Mega-cap tech, plus the U.S. dollar, S&P 500's 200-DMA, Marvel's Black Panther, and the week in review

The Sandbox Daily (11.11.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the underperformance and valuation reset for mega-cap tech, the deterioration in consumer sentiment, the U.S. dollar reversal, the S&P 500 approaches the 200-daily moving average, Marvel’s Black Panther: Wakanda Forever premiers in theatres today, and a brief recap to snapshot the week in markets.

Happy Veterans Day to all those who have served. We appreciate your service to this great country. Thank you.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.82% | S&P 500 +0.92% | Russell 2000 +0.79% | Dow +0.10%

FIXED INCOME: Barclays Agg Bond -0.07% | High Yield +0.35% | 2yr UST 4.329% | 10yr UST 3.811%

COMMODITIES: Brent Crude +2.60% to $95.76/barrel. Gold +0.90% to $1,769.4/oz.

BITCOIN: -4.13% to $16,824

US DOLLAR INDEX: -1.65% to 106.416

CBOE EQUITY PUT/CALL RATIO: 0.60

VIX: -4.29% to 22.52

Mega-cap tech fundamental performance and recent valuation reset

The 4th quarter is on track to be just the 11th quarter in the past ten years in which the four mega-cap tech stocks (AAPL, GOOGL, AMZN, and MSFT) have collectively underperformed the S&P 500. After all, stock performance during 2022 has been almost entirely a function of interest rate and valuation moves but has shifted to corporate fundamentals.

The characteristic most associated with large cap tech stocks – superior sales growth – has vanished, at least for this year. Mega-cap tech firms posted a compound annual growth rate (CAGR) sales growth of 18% for the past 10 years vs. 5% for the S&P 500. Sales for mega-cap tech is forecast to grow by 8% in 2022, below the 13% growth expected for the index.

After doubling in valuation during the pandemic, mega-cap tech now trades close to its long-term median valuation – 7x EV/sales down to 4x. The four stocks comprise 18% of S&P 500 market cap, down from a high of 22%. Lackluster earnings reports led to sharp sell-offs at the end of October, extending the reset that began early this year with interest rate hikes.

Source: David Kostin, Goldman Sachs Global Investment Research

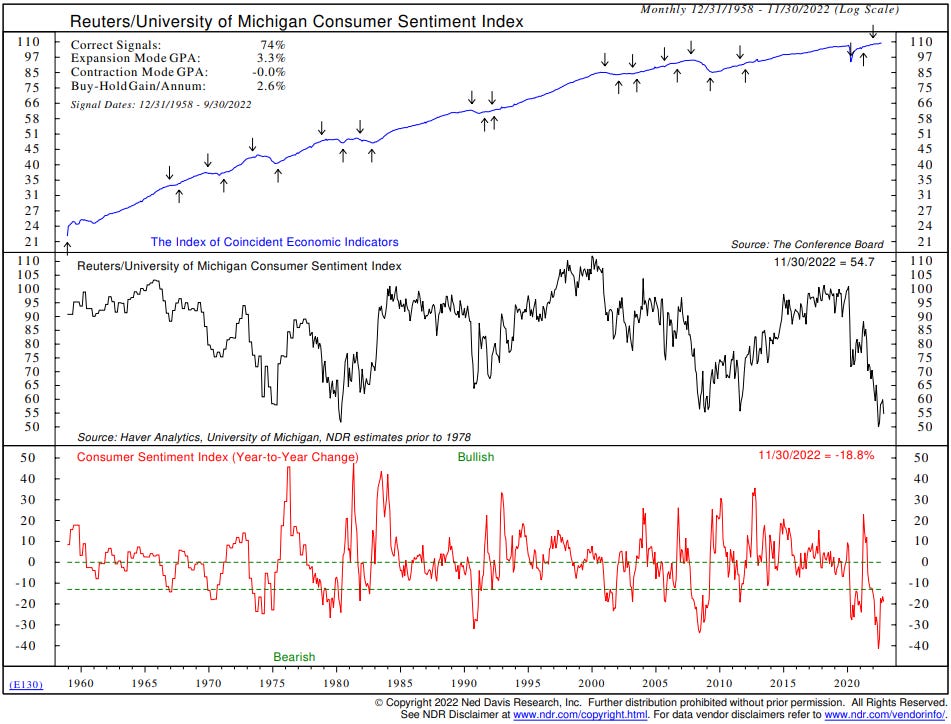

Consumer sentiment worsens

U.S. consumer sentiment slumped in November amid persistent worries about inflation and higher interest rates, according to the Reuters/University of Michigan November survey. The -8.7% decline was the first decline in five months, taking the index back toward its cycle low earlier this year and near its weakest level since 1980. Sentiment was lower across age, education, and income groups, as well as across regions and political affiliation.

Source: Ned Davis Research

Dollar drops as stocks and bonds bounce

The rally in equities this week came alongside a huge move lower in the U.S. Dollar.

The dollar's drop this week is key because it has now broken its uptrend for the year, with the dollar now down ~7% from its September 27 peak. And without a weaker dollar, it’s going to be hard for risk assets to maintain a durable rally and for a new bull market to emerge.

If the uptrend for the dollar is broken, will the downtrends in stocks and bonds be broken soon as well?

Source: Bespoke Investment Group

Risk on vibes

Yesterday, the S&P 500 gained +5.54%, its largest percentage increase since April 2020 and 15th largest since 1950.

With the S&P 500 pushing through major overhead supply at 3900, this incrementally bullish dynamic opens the door for a run to the 200-day moving average. The 200-DMA has acted as strong resistance for the two prior significant rallies earlier this year (March and August), so investors will be looking at this 3rd run at the 200-DMA as meaningful information – perhaps a durable bottom is in place, or this move is just another bear market rally.

Source: Potomac Fund Management

In theatres today: Marvel’s Black Panther

Black Panther: Wakanda Forever, Disney’s sequel to the 2018 smash hit that grossed $1.34 billion worldwide, is out in theatres today!

Launching in 2008 with Iron Man, the star-studded superhero stable of the Marvel Cinematic Universe (MCU) has been expanding ever since. With each year that passes, Disney’s $4.2 billion dollar acquisition of Marvel in 2009 looks better and better, even by the House of Mouse’s high standards.

Since the deal, Marvel has been relentlessly prolific, racking up more than $10 billion dollars at the U.S. box office in a meteoric rise to the top. Long-standing classic movie franchises like Star Wars (also now Disney-owned) and the James Bond films now pale in comparison, despite getting a multi-decade head start on the world of Marvel.

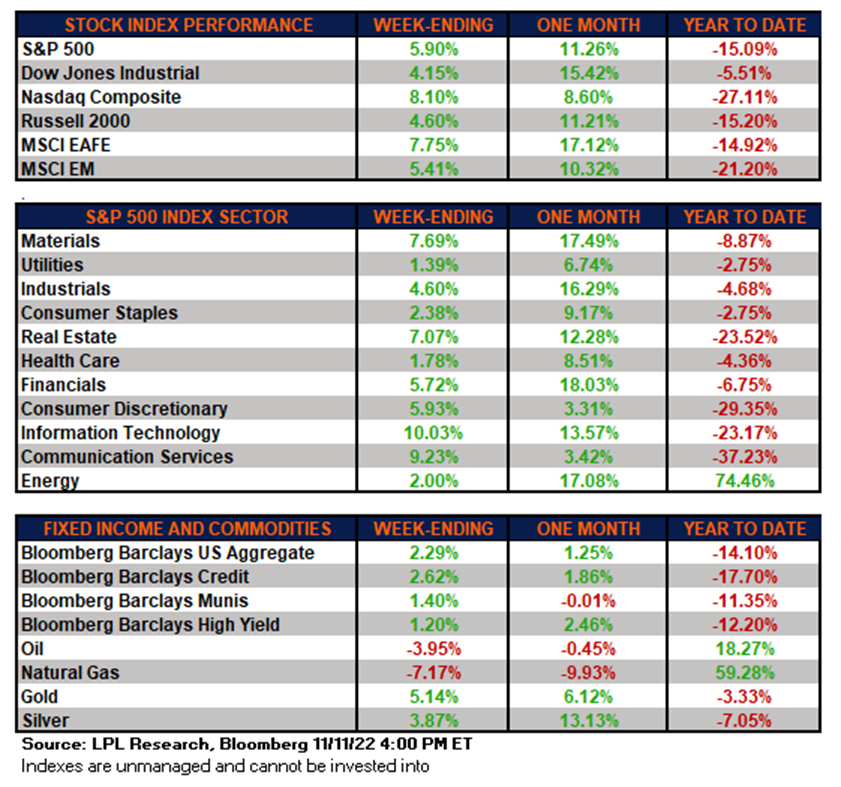

The week in review

The path of least resistance has swung firmly to the upside with the latest traction behind the peak inflation narrative and some widely previewed dialing back of zero Covid restrictions in China. Positioning still flagged as supportive for a renewed FOMO dynamic. Seasonality and buybacks some of the other bullish talking points. There also seem to be some positive takeaways surrounding recent corporate cost-cutting headlines, with a lot of attention on Meta Platforms slashing 11,000 employees. However, a cooler inflation print won't dent the Federal Reserve’s higher-for-longer messaging, particularly given central bank does not want to loosen financial conditions. Earnings another high-profile concern given combination of macro uncertainty messaging and estimates that still have a long way to go reflect recession risk.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.

Good summary, Blake!