Oil market, plus commercial real estate and lack of breadth expansion

The Sandbox Daily (10.9.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

potential oil market effects from the attack in Israel

commercial real estate prices stabilizing, for now

lack of breadth expansion frustrates traders

Let’s dig in.

Markets in review

EQUITIES: S&P 500 +0.63% | Russell 2000 +0.60% | Dow +0.59% | Nasdaq 100 +0.49%

FIXED INCOME: Barclays Agg Bond +1.04% | High Yield +0.74% | 2yr UST 5.081% | 10yr UST 4.795%

COMMODITIES: Brent Crude +4.13% to $88.07/barrel. Gold +1.71% to $1,861.5/oz.

BITCOIN: -1.05% to $27,604

US DOLLAR INDEX: +0.01% to 106.058

CBOE EQUITY PUT/CALL RATIO: 0.68

VIX: +1.43% to 17.70

Quote of the day

“To make better, more informed decisions about the future, we advise people to have 'strong opinions, which are weakly held'.”

- Bob Johansen, Author

Potential oil market effects from attack in Israel

With Israel at war with Hamas, oil prices may be on the verge of gushing higher.

Recognizing the elevated uncertainty and incomplete information at this early stage in the developing geopolitical conflict, it’s worth noting there’s been no impact to current global oil production. It’s also unlikely we will see any immediate large effect on the near-term supply-demand balance and near-term oil inventories, which tend to be the main fundamental drivers of oil prices.

That said, two potential implications of the shocking attacks could weigh on global supply.

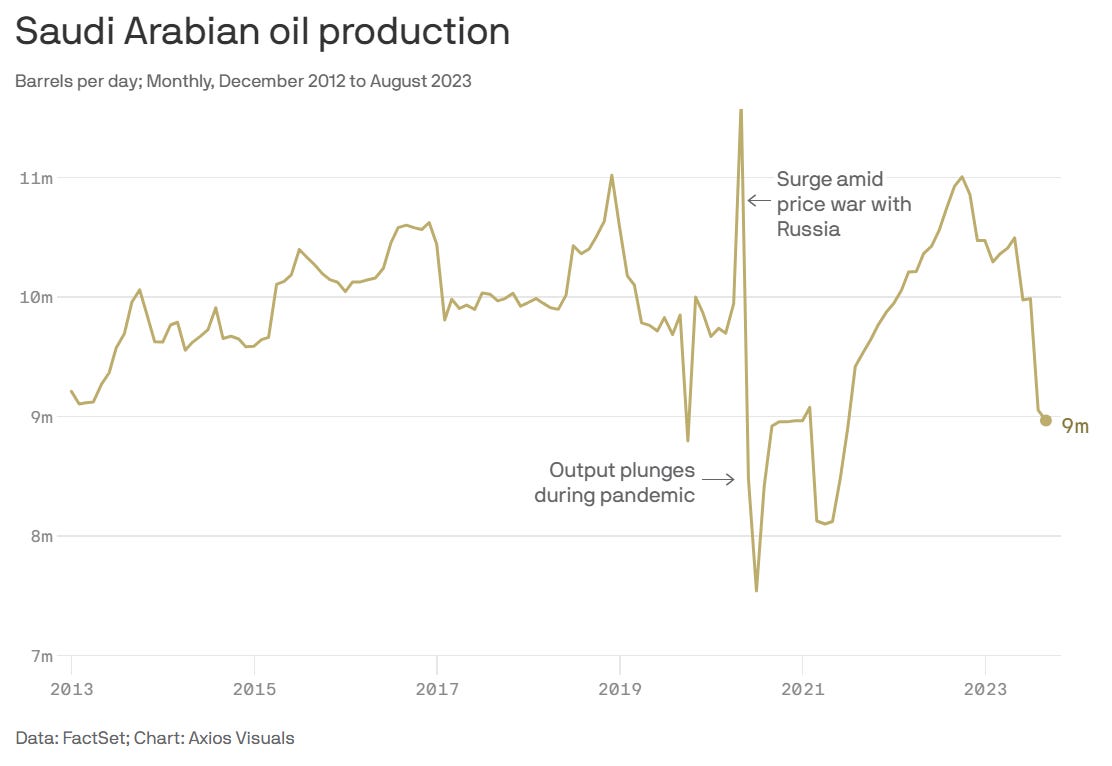

It’s unlikely Saudi Arabia unwinds the extra 1 million barrels per day production cut, which was announced in June 2023 and extended through December 2023. This scenario would further prop up oil prices. As a reminder, these productions cuts have driven up prices at the pump, enriched Moscow’s war chest, and complicated global efforts to bring down inflation.

This opinion stands in stark contrast to a Wall Street Journal report from Friday afternoon (before the attacks) that “Saudi Arabia has told the White House it would be willing to boost oil production early next year if crude prices are high—a move aimed at winning goodwill in Congress for a deal in which the kingdom would recognize Israel and in return get a defense pact with Washington, Saudi and U.S. officials said.” The escalating conflict in Gaza sharply reduces the likelihood of a near-term normalization in Saudi-Israeli relations.

It is highly probably the de-escalating trend in regional tensions prior to this weekend's events (as illustrated by the release of both Iran and U.S. prisoners) had likely been an important factor behind the rise in Iranian oil production over the past year. With the possibility of broader regional tensions re-escalating, the risks to Iranian production projections are now tilted to the downside. Expect Iranian crude production growth to slow down significantly.

Source: Wall Street Journal, Goldman Sachs Global Investment Research, Axios, Trading Economics

Commercial real estate prices stabilizing, for now

According to the Green Street Commercial Property Price Index, prices are down by 11% over the past year.

This is a small improvement from the summer when the index was in a 16% drawdown – the largest decline we’ve seen since the Global Financial Crisis (GFC) – but it appears prices are stabilizing. Over the past 6 months, the change in commercial property values is only down 1.5%.

The commercial space is just one segment of a much larger real estate market, but it’s especially important in the context of the regional banking woes. The issues in the commercial real estate sector are similar to the residential space in that it’s predicated on values that boomed too much in 2020 and 2021; now, in a softer market against the backdrop of higher interest rates, those same prices are cooling and any financed property (or new purchase) is rolling into a much higher interest rate regime. But, unlike the residential space, there is no supply shortage. In fact, COVID created the opposite effect where there’s excess supply of commercial space because of the transition to work-from-home (WFH).

Vacancy rates are ticking higher across multiple sectors, with office vacancies above 25-year highs.

According to Morgan Stanley, there is $1.5T of CRE debt coming due in the next 3 years – 67% of these loans are held by regional banks.

And the recent surge in rates coupled with the pullback in bank lending will continue to exacerbate pain on real estate investors and the lenders, specifically the small and regional banks. Financing costs withing commercial real estate have risen sharply:

A recent Bloomberg survey shows respondents believe prices to continue falling into next year and potentially as late as 2025, or worse.

Source: Green Street, Bloomberg, Goldman Sachs

Lack of breadth expansion

Here's a stat to show how frustrating 2023 has been for traders.

Only 41% of trading days have seen 52-Week Net New Highs in positive territory this year.

Source: Barchart.com

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.