National debt limit, plus gasoline prices, risk appetite, staff shortages in public schools, and AP's top photos of 2022

The Sandbox Daily (12.5.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the upcoming process and timeline to raise the national debt limit, the 2022 surge in gasoline prices has reversed entirely, two signs to look for when risk appetite rebounds, staffing shortages in America’s public schools, and the Associated Press released their collection of the best photos of 2022.

Let’s dig in.

Markets in review

EQUITIES: Dow -1.40% | Nasdaq 100 -1.73% | S&P 500 -1.79% | Russell 2000 -2.78%

FIXED INCOME: Barclays Agg Bond -0.79% | High Yield -0.95% | 2yr UST 4.396% | 10yr UST 3.583%

COMMODITIES: Brent Crude -2.98% to $83.02/barrel. Gold -1.55% to $1,781.5/oz.

BITCOIN: -1.12% to $16,939

US DOLLAR INDEX: +0.71% to 105.289

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +8.87% to 20.75

Raising the national debt limit

Our federal debt load is likely to reach its statutory limit in the next few weeks.

Treasury should be able to borrow as usual until late February or early March 2023, when the cash balance (and the debt that finances it) is likely to start shrinking to make room for deficit-related issuance. Running down the roughly $500bn cash balance could finance the deficit until August, but funds could run dry as soon as July and as late as October.

Of course, the Democrats could attempt to increase the debit limit this month in the lame-duck session using two procedural options: reconciliation (time-consuming, lacks sufficient Democratic support) and bipartisan support (unlikely given divisiveness over recent election cycle). Consensus, however, does not expect Congress to address the debt limit until Treasury has nearly exhausted all other financing options (i.e. the last minute).

To raise the debt limit next year, bipartisan support will be necessary but hard to achieve. Conditions next year will be similar to 1995-1996 and 2011 – the most disruptive debt limit experiences in recent history – when a new Republican majority in the House (and, in 1995, the Senate) faced a sitting Democratic president following a substantial increase in public debt.

Prior debt limit uncertainty has been characterized by two main financial market reactions: an increase in volatility and a sell-off in Treasuries maturing around – and particularly just after – the deadline. The current lower liquidity environment could amplify those trends.

The main risk that a failure to raise the debt limit in time – as opposed to just a close call – could theoretically destabilize a fragile global market. Next year will provide the political and fiscal conditions for another disruptive debate, and razor-thin majorities in both chambers and elevated inflation could further increase uncertainty.

That said, there have been more false alarms over the last decade than truly close calls, and it is hard to predict exactly how the next debt limit deadline will play out.

Source: Goldman Sachs Global Investment Research

The entire 2022 surge in gasoline has been erased

Gasoline prices in the United States have completely roundtripped. Remember the 100+ days of sequential daily increases in the national average price of gasoline? Gone. After rising as much as +65% YoY, gasoline is now basically flat.

Gasoline surged to >$5 by June 2022 and have since tanked. AAA national prices are back to $3.42, the same level as early 2022.

Higher gasoline fuels inflation throughout the US because all goods and many services ultimately are impacted by higher fuel. Also, higher gasoline has a major impact on how U.S. consumers perceive inflation. Thus, the fall in gasoline will have an impact on both actual and perceived inflation.

This downturn in gasoline was never seen during the inflationary Volcker years. Gasoline prices never showed a decline YoY from 1972 to 1982 – unlike today – and this surge in gasoline is what ultimately drove a structural rise in actual inflation and inflation expectations.

Source: FS Insight

Will risk appetite rebound?

Despite the recent stock market rally, two popular measures of risk appetite failed to catch bid’s higher and confirm the broader market move: the Ark Innovation ETF (ARKK), the benchmark for speculative growth stocks, along with one of the market’s favorite risk appetite barometers, the discretionary vs. staples ratio (XLY/XLP).

As you can see, both charts are currently pressing against the lower bounds of their ranges and threatening to break down.

These two charts are unlikely to resolve in opposite directions. It is also unlikely that the broader market continues trending higher if these charts continue resolving lower.

The strong positive correlation between these charts is due to their use as proxies gauging investors' appetite for risk assets. Bulls would like to see these charts hold their former lows and start making upward progress.

Source: All Star Charts

Staffing shortages in America’s public schools

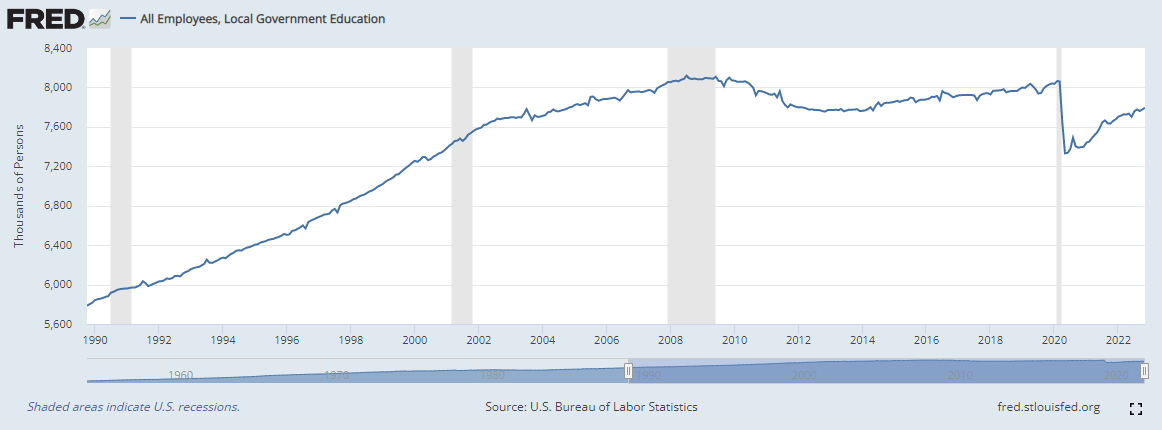

The most important long-term investment in America is our public school system. Throughout the past decade, the number of people working in public education was growing steadily. In fact, the workforce tasked with educating our youth added 300,000 teachers and administrative support staff since 2012. But in 2020, that changed – dramatically.

At the start of the pandemic, schools lost more than twice the number of workers in two months (-700,000) than it gained in eight years. What’s more, public schools aren’t recovering these jobs much on a net basis today; September lost more than 20,000 workers. After all, a Gallup survey from earlier this year showed that educators have been feeling burn-out at a higher rate than any other industry.

There are now more than 300,000 fewer workers in our schools than there were before the pandemic. If we want to invest in the future of America, we must invest in our school system and turn these numbers around.

Source: St. Louis Fed, Scott Galloway, Economic Policy Institute, CNBC, Wall Street Journal, Bloomberg

The Associated Press' best photos of the year

AP’s top 2022 photos capture a planet bursting at the seams.

As history in 2022 unfolded and the world lurched forward – or, it seemed sometimes, in other directions – Associated Press photographers were there to bring back unforgettable images. Through their lenses, across the moments and months, the presence of chaos can seem more encircling than ever.

A year’s worth of news images can also be clarifying. To see these photographs is to channel the jumbled nature of the events that come at us, whether we are participating in them or, more likely, observing them from afar.

Taken together, 150 Associated Press images from across 2022 can convey the feeling of a world convulsing – showing the fragments that make up our lives and freezing in time the moments that somehow, these days, seem to pass faster than ever.

Source: Associated Press (California wildfire, honoring Queen Elizabeth II, Russia-Ukraine conflict, Pittsburgh bridge collapse)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.