Mid-season earnings review, plus Nasdaq 100, debt limit update, and peak AI exuberance?

The Sandbox Daily (5.1.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Q1 mid-season earnings update

Nasdaq 100 hits highest level since August 2022

debt limit debate impacting Treasury markets

AI search interest is exploding

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.01% | S&P 500 -0.04% | Nasdaq 100 -0.11% | Dow -0.14%

FIXED INCOME: Barclays Agg Bond -1.02% | High Yield -0.45% | 2yr UST 4.145% | 10yr UST 3.582%

COMMODITIES: Brent Crude -1.23% to $79.34/barrel. Gold -0.52% to $1,988.7/oz.

BITCOIN: -4.31% to $28,132

US DOLLAR INDEX: +0.47% to 102.135

CBOE EQUITY PUT/CALL RATIO: 0.76

VIX: +1.90% to 16.08

Quote of the day

“Happiness is a mindset for your journey, not the result of your destination.”

-Shawn Achor, The Happiness Advantage

Q1 mid-season earnings update

Recent equity strength can partially be chalked up to better-than-expected Q1 earnings as corporate commentary still seems more supportive of a soft-landing scenario.

Earnings season is in full swing, with 178 companies in the S&P 500 Index (SPX) having reported results last week and another 162 companies reporting this week. Marquee names are reporting results every day, with Pfizer (PFE), Marriott (MAR), Ford Motor (F), CVS Health (CVS), Apple (AAPL), and Anheuser-Busch InBev (BUD) as some of the attention-grabbing headliners.

The performance of S&P 500 companies continues to be mixed, although better-than-feared, as we move into the heart of Q1 earnings season. Last week we saw nearly twice as many positive guidance announcements than negative.

Of the 53% of companies in the S&P 500 that have reported, 79% have reported actual EPS above their estimates, which is above the 5-year average of 77% and the 10-year average of 73%. In aggregate, companies are reporting earnings that are +7.3% above estimates, which is below the 5-year average of +8.4%, but above the 10-year average of +6.4%.

In other words, more companies are beating estimates and by larger amounts, at least against their 10-year averages. It must be noted these higher beat rates come against unimpressive expectations that have been revised downward for several months.

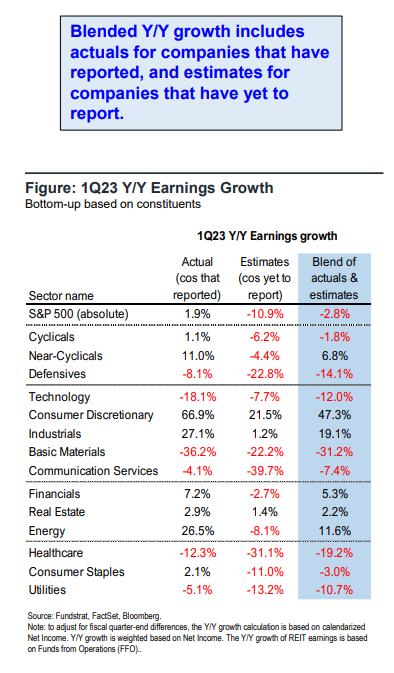

The blended earnings decline (blended combines actual results for companies that have reported and estimated results for companies that have yet to report) for the 1st quarter is -2.8% today, which would mark the 2nd consecutive quarter in which the index has reported a year-over-year decline in earnings – so the earnings valley/recession is here, as expected.

6 of the 11 sectors are reporting year-over-year earnings growth, led by the Consumer Discretionary and Industrials sectors. On the other hand, 5 sectors are reporting a YoY decline in earnings, led by the Materials and Health Care sectors.

Looking beyond Q1, analysts still predict earnings growth of +1.2% for calendar year 2023, despite Q1’s decline of -2.8% and Q2’s projected drop of -5.0% – that’s because of a reacceleration in the 2nd half where analysts are projecting earnings growth of +1.7% and +8.8% in the 3rd and 4th quarters.

Key themes are emerging from the results themselves and from the C-Suite on the conference calls: A.I. is the squishy buzzword of 2023, corporate cost-cutting and efficiency actions are paramount, a weaker Dollar strengthens demand abroad, lower interest rates are a tailwind, easing input prices and supply chain pressures boost margins, and deploying cash on stock buybacks to satisfy shareholders. Wages remain a lingering key issue against margins.

Source: Earnings Whispers, FactSet, Fundstrat

Nasdaq 100 hits highest level since August 2022

After leading to the downside in 2022, growth stocks have been leading the market higher in 2023 in both absolute and relative terms.

With the largest growth stocks in the market delivering eye-popping YTD returns – led by the likes of Meta Platforms (META) at +99.7% and Nvidia Corp (NVDA) at +89.9% – it should be no surprise to see this strength show up at the tech-heavy Nasdaq index level. Today, the Nasdaq 100 ETF (QQQ) printed fresh 8-month highs and is up +21% YTD:

It’s no coincidence the Nasdaq 100 index seems to be resolving higher at the same time the U.S. dollar index is hitting its lowest level in a year.

A weaker Dollar has translated into a healthy stock market over the past 6-7 years or so. It's only when the Dollar is strong that stocks have been under pressure.

And the fact that the heavyweight tech index is making new multi-month highs could support further outperformance from other growth segments of the market.

Source: All Star Charts

Debt limit debate impacting Treasury markets

Janet Yellen, the U.S. Treasury Secretary, warned policymakers in a letter on Monday that the United States government may run out of extraordinary measures as early as June 1st to pay its debt obligations on time if Congress doesn’t first raise the debt limit ceiling beyond the statutory limit of $31.4 trillion that was hit in January.

Some corners of the financial market have already begun to reflect debt limit-related risks. The Treasury bills curve appears to imply risk of disruption in June, July, and October. However, implied equity volatility shows little debt limit effects, however this will change as we move closer towards the projected cutoff date.

The cost of insuring U.S. debt against a default – via a credit-default swap (CDS) contract over the next 12 months – has soared to the highest on record, reflecting the uneasiness that persists in the bond market.

2023 CDS spreads have risen higher than the 2011 debt-ceiling showdown and subsequent Standard & Poor’s downgrading of the AAA credit rating, as well as the debt-ceiling dramas played out in 2013, 2015, and 2021.

Source: Goldman Sachs Global Investment Management, CNBC, Bloomberg

AI search interest is exploding

The undeniable exuberance around Artificial Intelligence (“AI”) in 2023 is palpable and omnipresent, buoying sentiment in certain companies and their publicly traded stock. Some are already calling this peak AI narrative a bubble.

This is reflected in the search interest for “AI stocks” which recently hit an all-time high and is anecdotally supported by the daily articles and social media mentions around its frenzy:

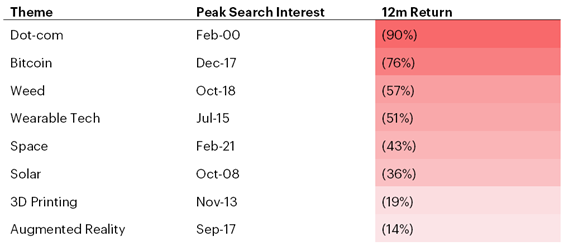

Previous “peak search engine” equity rallies have not ended well. This phenomenon played out numerous times throughout the 2000s as trends came and went, as illustrated below.

Unlike the once-upon-a-time $3 trillion dollar crypto market that still seeks a pragmatic real world use-case solution, ChatGPT and other AI programs are already finding their way into the code-building community, complementing academic research, and helping businesses automate tedious tasks.

Nevertheless, the large-scale benefits from AI will likely take longer to materialize and have more modest applications and scope than today’s AI evangelists would lead us to believe.

Source: Verdad Capital

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.