Monetary policy, plus homebuilders, the market cycle, and market breadth

The Sandbox Daily (5.18.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

is the Fed done hiking interest rates?

homebuilders lead the way

the market cycle of emotions

narrow market breadth fuels skepticism of 2023 stock rally

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.81% | S&P 500 +0.94% | Russell 2000 +0.58% | Dow +0.34%

FIXED INCOME: Barclays Agg Bond -0.47% | High Yield +0.05% | 2yr UST 4.261% | 10yr UST 3.651%

COMMODITIES: Brent Crude -1.17% to $75.95/barrel. Gold -0.31% to $1,980.4/oz.

BITCOIN: -2.02% to $26,861

US DOLLAR INDEX: +0.65% to 103.522

CBOE EQUITY PUT/CALL RATIO: 0.68

VIX: -4.86% to 16.05

Quote of the day

“The measure of a man is the depth of his convictions, the breadth of his interests, and the height of his ideals.”

-Unknown

Is the Fed done hiking interest rates?

As disinflation becomes the headline of 2023, the Federal Reserve has sufficiently tightened financial conditions to the point where the FOMC is likely done hiking rates for the cycle.

One sign the Fed has completed its intended goal is the upper limit of the Fed Funds Rate is now up to 5.25%, which is finally more than year-over-year CPI, which is 4.9%. Historically, the previous eight hiking cycles all saw Fed Funds rise above CPI before the Fed was done hiking. That is where we find ourselves today.

If this is the final rate hike of the cycle, U.S. equities have generally rallied in the months following the end of past Fed tightening cycles. Here’s a look at the last 10 Fed hiking cycles:

In the 12 months following the peak Fed Funds Rate, the S&P 500 has returned an average of +14.3%, ranging from +35% to -16% and rising in 8 of 10 episodes.

Source: Goldman Sachs Global Investment Research, Carson Group

Homebuilders lead the way

Although major U.S. indexes remain stuck in their ranges, one group that has been trending higher is the Home Construction ETF (ITB).

These cyclical stocks are an excellent gauge of global growth and a leading indicator for the broader market.

When home construction is trending higher, it tends to happen in an environment conducive to risk-seeking behavior. The opposite is true when homebuilder stocks are under selling pressure. Notice how the S&P 500 (SPY) looks quite similar to homebuilders over time.

Seeing ITB press against 52-week highs suggests a risk-on tone for the market and risk assets in general. It is also supportive of the bullish price action we’re seeing at the index level.

Source: All Star Charts

The market cycle of emotions

Creating an investment strategy is easy. Sticking with it is hard.

At the end of the day, we’re all human and beholden to our emotions.

What’s so interesting about investor psychology is that it doesn’t really change in the way that market cycles can change. It’s more or less consistent. Investor behavior, and our emotional response to seeing our accounts go up and down, doesn’t really deviate because of time or what’s driving the current market cycle.

Source: Quantified Strategies

Narrow market breadth fuels skepticism of 2023 stock rally

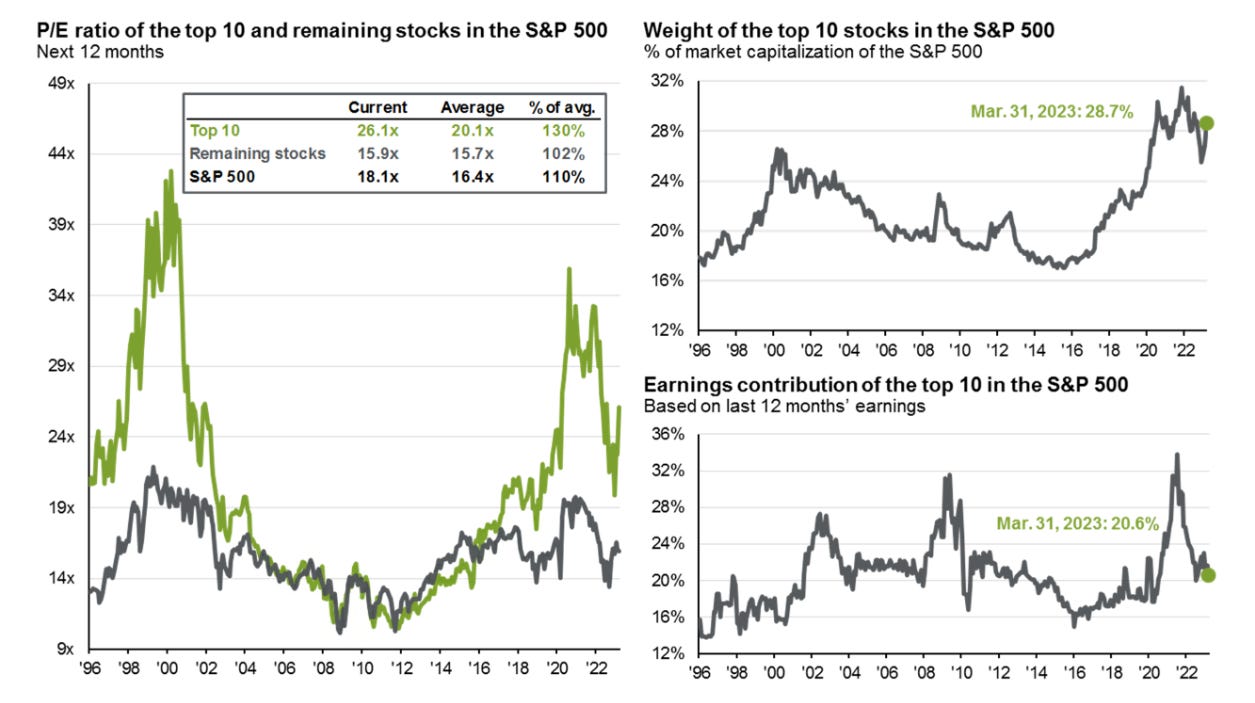

The concentration of large-cap stocks leading the overall market higher this year has raised skepticism among the investing community about whether the market can sustain its momentum.

This year’s stock gains have largely occurred among a small number of stocks, with large swaths of the broader market not participating.

The top 10 stocks within the S&P 500 comprise 28.7% of the total market capitalization for the entire index which is near the top end of its historical range. That itself is not a reason to fade the rally, but the rest of the constituents in the index will need to catch up to this year’s leaders if we should expect further expansion of the 2023 rally.

From a valuation perspective, it’s interesting to note that if you remove those top 10 stocks, the market is trading at a 15.9x forward P/E multiple, which is right in line with historical averages.

Source: J.P. Morgan Guide to the Markets

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.