November: month in review

The Sandbox Daily (12.1.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

November insights

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.36% | S&P 500 -0.53% | Dow -0.90% | Russell 2000 -1.25%

FIXED INCOME: Barclays Agg Bond -0.43% | High Yield -0.18% | 2yr UST 3.532% | 10yr UST 4.092%

COMMODITIES: Brent Crude +1.41% to $63.26/barrel. Gold +0.38% to $4,271.0/oz.

BITCOIN: -6.01% to $85,808

US DOLLAR INDEX: -0.06% to 99.401

CBOE TOTAL PUT/CALL RATIO: 0.70

VIX: +5.44% to 17.24

Quote of the day

“Real integrity is doing the right thing, knowing that nobody’s going to know whether you did it or not.”

- Oprah

November insights

In November, markets endured their first bit of volatility since the Liberation Day tariff policy rollout back in April.

While major indices have delivered strong year-to-date returns across stocks, bonds, international investments, and commodities, investors continue to worry about artificial intelligence-related stocks and the future path of Fed rate cuts. At the same time, the government shutdown delayed the publication of key economic reports, making it more difficult to judge how the economy is doing.

Despite growing uncertainties, many asset classes stabilized and rebounded by the end of the month. This underscores the importance of maintaining a balanced portfolio allocation and risk level that can navigate the ups and downs of the market.

Key Market and Economic Drivers in November

The S&P 500 delivered its 7th consecutive positive monthly return, rising +0.1% in November, while the Dow Jones Industrial Average gained +0.3% and the Nasdaq declined -1.5%. Year-to-date, the S&P 500 is up +16.4%, the Dow is up +12.2%, and the Nasdaq is higher by +21.0%.

The VIX, a measure of stock market volatility, finished lower at 16.35 after climbing as high as 26.42 mid-month.

The Bloomberg U.S. Aggregate Bond Index rose +0.6% in November and is positive +7.5% year-to-date. The 10-year Treasury yield ended the month lower at 4.02%, after briefly falling under 4%.

International developed markets gained +0.5% in U.S. dollar terms based on the MSCI EAFE Index, while emerging markets fell -2.5% based on the MSCI EM Index. Year-to-date, the MSCI EAFE Index has gained +24.3% and the MSCI EM Index +27.1%.

Bitcoin experienced a significant decline of about 17% in November, ending the month at $91,176. The largest crypto asset by market capitalization continues to suffer a wave of mass liquidations as leverage is purged from the system.

Gold prices ended the month higher at $4,218 but still below the October all-time high of $4,336.

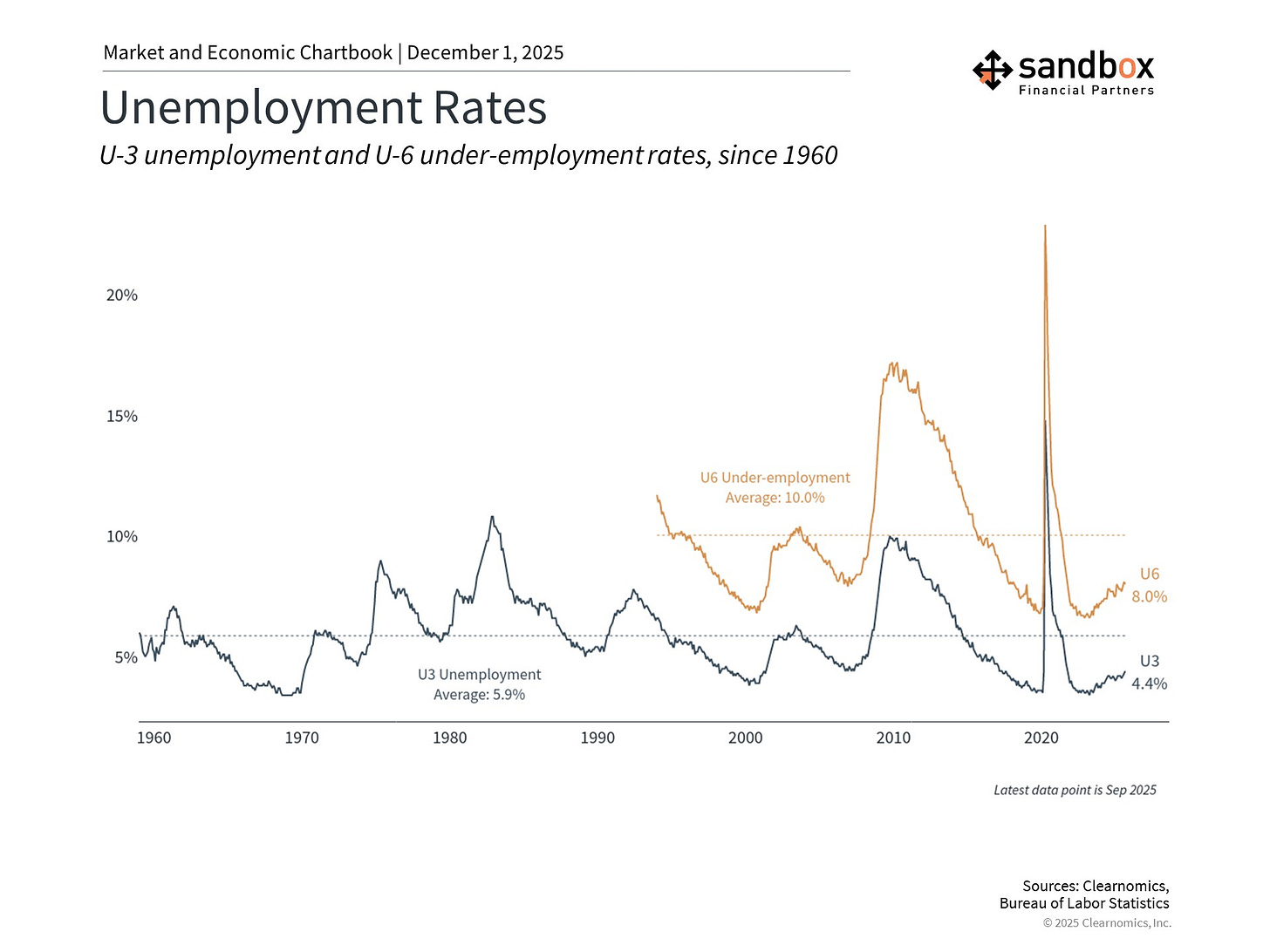

The September jobs report, which was delayed due to the government shutdown, showed that the economy added 119,000 new jobs and the unemployment rate ticked higher to 4.4% that month. There will be no October jobs report.

Markets briefly experienced a “risk off” environment

November saw investors temporarily move away from risk assets such as technology stocks, high-yield bonds, cryptocurrencies, and other high momentum investments.

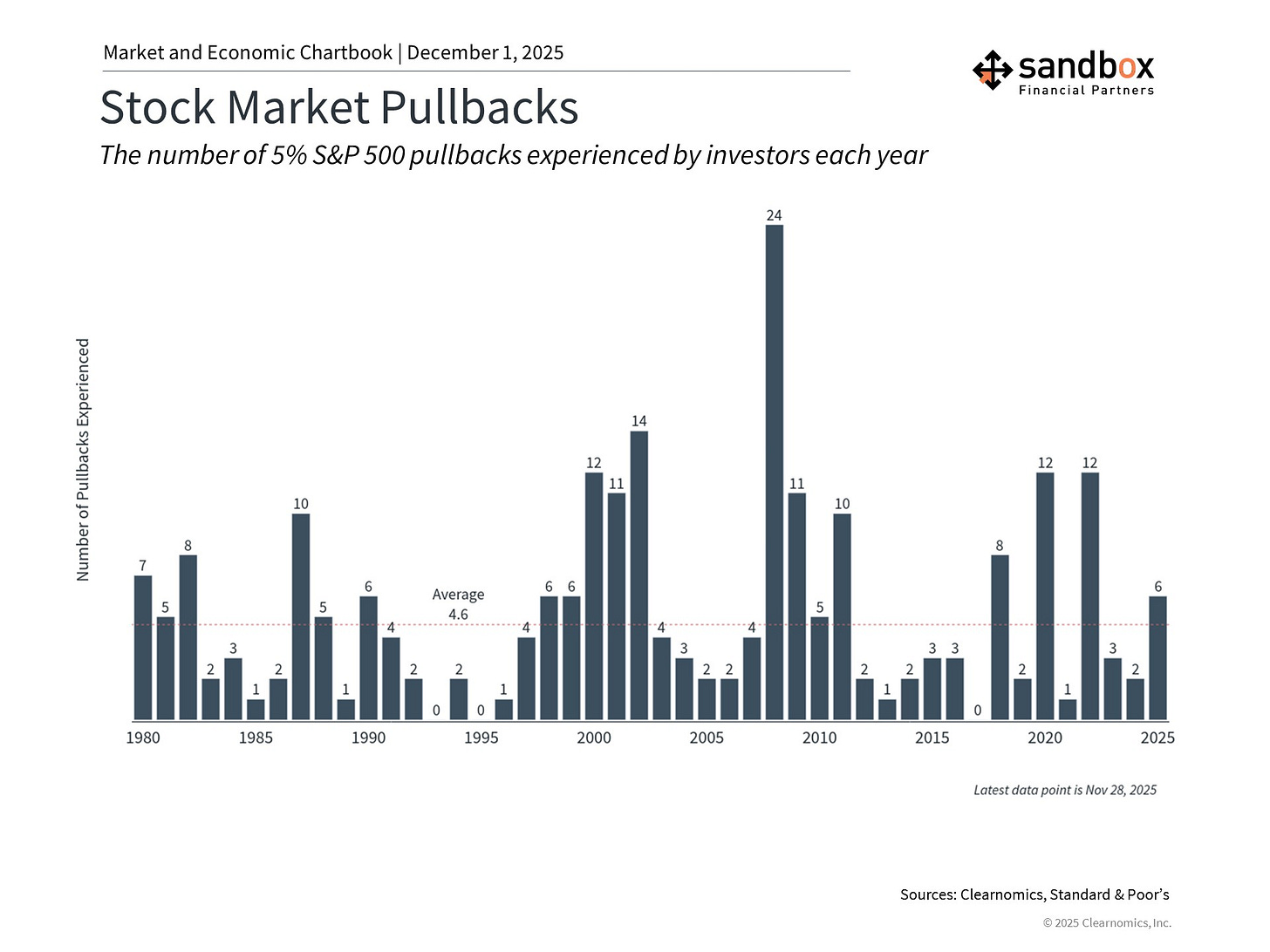

There have now been six declines of 5% or worse for the S&P 500 this year, the most since 2022 but still close to the historical average. Many asset classes rebounded in the final days of the month, and the S&P 500 index ended November slightly green.

During the month, AI-related technology stocks experienced their worst week since April. Concerns about their spending and debt levels, profit margins, and questions around a potential bubble created angst among investors. Yet beneath this, fundamentals remained strong with companies such as Nvidia reporting healthy revenue and earnings growth for the third quarter.

Cryptocurrencies experienced a sharp correction during this risk-off period. Bitcoin fell over 30% from its early October highs above $125,000, briefly trading below $85,000 and wiping out its year-to-date gains. While the adoption of cryptocurrencies by investors has grown, such periods demonstrate that these and similar assets can be highly speculative and prone to boom-and-bust cycles.

The government shutdown ended but economic uncertainty remains

The longest government shutdown in history ended after 43 days, but the federal government will only be fully funded through the end of January 2026. This means that political uncertainty will be in the headlines again in the coming weeks. That said, markets were generally able to look past the shutdown, even with greater challenges due to a lack of economic data.

The Bureau of Labor Statistics released the long-awaited September jobs report, which was originally scheduled to be published in October. This report showed that job gains exceeded expectations that month, rebounding from weakness over the summer. However, the revised figures show that 4,000 jobs were lost in August, the 2nd month of negative jobs growth this year. The unemployment rate edged higher to 4.4% in September, its highest level since October 2021, although this is still low by historical standards.

A full October jobs report will not be published since surveys of households and businesses were not conducted during that month, but some of the data will be published with November’s report on a delayed basis.

Market expectations for the next Fed rate cut have shifted

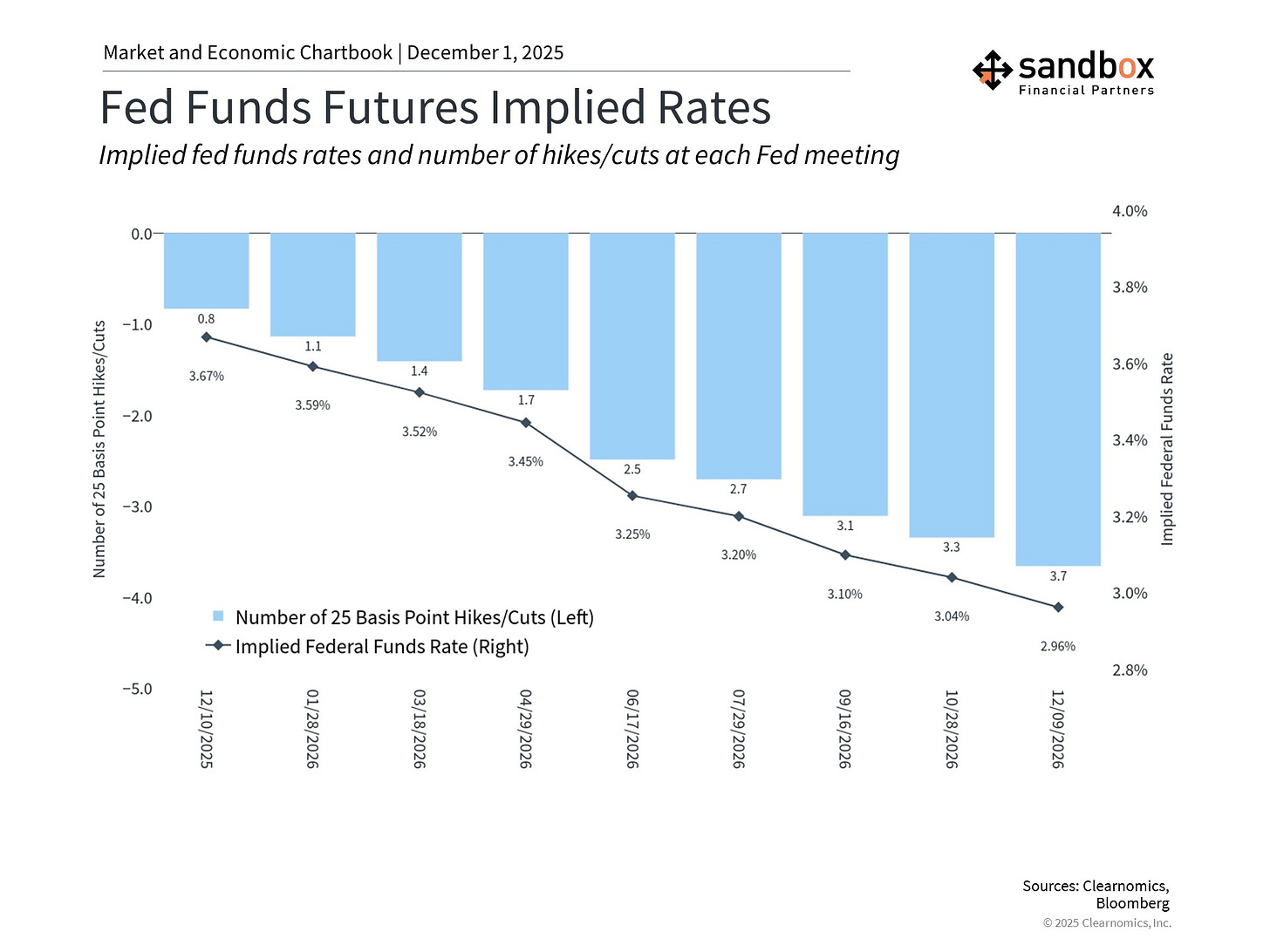

These data delays mean the data-dependent Fed will enter its mid-December meeting next week without the full economic picture.

Expectations for a rate cut at the next Fed meeting have shifted dramatically, with the probability collapsing in mid-November before rebounding once again. At the moment, market-based expectations suggest the Fed will cut rates in December and then again in April or June 2026.

Other economic data, such as consumer confidence, have also worsened. The preliminary estimate of the University of Michigan’s Index of Consumer Sentiment declined from 53.6 to 50.3 in November. This reflects ongoing concerns among Americans about job security, higher prices, and their overall financial situations. While many households are feeling the financial pinch, poor sentiment over the past few years has not translated into reduced spending or corporate revenues.

Bottom line?

November’s market volatility and ongoing uncertainty across the economy are reminders that swings in the stock market are normal. Investors should maintain a broader perspective as we approach year-end.

Source: Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)