October: month in review

The Sandbox Daily (11.3.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

October insights

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.44% | S&P 500 +0.17% | Russell 2000 -0.33% | Dow -0.48%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield -0.31% | 2yr UST 3.607% | 10yr UST 4.110%

COMMODITIES: Brent Crude +0.11% to $64.84/barrel. Gold +0.43% to $4,013.8/oz.

BITCOIN: -2.91% to $106,859

US DOLLAR INDEX: +0.07% to 99.878

CBOE TOTAL PUT/CALL RATIO: 0.86

VIX: -1.55% to 17.17

Quote of the day

“The arc of the moral universe is long, but it bends toward justice.”

- Theodore Parker

October insights

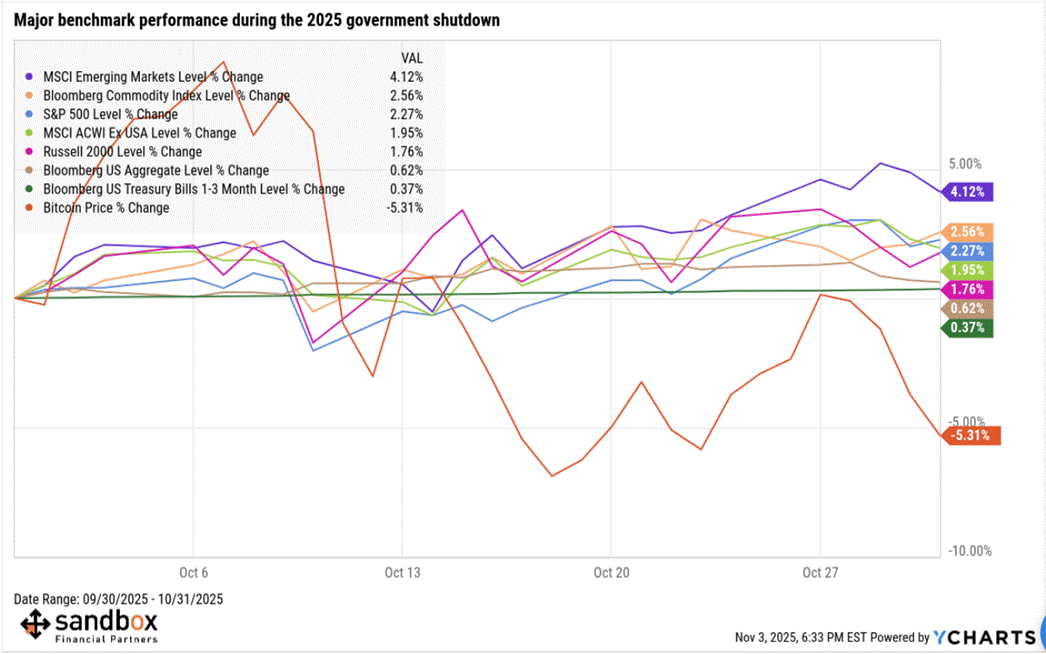

The stock market continued its strong performance in October despite uncertainty from a government shutdown, renewed trade tensions with China early in the month, and rising fears of a market bubble.

Most of the major indices reached new all-time highs after recovering from a brief period of volatility. Bonds also contributed positively to portfolios as interest rates declined, fueled partly by the Federal Reserve’s second consecutive rate cut.

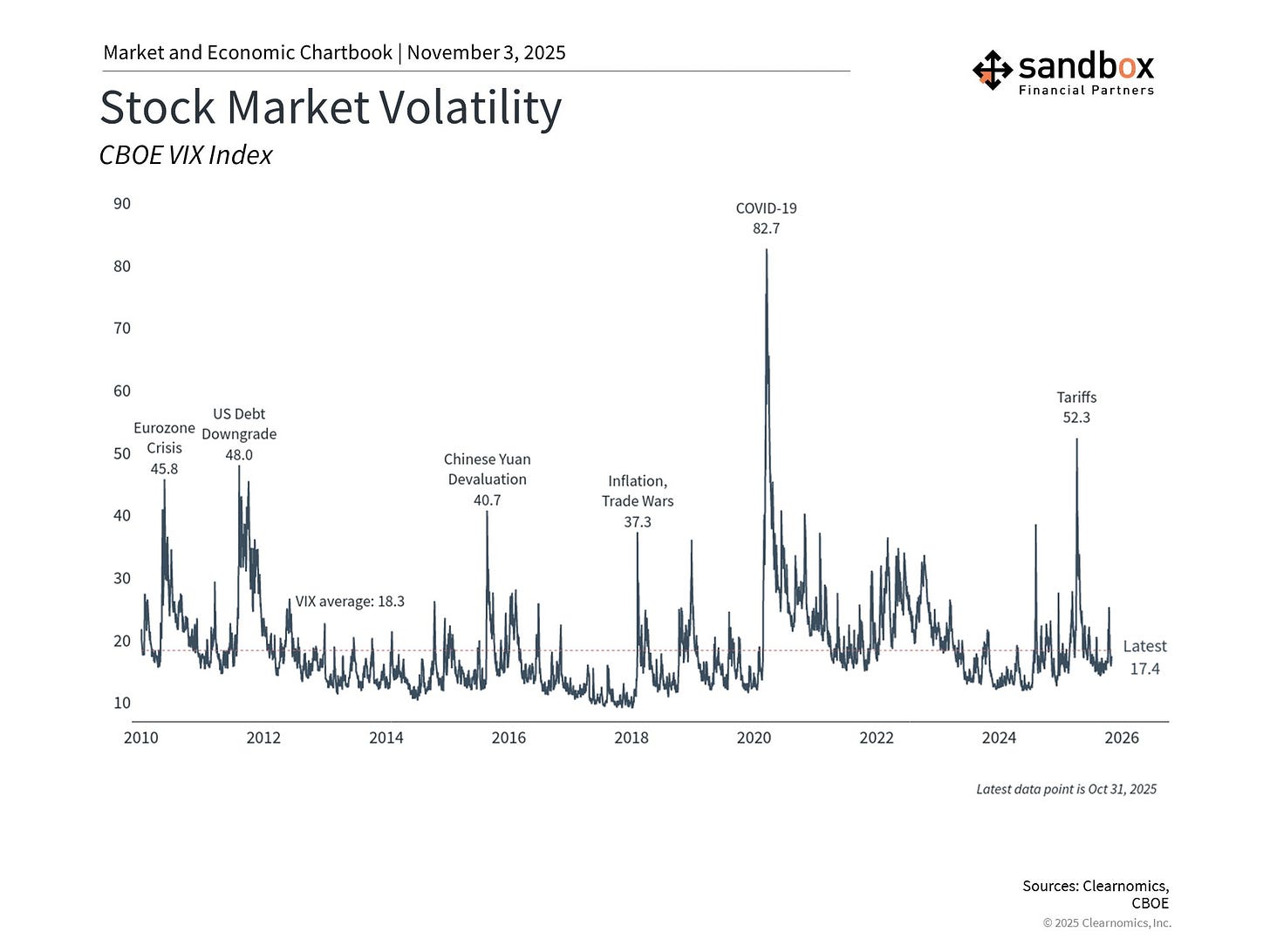

Despite positive gains, the month was not without challenges. The ongoing government shutdown captured headlines, while a brief “tariff tantrum” over rare earth metals caused the largest single-day market decline since April. However, markets quickly recovered, reinforcing the importance of not overreacting to headlines.

Key Market and Economic Drivers

The S&P 500 rose 2.3% in October, the Dow Jones Industrial Average 2.5%, and the Nasdaq 4.7%. Year-to-date, the S&P 500 is up 16.3%, the Dow is up 11.8%, and the Nasdaq is up 22.9%.

Nvidia became the 1st company to reach the $5 trillion market cap milestone

The Bloomberg U.S. Aggregate Bond Index gained 0.6% in October. The 10-year Treasury yield ended the month lower at 4.08%.

International developed markets gained 1.1% in U.S. dollar terms using the MSCI EAFE index, while emerging markets jumped 4.1% based on the MSCI EM index. Year-to-date, the MSCI EAFE index has gained 23.7% and the MSCI EM index 30.3%.

Bitcoin traded poorly in October and experienced the largest liquidation event in its history, ending the month at $109,428

Gold prices ended the month lower at $3,997, after reaching a new all-time high of $4,336 earlier in the month

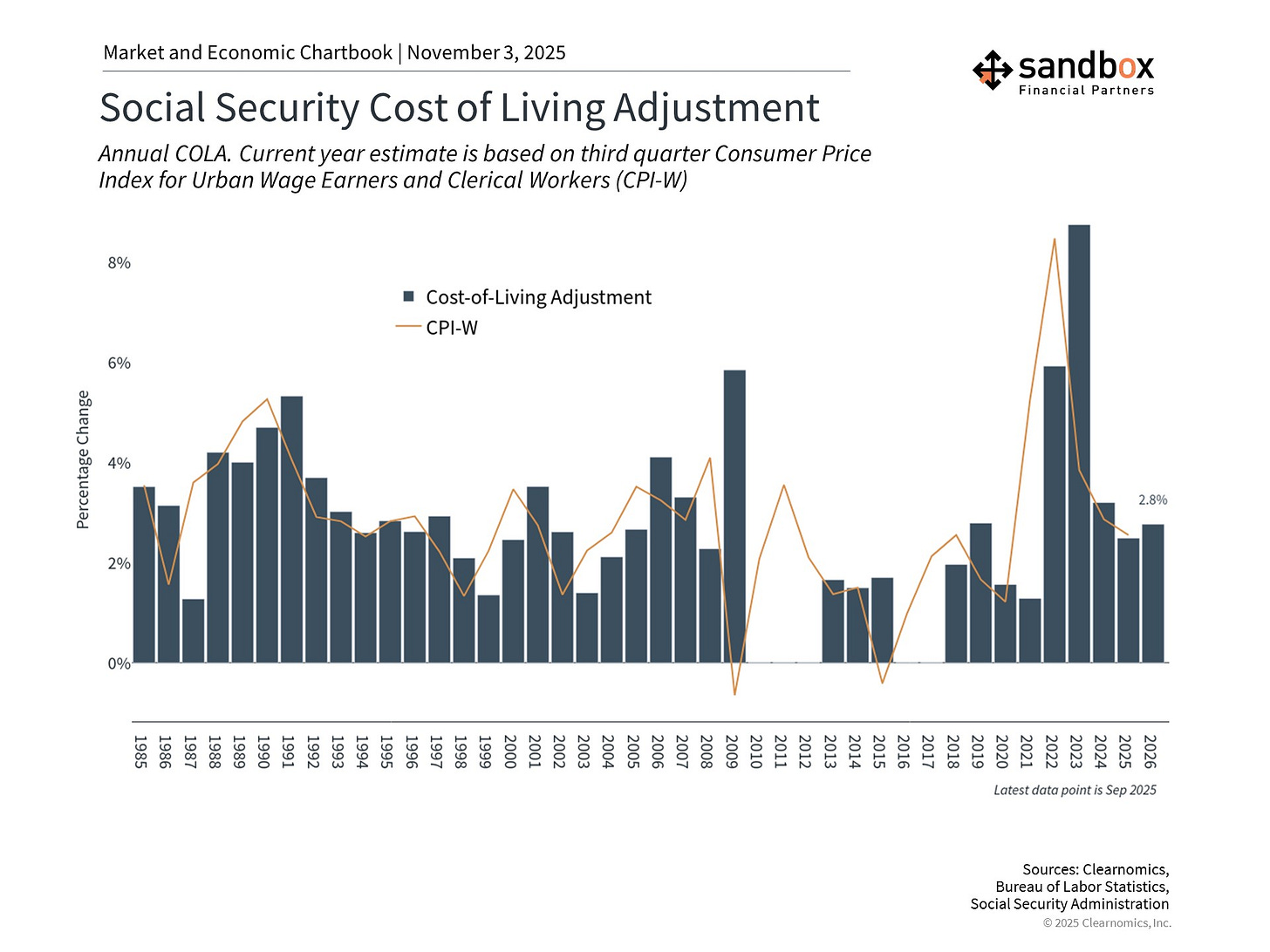

The Consumer Price Index (CPI) was reported late due to the government shutdown, but showed that prices rose 3.0% on a year-over-year basis in September. This report is used to calculate the Social Security cost-of-living adjustment (COLA), which will be 2.8% in 2026.

Other economic data, such as the monthly jobs report, has been delayed due to the government shutdown

Markets remain unfazed by the government shutdown

October began with the government shutdown, which is now approaching the longest on record. Many agencies, including those that provide timely economic reports, have been operating at minimal levels since then.

Historically, government shutdowns have not had lasting effects on financial markets since government spending is typically postponed, rather than lost entirely. The longest previous shutdown lasted 35 days during 2018 to 2019, yet the S&P 500 went on to gain 31.5% in 2019. There is no guarantee this will happen again, but it’s a reminder that markets often look past these events.

There are also concerns around government layoffs, known as reductions in force (RIF). From the perspective of the broader economy, federal government employment represents just 1.8% of the total workforce, and recent reduction-in-force notices amount to just 0.002% of total U.S. employment.

While the shutdown creates real difficulties for affected workers and interrupts government services, its overall economic impact remains limited.

Trade tensions created brief volatility

The market experienced its sharpest one-day decline since April, driven by escalating tensions between the U.S. and China over rare earth metals and the threat of 100% tariffs on Chinese goods. Rare earth metals represent one of China’s greatest points of leverage in trade discussions. China controls approximately 70% of global rare earth production and nearly 90% of processing capacity, creating significant supply chain dependence.

Despite the brief selloff, markets quickly recovered following softer language from the White House. Presidents Trump and Xi then met near the end of the month, which resulted in a de-escalation period and a 10% decline in the tariffs imposed on China.

This pattern has repeated throughout the year, with trade-related concerns causing temporary pullbacks followed by a market recovery.

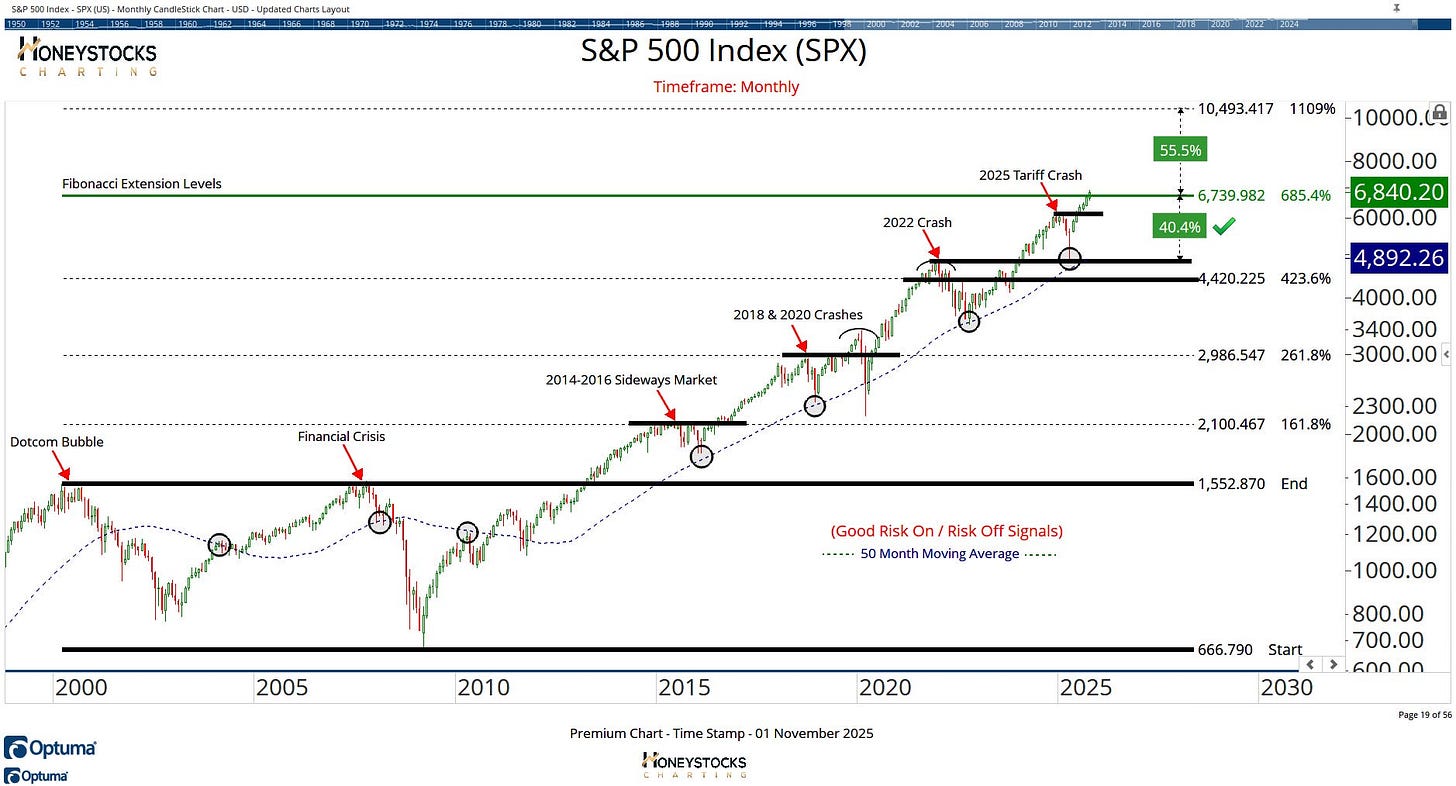

Specifically, the S&P 500 has risen 37% from its April low and has set 36 new all-time highs this year through October. Of course, the market never moves up in a straight line, so this is a reminder that short periods of market volatility are normal and expected.

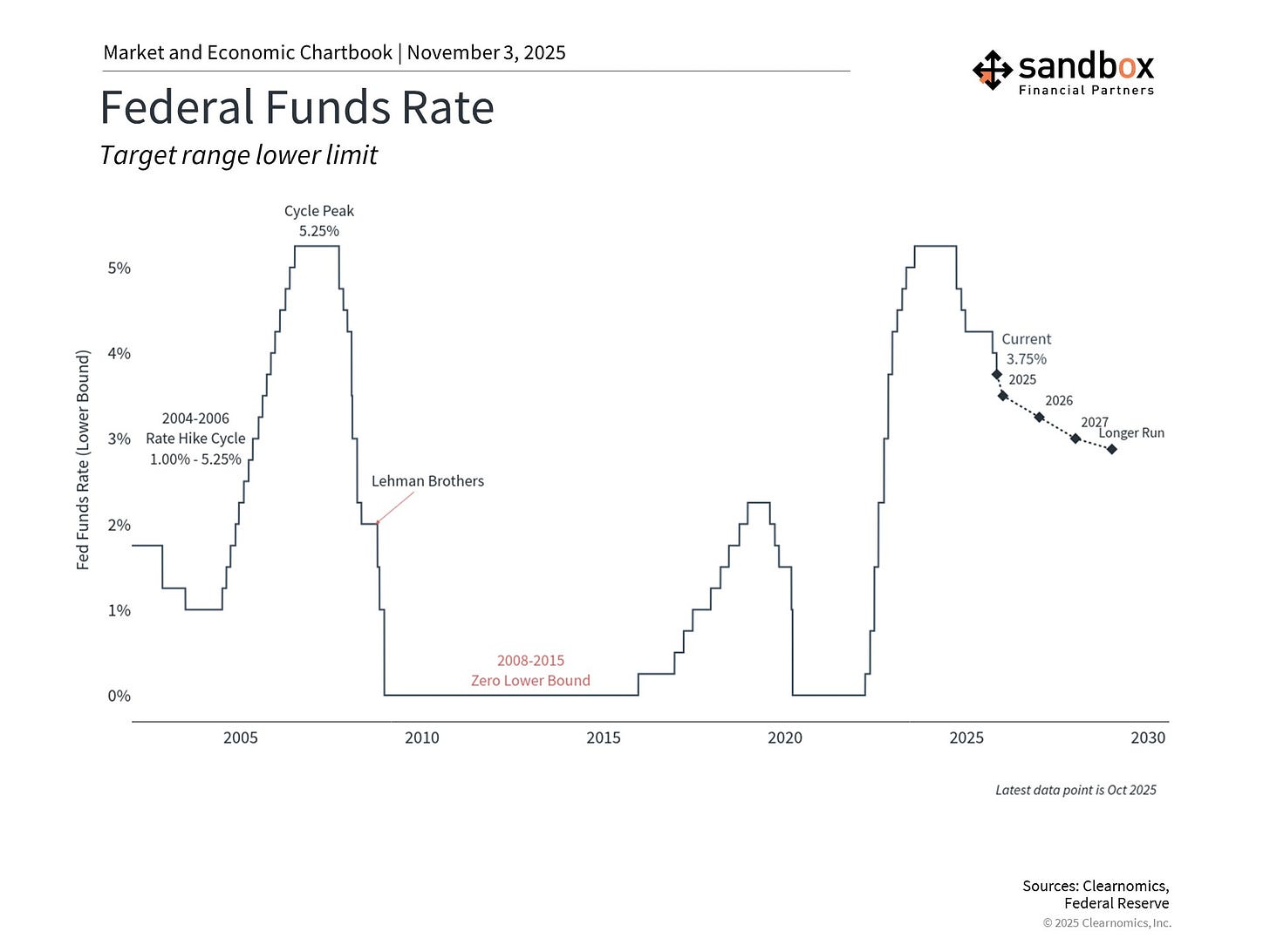

The Fed continues its easing cycle

At its October meeting, the Federal Reserve lowered interest rates by 0.25% to a range of 3.75% to 4.00%, marking its 2nd consecutive rate cut.

This decision reflects the Fed’s efforts to support economic growth while navigating inflation and a weakening labor market. In its statement, the Fed noted that “uncertainty about the economic outlook remains elevated” and that “downside risks to employment rose in recent months.”

Market expectations suggest another rate cut is likely by January, with one or two additional rate cuts in 2026.

Beyond policy rates, the Fed also announced it would stop shrinking its balance sheet in December. Over the past three years, the Fed has tightened policy by reducing its balance sheet by $2.2 trillion, so ending this process provides additional economic support.

Retirees face challenges from modest COLA and lower rates

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, reflecting continued but slowing inflation.

For the average Social Security beneficiary, the monthly benefit will be about $2,064, an increase of only $56. While any increase helps, this modest adjustment pales in comparison to the 8.7% increase in 2023, which was the largest since 1981.

The challenge for retirees is that the COLA is calculated using an index that may not reflect the inflation that they actually experience. Healthcare costs, housing expenses, and other categories that weigh heavily in retiree budgets have risen faster than the overall index. For example, medical care services rose 3.9% over the past year, health insurance increased 4.2%, and home insurance climbed 7.5%.

With life expectancies continuing to increase – many retirees will live into their 90s – planning for multi-decade retirement periods requires portfolios that can provide both income and growth.

Bottom line?

Despite government shutdowns, trade tensions, and other uncertainties, markets continued to exude strength and deliver strong performance in October.

Sources: Honeystocks, YCharts, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

The fact that the S&P 500 has set 36 new all-time highs this year while rising 37% from the April low is remarkable, especially given all the headline noise around government shutdowns and trade tensions. Your point about markets quickly recovering from the tariff tantrum reinforces why staying invested through volatility is so importnt for capturing these gains. The Fed's shift from balance sheet reduction to maintaining its current size alongside rate cuts provides a supportive backdrop for continued equity strength. For 3X leveraged products tracking this index, that 37% move translates to exceptional returns for those who maintained exposure through the choppy periods.