No stress in credit, plus managing downside risk, long-term investing, and leading economic indicators

The Sandbox Daily (8.17.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

no stress in credit

managing downside risk

the decline of long-term investing

leading economic indicators still show weakness ahead

Let’s dig in.

Markets in review

EQUITIES: S&P 500 -0.77% | Dow -0.84% | Nasdaq 100 -1.08% | Russell 2000 -1.15%

FIXED INCOME: Barclays Agg Bond -0.10% | High Yield -0.42% | 2yr UST 4.936% | 10yr UST 4.284%

COMMODITIES: Brent Crude +0.43% to $83.81/barrel. Gold -0.15% to $1,918.9/oz.

BITCOIN: -7.43% to $26,592

US DOLLAR INDEX: +0.02% to 103.439

CBOE EQUITY PUT/CALL RATIO: 1.03

VIX: +6.62% to 17.89

Quote of the day

“Someone's sitting in the shade today because someone planted a tree a long time ago.”

- Warren Buffett, Berkshire Hathaway

No stress in credit

When markets are under stress, it shows up in credit spreads.

To the bulls credit, Junk yields have been largely tame and have not begun to widen out dramatically, despite the escalation in Treasury yields.

Here is a ratio chart of the High Yield Corporate Bond ETF (HYG) and U.S. Treasury 7-10 Year Bond ETF (IEI) ratio:

When the HYG/IEI ratio is falling (and credit spreads are widening), stocks tend to come under increased selling pressure. Given the recent weakness in equity markets, one would expect to see a decline in the HYG/IEI ratio (i.e. expansion in high-yield credit spreads).

But credit spreads aren’t expanding. Instead, they’re contracting – a clear sign of a healthy market, for now.

Source: All Star Charts

Managing downside risk

It is easier to recover from smaller declines than bigger declines.

As the magnitude of loss increases, it takes even more upside return just to get back to even on your invested position. This simple math illustration shows the importance of downside risk management.

Knowing when to cut your losses can be more art than science, but setting downside targets or corridors or trailing stops can remove human emotion and establish pragmatic risk controls – while improving portfolio returns over the long term.

Source: Independent Vanguard Advisor

The decline of long-term investing

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Those are words from famed investor Warren Buffett, an advocate of the buy-and-hold approach to investing. Buy-and-hold is a long-term strategy in which shares are gradually accumulated over time, regardless of short-term performance, allowing for time and compounding to do the heavy lifting on behalf of the shareholder.

And while Buffett is undoubtedly a successful investor, data from the NYSE suggests that few are actually following his advice.

Unfortunately, over time, the investor’s average holding period has continued to get shorter and shorter, often producing inferior investor returns versus the associated benchmark. The current average holding period of 5.5 months is a staggering decline from the peak of 8 years back in the 1960s.

Several factors contribute to this phenomenon, most of which hinge on technological advancements: automated trading systems, smartphones and brokerage apps in the palm of your hand, improved data capture and transmission, low transaction costs, tighter bid-ask spreads, competition, and, of course, human behavior.

Source: Compounding Quality

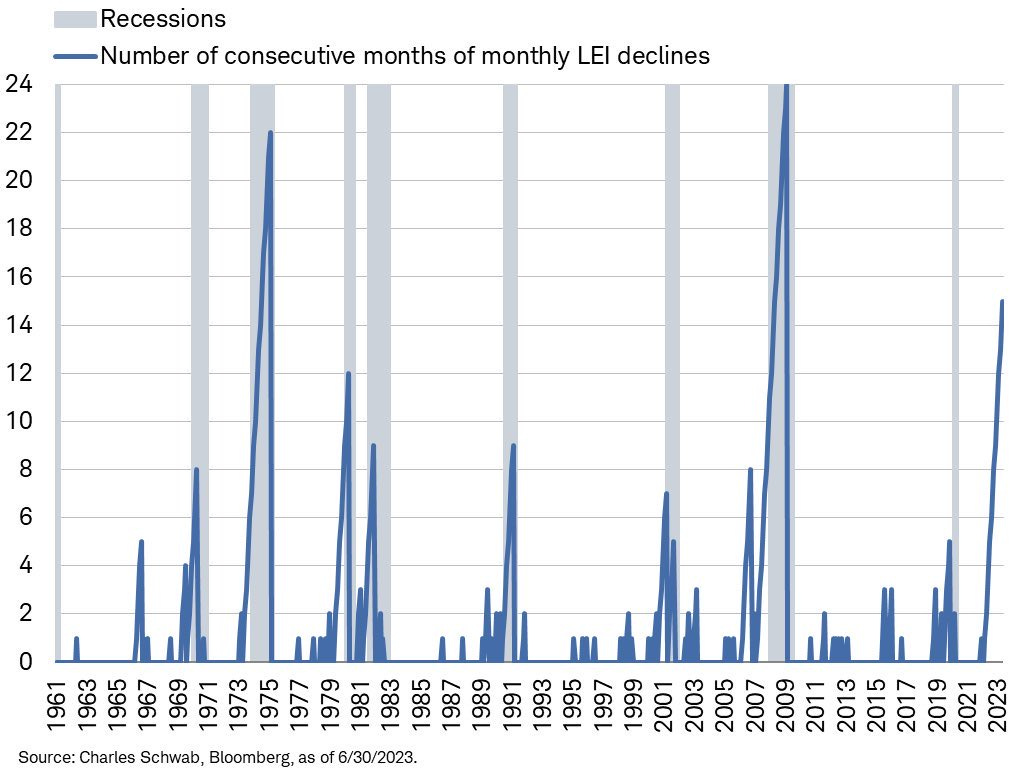

Leading indicators still show weakness ahead

While a number of recent economic indicators show a diminishing risk of recession in the near-term, the Conference Board’s Leading Economic Index (LEI) suggests the sky is not all clear.

The U.S. Leading Economic Indicators (LEI) index, compiled by the Conference Board, sank -0.4% in July. The decline was the 16th contraction in a row.

Declines of this magnitude have always been associated with recession.

The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major global economies. Many economists and investors track this measure closely.

As shown below, such a streak of consecutive monthly declines has led to 7 of the last 8 recessions; the only instances we’ve had more consecutive declines were the recessions that started in 1973 and 2007. The pandemic-related recession is the outlier, but given the unexpected and somewhat random nature of the pandemic, it is not surprising that this indicator or any other leading indicator could not forecast it.

The rate of decline in the LEI and the weak indicator breadth are historically consistent with falling economic activity. The Conference Board projects “a short and shallow recession in the Q4 2023 to Q1 2024 timespan.”

The forward-looking indicators suggest the near-term outlook for growth remains uncertain but leans negative. While no forecasting system is perfect, this one has a pretty good track record.

Source: The Conference Board, Ned Davis Research, Liz Ann Sonders

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.