Near-term risks are rising

The Sandbox Daily (11.17.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

stress fractures in the stock market’s foundation

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.83% | S&P 500 -0.92% | Dow -1.18% | Russell 2000 -1.96%

FIXED INCOME: Barclays Agg Bond +0.02% | High Yield -0.16% | 2yr UST 3.608% | 10yr UST 4.133%

COMMODITIES: Brent Crude +1.63% to $64.04/barrel. Gold -1.22% to $4,044.2/oz.

BITCOIN: -2.59% to $91,691

US DOLLAR INDEX: +0.26% to 99.556

CBOE TOTAL PUT/CALL RATIO: 1.04

VIX: +12.86% to 22.38

Quote of the day

“In the beginner’s mind, there are many possibilities, but in the expert’s, there are few.”

- Shunryu Suzuki

Stress fractures in the stock market’s foundation

Markets continue to wobble near-term.

Excitement over any AI-related announcement has been replaced with skepticism about spending plans and ROIs. Multiple Fed officials casting doubt on a December rate cut has flipped sentiment on companies beholden to the debt markets. And explaining away elevated market multiples seems to have run out of oxygen.

Together, this reflects a change in market character.

Sure, the recent pullback from the late October highs has been tame by historical standards.

The S&P 500 is off just 3.5% from its all-time high from late October, while the Dow Jones Industrial Average printed a new all-time high only last week. Indexes around the world also trade at or near all-time highs.

But, under the surface, the persistent deterioration in market internals over the last several weeks surely has my attention.

While not a market technician by trade, I often incorporate technical analysis into my process to complement my more fundamentally-driven approach to investing.

I’ve found that using a weight-of-the-evidence approach – one that incorporates data and signals beyond just fundamentals – leads to better investment decisions and higher probabilities of success.

While there’s no shortage of markers flashing yellow, let’s run through a few.

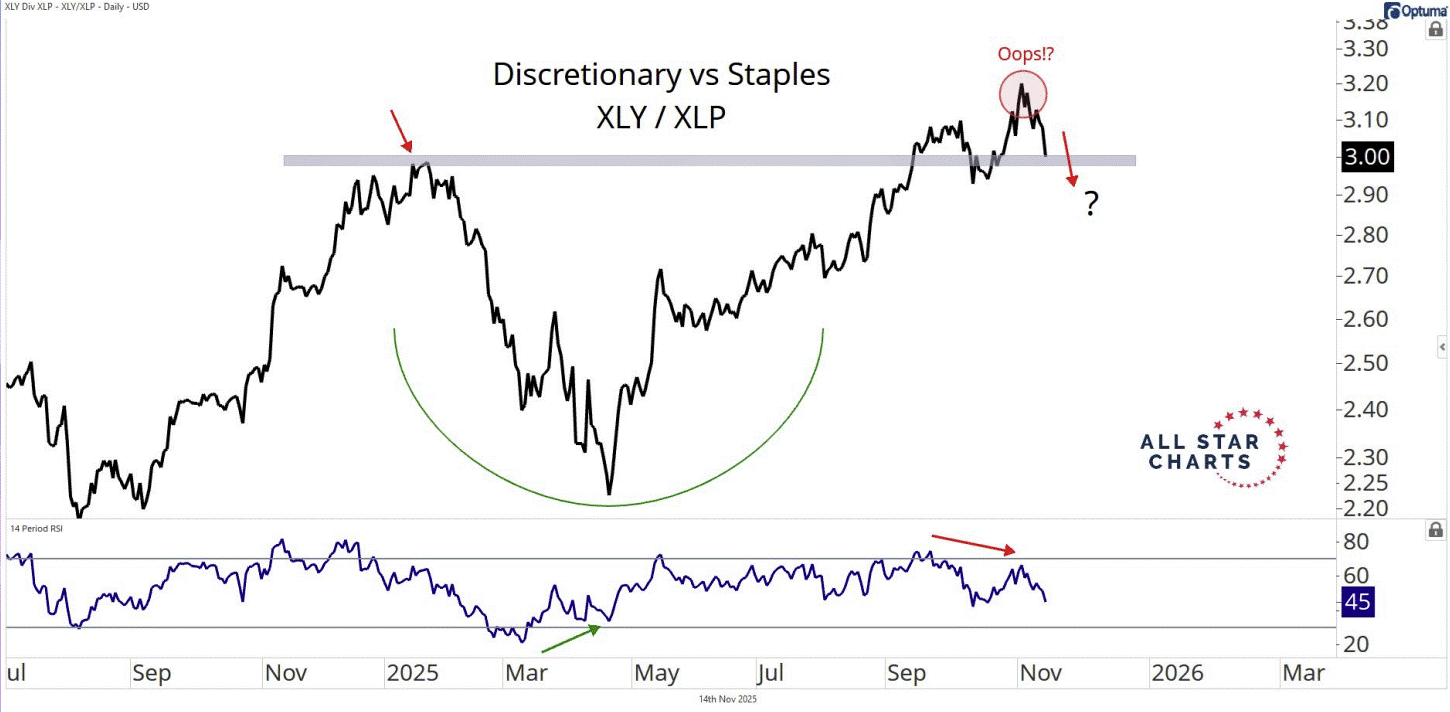

One key relationship to take the market’s temperature – either risk-on or risk-off – is the ratio between consumer discretionary stocks (XLY) and consumer staples stocks (XLP). This relative relationship says a lot about positioning and risk appetite. Discretionary is the offense, Staples are the defense. Right now, this ratio looks to be on the verge of rolling over and must find support fast for the bulls to defend their case. This is a subtle but important sign that risk appetite is fading beneath the surface.

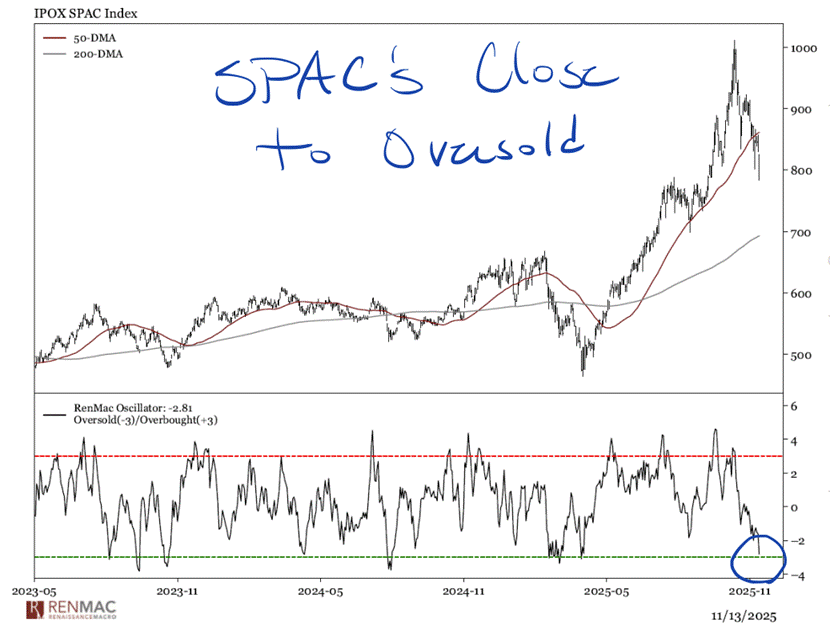

The momentum unwind in the riskier corners of the market, here represented by the SPAC index, reflects a sharp change in temperament. When momentum in highly sensitive segments breaks down, near-term caution may be warranted unless rotation picks up the slack. The good news is recent weakness in speculative assets has extinguished the excessive bullish sentiment that had built up. There’s likely more work to be done here, but a near-term reprieve looks probable based on history.

Moving to market breadth, the share of S&P 500 stocks trading above their 50-day moving average has been slipping for some time, showing that fewer stocks have been participating in the rally. Weakening breadth means the market is being held up by a shrinking group of leaders rather than broad-based support. The Mag 7 can mask weak breadth, but if the bears come for the leadership groups, looks for the leaders to catch down to the laggards.

Taken together, these indicators show that the character of the market has changed in the short-term and now carries increasing signs of stress.

The weight of evidence is flipping toward the bears, even if the major averages haven’t fully reflected that shift yet. Maybe the market finds a catalyst – like Nvidia’s earnings on Wednesday – to repair the damage, but investors should understand near-term upside/downside risks are well balanced.

So, for long-only investors, what can you do here?

When it comes to deploying cash into market weakness, the key is simple: don’t buy all at once.

Arrogance is a sin in this business. Believing you can pick the bottom consistently isn’t skill, it’s luck pretending to be certainty.

The most reliable edge you have is accepting that you’ll never be 100% right and using that humility to your advantage by scaling into positions over time, whether it’s an existing position or a new one.

Be patient and pick your spots. Getting the order done right matters far more than getting it done fast.

Sources: All Star Charts, Renaissance Macro, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)