Not every crack is a crisis

The Sandbox Daily (11.10.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

cracks in the credit market: what investors should know

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +2.20% | S&P 500 +1.54% | Russell 2000 +0.94% | Dow +0.81%

FIXED INCOME: Barclays Agg Bond -0.04% | High Yield +0.34% | 2yr UST 3.595% | 10yr UST 4.120%

COMMODITIES: Brent Crude +0.52% to $63.96/barrel. Gold +2.77% to $4,121.1/oz.

BITCOIN: +1.29% to $105,657

US DOLLAR INDEX: +0.02% to 99.618

CBOE TOTAL PUT/CALL RATIO: 1.08

VIX: -7.76% to 17.60

Quote of the day

“Worrying is worshipping your problems.”

- Unknown

Cracks in the credit market: what investors should know

There’s an old saying that criminals rob banks because that’s where the money is.

However, in today’s financial system, money isn’t just in banks anymore. It’s spread across a growing ecosystem of lenders.

Policymakers hoped that diversifying credit sources after the 2008 financial crisis would reduce systemic risk to the banks. Instead, its just created new complexities and challenges.

Since 2008, lending has increasingly shifted to “non-depository financial institutions” (NDFIs) like private credit funds, mortgage and insurance companies, online lenders, and a whole host of others. The key is that these lenders are not banks since they do not accept customer deposits, so are not subject to traditional banking regulations.

Why is this coming up in the current news cycle?

In the past few months, we have witnessed a few cases of alleged fraud among specific borrowers.

In September, subprime auto lender Tricolor collapsed after allegedly using the same cars as collateral for multiple loans. Auto parts supplier First Brands filed for bankruptcy around the same time amid concerns about off-balance-sheet debt. More recently, fraud allegations have been raised against affiliated companies Broadband Telecom and Bridgevoice, based on fake invoices used in asset-based finance deals.

Then came comment from JPMorgan’s CEO Jamie Dimon that resonated with many investors: “when you see one cockroach, there are probably more.”

While these individual cases are concerning and have led to renewed credit concerns, the key question is whether they represent isolated incidents or the start of broader stress in credit markets.

Comparing today’s concerns to past crises

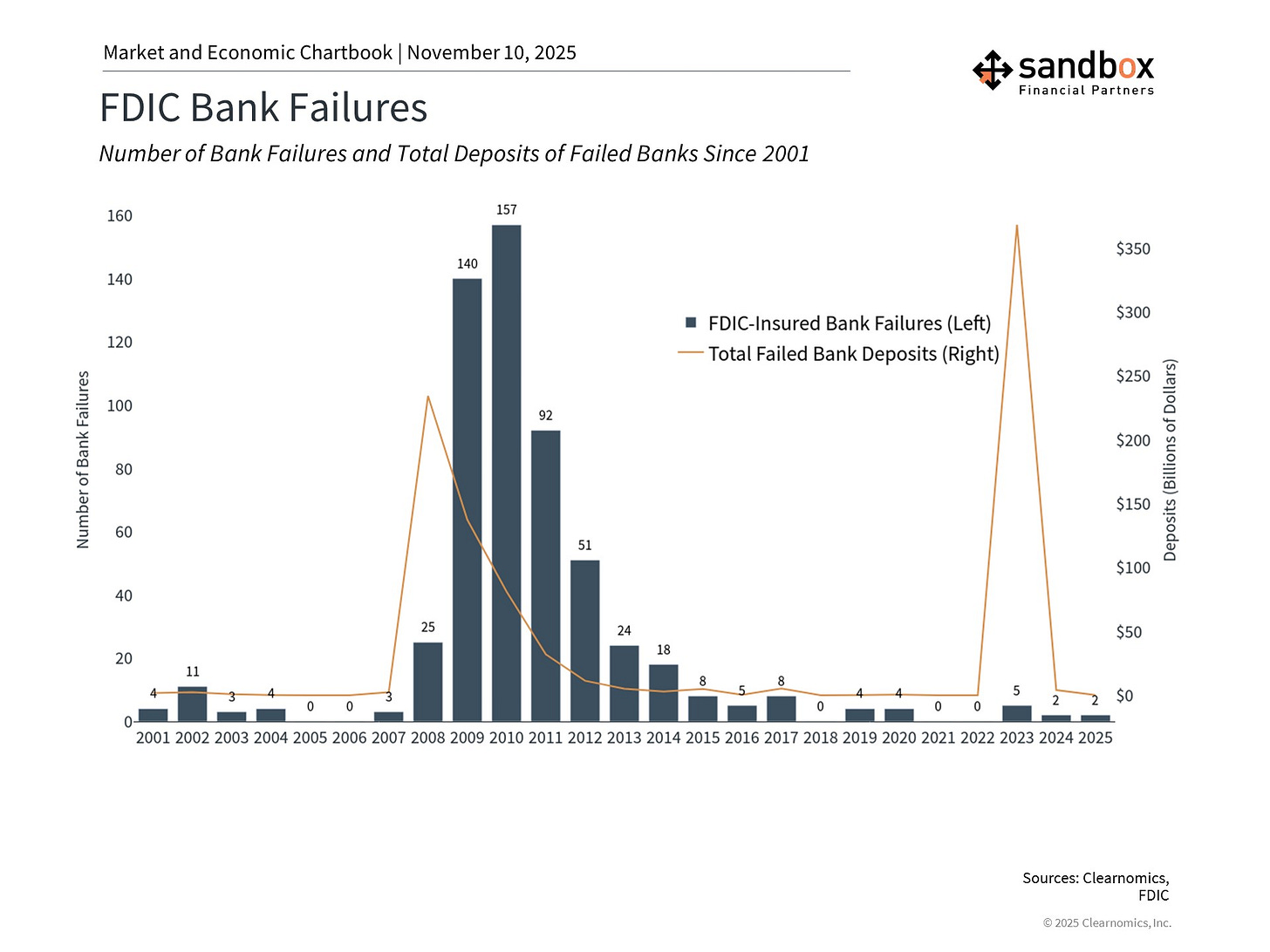

When credit problems emerge, it’s natural to draw comparisons to the 2008 global financial crisis or the 2023 regional banking crisis.

While certain cases of fraud were absolutely revealed during the 2008 financial crisis, what made it systemic were neither these cases nor the housing crash itself, but the significant financial leverage among the largest institutions on Wall Street. In many cases, these leveraged positions eclipsed the amount of equity held at each company.

In 2023, the collapse of several regional banks, like Silicon Valley Bank, reflected a different vulnerability: interest-rate mismatches and concentrated depositor bases.

Today’s credit concerns share neither the leverage of 2008 nor the funding mismatches of 2023. While fraud can expose weak underwriting or oversight, there’s little evidence of systemic contagion.

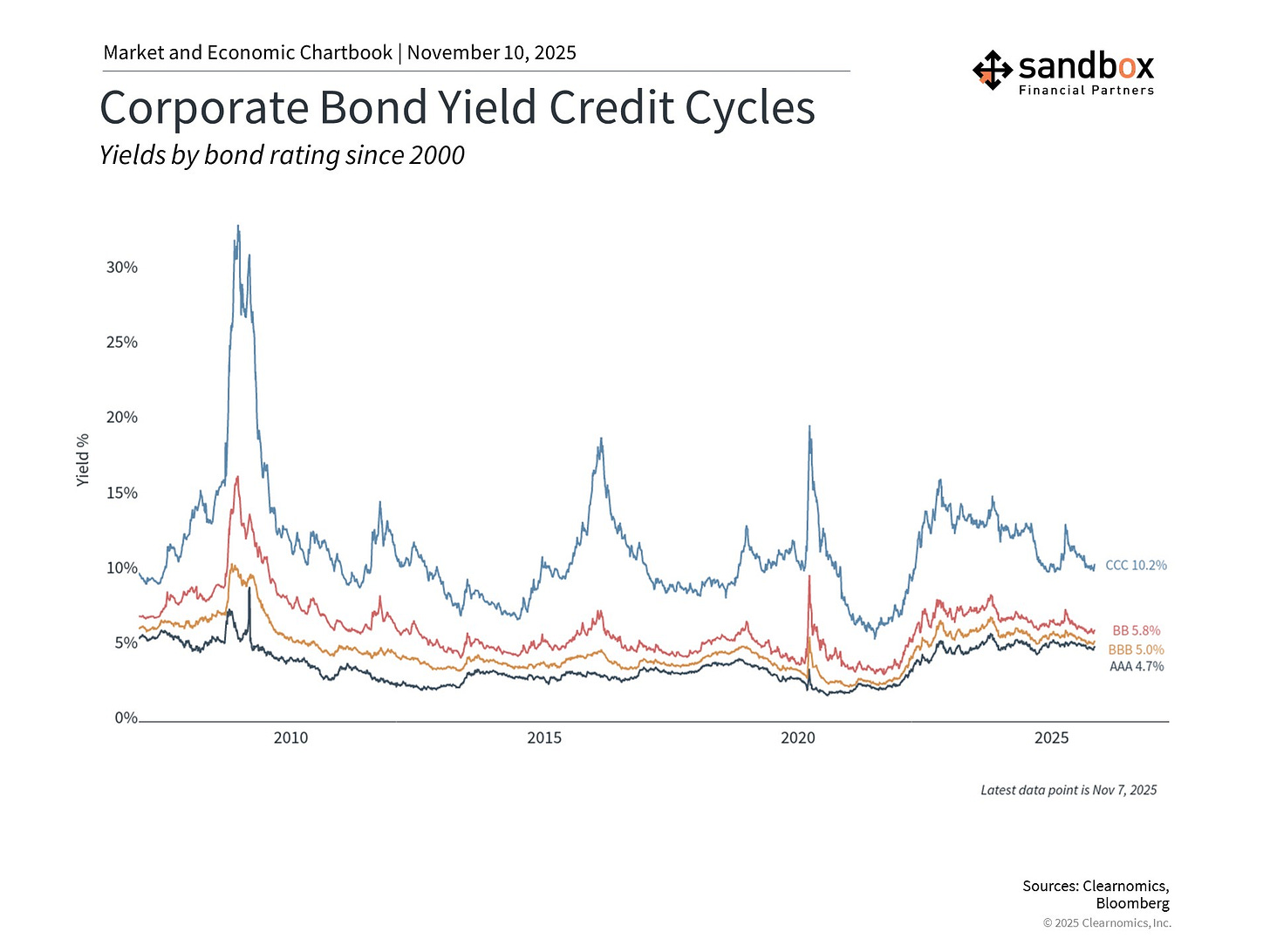

Credit cycles are a key component of economic turning points

Throughout history, it has often been credit and debt cycles at the heart of most significant economic expansions and contractions – from the railroad boom of the 1800s, to the roaring twenties a century ago, to the housing bubble of the mid-2000s.

And yet it’s important to distinguish the perspective of a large bank from that of a long-term investor.

For large financial institutions, each loan matters and can result in write-offs that affect quarterly earnings. For investors, what matters is whether these issues are “systemic,” affecting the broader economy and asset values across the ecosystem.

So far, the data does not suggest contagion. Markets stabilized after initial bankruptcies, while large banks remain well-capitalized and diversified.

The current phase looks like a natural systems check within that long rhythm of credit cycles.

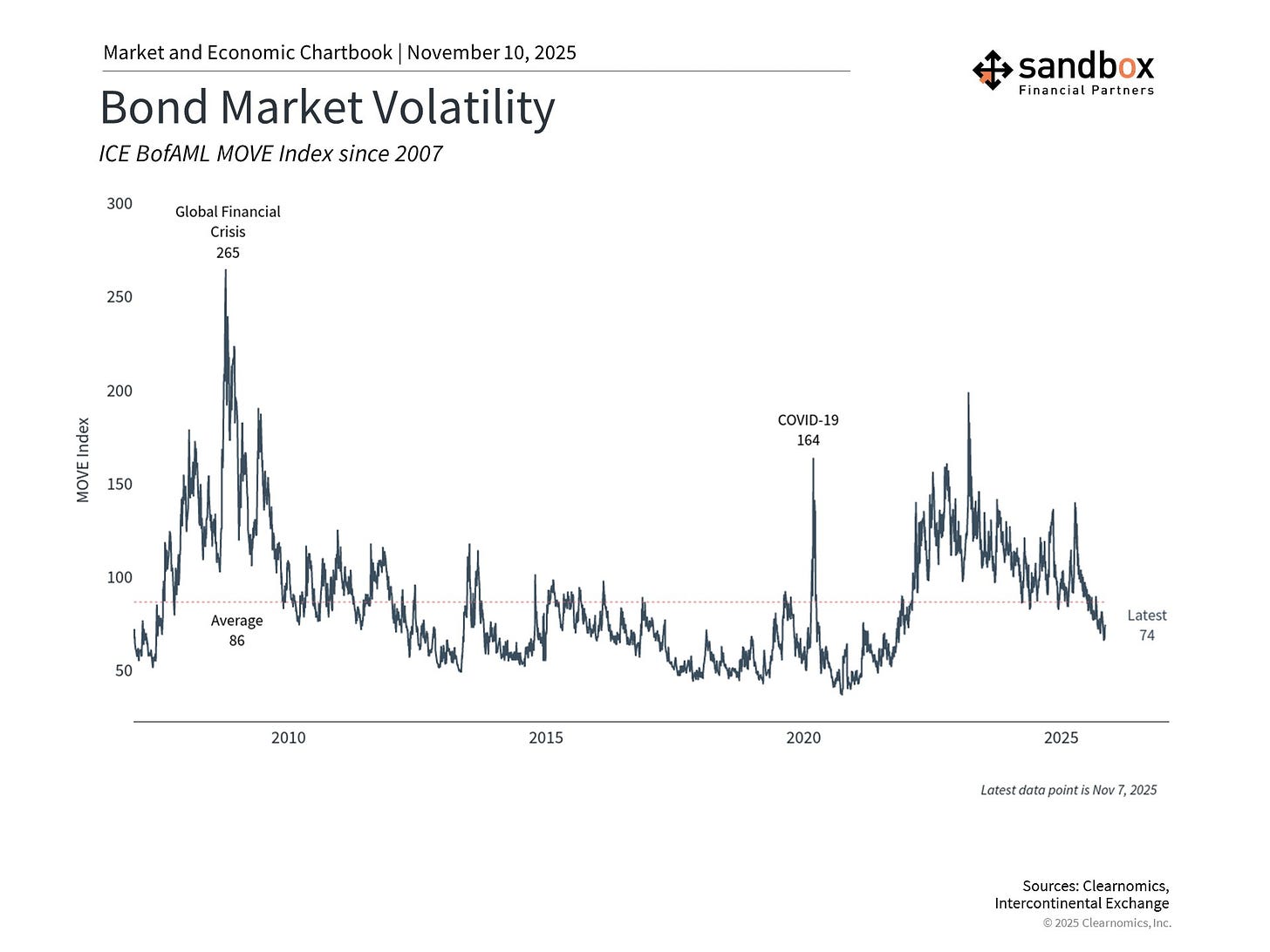

Stock and bond markets have remained relatively calm

Both the stock market and bond market have experienced brief periods of uncertainty in recent months – driven by tariffs, the government shutdown, swelling deficits, and questions around AI valuations.

And yet, during this period, major stock market indices have continued to climb the wall of worry to reach new all-time highs, while credit instruments continue to perform.

For any investor that’s been around for a few market cycles, the key lesson is that recent headlines around financial fraud and bankruptcies are just a natural (and unfortunate) part of credit cycles and the functioning of capital markets.

While individual cases are often concerning, this is separate from whether it sinks the broader financial system.

Sources: Clearnomics, Fitch Ratings, Bloomberg, Wall Street Journal

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)