Market wipeout despite NVDA's stellar quarter

The Sandbox Daily (11.20.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the market wipeout

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.84% | S&P 500 -1.56% | Russell 2000 -1.82% | Nasdaq 100 -2.38%

FIXED INCOME: Barclays Agg Bond +0.12% | High Yield -0.06% | 2yr UST 3.539% | 10yr UST 4.088%

COMMODITIES: Brent Crude -0.66% to $63.09/barrel. Gold -0.16% to $4,076.3/oz.

BITCOIN: -2.96% to $87,160

US DOLLAR INDEX: +0.03% to 100.260

CBOE TOTAL PUT/CALL RATIO: 0.98

VIX: +11.67% to 26.42

Quote of the day

“Yesterday I was clever, so I wanted to change the world. Today I am wise, so I am changing myself.”

- Rumi

Market wipeout

Welp, that was ugly!

Today, the market slipped on a banana peel and wiped out.

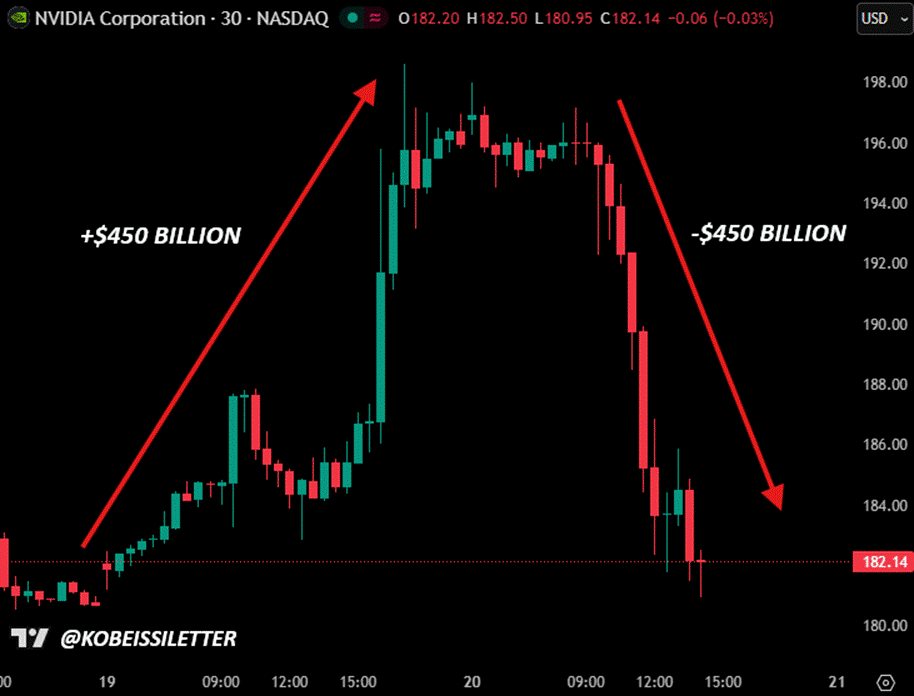

On Wednesday afternoon, Nvidia reported quarterly earnings, and by any metric, Jensen and company crushed its results. Nvidia beat-and-raised on a sterling quarter, wowing its most hardened critics and immediately relieving any FUD around the AI buildout.

A wave of relief washed across investors.

On Thursday’s open, Nvidia’s stock gapped higher by +5%.

By Thursday’s close, it was down -3%.

It’s worth noting Nvidia is 8% of the S&P 500 (SPY), 10% of the Nasdaq 100 (QQQ), and 18% of the VanEck Semiconductor ETF (SMH).

Meaning, if there’s one stock that can dictate the direction of this market, it’s this one.

With Nvidia surrendering its early gains, fear rippled out across the broader market.

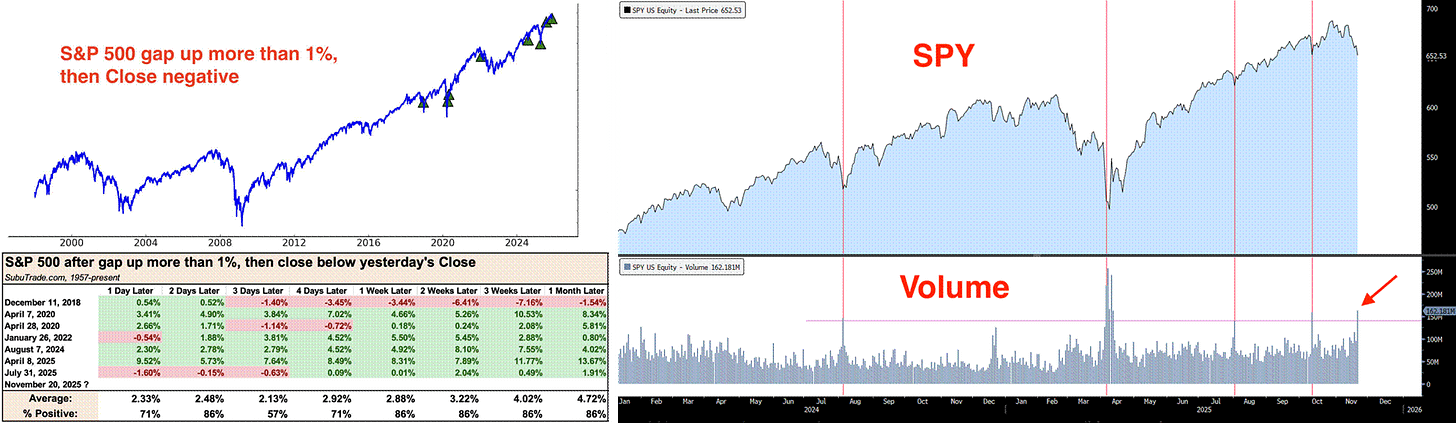

Today’s swift intra-day reversal saw significant selling pressure on heavy volume, as the S&P 500 index wiped out its +1.5% pre-market gains to close red on the session (-1.5%) – erasing over $1.5 trillion in market value from session highs. An +80% upside volume day finished -80%.

Adding to the market’s stress was overdue BLS jobs data that reflected stronger-than-expected job growth for September, but still painted an uneven picture of the U.S. labor market as the unemployment rate (4.4%) continues to slowly move higher.

Days like today serve an important reminder that risk happens fast. Escalator up, elevator down.

Outright panic in crypto markets, the yen carry trade unwind, and continued jawboning from the Fed help explain the price action, but they don’t explain the fundamentals of what was a stellar quarter for earnings.

What’s also clear is the corrective wave in the stock market that’s been underway since late October was not fully exhausted.

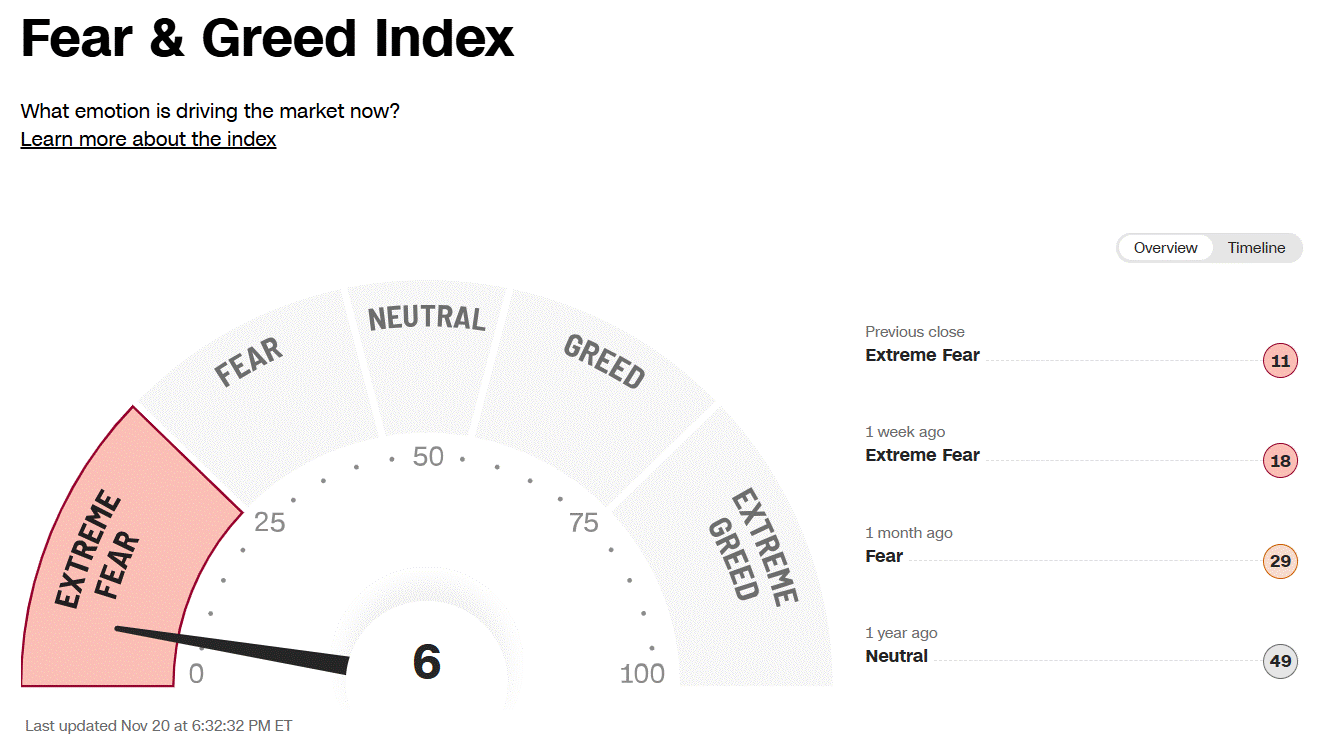

Conditions are oversold in many corners of the market, which sets up for a bounce at the very least.

When the mechanical selling pressure clears, the bull market will reassert itself. But, for that to happen, stocks need to first stop going down.

Taken together, the capitulatory-like volume, broad-based selling, and spikes across various volatility gauges are characteristics of bottoming price action. Today most likely won’t mark the bottom, but know these trading days often occur at/around bottoms.

Remember that days like today are a part of the journey.

The uncomfortable truth about investing in the stock market is that volatility is not a detour on the investing road. It is THE road. And, if you have to travel long to meet your financial goals, you must travel through it.

As always, stay the course.

Sources: The Kobeissi Letter, SubuTrade, CNN, Alfonso De Pablos, Barchart

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)