Money market cash balances, plus the 2000 bubble, market breadth, default rates, and 🧁 weekend sprinkles 🧁

The Sandbox Daily (3.15.2024)

Welcome, Sandbox friends.

We’re up 16 of the last 20 weeks since the October 2023 lows on the S&P 500 index, good for +24% or 1000 points (4117 to 5117). Does next week’s Fed meeting and their updated Summary of Economic Projections (SEP) statement throw cold water on the rally? It’ll surely be a big week for monetary policy, stocks, rates and credit, and everything in-between.

The feedback was overwhelmingly positive on last week’s new section “Weekend Sprinkles,” so we are keeping it on a go-forward basis. Enjoy this week’s selections!

For now, today’s Daily discusses:

money market cash reaches record $6.1T

this isn’t 2000

it’s just a handful of stocks, right?

default rates ticking higher

weekend sprinkles

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.40% | Dow -0.49% | S&P 500 -0.65% | Nasdaq 100 -1.15%

FIXED INCOME: Barclays Agg Bond -0.01% | High Yield -0.06% | 2yr UST 4.732% | 10yr UST 4.306%

COMMODITIES: Brent Crude -0.13% to $85.31/barrel. Gold -0.31% to $2,160.8/oz.

BITCOIN: -2.61% to $68,180

US DOLLAR INDEX: +0.08% to 103.446

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: +0.07% to 14.41

Quote of the day

“As a rule, men worry more about what they can't see than about what they can.”

- Julius Caesar

Money market cash reaches record $6.1T

When thinking about liquidity and potential catalysts for 2024, one must at least consider money market assets as a tailwind – which just rose for the 3rd consecutive week to a fresh record high of $6.1 trillion.

And yet, many are quick to pooh-pooh the “cash on the sidelines” idea, arguing the $1.2 trillion rise in money market balances from early last year is due to deposit flight from banks and their low-yielding savings accounts.

However, in Fundstrat’s morning note from today, Tom Lee pushes back on this line of thought, stating:

So where is all this cash on the sidelines coming from?

Well, it’s certainly not just bank deposit flight. Perhaps it is a combination of new savings accumulation, interest income from bonds and cash, stock liquidations, and Treasury/CD maturities from the last 1-3 years.

Bottom line, there is plenty of firepower on the sidelines to continue buying the dip – even as markets continue to print new all-time highs.

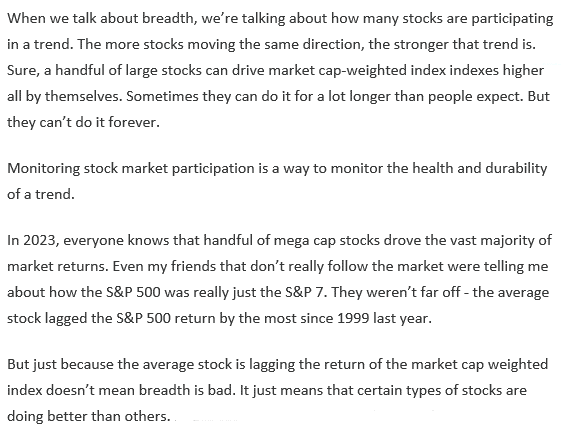

This isn’t 2000

Recognizing the concentrated outperformance and extended valuations emanating from certain large-cap growth stocks, specifically around those companies catching the artificial intelligence euphoria bid, several notable investors – including Jeffrey Gundlach and Jeremy Grantham – are declaring these stocks are forming a bubble and comparing the current period to the height of the dot-com bubble at the start of 2000.

One meaningful difference between the current backdrop and the 2000 tech/momentum bubble, however, is centered around quality – which can be measured countless different ways, of course.

Take a look at the Piper Sandler chart below that shows the momentum bubble of the early 2000s looked just like the performance of stocks with negative earnings. Pipe-dream growth companies, those with low returns-on-equity (ROE) or lacking earnings power, fueled the move back then.

Today, though, is a very different story – one rooted in much stronger profitability and fundamentals.

Source: Piper Sandler, Burton Malkiel

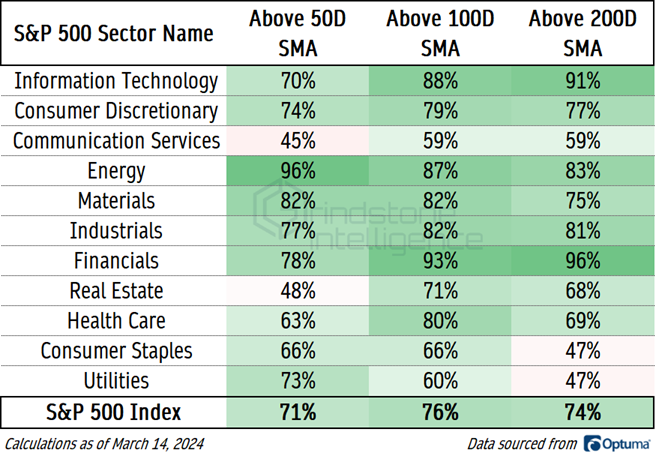

It’s just a handful of stocks, right?

It’s exhausting to hear people still complain about market breadth. That narrative is tired, lazy, and frankly downright wrong.

When scanning across the 11 sectors of the S&P 500 index, there is very little weakness to speak of when you see these percentages of stocks that remain above their intermediate and longer-term price trends.

And why is it so important for investors to track market breadth?

Here is Austin Harrison, CMT of Grindstone Intelligence to explain:

It’s always important to remember that the stock market is a market made up of individual stocks.

Looking across sectors and industry groups, both in absolute and relative terms, provides much more information than a throwaway media headline.

Source: Austin Harrison (Grindstone Intelligence)

Default rates ticking higher

More companies have defaulted on their debt in 2024 than in any start to the year since the Global Financial Crisis (GFC) as the fallout from high interest rates and persistent inflation place significant burdens on the most vulnerable borrowers worldwide.

This year’s global tally of corporate defaults stands at 29, the highest year-to-date count since the 36 recorded over the same period in 2009.

Source: Financial Times

Weekend sprinkles

Here are some ideas that caught my attention this week – perfect for quiet time reading over the weekend.

The Atlantic – Why Americans suddenly stopped hanging out (Derek Thompson)

Young Money – Why don’t we do what we want? (Jack Raines)

Grindstone Intelligence – The Monday morning grind (Austin Harrison)

A Wealth of Common Sense – 20 lessons from 20 years of managing money (Ben Carlson)

Investor Amnesia – Using history to identify inflection points (Jamie Catherwood)

And here is the fun stuff that got me through the finish line (aka Friday).

The Covenant, directed by Guy Ritchie (IMDB)

Thank You For Smoking, directed by Jason Reitman (IMDB)

Zac Brown Band – Stubborn Pride (Spotify, Apple Music)

Nas & Damian “Jr. Gong” Marley – Patience (Spotify, Apple Music)

Blink 182 – Anthem Part 3 (Spotify, Apple Music)

Maceo Parker – Children's World (Spotify, Apple Music)

In honor of 🍀 St. Patrick’s Day 🍀, I’ll be dialing back the clock (to college) and enjoying at least one Irish Car Bomb this weekend !

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

love the weekend sprinkles addition - thank you !