No love for gold, plus breadth compression, rates, positioning, and Bitcoin halving

The Sandbox Daily (10.30.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

gold remains under-owned

breadth compression indicates market is extremely oversold

the race to raise rates

NAAIM survey shows historic one-week drop in positioning

4-year halving cycle for Bitcoin turning favorable

Let’s dig in.

Markets in review

EQUITIES: Dow +1.58% | S&P 500 +1.20% | Nasdaq 100 +1.09% | Russell 2000 +0.63%

FIXED INCOME: Barclays Agg Bond -0.24% | High Yield +0.03% | 2yr UST 5.058% | 10yr UST 4.896%

COMMODITIES: Brent Crude -2.97% to $87.79/barrel. Gold +0.36% to $2,006.2/oz.

BITCOIN: +0.27% to $34,452

US DOLLAR INDEX: -0.39% to 106.145

CBOE EQUITY PUT/CALL RATIO: 0.82

VIX: -7.15% to 19.75

Quote of the day

“When drinking with traders, stay one drink behind and shut up.”

- Bob Pisani, CNBC Senior Markets Correspondent in Shut Up & Keep Talking

Gold remains under-owned

Despite the recent push toward all-time highs, gold remains severely under-allocated in client portfolios.

In fact, 71% of U.S. advisors have little to no exposure to the precious metal – meaning <1%.

While central banks continue to aggressively accumulate gold, conventional investment portfolios have yet to take steps to find true diversifiers.

Gold is often used in portfolios to diversify against the traditional asset classes – defined as stocks and bonds – as well act as a hedge against a deterioration in markets or rising geopolitical tensions.

Source: Bob Elliott

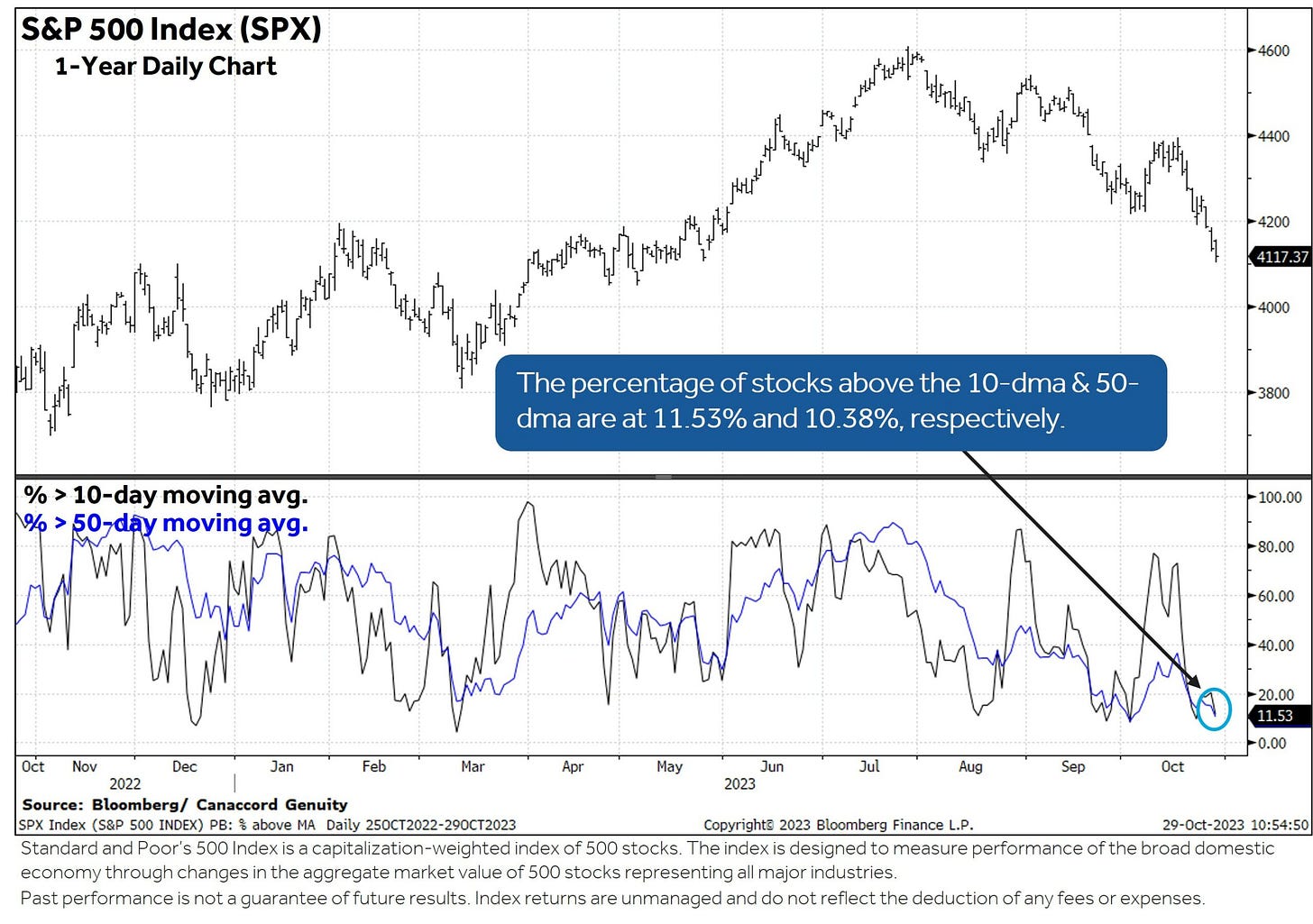

Breadth compression indicates market is extremely oversold

The percentage of S&P 500 index components trading above their 10- and 50-day moving averages dropped to 11% and 10%, respectively.

These are generally viewed as oversold readings, especially the percentage of stocks trading above their 50-day (blue line below).

Source: Canaccord Genuity

The race to raise rates

The change in policy rates by central banks overseeing the 10 most traded currencies since the start of the interest rate tightening cycle in September 2021:

Source: Reuters

NAAIM survey shows historic one-week drop in positioning

The National Association of Active Investment Managers (NAAIM) Exposure Index saw a sharp drop last week from 66.67 to 24.82 – a reflection that people are holding their positions very lightly.

The one-week plunge was the greatest since January 2008 and the survey number represented the lowest exposure since the October 2022 low.

The NAAIM report shows the collective professional money manager’s weekly average exposure to equities (scaled from -200% which is leveraged short to +200% which is fully levered long).

Source: National Association of Active Investment Managers, Dwyer Strategy

4-year halving cycle for Bitcoin turning favorable

One of the most pivotal developments on Bitcoin's blockchain is a halving event, when the reward for mining Bitcoin transactions is cut in half. Halvings reduce the rate at which new coins are created and thus lower the available amount of new supply – often acting as a tailwind for price.

Bitcoin last halved on May 11, 2020 which resulted in a block reward of 6.25 BTC. The next Bitcoin halving of 3.125 BTC is scheduled for April 2024, roughly 6 months from now.

Historically, these events have acted as bullish catalysts for Bitcoin’s price. While macro conditions do influence these trends as well, the halving events themselves improve supply-and-demand dynamics while also helping foster a positive narrative around Bitcoin.

This chart from Ned Davis Research shows calendar year performance categorized to each bucket across the halving cycle. 2023 is the grey box, while 2024 will fall under the 3rd column “Halving Year.”

An analysis of performance data from the previous halvings suggests considerable opportunity for investors. Bitcoin forward returns preceding and following the halving have been impressive across various time frames.

Source: Koinly, Ned Davis Research, FS Insight

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.