Narrow market leadership, plus earnings, small-caps, and bullish sentiment

The Sandbox Daily (11.9.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

narrow leadership

tough reception during earnings season

what’s the skinny on small-caps?

bullish sentiment jumps by the most in 13 years

Let’s dig in.

Markets in review

EQUITIES: Dow -0.65% | S&P 500 -0.81% | Nasdaq 100 -0.82% | Russell 2000 -1.57%

FIXED INCOME: Barclays Agg Bond -0.84% | High Yield -0.62% | 2yr UST 5.026% | 10yr UST 4.632%

COMMODITIES: Brent Crude +0.40% to $79.86/barrel. Gold +0.32% to $1,964.1/oz.

BITCOIN: +3.15% to $36,573

US DOLLAR INDEX: +0.29% to 105.899

CBOE EQUITY PUT/CALL RATIO: 1.18

VIX: +5.81% to 15.29

Quote of the day

“I have approximate answers, and possible beliefs, and different degrees of uncertainty about different things. But I am not absolutely sure of anything and there are many things I don’t know anything about. I don’t feel frightened not knowing things.”

- Professor Richard Feynman

Narrow leadership: By The Numbers

The top 10 stocks in the S&P 500 index have contributed more than 100% of the index’s return year-to-date – unprecedented and a statistical outlier versus history.

The 10 largest constituents have contributed 134% of this year’s index performance:

Yet, it’s notable that while the Tech sector accounts for ~29% of the market cap in the index, it only accounts for an 18% share of the index’s earnings.

Source: Nate Geraci, Ed Clissold

Tough reception during earnings season

With 90% of the S&P 500 index having reported 3rd quarter earnings, 82% are beating estimates by a median of 7%.

This 82% beat rate is above the 5-year average of 77% and 10-year average of 74%. That’s good news.

The blended earnings growth rate for the 3rd quarter is +4.6% as of today, above the low-bar expectations and growing at a modest clip.

+4.6% is below the long-term average of 9-ish% but it’s not terrible, either.

Also good news.

This quarter’s earnings season is also the first time EPS growth has been positive since the earnings recession began in the 4th quarter of 2022.

Good news, as well.

With earnings finally turning higher and beating street expectations in a general sense, the market should be reacting positively, right? Nope.

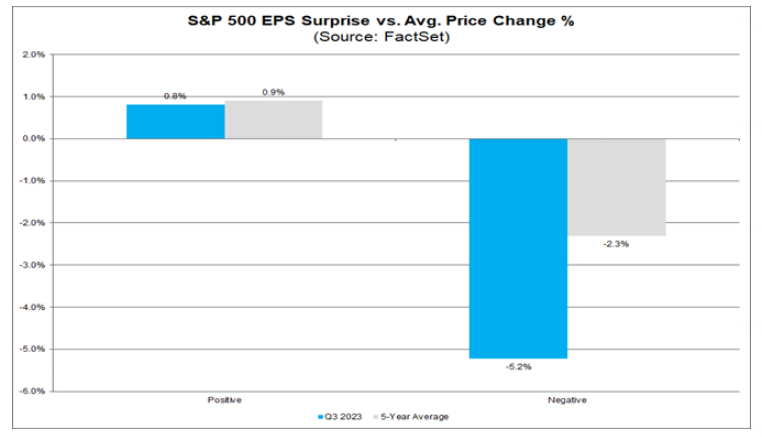

Companies that have reported positive earnings surprises have seen a modest +0.8% average price increase around its earnings announcement. Roughly in line with the 5-year average of +0.9%.

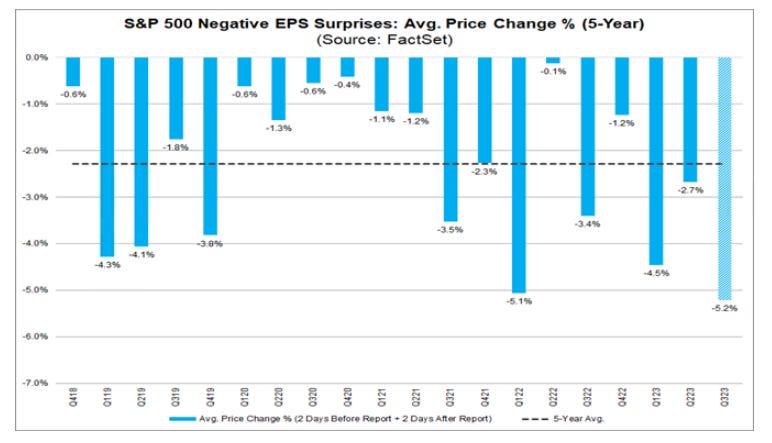

But, for companies reporting negative earnings surprises, the average stock price has dropped -5.2% versus the 5-year average of -2.3%. This would be the worst response from the market since the 2nd quarter of 2011 (-8.0%).

Source: FS Insight, FactSet, Yardeni Research

What’s the skinny on small-caps?

Small-caps just can’t get going, so let’s take a look.

Zooming out, we can see the Russell 2000 index is bouncing along a key polarity line of critical technical importance: long-term resistance from the former cycle (2018 highs and pre-pandemic 2020 highs) as well as support from the lows in the current cycle (multiple tests across 2022 and 2023).

The rapid increase in interest rates in 2023 has been a natural headwind for this universe, which currently finds itself down ~30% from its highs:

Relative analysis is also helpful to measure strength or weakness.

Small-Caps are hitting new multi-decade lows relative to Large-Caps, as the ratio of the Russell 2000 index relative to the S&P 500 has fallen to its lowest level since late 2001.

So, what is happening to small-caps?

For starters, almost half of the companies in the Russell 2000 Index are currently generating negative earnings.

Tough going when large swaths of your universe is unprofitable. Keep in mind that just ~15% of companies in the Russell 2000 had negative EPS during the 1990s.

Another headwind? Debt.

Small-cap stocks are traditionally more leveraged than their large-cap counterparts. Given floating rate makes up almost half of small-cap companies’ debts, the current reset in the bond market is increasing financing costs and putting additional pressure on earnings.

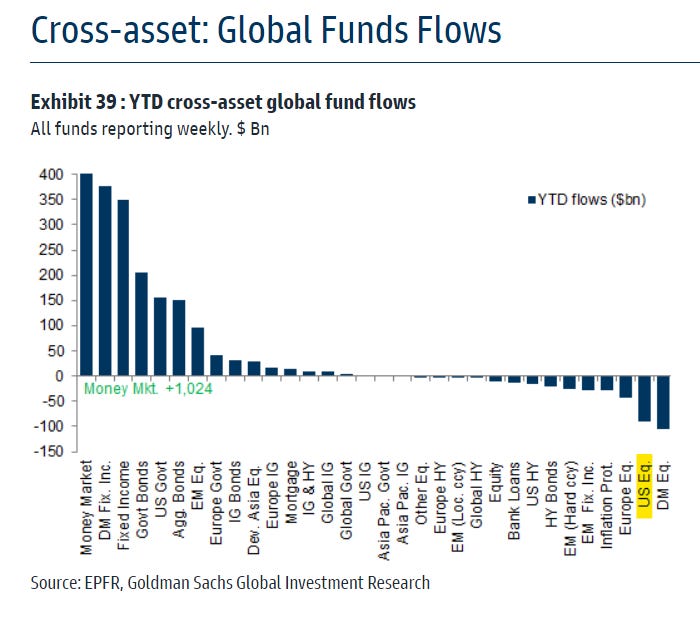

Finally, one must consider asset flows.

Small-caps rely heavily on flows, which can be a bi-product of sentiment and positioning. This fur, U.S. equities have as a group have been deprived of oxygen all year:

Small-caps are cheap, very cheap. Expect small-caps to be an area of interest during the 2024 outlook season, especially for those with the view that the United States can achieve that elusive soft landing.

Source: Liz Ann Sonders, All Star Charts, Pacer ETFs, Goldman Sachs

Bullish sentiment jumps by the most in 13 years

Retail investors turned much more bullish as the S&P 500 Index (SPX) has risen over the previous eight consecutive sessions.

After falling over the previous three weeks, the American Association of Individual Investors (AAII) reported bullish sentiment surged from 24.3% to 42.6%. That is the largest one-week increase since July 15, 2010, and the 12th largest point increase on record.

Conversely, bearish sentiment plunged by a nearly equal amount, from 50.3% to 27.2%.

Nothing like price to change sentiment.

Source: American Association of Individual Investors, Dwyer Strategy

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.