Office vacancy rates, plus spot Bitcoin approval imminent, inflation expectations, and the most sanctioned countries

The Sandbox Daily (1.9.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

office vacancy rate in America hits record high

asset managers finalize spot Bitcoin ETF applications, SEC approval imminent

consumer inflation expectations tumble

the world’s most sanctioned countries

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.17% | S&P 500 -0.15% | Dow -0.42% | Russell 2000 -1.05%

FIXED INCOME: Barclays Agg Bond -0.02% | High Yield +0.16% | 2yr UST 4.366% | 10yr UST 4.015%

COMMODITIES: Brent Crude +1.81% to $77.51/barrel. Gold +0.14% to $2,035.9/oz.

BITCOIN: +0.09% to $46,126

US DOLLAR INDEX: +0.30% to 102.517

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: -2.45% to 12.76

Quote of the day

“He who lives by the crystal ball will eat shattered glass.”

- Ray Dalio, Principles

College Football National Champions !!

We are going to cherish this one for years to come. Go blue!

Onward…

Office vacancy rate in America hits record high

America’s corporate offices are more empty than at any point in at least 4 decades, reflecting years of overbuilding, cheap credit, and shifting work habits that were accelerated by the pandemic.

Office vacancies hit a record high in the 4th quarter of 2023, surpassing previous peaks last reached in 1991 and 1986.

A staggering 19.6% of office space in major U.S. cities wasn’t leased, up from 18.8% a year earlier.

Companies are eager to cut costs by ditching spacious corporate offices to improve bottom-line margins, as well as dump aging office parks built in the 1980s or earlier as they leave for more modern buildings.

Source: Axios

Asset managers finalize their spot Bitcoin ETF applications, SEC approval imminent

The general consensus pertaining to the permanence of Bitcoin has shifted dramatically in the last year.

Many large financial institutions – including BlackRock, Fidelity, ARK, VanEck, and several others – have filed to bring forward public spot Bitcoin ETFs as institutional and retail investor interest grows. In fact, just this week, the spot bitcoin ETF hopefuls filed another round of fresh amendments to their applications as the Securities and Exchange Commission’s deadline to approve or deny the exchange-traded funds fast approaches (January 19th).

As such, it's quite likely that the world's largest financial marketing campaign to introduce a "new" asset class is on the eve of commencement. This approval will have wide-ranging implications for investors and their portfolios with respect to strategy, asset allocation, and risk.

No one knows for sure what capital formation may look like, but safe to say, the legacy institutions have been waiting for this moment for quite some time. This means inflows into spot Bitcoin products should be tantalizing from day 1. Some whispers have noted that BlackRock itself has commitments in excess of $2 billion for their product alone.

Here is the list of the top 25 largest ETF launches in history, with the ProShares Bitcoin futures ETF (BITO) coming in at 15th place. Many expect the aggregate amount across all spot Bitcoin ETFs to easily surpass $2.1B for the #1 spot.

Source: FXStreet, Eric Balchunas, ETF.com

Consumer inflation expectations tumble

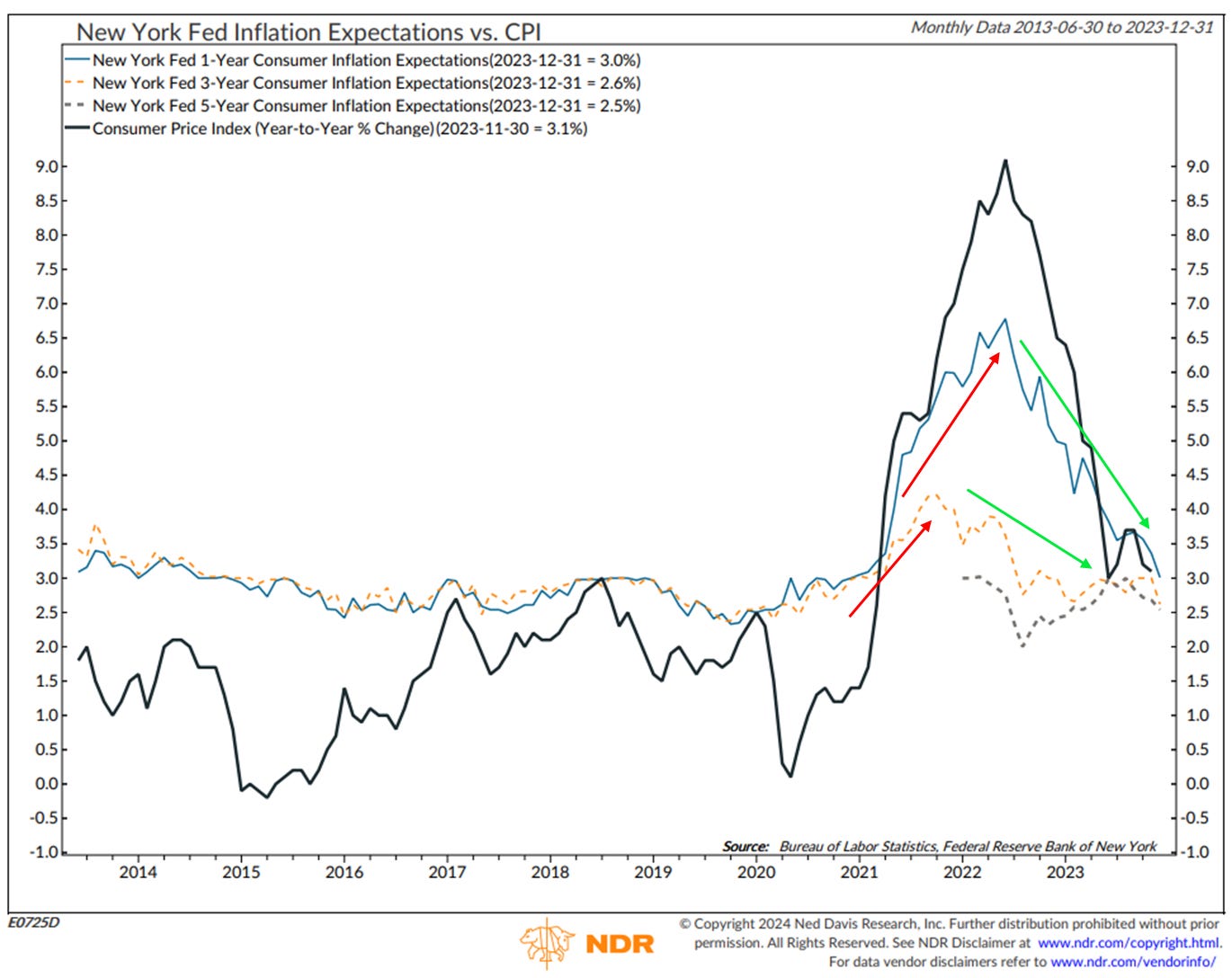

New survey data from the New York Fed suggests Americans' expectations for inflation in the years ahead fell precipitously in December — back, roughly speaking, to pre-pandemic levels.

The New York Fed’s December Survey of Consumer Expectations showed median inflation expectations tumbled across all time horizons, as did expectations for wage growth and consumer spending, supporting the soft-landing narrative.

The one-year inflation outlook dropped from 3.4% to 3.0%, the lowest level since January 2021. The 3-year and 5-year inflation expectations also came down to 2.6% and 2.5%, respectively. Meanwhile, wage growth expectations moderated to 2.5%, the lowest level since April 2021 – suggesting a falling risk of a wage-price spiral.

The decline in inflation and wage expectations should facilitate the Fed’s next policy easing cycle.

Source: Ned Davis Research

The world’s most sanctioned countries

Economic sanctions have been levied by governments and multinational bodies for centuries as a tool to advance a range of foreign policy and economy goals as well as a tool of war. The primary national interests being protected include counterterrorism, human rights, cybersecurity, narcotics, etc.

Sanctions often take two basic forms:

those intended to compel (an attempt to change an actor’s behavior) or…

those intended to deter (an attempt to stop an actor from certain actions)

Sanctions can materialize in a variety of forms, including travel bans, asset freezes, arms embargoes, capital restraints, foreign aid reductions, and trade restrictions. The most recent high profile example of a sanction included the removal of Russia from the SWIFT system, which is a vast messaging network that banks and other financial institutions use to quickly, accurately, and securely send and receive information.

In the wake of its incursion into Ukraine, Russia is the most sanctioned country in the world having received a tsunami of sanction packages in 2022 and 2023, now totaling 18,000+. Iran was the most sanctioned country prior to Russia’s invasion in 2022. Syria, North Korea, Belarus, and Myanmar round out the top 6.

Source: International Monetary Fund, Wilson Center, Statista

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.