Michael Burry's Big Short 2.0, plus the U.S. dollar and MSFT-GOOGL chatbot race

The Sandbox Daily (8.14.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Michael Burry’s The Big Short 2.0

rejection or breakout coming from the U.S. dollar?

the chatbot race between Microsoft and Google

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.18% | S&P 500 +0.58% | Dow +0.07% | Russell 2000 -0.24%

FIXED INCOME: Barclays Agg Bond -0.07% | High Yield -0.01% | 2yr UST 4.967% | 10yr UST 4.193%

COMMODITIES: Brent Crude -0.60% to $86.29/barrel. Gold -0.36% to $1,939.5/oz.

BITCOIN: -0.33% to $29,329

US DOLLAR INDEX: +0.31% to 103.157

CBOE EQUITY PUT/CALL RATIO: 0.80

VIX: -0.13% to 14.82

Quote of the day

“Fear incites human action far more urgently than does the impressive weight of historical evidence.”

- Jeremy Siegel, Professor of Finance at the Wharton School of Business

A huge bet against the market

Today is the deadline for filing 13F disclosures, a big day in the investor community.

The Securities and Exchange Commission (SEC) Form 13F is a quarterly report that is required to be filed by all institutional investment managers with at least $100 million in assets under management (AUM). These public disclosures provide a peek behind the curtain for some of the largest and brightest investors on the street, most notably hedge funds, pension funds, and endowments.

These filings provide insight into what the “smart money” is doing in the market, although the holdings are dated as of the most recent quarter end – so not exactly timely or actionable or even still relevant.

Of particular interest for me – beyond what Bill Ackman (Pershing), David Einhorn (Greenlight), David Tepper (Appaloosa), and the rest of the Wall Street titan investors were buying/selling and holding in 2Q23 – was what Michael Burry was doing.

Michael Burry was the Christian Bale character from The Big Short who famously bet against the United State housing market and benefitted handsomely doing so. Burry is a famed short seller – right or wrong – who garners a lot of attention when he speaks and makes trades.

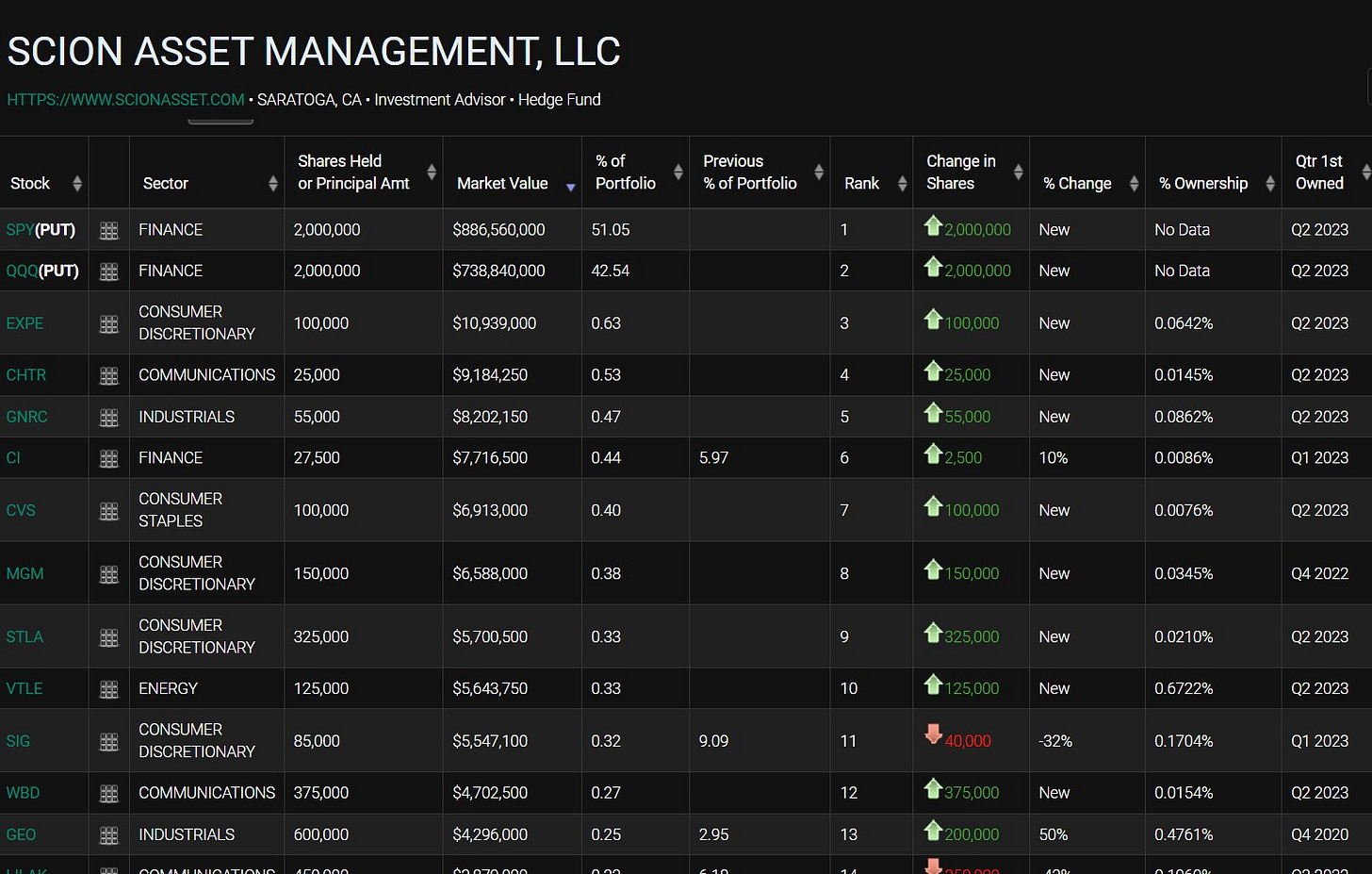

According to a new 13F SEC regulatory filing released today, Michael Burry just unveiled massive bets against the stock market and the tech sector for his hedge fund, Scion Asset Management.

As of June 30th, Burry owned put options against shares of the SPDR S&P 500 ETF (SPY) and the Invesco Nasdaq 100 Trust ETF (QQQ), which increase in value as the underlying asset falls in price. His underlying notional exposure is $1.6 billion, however we don’t know the prices paid, the strikes, or expiration dates.

So it appears Michael Burry is forecasting a major leg down in the market.

Or maybe not…

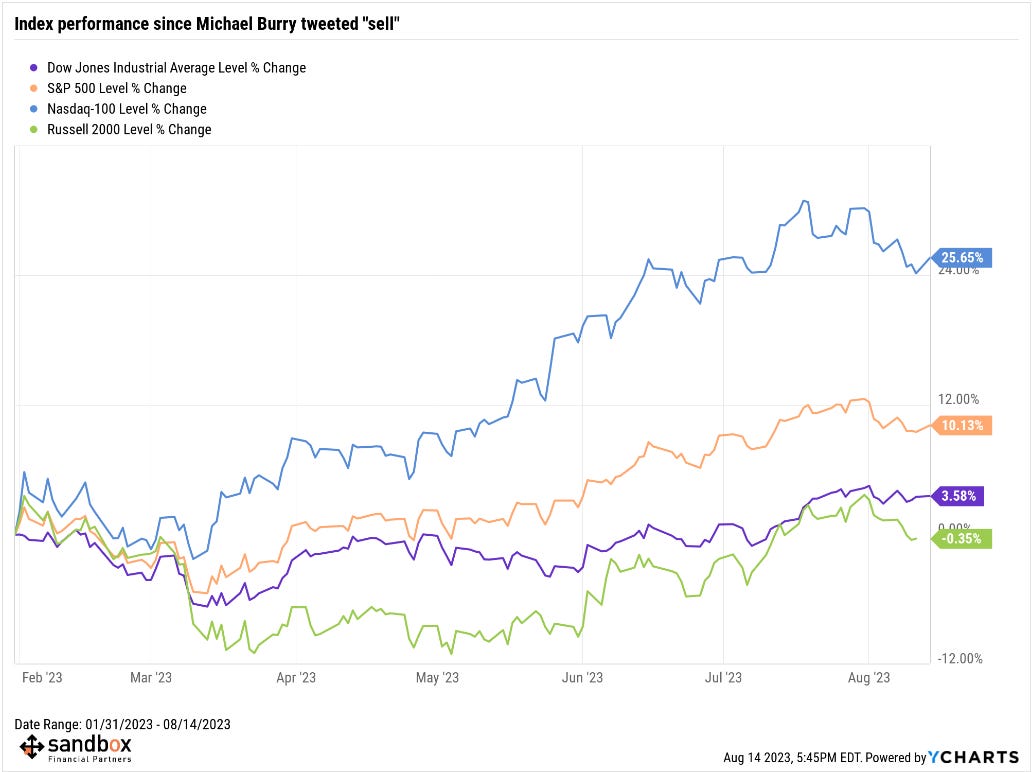

Let’s rewind the clocks back 7 months ago. Here is what Michael Burry tweeted to the public on January 31st, receiving 2 million views on just the 1st day:

“Sell.”

And what was Michael doing behind the scenes at the time? Buying stocks, of course! Scion Capital went on its biggest buying spree in years, adding to his existing Chinese exposures (JD and Alibaba), starting new positions across a few energy names, and building lots of positions across financials. Here was the 13F showing Scion’s holdings as of March 31st, despite the very public “sell” just two months earlier:

Since the January 31st “sell” tweet, markets have mostly been quite strong, save the Russell 2000:

There’s a very important lesson here for investors.

Everyone has their own unique risk tolerance, return objectives, time horizon, agenda, opinion on markets, and ability to trade markets.

None of these Michael Burry headlines matter to you. What someone else is buying/selling should have no bearing on how you manage your own portfolio. We also do not know his motivations or broader strategy at play. And worst of all, when you listen to the big money managers on CNBC or Bloomberg, they can say one thing and do another/change their mind in a moment’s notice. They don’t have to check in on you. They owe you nothing.

So best practice is to listen and move on, because it has nothing to do with your specific financial plan, goals, and situation.

Source: Securities and Exchange Commission, Bloomberg, ZeroHedge

Dollar rejection or breakout?

The U.S. Dollar was a major headwind for stocks last year. Each time it moved higher, stocks took another leg lower. Only when the Dollar Index peaked in late September 2022 did stock prices set their bear market low in October.

So is the catalyst for stock prices in the back half of 2023 coming from a weaker dollar?

Well, unfortunately for many investors, stocks have had a rocky 4 weeks since the U.S. dollar found renewed strength beginning in mid-July.

Bulls would like to see rejection at the descending resistance trendline from the 2022 highs, which also roughly coincides with the 200-day moving average. A dollar rollover to those 2023 lows is part of the 2nd half playbook.

On the flip side, Bears are looking for continued strength in the U.S. dollar, being driven in part from (quickly) rising U.S. yields.

Source: Kimble Charting Solutions, Caleb Franzen

The chatbot race between Microsoft and Google

Much ink has been spilled about the explosive growth and endless possibilities surrounding ChatGPT and generative artificial intelligence (AI).

Much of that narrative focused on Microsoft’s (MSFT) first mover advantage and $10 billion dollar investment/partnership in Sam Altman’s OpenAI.

And yet, since the November 30th, 2022 successful launch of ChatGPT, it is Google’s parent company Alphabet (GOOGL) that is outperforming Microsoft, despite the sloppy introduction of its own chatbot, Bard, back in February.

Source: Bespoke Investment Group

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.