Markets ignore shutdown noise. You should too.

The Sandbox Daily (10.15.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

markets ignore shutdown noise

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.97% | Nasdaq 100 +0.68% | S&P 500 +0.40% | Dow -0.04%

FIXED INCOME: Barclays Agg Bond -0.04% | High Yield +0.32% | 2yr UST 3.501% | 10yr UST 4.038%

COMMODITIES: Brent Crude +0.03% to $62.41/barrel. Gold +1.56% to $4,228.4/oz.

BITCOIN: -1.06% to $111,478

US DOLLAR INDEX: -0.36% to 98.693

CBOE TOTAL PUT/CALL RATIO: 0.87

VIX: -0.82% to 20.64

Quote of the day

“Life is like a snowball. The important thing is finding wet snow and a really long hill.”

- Warren Buffett

Markets ignore shutdown noise

As the government shutdown marches on and mentions continue across traditional media outlets as well as my personal conversations, it’s important to remind ourselves these shutdowns represent political rather than fundamental economic events.

A casual observer might think the markets would be panicking while Washington D.C. grinds to a halt.

Headlines are screaming about furloughed workers and reductions in force, stalled programs, and political chaos.

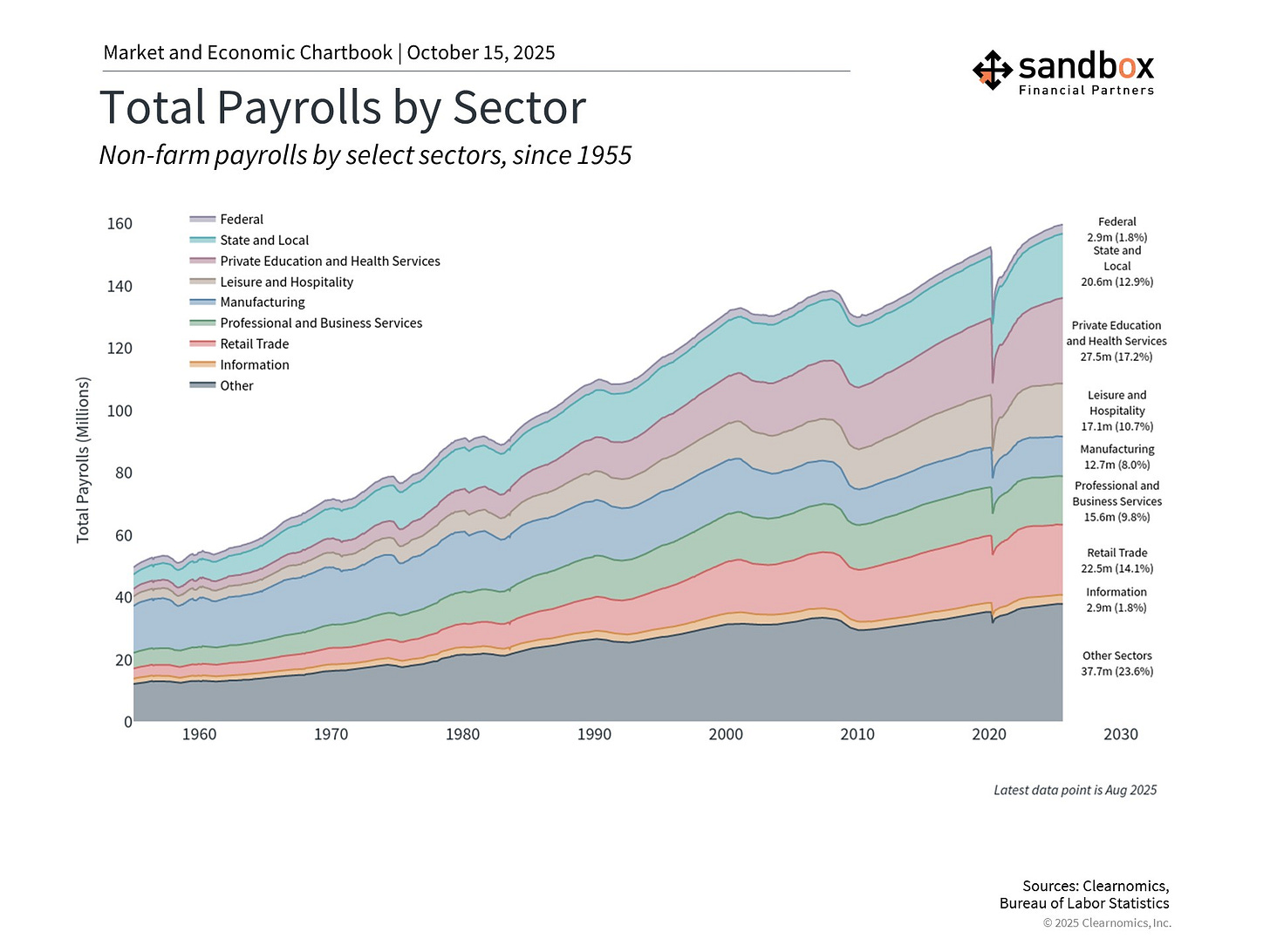

And yet, federal employment only makes up 1.8% of the entire workforce. These workforce reductions and furloughs – while not trying to minimizing the impact on the effected government workers and their families – represent a very small fraction of the total labor market, thereby limiting their overall economic impact.

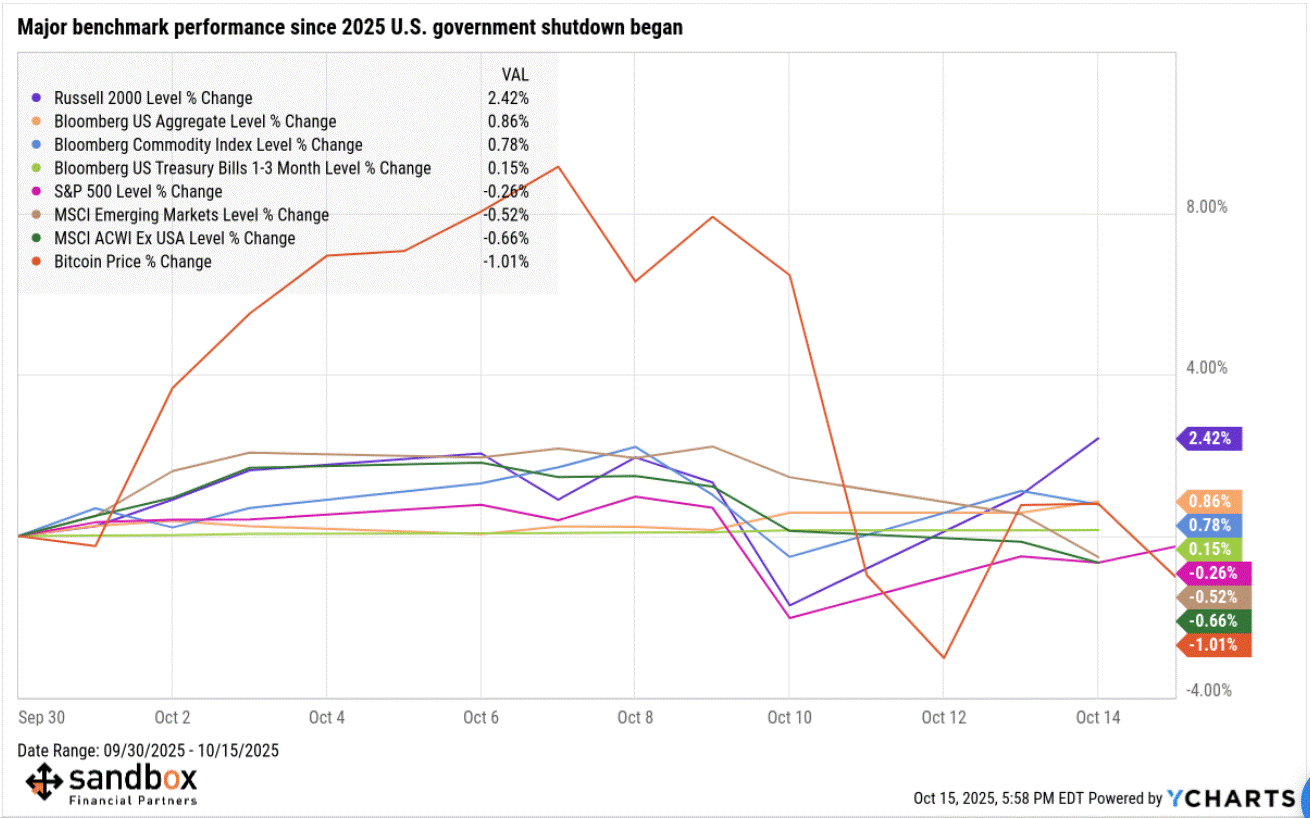

At the same time, the S&P 500, and markets more broadly, continue to hum near record highs while volatility remains around its long-term average.

So, what gives?

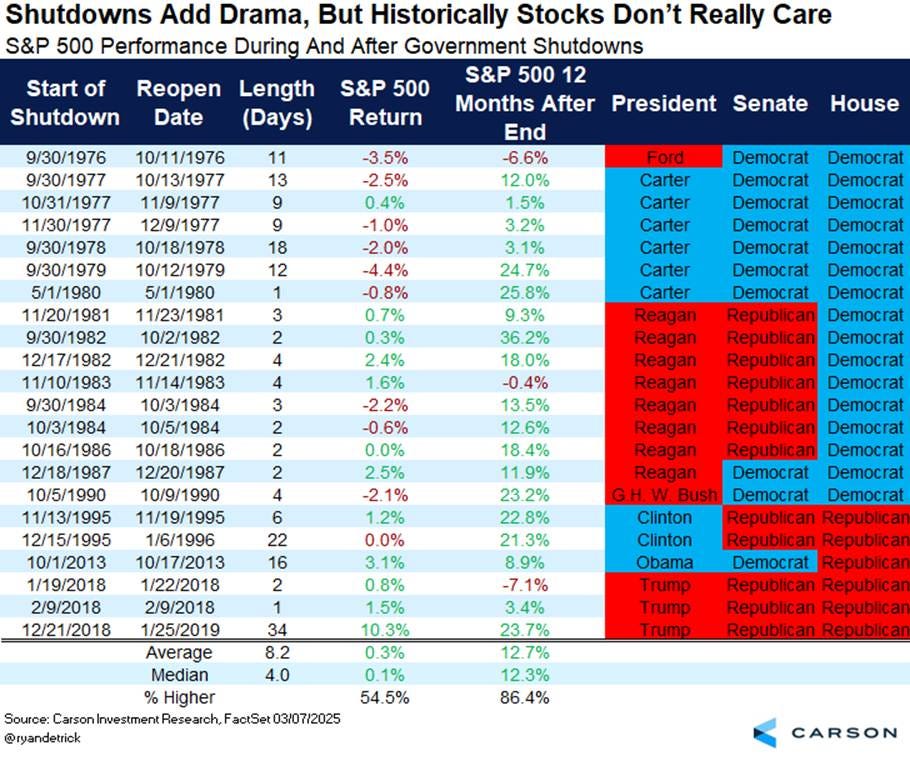

The market has seen this movie before and it never ends the way headlines predict.

Historically, government shutdowns make great theater and fuel fodder for the morning talk show programs.

But, for investors, they barely dent consumer demand or corporate profits. Markets, themselves, hold up just fine.

Markets trade through shutdowns because investors know the political gamesmanship always ends the same way: a deal is announced, a press conference featuring the President or Speaker of the House, and a final round of finger pointing across the two houses.

In the meantime, liquidity and risk-seeking behavior remains, earnings stay on track, and the Fed (not Congress) remains the real driver of market direction.

The deeper reason the market doesn’t care is that investors have learned to tune out the noise and focus on the data that actually drives economic activity and moves money around the board.

This includes stable economic growth (Atlanta Fed tracking Q3 GDP at 3.8%), historically low unemployment, and steady inflation that hasn’t spiraled out of control from tariffs despite expectations to the contrary.

This is what matters for investors and traders. Inputs that impact corporate profits. The shutdown may grab headlines but it doesn’t re-write the balance sheets of corporate America.

Don’t confuse the drama with danger. Political noise can shake sentiment, but long-term fundamentals and near-term momentum/positioning drive returns.

Politicians fight, headlines print, and yet the market quietly moves forward.

Sources: YCharts, Clearnomics, Ryan Detrick

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)