New housing market paradigm, plus tech leadership, private credit, CRE 2023 vs. mortgages 2007, hotel occupancy, and the week in review

The Sandbox Daily (5.19.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

the new housing market paradigm

tech leads the way

AUM growth for the private credit market

commercial real estate (2023) vs. residential mortgages (2007)

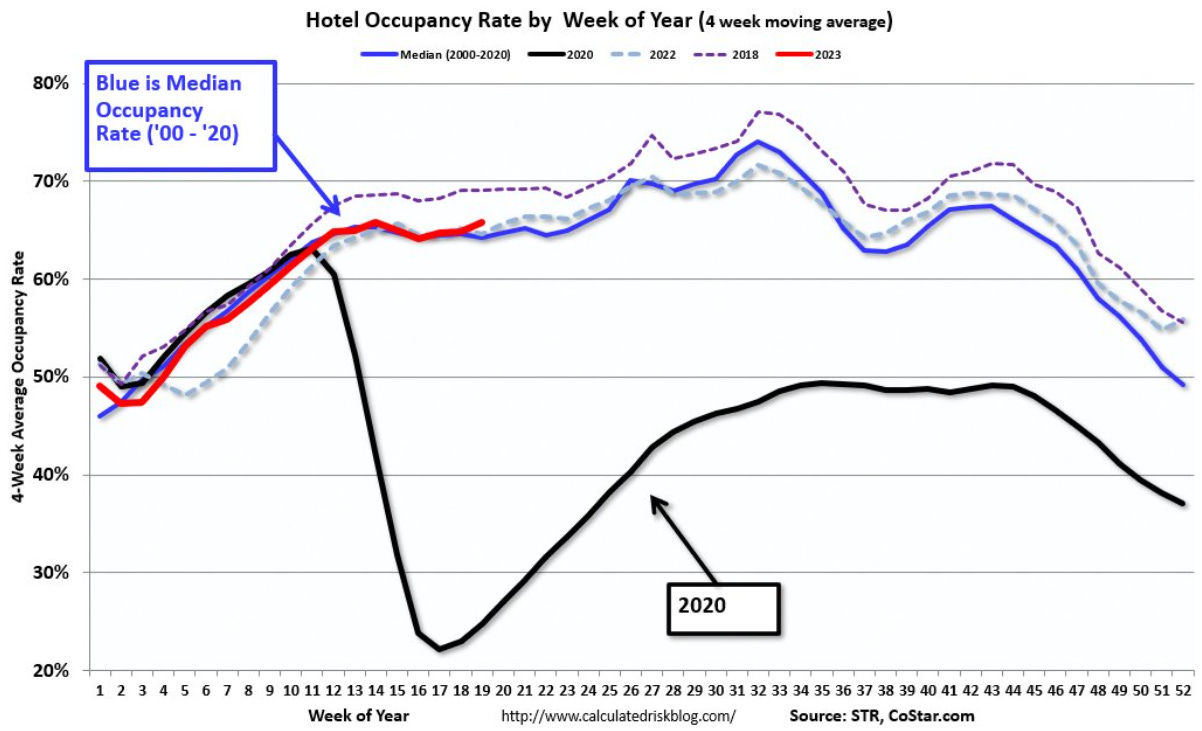

hotel industry occupancy stronger than 20-year median rate

a brief recap to snapshot the week in markets

Hope everyone has a great weekend!

Let’s dig in.

Markets in review

EQUITIES: S&P 500 -0.14% | Nasdaq 100 -0.22% | Dow -0.33% | Russell 2000 -0.62%

FIXED INCOME: Barclays Agg Bond -0.22% | High Yield +0.11% | 2yr UST 4.279% | 10yr UST 3.682%

COMMODITIES: Brent Crude -0.08% to $75.80/barrel. Gold +0.95% to $1,997.1/oz.

BITCOIN: +0.41% to $26,845

US DOLLAR INDEX: -0.36% to 103.211

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: +4.74% to 16.81

Quote of the day

“Most of life’s greatest opportunities come out of moments of struggle; it’s up to you to make the most of these tests of creativity and character.”

- Ray Dalio, Principles

The housing market, post interest-rate hikes

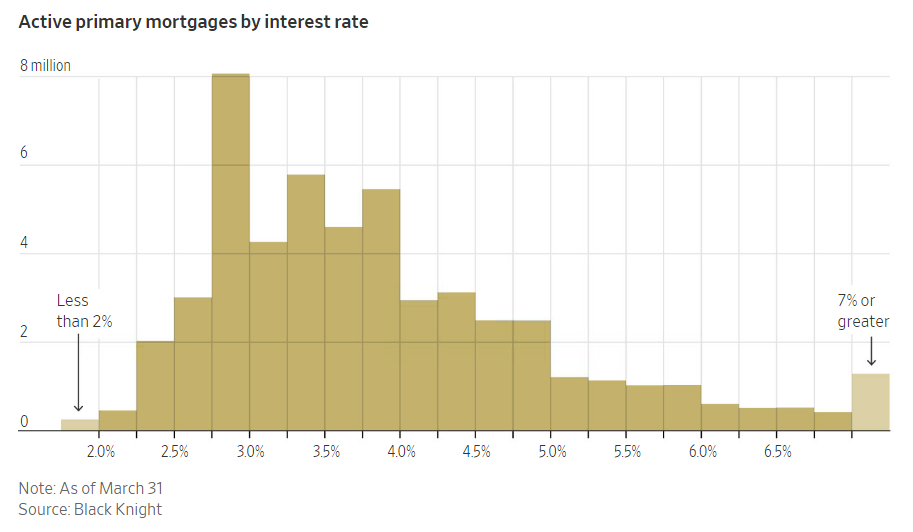

As of March 31st, nearly two-thirds of primary mortgages had an interest rate below 4%, according to a report from mortgage-data firm Black Knight. About 73% of primary mortgages have fixed rates for 30 years.

Per Freddie Mac, the average rate for a new 30-year fixed mortgage is ~6.3-6.4%.

Millions of Americans locked into a sub 4% interest rate on 30-year fixed mortgages is a wonderful thing. For many households, a home is their biggest asset so financing the property with long-duration, low-interest debt is great for their personal financial well-being.

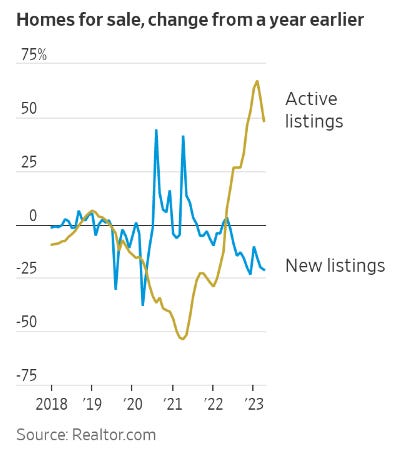

However, this is causing a lack of both supply and demand in the residential housing market because some people that wanted/needed to sell in 2022 or 2023 shelved their plans due to financing concerns. The mortgage-rate factor is leaving some people in houses that aren’t a good fit, whether it’s a growing family without enough bedrooms or aging homeowners with too much space, or dissuading people from relocating for jobs or other opportunities.

Source: Wall Street Journal

Tech leads the way

Technology has been a clear area of leadership over the past six months. Not only are tech stocks pushing against new highs in absolute terms, but the relative trends are reaching new heights as well.

Here's the Large Cap Technology Sector SPDR (XLK) breaking out of a 15-month base relative to the S&P 500 (SPY):

After a prolonged period of sideways action, the XLK/SPY ratio is taking out its 2021 highs as it looks poised to resolve from its current range. The last time technology was trading at these levels versus the S&P was during the dotcom bubble in 2000.

If this breakout is a valid one, we could see further outperformance from tech and growth stocks in the coming weeks and months.

Source: All Star Charts

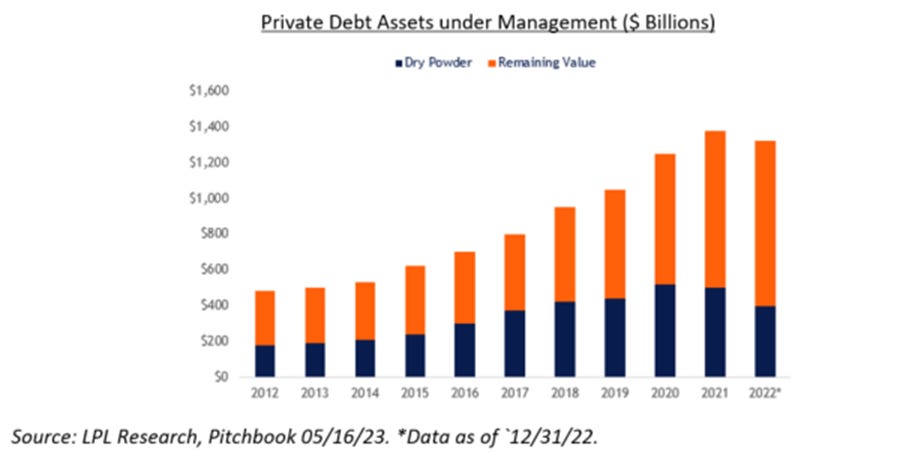

AUM growth for the private credit market

Private Credit has become a big player in the lending market, which used to be predominantly controlled by the banks.

Assets under management (AUM) have grown substantially in recent years, from $500 billion in 2012 to $1.3 trillion in 2022, as more borrowers turn to private lenders for the speed, quality, and certainty of transactions, along with institutional investors who flow into the space for the attractive yields and stable valuation that help portfolio diversification.

Source: LPL Research

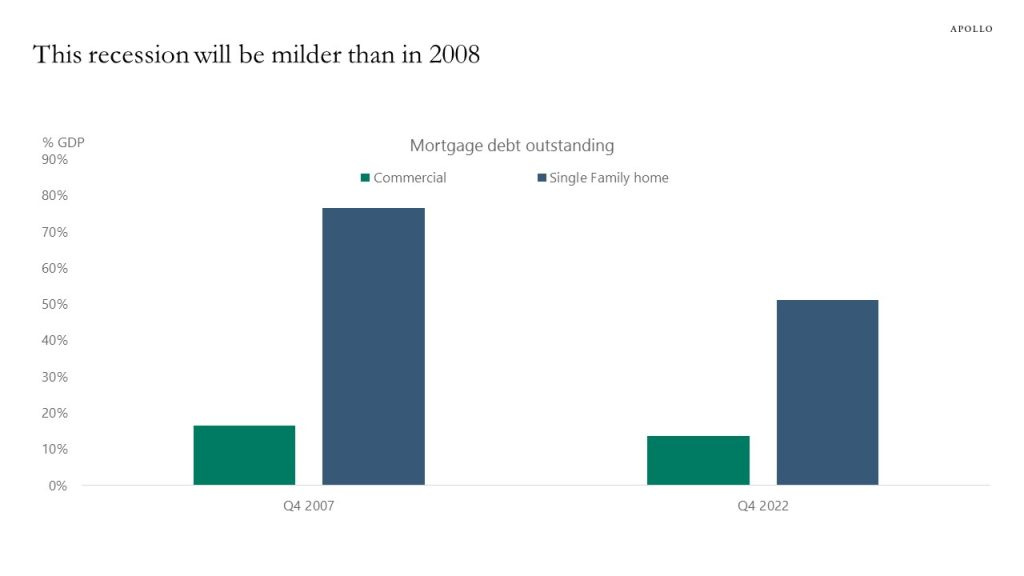

Commercial real estate (2023) vs. residential mortgages (2007)

With several headwinds plaguing the commercial real estate market (CRE) – the meteoric rise in remote work for employees, high vacancy rates, companies decreasing their corporate footprint, and of course higher interest rates (the grandaddy of them all ) – some are trying to connect the dots to the 2007 mortgage crisis for risk assessments.

What’s noteworthy is the stock of CRE debt outstanding today is significantly smaller than the stock of residential mortgage debt outstanding in 2007.

As a result, any recession now will be milder than in 2008, and it will likely be longer because the required correction in CRE prices will be spread out over a longer period.

Source: Apollo Global Management

Hotel industry occupancy stronger than 20-year median rate

The hotel industry continues to outperform its historical averages, as recent hotel performance shows 65.1% occupancy – slightly better than the median occupancy rates from 2000-2020.

New York City holds the top spot (83.7%) as it’s the only major market to report occupancy above 80%.

A strange quirk: the Taylor Swift tour has impacted recent hotel trends as her Eras tour travels from city to city around the United States. Philadelphia was the most recent recipient of the Swifty bump with the city reporting a double-digit increase in occupancy (+13.3% to 73.2%) during her recent performance.

Source: STR Data Solutions, Calculated Risk, CoStar

The week in review

Talk of the tape: The tone out of the debt ceiling meetings has been more optimistic with the focus to narrow the group of negotiators involved in talks going forward; the hopeful view is a deal gets done by the end of next week, as Biden states there’s an overwhelming consensus that defaulting is not an option. However, no reports of meaningful progress on the substance of the talks.

Meanwhile in markets, there’s a lot of talk about tight trading ranges, which seems to fit with the moving pieces surrounding a number of high-profile themes, including the soft- vs hard-landing debate. The Fed is another area of scrutiny with officials continuing the central bank's higher-for-longer messaging while the market expects a near-term pivot. On the inflation front, core CPI remains above 5%. Earnings and guidance trends are better but still concerns consensus is too rosy/complacent about the potential for macro headwinds to dampen operating leverage.

The latest Bank of America global fund manager survey shows that allocations to bonds are at a 14-year high, with cash levels up to 5.6% amid persistent recession concerns.

Stocks: U.S. stocks ended the week higher as growth sectors led the advance. Year-to-date, growth has outperformed as some investors believe the slowing economy will cause the Federal Reserve to pivot. In addition, positive advancements surrounding artificial intelligence has helped these sectors advance, even as some investors question elevated valuations.

Bonds: The Bloomberg Aggregate Bond Index finished lower as bond prices declined while yields increased.

Commodities: Energy prices finished higher this week as global economic sentiment has improved. Natural gas prices have finished higher for the second consecutive week. The major metals (gold, silver, and copper) ended the week lower. The World Gold Council reported this month that global central bank purchases of gold hit a record high in the first quarter of this year, after record annual highs in 2022 amid the present inflation landscape and concerns over a U.S. debt default.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.