Narrow leadership, plus bond flows, the Prime Rate, and the rule of 72

The Sandbox Daily (10.2.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

narrow leadership

bond inflows persist despite unrelenting backup in yields

Prime Rate hits 8.50%

rule of 72

We are taking on the Sober October challenge to embrace a month of clarity, health, and self-discovery – will share thoughts and challenges at the end of the month.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.83% | S&P 500 +0.01% | Dow -0.22% | Russell 2000 -1.58%

FIXED INCOME: Barclays Agg Bond -0.70% | High Yield -0.61% | 2yr UST 5.108% | 10yr UST 4.685%

COMMODITIES: Brent Crude -1.92% to $90.43/barrel. Gold -1.18% to $1,844.1/oz.

BITCOIN: -1.26% to $27,532

US DOLLAR INDEX: +0.84% to 107.016

CBOE EQUITY PUT/CALL RATIO: 0.73

VIX: +0.51% to 17.61

Quote of the day

“The most important quality for an investor is temperament, not intellect.”

- Warren Buffett, Berkshire Hathaway

Narrow leadership

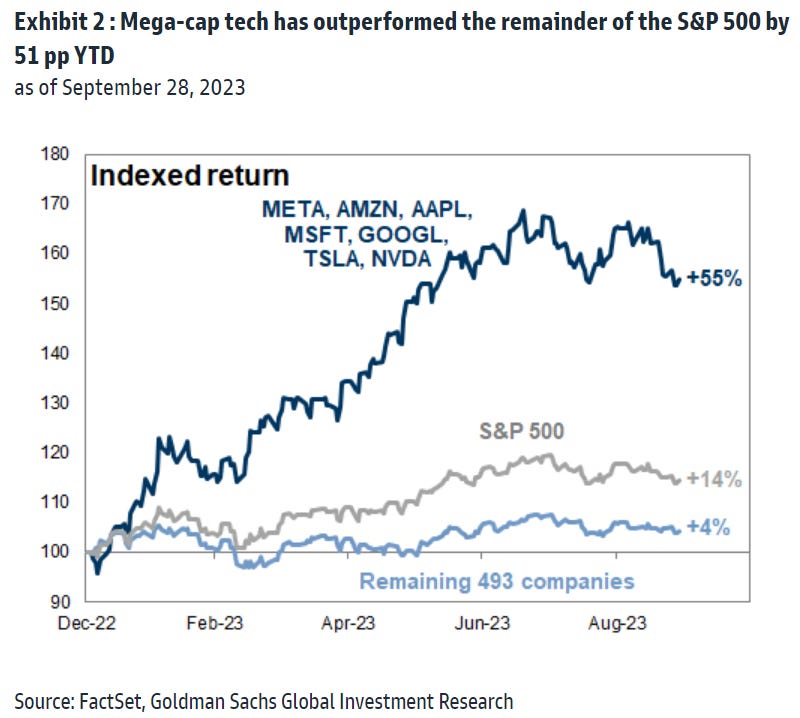

The market leadership of 2023, one driven by the hope and optimism of AI, remains largely confined to the “Magnificent 7” – Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META).

This group of stocks – which account for 27% of the market capitalization of the S&P 500 index – is up +55% year-to-date, while the remaining 493 constituents of the index are returning +4%. Taken together, the S&P 500 is up +14% for 2023.

The forward P/E of these 7 mega-cap tech stocks trade at a robust premium to the rest of the market: 27x vs. 16x.

In just the last two months, however, the multiple of the Magnificent 7 has fallen by 20% in aggregate with the sharp increase in Treasury yield – from 34x to 27x – while the P/E of the remainder of the S&P 500 fell just 12% (18x to 16x).

“The divergence between falling valuations and improving fundamentals represents an opportunity for investors: On a growth-adjusted basis, the mega caps trade at the largest discount to the median S&P 500 stock in over six years.”

Source: Goldman Sachs Global Investment Research

Bond inflows persist despite unrelenting backup in yields

The strong inflow into bond funds this year – currently estimated at more than net +$455bn year-to-date – is confounding, perhaps reflecting an almost magnetic attraction to higher yields while completely ignoring the gravitational pull in bond prices lower.

The investor enthusiasm suggests credit markets are priced for the end of a cycle rather than middle, thus vulnerable from a valuation point of view.

Much of these bond fund flows are going into core funds and corporate bond funds, which has likely helped to contain credit spreads.

Source: J.P. Morgan Markets

Prime Rate hits 8.50%

The Bank Prime Loan Rate, often simply referred to as the “Prime Rate,” has historically been a key indicator of prevailing lending rates and has played a crucial role in shaping credit markets and personal access to credit

Recently, the Prime Rate jumped to 8.50% - above its 6.81% long-term average rate dating back to 1955 – after spending much of the post-2010 period at 3.25%.

The Prime Rate's fluctuations have direct implications for borrowers and lenders. When the Prime Rate is low, it becomes cheaper for consumers and businesses to access credit, stimulating spending and investment. Conversely, a higher Prime Rate can discourage borrowing, potentially curbing inflation but also slowing economic growth.

The Prime Rate serves as a benchmark interest rate that influences a wide range of loans and financial products, most notably home equity lines of credit. It also serves as a reference point for variable-rate loans such as credit cards and adjustable-rate mortgages; as it changes, so do the interest costs for borrowers.

This is yet another sign of tightening financial conditions within the broader credit market.

Source: St. Louis Federal Reserve

Rule of 72

The Rule of 72 is a simple formula that estimates the number of years it takes for an investment to double in value, given a fixed annual rate of return. To calculate it, divide 72 by the annual interest rate or rate of return.

For example, if an investor has an investment with a 6% annualized return, the rule of thumb estimates it requires 12 years for their money to double (72 divided by 6 equals 12). This rule provides a rough approximation and assumes that the interest is compounded annually.

It’s important to note how often different asset classes double, based on historical returns from 1928 to 2022.

While past performance is no guarantee of future return, we can see that U.S. large cap stocks (using the S&P 500 as its proxy) doubled the fastest on average, roughly every ~6.5 years, while short-duration U.S. Treasury-Bills produced the longest average time period to double your money at ~21 years.

Source: Visual Capitalist

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.