Messy markets, plus the cost of capital and oil demand

The Sandbox Daily (9.27.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

messy markets under cloudy skies

higher costs of capital are top priority in C-suite circles

oil demand

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.98% | Nasdaq 100 +0.24% | S&P 500 +0.02% | Dow -0.20%

FIXED INCOME: Barclays Agg Bond -0.35% | High Yield -0.14% | 2yr UST 5.139% | 10yr UST 4.607%

COMMODITIES: Brent Crude +2.81% to $96.60/barrel. Gold -1.32% to $1,894.5/oz.

BITCOIN: +0.87% to $26,443

US DOLLAR INDEX: +0.44% to 106.695

CBOE EQUITY PUT/CALL RATIO: 0.88

VIX: -3.80% to 18.22

Quote of the day

“Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.”

- Morgan Housel, The Psychology of Money

Messy markets under cloudy skies

The charts are a mess these days.

The more charts I flip through, the less conviction I have on direction over the next 6 to 9 months – but I suppose that’s how markets work. Mr. Market seems to always find a way to frustrate the most investors possible! Below are just a few charts that capture this uneasiness, however I could put together a whole deck that supports a narrative that “we are navigating by the stars under cloudy skies.”

Near term, this orderly selling pressure has resulted in 7 consecutive weeks where we have more new lows than new highs; the bulls remain on ice.

And this breadth issue has plagued the market for the last year-and-a-half.

Since the Federal Reserve began raising its target benchmark rate, only the median stock in the two largest deciles of stocks by market cap have gained any ground. Intuitively, this makes sense as rising rates and tighter financial conditions should weigh more on smaller companies than the bigger companies with big balance sheets.

This next chart from Torsten Slok made its rounds on Twitter this week showing that while the 7 biggest stocks in the S&P 500 are up +50% in 2023, the other 493 stocks are basically flat.

The takeaway here being that investing in the index really means you own narrow leadership (34% of the index) at an expensive cost (average P/E ratio of ~50).

Meanwhile, over in bond land, investors seeking safety in traditional safe-haven assets are taking their licks.

With rates making new cyclical highs daily, it’s confusing to see the iShares 20+ Year Treasury Bond ETF (TLT) taking in $16B of inflows in 2023 (good for 2nd of all ETFs on the year) – despite TLT being down ~50% off its March 2020 highs on a price basis.

Eric Balchunas notes you can achieve the same yield at the short-end of the curve, yet without any duration risk attached in this rising rate environment. Yet somehow, the $750M of inflows this week didn’t get that same memo.

In terms of where rates go from here, it seems the logical direction is a continuation of yields lifting higher further – especially if inflation is slowly creeping back from the shadows as evidenced by various commodities reflating, with oil front and center.

Here is the battle everyone is watching in bond positioning.

Hedge Funds have built up short positions in Treasury futures contracts to record levels in various maturities over recent weeks, gaining the attention of regulators who are worried about a potential dislocation from a margin deleveraging event. In fact, Bill Ackman is short 30-year U.S. Treasuries “in size.” Yet, on the other, investors like pension funds, mutual funds, and ETFs are all positioned for rates to fall from here.

The rising pressures from interest rates, the U.S. dollar, and slowing of credit creation/availability still hasn’t created fractures among credit spreads, though – meaning the market is not yet signaling credit stress. This measure historically rolls over before/during periods of market turmoil, which we are not seeing yet.

Tough tape to read, to be sure.

Source: Willie Delwiche, Michael Batnick, Torsten Slok, Eric Balchunas, Otavio Costa, Financial Times

Higher costs of capital are top priority in C-suite circles

"Sufficiently restrictive" impacts corporations in different ways.

Large multi-national corporations have more robust balance sheets, bridge financing, access to capital markets, and a myriad of other levers to pull when financial conditions tighten.

Smaller companies do not enjoy these same luxuries. Often times, these companies access credit through variable interest rate loans (which are generally secured by company collateral). When financial conditions tighten, these companies have few levers to pull.

Petco (WOOF), a company with a $1B market cap (i.e. small-cap), took out a $1.7B loan two years ago at an interest rate ~3.5%. Now it pays almost 9%.

Executives say easing that burden is a company priority. In fact, the Chairman of the board stated on a recent earnings call that debt reduction is one of Petco’s three key capital-allocation initiatives.

Hanesbrands, alongside many other borrowers, has discovered that managing increased interest costs are eating away at cash flows and tightening corporate purses, which is catching the attention of the ratings agencies.

Source: Wall Street Journal

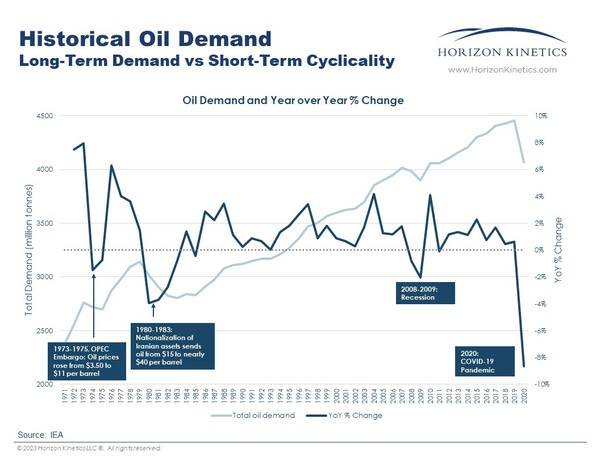

Oil demand

With oil prices recently back above $90/barrel and marching higher, a look at what might cause demand to contract seems timely.

Most assume that oil demand declines during an economic contraction. In reality, demand typically simply fails to grow in all but the most severe or commodity price-driven recessions – a subtle but important difference.

Global oil demand has only materially contracted four times in the past 55 years.

Between 1973 and 1975, demand fell by 2.2%, when the OPEC Oil Embargo resulted in oil prices rising from approximately $3.50 per barrel to nearly $11 per barrel.

Between 1980 and 1983, when the nationalization of Iranian oil assets sent prices from approximately $15 to nearly $40, demand contracted nearly 10%.

In 2008-2009, demand fell a total of 2.6% in the only instance where demand declined due to an “ordinary” recession.

In 2020, demand by over 9% when the entire world was operating under pandemic restrictions.

Clearly, it takes rather extraordinary circumstances to precipitate net declines in energy consumption, which has thus far been equivalent to oil demand.

Source: Horizon Kinetics

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.