Nasdaq 100 approaching ATHs, plus the largest stocks, global supply chain, Binance, and giving thanks

The Sandbox Daily (11.22.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Nasdaq 100 just 3.5% away from new all-time highs

the largest stocks

another sign on the road to lower inflation

crypto’s final domino falls in staggering fashion

Let’s dig in.

Publisher’s note

As we gather with family and friends to give thanks, I want to take a moment to express my heartfelt gratitude to each of you, our wonderful subscribers.

Thank you for being a part of the Sandbox community and for allowing us to be a small part of your investing journey.

I encourage everyone to turn off their computer, mute their inboxes, and power down their social media distractions. Whatever you find enjoyment in, go do it! I hope everyone is able to spend time with loved ones, watch some football games, and above all, enjoy the Thanksgiving food!

Happy Thanksgiving to all!

One final note: The Sandbox Daily is off for the rest of the week and will return to your inbox on Monday, November 27th.

Markets in review

EQUITIES: Russell 2000 +0.69% | Dow +0.53% | Nasdaq 100 +0.43% | S&P 500 +0.41%

FIXED INCOME: Barclays Agg Bond +0.09% | High Yield +0.17% | 2yr UST 4.901% | 10yr UST 4.412%

COMMODITIES: Brent Crude -0.98% to $81.64/barrel. Gold -0.48% to $2,012.3/oz.

BITCOIN: +2.33% to $37,801

US DOLLAR INDEX: +0.31% to 103.891

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: -3.75% to 12.85

Quote of the day

“Every day I assume every position I have is wrong.”

- Paul Tudor Jones

Nasdaq 100 just 3.5% away from new all-time highs

The Nasdaq 100 index, up +46% year-to-date and just 3.5% away from new all-time highs, is breaking out from a bullish “cup and handle” formation (more on that below), with the index now trading back above its rising 50- and 200-day moving averages.

The QQQs are up a whopping +13.5% from the recent low at the October 26th close. The index made another new 52-week high today.

The Relative Strength Index (RSI) is approaching overbought levels, so perhaps some time and price is needed to digest the monster gains off the October lows.

The next significant level to watch is a retest of the November 2021 highs at 16,573.

And it’s not just the biggest names in the index participating, despite all the attention focused on the Mag 7.

Here’s a ratio chart of the equal-weighted Tech basket vs. the equal-weighted S&P 500 index turning higher above a critical shelf and setting new relative highs:

Bottom line takeaway? There’s nothing bearish about all-time absolute and relative highs, especially when those new highs occur in the biggest and most important sector in the market.

Here is a simplified explanation on the “cup and handle” pattern setup on the chart:

Source: Piper Sandler, Grindstone Intelligence, Scanz

The largest stocks

Episodic periods of high concentration have been a feature, not a bug, of cap-weighted benchmarks.

The Nifty 50 in the 1970s, tech stocks in the late 1990s, and tech again during the COVID aftermath in 2020/2021 were all periods where investor enthusiasm led to soaring market concentrations.

Persistent mega-cap leadership has resulted in another rise in S&P 500 concentration this year after plummeting in the tech-driven bear market last year.

The chart below shows that the largest 10 companies in the index have seen their combined weight jump from 25.4% on January 6 to 34.8% currently. The reading represents a record high for the index going back to 1972.

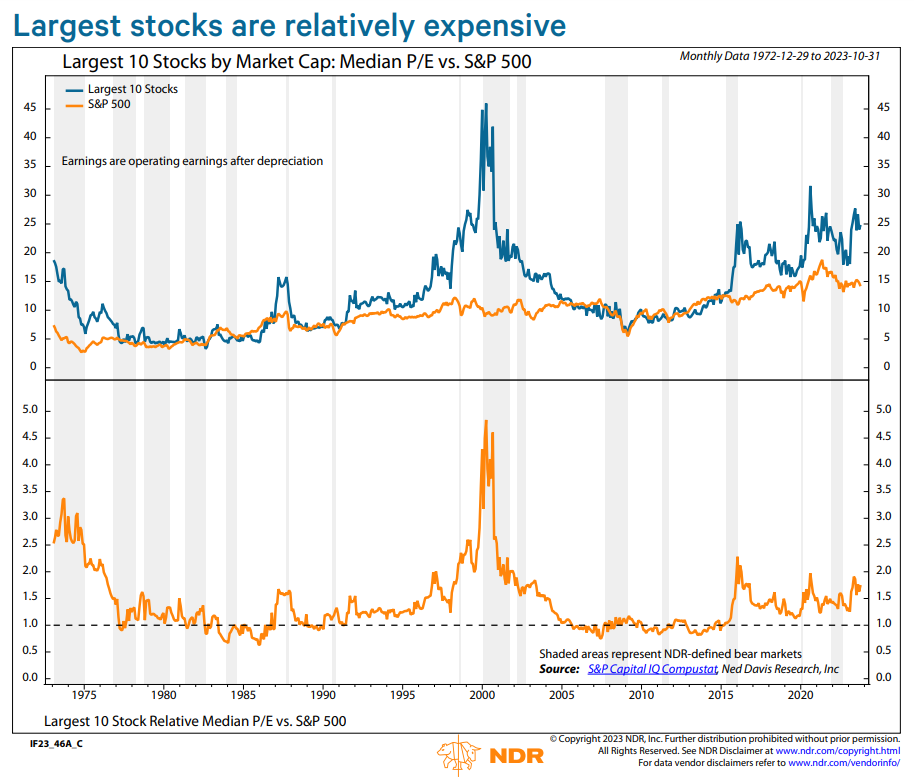

Outsized returns for the largest stocks have led to rising valuations but are not stretched by historical standards.

The chart below (top pane) shows the median P/E ratio (trailing four quarters) for the largest 10 stocks has risen from 17.8 at the start of the year to 24.8 at the end of October. The reading is high by historical standards but well below the record high set in 2000 and the high reached in 2020.

On a relative basis, the premium for the top ten stocks has ranged from 1.1 to 2.3 times the P/E ratio of the S&P 500 since October 2015. The current reading of 1.8 is actually within that 8-year range and far from prior tops; reference the bottom pane of the chart below.

Source: Ned Davis Research

Another sign on the road to lower inflation

The Global Supply Chain Pressure Index recently hit a record low of -1.74 standard deviations below the mean, indicating that supply chains are back to normal and functioning well.

In less than 2 years, the New York Fed’s Global Supply Chain Pressure Index has moved from its worst level ever (December 2021) to its best level ever (October 2023).

As long as this trend continues, this will put less pressure on businesses to raise prices – helping to cool inflation further.

Source: Charlie Bilello

Crypto’s final domino falls in staggering fashion

Changpeng 'CZ' Zhao, CEO of Binance, has been forced to step down from his post having plead guilty to violating U.S. anti-money-laundering requirements.

U.S. prosecutors accused Binance of facilitating transactions with various sanctioned groups – the who’s who of the worst people on this planet – while the cryptocurrency exchange agreed to pay a $4.3 billion fine for wrongdoing !

The deal ends long-running U.S.-based investigations of Binance, while simultaneously flushing the cryptocurrency ecosystem of the last major player polluting the space.

Zhao founded Binance in 2017 and turned it into the most important hub of the global crypto market. In the wake of FTX’s failures, Binance gained more than 60% market share of all exchange-based crypto trading volume.

Many crypto investors viewed the risk around Binance and potential DOJ actions as real but likely overhyped – the base case having already baked these possible criminal charges into market prices, with any market impact to be short-lived.

Crypto markets like the development so far and the preliminary view on this evolving story is that it’s bullish for crypto prices.

Source: The Block, The Wall Street Journal, Chartr, Changpeng Zhao

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

You’re the man, Blake. Happy Thanksgiving