Money market flows, plus European banks, SPR reserves, yield inversion, and $100,000

The Sandbox Daily (3.27.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Money market inflows accelerate, amidst TARA and banking stress

Contagion risks in Europe

Crude prices fall as U.S. holds off replenishing SPR

Common recession indicator pulling back

Where $100,000 salary feels like $36,000

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.08% | Dow +0.60% | S&P 500 +0.16% | Nasdaq 100 -0.74%

FIXED INCOME: Barclays Agg Bond -1.08% | High Yield -0.24% | 2yr UST 4.002% | 10yr UST 3.536%

COMMODITIES: Brent Crude +4.09% to $78.06/barrel. Gold -1.31% to $1,975.5/oz.

BITCOIN: -2.78% to $27,038

US DOLLAR INDEX: -0.27% to 102.837

CBOE EQUITY PUT/CALL RATIO: 0.73

VIX: -5.24% to 20.60

Quote of the day

“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

-Benjamin Graham

Money market inflows accelerate, amidst TARA and banking stress

Equity markets stabilized last week amid a mix of positive and negative news. The S&P 500 rose 3% from its recent trough on March 13th, despite hawkish Fed commentary, a 0.25% increase in the Fed Funds Rate (target range 4.75-5.00%), continued ambiguity from policymakers on blanket deposit insurance, and tremendous pressure on the banking sector.

An acceleration of money market inflows suggests deposit flight remains an ongoing identity crisis for the banks. Last week $136 billion flowed into U.S. money market funds (the 4th largest weekly inflow since 2007), up from $116 billion the prior week. Banking stress aside, YTD flows out of U.S. equity funds and into money market and bond funds are reflective of an increasing investor preference for lower risk, yield-bearing assets.

On Friday of last week, the Federal Reserve released a report that showed the 25 largest U.S. banks added $67 billion in deposits for the week ended March 15th, just days after Silicon Valley Bank’s collapse. Meanwhile, deposits at smaller banks fell by $120 billion from a week earlier; the 1.5% decline for small banks’ total deposits was the first decline since 1986.

Because of the lag in the Fed’s reporting, these numbers will continue to balloon as more recent data is reported this week and next.

Source: Goldman Sachs Global Investment Research, CNBC, Grit Capital

Contagion risks in Europe

After Credit Suisse’s forced merger into UBS, Deutsche Bank is the latest bank on the chopping block. Deutsche Bank shares fell more than 10% on Friday and over 30% since March 1st as investors grow anxious about the banking sector's health.

The chart below shows that European bank Credit Default Swap (CDS) spreads have increased significantly, yet the distance to the CDS spread levels seen during the Eurozone Debt Crisis and the Great Financial Crisis remains vast. As a reminder, CDS are derivatives contracts allowing investors to hedge a company's credit risk and if the associated company defaults, the insurance owner is essentially made whole.

It is worth noting the CDS spreads of some banks have now surpassed the levels seen during the United Kingdom mini budget crisis last year and COVID-19, implying that things are heating up again. Despite the impressive size of Swiss National Bank guarantees – larger than the U.S. measures concerning regional banks relative to deposits – circumstances are intensifying again.

Source: True Insights

Crude prices fall as U.S. holds off replenishing SPR

After drawing from the U.S. Strategic Petroleum Reserve (SPR) last summer to offset soaring gasoline prices, many are wondering what’s next in regard to refilling this national stockpile that was traditionally saved as a national security measure.

The SPR is at its lowest level since 1983 after 2022’s historic (estimated) sale of 180 million barrels.

Despite U.S. crude prices recently touching 15-months lows, Energy Secretary Jennifer Granholm told lawmakers last week that replenishing the stockpile could take years. This stands in contrast to what the Biden Administration relayed last year when the U.S. government would step into the market as buyers when oil prices were at or below $67-$72. As you can see in the chart below, we’ve been in that “buy zone” for over a week.

This would be a wonderful time to repurchase large stocks of oil, buying into a market where prices are substantially lower than last year’s average price of $95/barrel.

Buy low, sell high.

Source: Reuters, Yahoo Finance, Financial Times, Liz Young

Common recession indicator pulling back

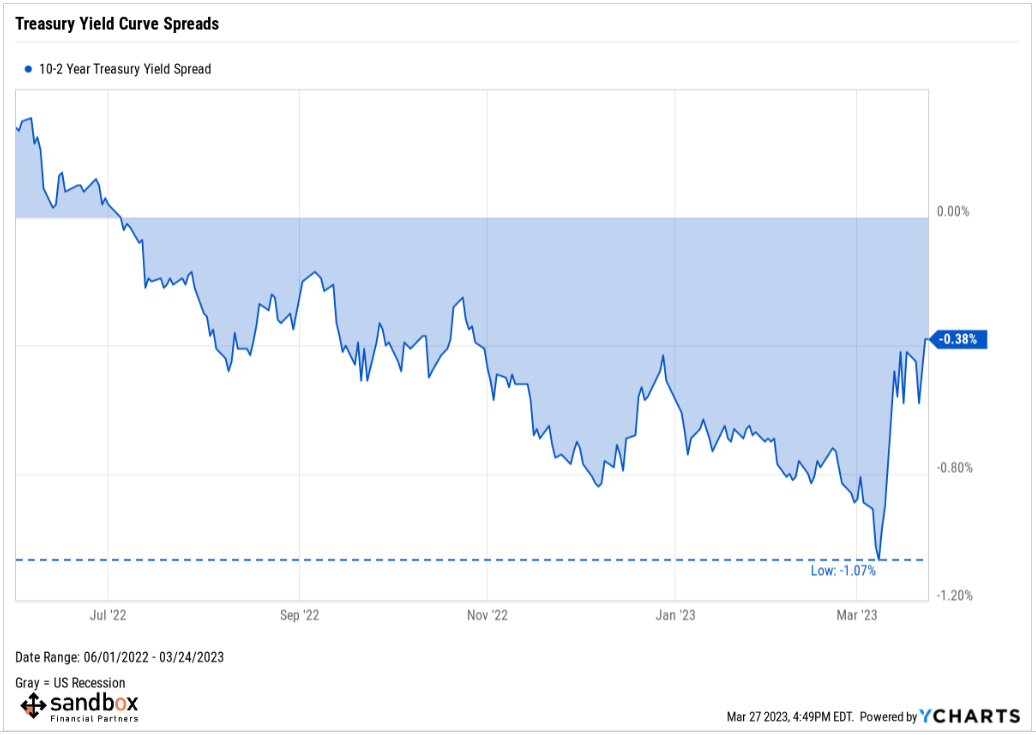

Since March 8th when the spread between longer-dated U.S. Treasuries (10-year) and shorter-dated U.S. Treasuries (2-year) reached peak inversion (-1.07%) – the largest curve inversion since 1981 – this portion of the yield curve has started steepening again, gaining 69 basis points (0.69%) in the last few weeks.

While still deeply inverted, it’s worth noting the abrupt change as markets consider what the latest development in the delicate banking system portends for future monetary policy; after all, we are heading for 2s-10s steepest monthly increase since October 2008. The direction has been reversing because short-term rates (the 2s part) have been plunging, on investors’ increasing expectations that the Fed is close to completing its rate hiking cycle and will be cutting rates in short order.

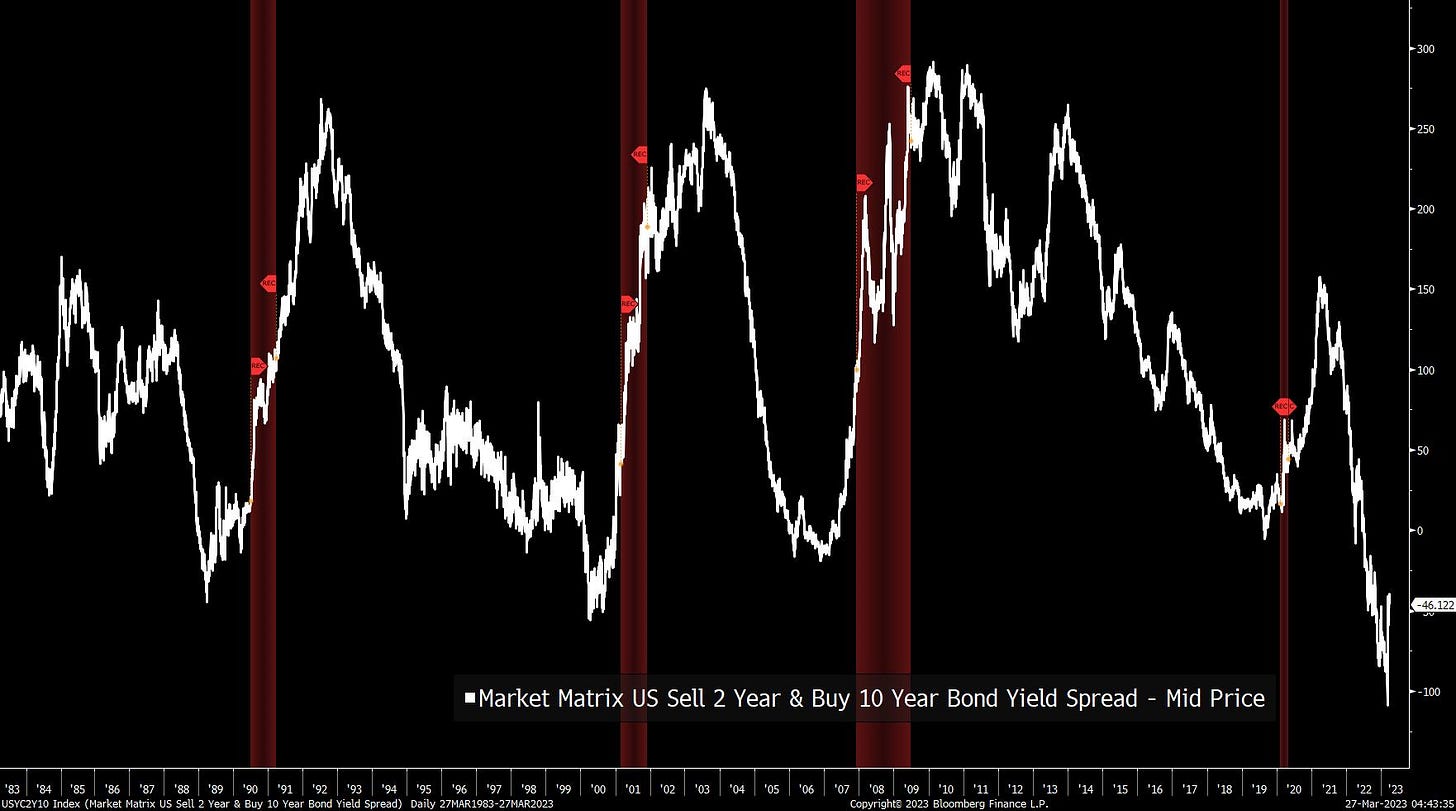

When reviewing the last 4 decades, each official recession declared by the National Bureau of Economic Research (NBER) – the red vertical bars below – was preceded by a sharp re-steepening of the yield curve, as the market prices in cuts to the overnight lending rate before the downturn manifests itself.

Source: Bloomberg

Where $100,000 salary feels like $36,000

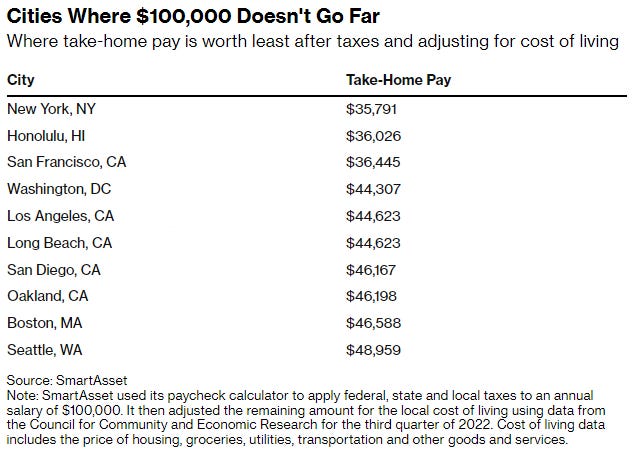

A salary topping $100,000/year can feel like an important milestone or mark of success for American workers.

But, if you live in New York City, that’s worth just $36,0000 after taxes and the steep cost of living per a recent report from SmartAsset, a consumer-focused financial information provider. The city tops the company’s list of most expensive in the United States, followed by Honolulu, San Francisco, and Washington, D.C.

Memphis is where you keep the most of your take-home pay, SmartAsset contends, though the median salary is about $44,000 compared with a little over $70,000 in New York; the nice offset comes via tax exemption on earned income and a cost of living that’s 14% lower than the national average.

Source: SmartAsset, Bloomberg

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.