Markets turn the page to October, plus momentum (RSI) at extremes, Fed's inflation measure, and the week in review

The Sandbox Daily (9.29.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

seasonal relief coming?

extreme RSI readings

Fed’s preferred inflation measure moderates in August

a brief recap to snapshot the week in markets

Nature is healing –> *NSYNC released their first song today in 23 years (via the Trolls Band Together movie soundtrack), which finds the group in a Better Place.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.08% | S&P 500 -0.27% | Dow -0.47% | Russell 2000 -0.51%

FIXED INCOME: Barclays Agg Bond -0.10% | High Yield -0.15% | 2yr UST 5.052% | 10yr UST 4.579%

COMMODITIES: Brent Crude -0.07% to $95.34/barrel. Gold -0.71% to $1,865.2/oz.

BITCOIN: -0.88% to $26,903

US DOLLAR INDEX: -0.07% to 106.147

CBOE EQUITY PUT/CALL RATIO: 0.80

VIX: +1.04% to 17.52

Quote of the day

“Someone's sitting in the shade today because someone planted a tree a long time ago.”

- Warren Buffett, Berkshire Hathaway

Seasonal relief coming?

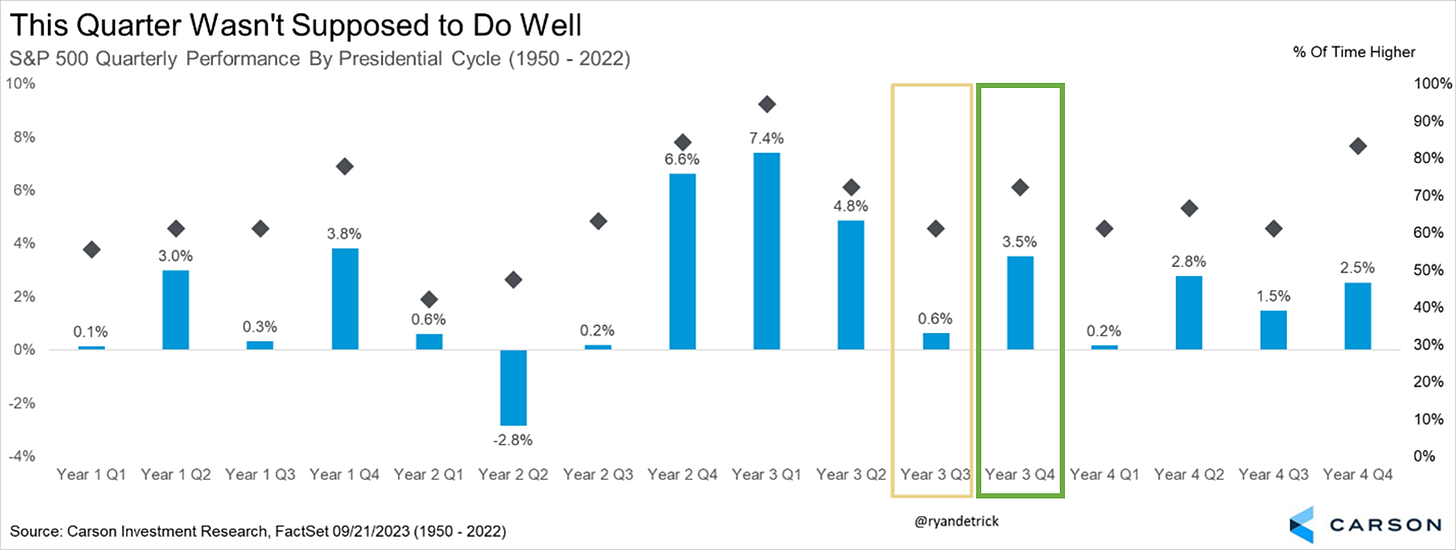

After a difficult back-to-back for the S&P 500 index in August and September, seasonal headwinds shift into tailwinds as stocks have historically gained ground in the 4th quarter – starting with October.

October’s average gain since 1950 for the S&P 500 index is +0.96%, positive 60.3% of the time. It’s also the 3rd and 4th best performing month over the past 10 and 20 years, respectively.

In fact, the October-November two-month period is historically one of the strongest periods on the calendar over any time frame.

And when you review the 4-year Presidential Election cycles going back to 1950, the upcoming period shows history favors renewed strength – see the green box below.

In fact, the weakness we just experienced in the stock market occurred exactly when it was expected – the 3rd quarter of pre-election years – reference the yellow box below.

At risk of stating the obvious, it’s important to remember that only price pays. These seasonal charts are just a roadmap for how humans have behaved historically.

We only use these tools to put the environment into context, similar to sentiment or positioning data.

Source: All Star Charts, LPL Research, Ryan Detrick

Extreme RSI readings

The RSI, or the Relative Strength Index, is a momentum indicator measuring the speed and magnitude of recent price changes. Quite often, when the RSI gets to extreme measures, a reversal of the current price trend is in store. Sometimes, the reversals are short-term, allowing the imbalances to moderate and the prior trend to continue. Other times, the RSI signals a long-term price change.

The RSI ranges between 0-100, with a score above 70 considered extremely overbought and extremely oversold when below 30. The RSI rarely lingers in either extreme territory.

When many asset classes have extreme RSI readings at the same time, a broad shift in markets may be at hand. The charts below show the RSI for the S&P 500 index, U.S. Treasury bonds (IEF), U.S. Dollar index, and crude oil are simultaneously in extreme overbought or oversold territory.

Source: Lance Roberts

Fed’s preferred inflation measure moderates in August

Inflation pressures continued to moderate in August, confirming the Federal Reserve’s shift to a slower pace of tightening this year.

The Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, showed core inflation increased just +0.1% MoM. The 3-month annualized rate of change of the core PCE Price Index has come down continuously for the past six months and was just 2.2% in August, the least since December 2020.

As for the YoY change, core PCE inflation moderated to +3.9%, the slowest pace since June 2021. Although this is well above the 2.0% inflation target, it is just 0.2% above the Fed’s projection of 3.7% core inflation at year-end.

Meanwhile, the headline PCE price index – which includes the more volatile food and energy categories – jumped 0.4% in August, driven by the recent resurgence in gasoline and other energy prices.

Most of the slowdown in inflation has come from the goods side, but core inflation continues to run above the Fed’s target of 2%. As favorable base effects diminish in the 2nd half of this year, further progress on inflation will prove more difficult, especially if the labor market remains tight and consumer demand holds up.

This latest PCE report suggests the Fed is attuned to current inflation trends and should keep rates higher for longer in its unwavering commitment to defeat inflation.

Source: Bureau of Economic Analysis, Ned Davis Research, Dwyer Strategy, Bloomberg

The week in review

Talk of the tape: That’s a wrap on the 3rd quarter – today we get new weekly, monthly, and quarterly candlesticks to review! The path of least resistance for stocks has been lower throughout the month on the unrelenting bond yield backup. No real change in the fundamental backdrop as of late and lots of discussion about how the market is in a catalyst vacuum through mid-October.

Soft-landing expectations underpin the bullish narrative. The potential for a return to positive earnings growth in Q3, record amount of money market assets on the sidelines, and favorable seasonality in Q4 flagged as other bullish drivers. Disinflation traction cited as another tailwind, although recent inflationary pressures from commodities have stoked inflationary embers. Consumer resilience, although showing some signs of fatigue, continues to be a higher-profile bright spot.

Bearish talking points, which have gained traction over the last couple months, revolve around the upward pressure on rates, liquidity headwinds, and the lagged effects of policy tightening (18 months now). The UAW auto strike, restart of student loan payments, and the likely government shutdown all have been cited as near-term overhangs as the market decides what to make of their implications. Narrow market leadership also an active talking point among the bears.

Stocks: Stocks have struggled of late given the Fed’s “higher for longer” policy stance as many investors believe the central bank’s actions may result in both an economic and/or earnings contraction. According to the most recent AAII Sentiment Survey, the percentage of bullish investors declined for the 3rd straight week from 31.3% to 27.8% this week, tracking below the historical long-term average of 37.5%.

Bonds: The yield curve continues to dis-invert (bear steepening discussed in Tuesday's post) with longer maturity securities selling off more than shorter maturity Treasury securities. Bear steepening is far less frequent and usually doesn’t persist long term; as long as the curve remains deeply inverted, upward pressure on long-term yields may remain. Bonds were negative in September across the major categories.

Commodities: Many commodities are re-inflating. Natural gas and energy prices finished positive again. Many agricultural commodities have increased in price in recent months, given weather-related challenges worldwide. Futures contracts on orange juice, live cattle, raw sugar, and cocoa each hit their highs for the year in September amid lower supplies.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.