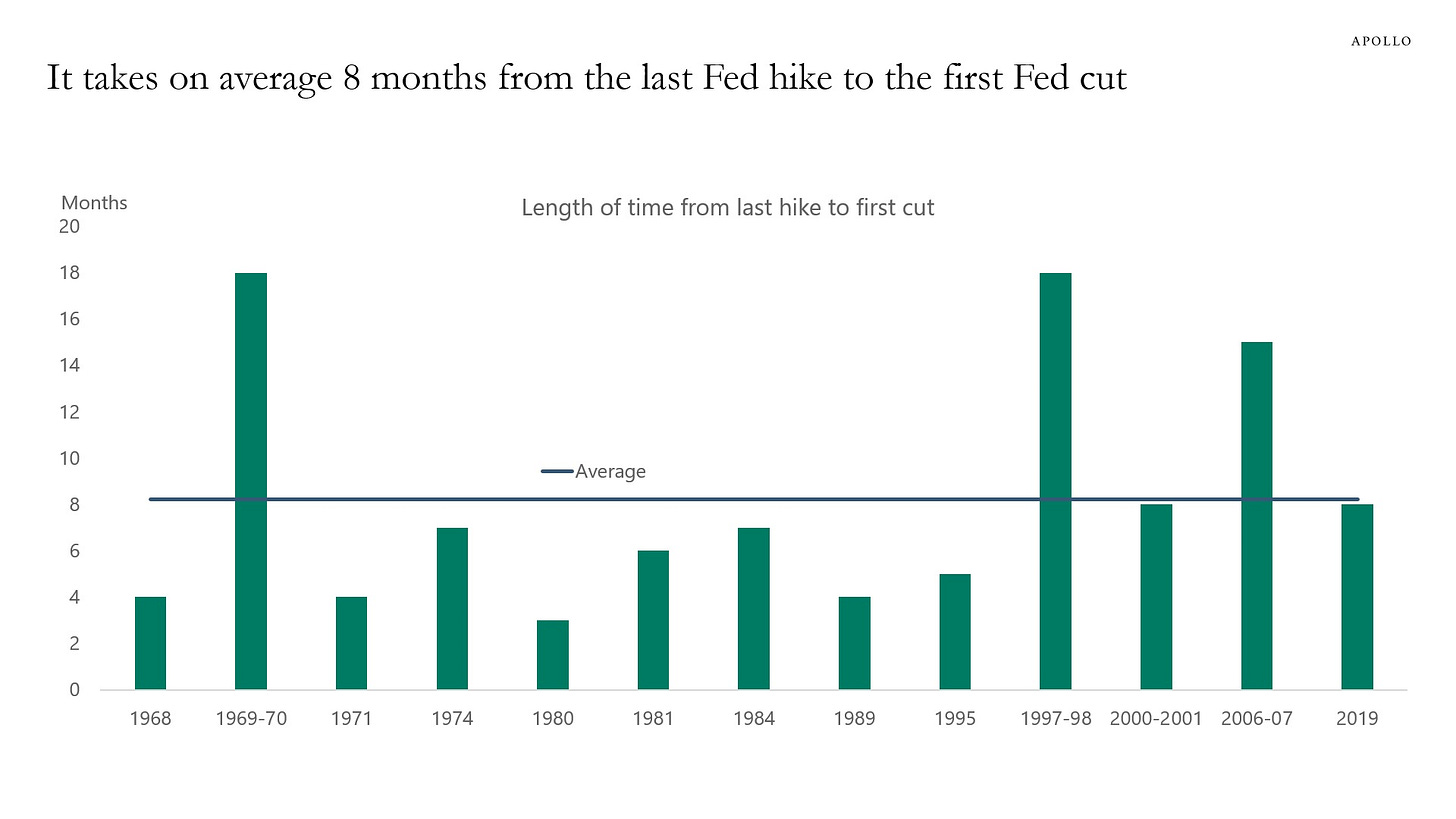

Since 1950, the average length of time from the final rate hike of a tightening cycle to the first rate cut of an easing cycle is 8 months.

As July 2023 was indeed the last rate hike of this cycle from the Federal Reserve, then the Fed should’ve started to cut rates around March 2024 based on historical averages and precedent.

If the Fed cuts next month in September as expected, it will be a 14 month window from the final hike to the first cut, just short of the three longest periods (1969-70, 1997-98, 2006-07).

However, the variability (3 months to 18 months) and small sample size (13 instances) does suggest weak predictive power and falls short of explaining the macro backdrop accompanying each cycle.

Source: Torsten Slok

Deep Risk vs. Shallow Risk

In William Bernstein’s book Deep Risk, he draws a distinction between "deep risk" and "shallow risk." While Bernstein writes about these risks under specific environments like hyperinflation, deflation, confiscation, and devastation, my analysis is a bit more rudimentary but hopefully impactful nonetheless.

Deep risk is Bernstein's term for permanent loss.

Shallow risk is what most investors are accustomed to: market downturns that last a few months or a couple years but eventually come and go. The drops can feel sudden, if not terrifying at times, but a part of the process when putting your capital at risk.

In other words, the mathematical catch-up game to recover from losses becomes more problematic as you shift from “shallow risk” into more “deep risk.”

Bernstein wrote this book because he saw a gap in investors' thinking: when we think about risk, most of us focus almost exclusively on shallow risk – periodic losses that are transitory. But deep risk – the risk of permanent loss – is often overlooked when we think about the range of things that could go wrong.

So his message is straightforward: pay attention to both. And don't minimize the probability of deep risk, even if they're the types of events that we haven't seen recently.

William Bernstein himself writes:

“Put into different words, shallow risk, if handled properly, deprives you only of sleep for a while; deep risk deprives you of sustenance.”

Source: Deep Risk: How History Informs Portfolio Design

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.