Most often we're talking stocks, when we should be asking about credit

The Sandbox Daily (7.22.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

are cracks forming in credit?

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.79% | Dow +0.40% | S&P 500 +0.06% | Nasdaq 100 -0.50%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.17% | 2yr UST 3.836% | 10yr UST 4.346%

COMMODITIES: Brent Crude -0.45% to $68.90/barrel. Gold +1.09% to $3,443.4/oz.

BITCOIN: +2.18% to $119,750

US DOLLAR INDEX: -0.48% to 97.384

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: -0.90% to 16.50

Quote of the day

“You're not where you want to be. You feel like you're supposed to be somewhere else. Say you could snap your fingers and be, where ever you wanted to be. I bet you'd still feel this way, not in the right place. The point is, you can't get so hung up on where you'd rather be, that you forget how to make the most of where you are. Take a break from worrying about what you can't control. Live a little.”

- Arthur (Michael Sheen), Passengers

Are cracks forming in credit?

We spend a lot of time around here talking stocks because well… people are most heavily invested in the stock market.

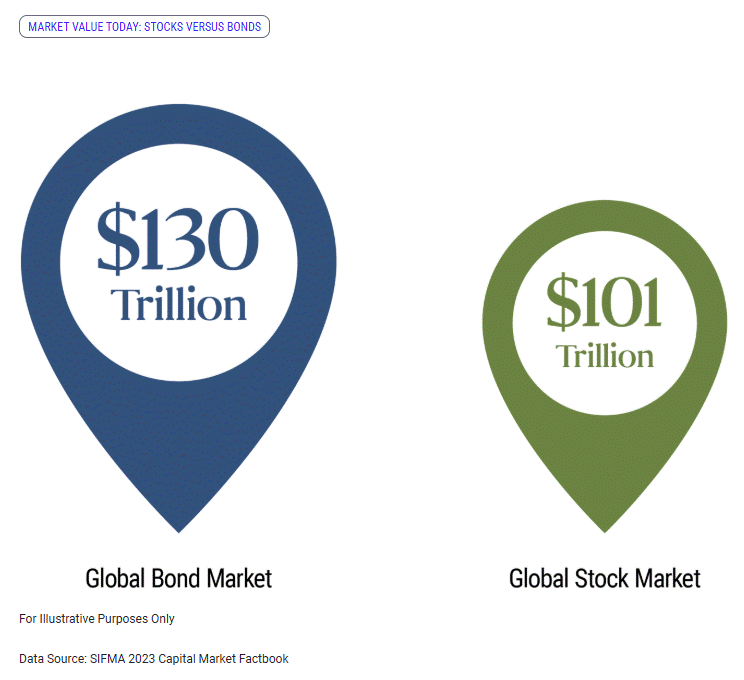

The truth is, behind the scenes, we spend a fair amount of time and energy on the credit and rates markets because well… the bond market is the biggest segment in global capital markets and often confirm or reject what stocks are doing.

For many, the story starts and ends with the bond market. That may not interest you, but it does interest a lot of the biggest players in the market who drive positioning and flows of capital. And that’s the world we’ve always lived in.

What are we seeing now?

Credit and securitized assets continue to power ahead this year with cumulative excess returns at record highs (except for agency MBS), which is still recovering from the brutal bond bear market a couple years ago.

As long as we avoid recession, that should continue to be the case.

So, all good?

On the surface, credit stress is minimal. Delinquency rates on loans from banks – as reported from the FDIC and the Fed – have risen but remain subdued except for consumer loans, which have climbed to their highest level since 3Q12.

Within the consumer bucket, credit card delinquencies have eased over the past three quarters.

But, if we are to broaden the aperture, delinquent bank loans provide an incomplete view of the health of the consumer. For some help, I’ve pulled some charts from the Ned Davis Research library to help you with the visuals.

Data from Equifax – processed by the New York Fed – presents a bit more murky picture. The credit card delinquency rate has climbed above 12% (black dashed-line below).

The delinquency rate on student loans has soared to 7.7% (red line below) now that the grace and forgiveness period under the Biden administration has ended.

Vehicle loan delinquencies are now 5% (blue line below), just a shade below its pandemic peak and below the post-GFC peak.

On the other side, delinquency rates on mortgages and HELOCs remain in check. That’s because layoffs are low and home prices are up.

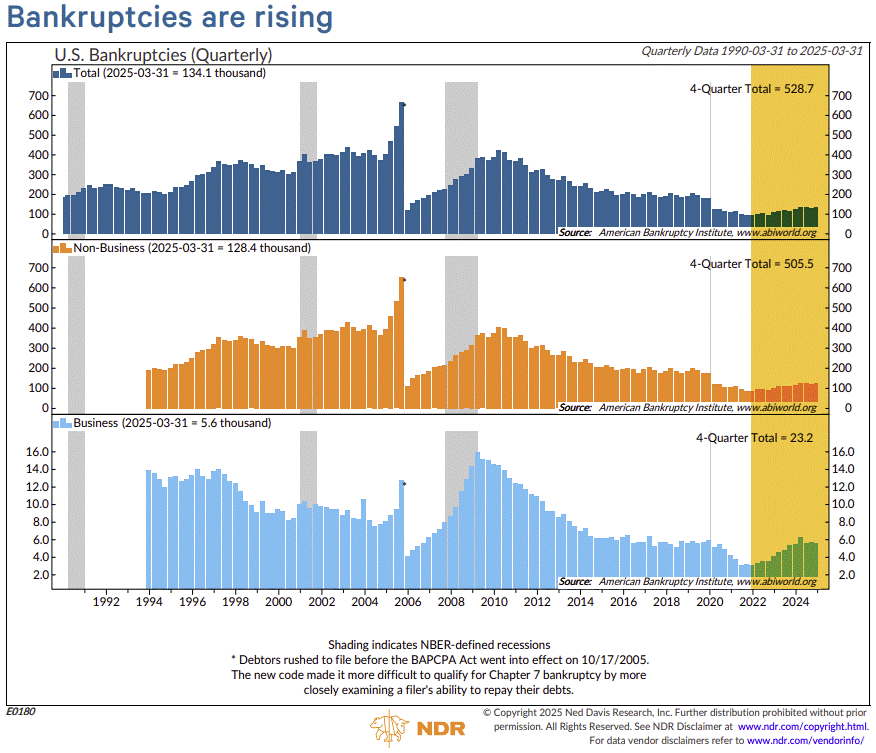

And yet, bankruptcy is the ultimate measure of financial stress.

Here, the trends are moving in the wrong direction, albeit off historical low levels. Call it normalization.

Business and non-business bankruptcies have been rising steadily on a 4-quarter basis.

Again, nowhere near GFC levels, but considering that labor markets are loosening and incomes aren’t growing like they were two years ago, this might be a headwind for creditors as tariffs start to hit those most vulnerable.

Today, the bond market seems to be whistling past the graveyard.

Spreads on corporate credit and securitized loans remain tight.

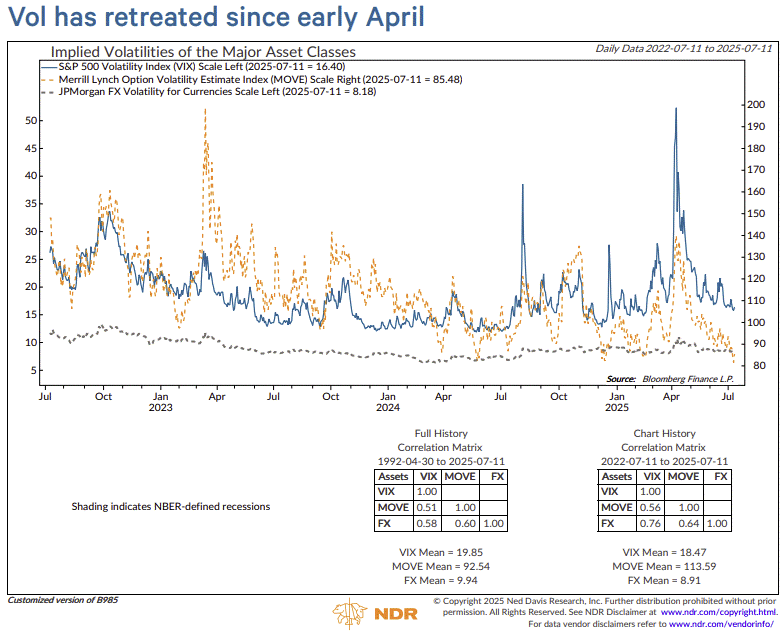

Volatility measures, which typically reflect prevailing sentiment, show the bond market has taken a more complacent view as of late despite near-term that linger.

The MOVE index, an index of Treasury market volatility, has tumbled ~55 points from April 8 peak to the low-end of its multi-year range.

And it’s not just the bond market. Equity volatility has also subsided. The VIX has declined ~43 points to 16 over that same time.

Investors should question whether picking up some protection is worthy of consideration while it’s on the cheap.

Remember, always purchase flood insurance before the catastrophic flood.

Sources: PIMCO, Ned Davis Research, New York Fed

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)