Midterm election cycles

The Sandbox Daily (12.10.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

midterm election cycles

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.32% | Dow +1.05% | S&P 500 +0.67% | Nasdaq 100 +0.42%

FIXED INCOME: Barclays Agg Bond +0.32% | High Yield +0.34% | 2yr UST 3.532% | 10yr UST 4.141%

COMMODITIES: Brent Crude +1.13% to $62.64/barrel. Gold +0.68% to $4,264.7/oz.

BITCOIN: -0.87% to $92,368

US DOLLAR INDEX: -0.55% to 98.669

CBOE TOTAL PUT/CALL RATIO: 0.82

VIX: -6.85% to 15.77

Quote of the day

“Hardship often prepares an ordinary person for an extraordinary destiny.”

- C.S. Lewis

Midterm election cycles

As 2025 comes to a close, equity markets are ending the year on a high note, with the S&P 500 on track for its 3rd consecutive year of double-digit returns, driven by AI momentum and a resilient economy that has shrugged off fiscal and political headwinds.

The upcoming 2026 midterm election year signals a shift that will likely be less about “resiliency” and more about “discernment.”

The new year, however, begins with more uncertainty in Washington as the short-term funding bill expires at the end of January. This means there could be another wave of negotiations that could result in another government shutdown.

Looking further ahead, investors will likely shift their attention to the midterm election and what it could mean for tariffs, regulation, government spending, and more.

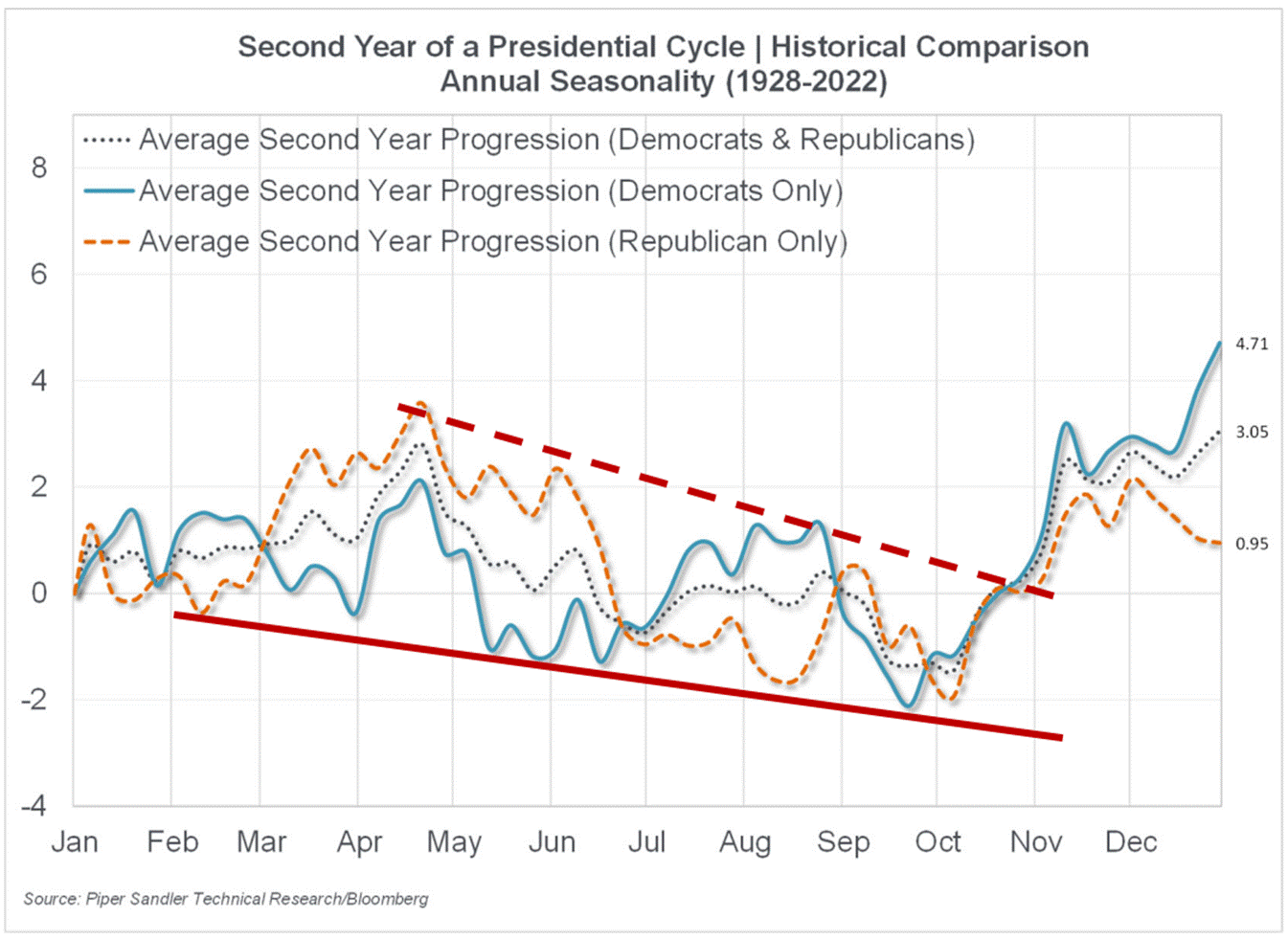

On average, midterm election-year performance has been modest at 3.1% over the last 100 years.

Under a Republican presidency, the average returns were much lower, around roughly 1%.

Yet midterm election years are often marked by their volatility.

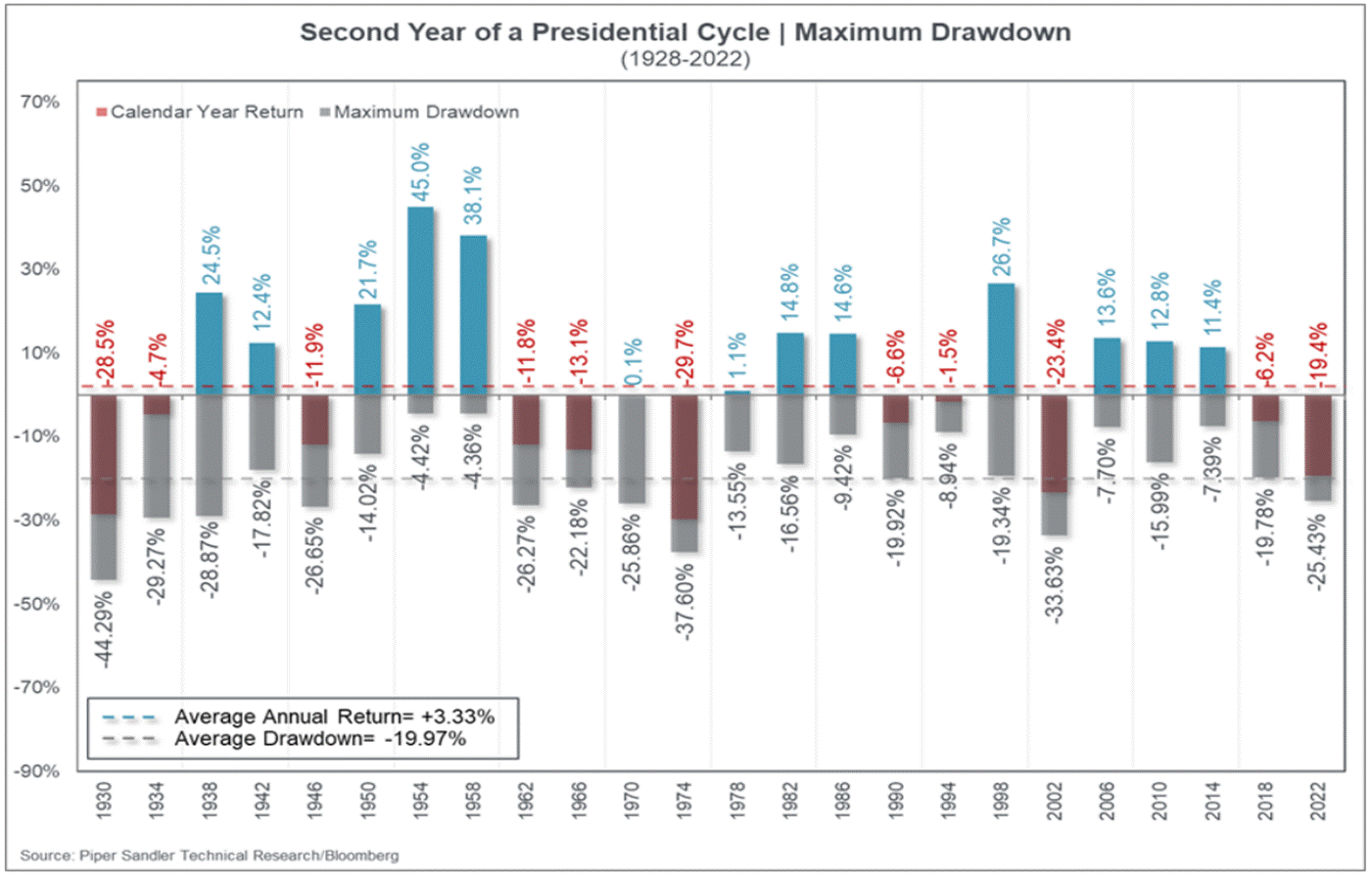

Historically, annual returns have averaged +3.3% for the S&P 500 with average maximum drawdowns of about -20%.

The largest drawdown, -44%, occurred in 1930. Since 2000, we’ve experienced three of six instances where stocks fell 20% or more at one point intra-year.

In terms of recovery performance, meaning after a maximum drawdown, the index posted positive returns of +9.0%, +14.2%, and +20.5% over the next 4-, 13-, and 26-week periods, respectively. Some good news, to be sure.

The technical evidence suggests investors should prepare for a more volatile and muted market come 2026.

Sources: Clearnomics, YCharts, Piper Sandler

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)