Mid-summer check-in: tactically neutral but strategically bullish

The Sandbox Daily (7.29.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the lazy days of summer

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.21% | S&P 500 -0.30% | Dow -0.46% | Russell 2000 -0.61%

FIXED INCOME: Barclays Agg Bond +0.54% | High Yield +0.06% | 2yr UST 3.871% | 10yr UST 4.324%

COMMODITIES: Brent Crude +3.95% to $72.81/barrel. Gold +0.43% to $3,324.3/oz.

BITCOIN: -0.43% to $117,609

US DOLLAR INDEX: +0.26% to 98.891

CBOE TOTAL PUT/CALL RATIO: 0.85

VIX: +6.32% to 15.98

Quote of the day

F-E-A-R has two meanings:

'Forget Everything And Run' or 'Face Everything And Rise.'

The choice is yours.

- Zig Ziglar

Tactically cautious but strategically bullish

Believe it or not, the back half of 2025 is well underway, as most of us endure the intense heat of summer and enjoy a refreshing cocktail poolside or beachside to cool/wind down.

As such, choosing our line to get the portfolio ready for the remainder of 2025 seems prudent during the dog days of summer.

The near-term tactical picture for the vast majority of asset classes tilts positive – not necessarily due to the attractiveness of stocks, bonds, or credit – but more because the worst-case scenarios are thought to be eliminated.

Looking tactically over the short-term horizon, some caution over further upside is warranted. The market could be susceptible to a shallow pullback given the extensions of the move off the April lows and current valuations, but pinpointing the exact timing of such development is not winning strategy.

Longer-term we remain in a momentum thrust regime given the multitude of signals that flashed throughout April and May. Other important positives include a subsiding of the chaotic tariff policy, fiscal pull forward from the One Big Beautiful Bill Act, and monetization of the AI trade.

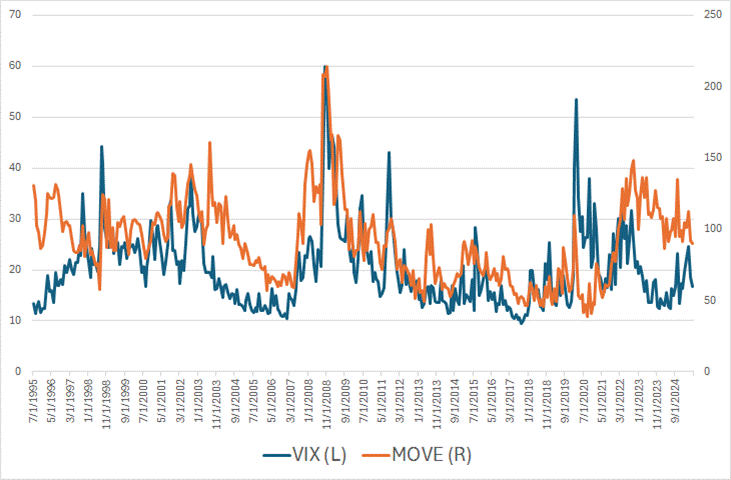

In the case of stocks, strong earnings and the willingness of the Trump administration to keep pushing off tariff threats/deadlines suggest there is some upside that remains with volatility having room to subside.

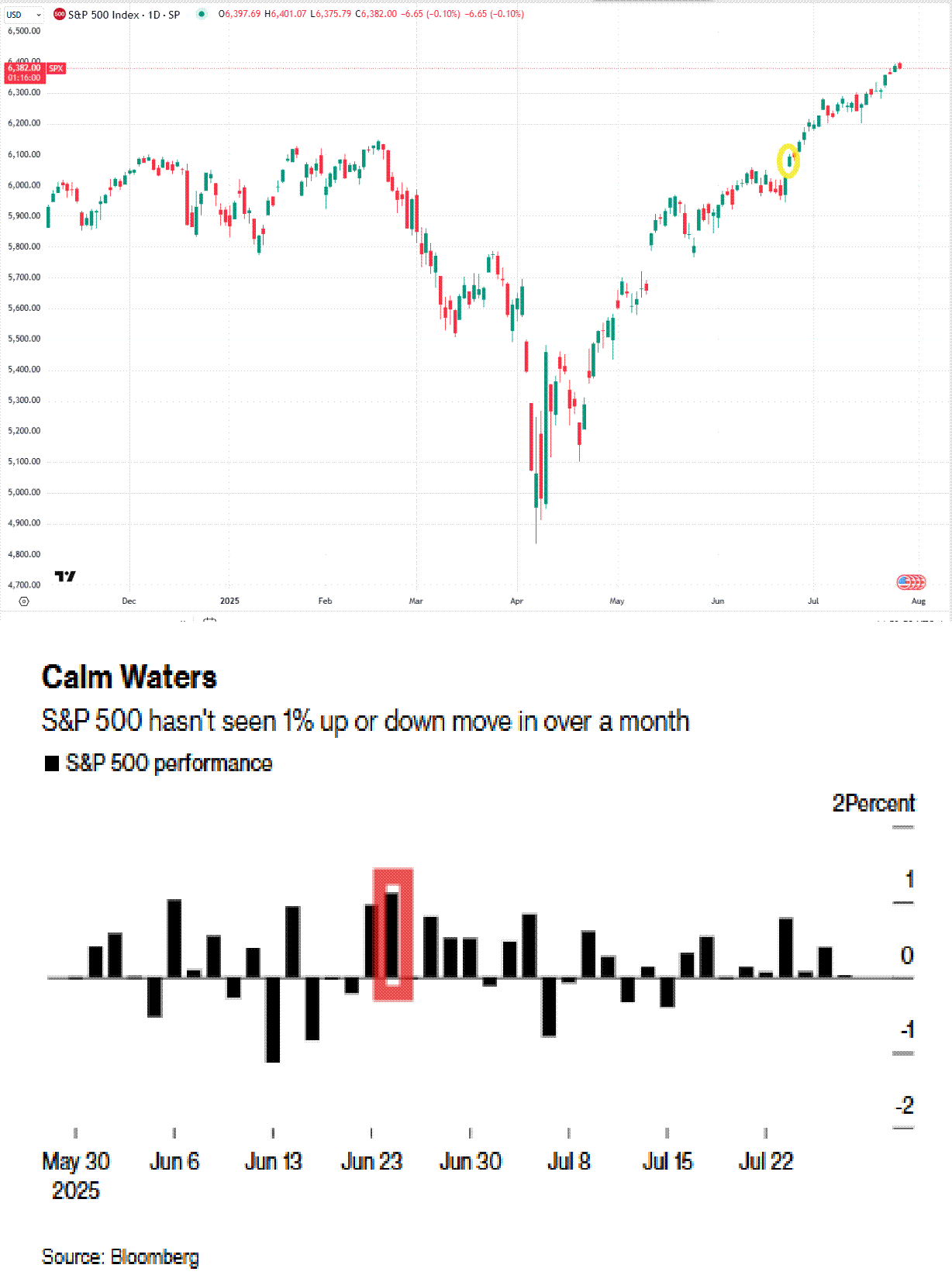

After a chaotic and volatile 1st half of 2025, the 2nd half has been the exact opposite story. To wit, the S&P 500 hasn’t experienced an up or down move of 1% or greater since June 24th.

For bonds, the worry was the global rise of yields at the long end and steepening in the United States thanks to policy uncertainty and swelling debts and deficits.

The 30-yr UST yield is hanging around 5%, which represents an important level for asset allocators, while the steepening in the 2s10s yield curve that we saw in the past year stalled from April onward. In the context of other steepening episodes, I would not expect to get anywhere near the steepness we saw in other post-recession scenarios as the expected rate cutting should be modest relative to post dotcom and GFC bubbles.

Bond yields seem to be looking past the deficit worries, and even as the recent core CPI print was benign, the tariff uncertainty should keep the Fed on hold.

Meanwhile, in credit, the story has remained the same where the combination of credit spreads at decades-long tightness, coupled with all-in yields at decades-long highs, is still reasonable so long as the business cycle is not under threat.

Credit has served as an effective barometer for the “buy the dip” mentality as the lack of response from credit spreads tells us it’s safe to jump back in the pool.

Of course, underlying all of these moderating tail risks is the idea that we are in a soft landing rate-cutting cycle.

With only a few historical examples to go off in the past dozen rate-cutting cycles (mid-60s, mid-80s, 1994), the idea is that unlike in rate-cutting cycles for growth risks, where stocks go down, rate-cutting with soft landings will be bullish for stocks (in particular Growth stocks), as moderating economic downpulses push investors and cash on sidelines into the market.

So, even as the bearish outliers are clipped from the narrative, so too are the near-term positive scenarios.

Even as the market cheers resilient stock earnings, it is worth bearing in mind that these are already reflected in the high U.S. multiples, setting up the market for disappointment – unless of course expectations were driven low enough that just-good-enough satisfies Mr. Market.

Sources: Neil Sethi, Goldman Sachs Global Investment Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)