My wife is asking questions now...

The Sandbox Daily (3.12.2025)

Welcome, Sandbox friends.

Quick programming note before we get started.

The Sandbox Daily will be taking a publishing break next week. If you are attending Future Proof Citywide in Miami, I’ll be there – come say hi !

Today’s Daily discusses:

market-induced therapy

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.13% | S&P 500 +0.49% | Russell 2000 +0.14% | Dow -0.20%

FIXED INCOME: Barclays Agg Bond -0.29% | High Yield +0.11% | 2yr UST 3.989% | 10yr UST 4.314%

COMMODITIES: Brent Crude +2.01% to $70.96/barrel. Gold +0.67% to $2,940.9/oz.

BITCOIN: +0.36% to $83,113

US DOLLAR INDEX: +0.27% to 103.565

CBOE TOTAL PUT/CALL RATIO: 0.91

VIX: -9.99% to 24.23

Quote of the day

“I’ve worked with thousands of wealthy people over the years. Not once did someone tell me they got rich by timing recessions.”

- Ben Carlson in Market Timing a Recession

Market-induced therapy

This morning, while preparing our four kids’ breakfasts and getting them dressed/cleaned up for school, my wife Jen did something she almost never does. Ever.

“What’s happening with the market? What’s with Trump and all this tariff stuff?”

Then, my eight-year-old Hudson chimes in: how’s Apple doing? what about Tesla?

It’s official, folks.

Markets and the Trump and the recession worries have migrated from Wall Street to Main Street. If Jen knows it’s happening, then it’s everywhere. No stone remains unturned at this point.

On cue, the CNN Fear & Greed Index has plummeted into the Fear Zone as investors are panic-selling by the day.

There are any number of ways to answer her questions, some being more clinical in nature (data-driven) while others more squishy (therapy-based).

Today let’s focus on the latter. After all, investing is as much behavioral as it is mechanical.

Here are a few thoughts.

This time is different. Capitalism is over.

Nope! If you’ve been doing this as long as I have, this current bout of market indigestion is but just one instance in a long line of market risks that wraps around the block. Twice.

If you need a visual, Michael Batnick has you covered. The fact this chart is becoming harder and harder to read tells me there’s always a reason to sell.

Government shutdowns, virus/pandemics, oil spills, mass shootings, credit events, liquidity crunches, terrorists, bank runs, rate hikes, bankruptcies. Sorry, a little bit of 2025 tariff whiplash is not checkmate.

This is the Mark Twain effect. An aphorism attributed to Twain is that history doesn’t repeat, but it does rhyme. That certainly applies to the stock market. When it comes to market downturns, historically they’ve all ended the same way – with the market recovering and eventually moving higher. But that’s the easy part. Where they’ve differed – and where they probably always will differ – is in their origins.

Uncertainty is uncomfortable but it’s also perfectly normal.

Because each crisis is so different, no one can be sure how bad it will get or how long it will last. And because of that, each one feels uniquely terrifying.

During these intense periods of stress, all logical thought gets tossed out the window. Shoot first, ask questions later.

That’s typically what causes markets to drop suddenly at the start of a crisis. The release of the market pressure valve compounds the atmosphere of panic. Then this triggers feelings of collective anxiety, fear, and helplessness – deeply emotional negative states. People often band together around this manic state because we are communal creatures by nature and sharing that feeling together makes us feel better.

All of this leads to an important dynamic we see during crises: capitulation – the hallmark of local bottoms and a signal the last of the sellers are near exhaustion.

Dollar-cost your dry powder.

Do you have a shopping list? No, not that one. The other one that has Costco, Apple, and CrowdStrike on it – the strongest companies in their respective categories.

Plug your nose and go buy some shares right now. Or, keep it simple and buy broad-based indexes like SPY or VIG or COWZ.

There’s an old saying on Wall Street that applies here: “The stock market is the only market where things go on sale and all the customers run out of the store.” Wall Street just gifted investors a store-wide 20% March Madness sale.

There’s no need to jump headfirst into the deep end, though. Walk down the pool steps and slowly acclimate to the cold water hitting your belly. Start small, then wade further into the position over the coming days, weeks, and months.

Today is not the day to abandon ship.

Sorry, that was two months ago, or in six months from now.

Market corrections are a great way to level set your risk tolerance. BUT, don’t make those changes now. Wait for clearer skies. Then, make a sound and reasonable judgment that isn’t based on how much red you saw on your screen yesterday.

You thought Aggressive (5/5) was appropriate because SPX just produced back-to-back 20%+ gains and you felt like a million bucks? How are you feeling now after a 10% “flesh wound” pullback?

Risk works both ways. It’s one thing to internalize that, but it’s another to live it. If you enjoyed all the gains on the way up (2023, 2024) but cannot handle the drawdowns along the way (Aug 2024, Sept 2024, March 2025), then perhaps turn the risk dial down by one level (4/5).

Take a break.

The sun will rise tomorrow. Dinner must be prepared. The kids lacrosse games are still on.

If this is all too much, take a mental break.

Turn off the tv, exit your Yahoo Finance app, close the 401(k) account balance tab on your laptop.

Hit the gym or take in a movie. Go for a walk outside; Phil Pearlman would love that. Or, reach to a professional and ask for help.

Ok, now for some historical perspective

Keep in mind the recent selling pressure is truly historic in nature, so it’s understandable to be feeling on edge.

Stocks fell 10% over the previous 20 trading days as stagflation talk, rising recession fears, escalating trade rhetoric, and the DOGE “flood the zone” strategy striking fear and uncertainty across the government.

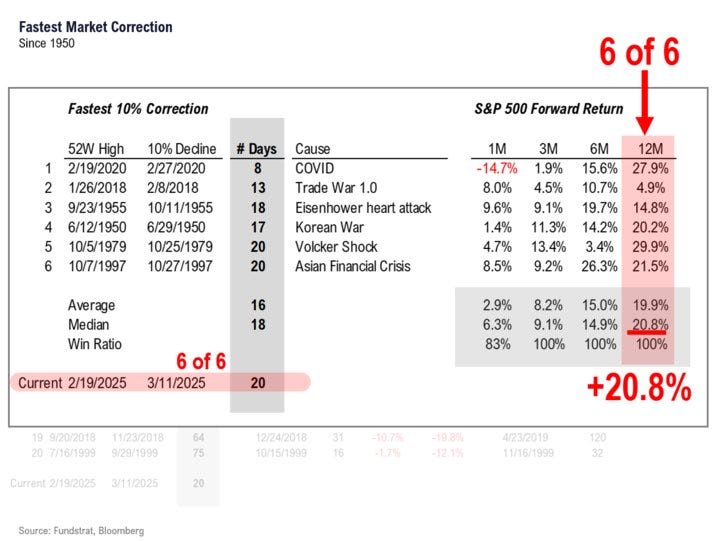

The chart below from Tom Lee is currently making the rounds on Twitter.

It shows this recent market correction marks the fifth fastest decline since 1950. In other words, we are in the midst of a buyer’s strike.

The upshot?

Historically, stocks have snapped back from the “rage selling” and moved higher 12 months later in all previous six instances.

Sources: CNN, Ryan Detrick, Tom Lee, Michael Batnick

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: