One powerful tailwind for stocks, plus small-caps, economic data disappoints, and the cost of our national debt

The Sandbox Daily (6.20.2024)

Welcome, Sandbox friends.

Golden Goose delayed its initial public offering (IPO) in Milan at the last-minute, Russian President Vladimir Putin and North Korean leader Kim Jong Un signed a comprehensive strategic partnership agreement yesterday in Pyongyang, Stonehenge sprayed with orange paint by Just Stop Oil environmental activists, and the Bank of England held steady on its key interest rate.

Today’s Daily discusses:

short interest – the invisible hand

still waiting on small-caps to fire

economic data continues to surprise to the downside

servicing the national deficit is expensive

Let’s dig in.

Markets in review

EQUITIES: Dow +0.77% | S&P 500 -0.25% | Russell 2000 -0.39% | Nasdaq 100 -0.79%

FIXED INCOME: Barclays Agg Bond -0.17% | High Yield -0.06% | 2yr UST 4.733% | 10yr UST 4.257%

COMMODITIES: Brent Crude +0.79% to $85.74/barrel. Gold +1.09% to $2,372.4/oz.

BITCOIN: +0.23% to $64,989

US DOLLAR INDEX: +0.37% to 105.645

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +7.97% to 13.28

Quote of the day

“Challenge yourself; it's the only path which leads to growth.”

- Morgan Freeman, Actor

Short interest – the invisible hand

Question: where did all the bears go?

Answer: broke.

One area of support for the U.S. equity market over the past 1.5 years is derived from the decline in short interest from two monster equity ETFs, the SPDR S&P 500 ETF (SPY) and Invesco Nasdaq 100 ETF (QQQ).

Short interest is the number of shares that have been sold short and remain outstanding. Investors/trades typically sell a security short if they anticipate that price will decline by borrowing shares of stock. Generally speaking, when stocks are rising (like they have been for nearly two years), short interest falls as investors look to cover their losses and close short positions.

As SPY and QQQ represent significant vehicles by investors for placing positions on U.S. equities at the index level, their declining short interest has provided a steady flow of upward support and momentum as short positions were gradually covered.

Source: J.P. Morgan Markets

Still waiting on small-caps to fire

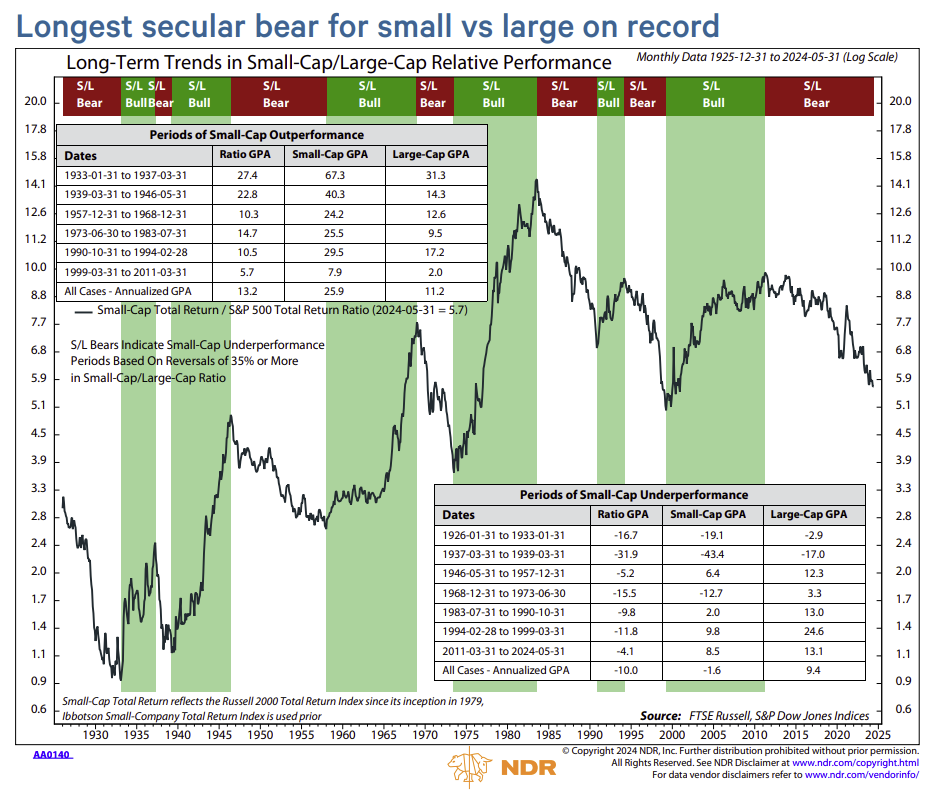

The secular bear in small-caps relative to large-caps is in its 14th year, the longest on record.

The duration suggests the small-cap bear is in its late innings. However, a tactical rally driven by an easing cycle after the Fed starts cutting interest rates should not be confused with a secular rotation – that will take a longer time to play out and confirm.

The long-term challenge for small-caps is that the best companies do not go public as early as they have in the past. Deeper capital markets allow them to stay private until they are mid- or large-caps, or they are acquired by large-caps. The best chance for a small-cap secular bull may be when large-cap stocks enter a secular bear.

Another obvious but important consideration is the small-cap index kicks out its best players by very definition. Once the largest small-caps achieve a certain market cap, the company graduates up the cap stack – similar to what we experienced with Super Micro Computer Inc. (SMCI) earlier this year. This means the small-cap index is always losing its largest positive contributors to performance.

On an absolute basis, the Russell 2000 index is near the upper end of a two-year trading range, however the index has not printed a new record high since November 2021, or 651 trading days.

Normally, the S&P 500 and Russell 2000 endure long stretches in between record highs together. With the S&P 500 hitting a record high yesterday, this is the longest streak of the Russell 2000 not hitting an all-time high while the S&P 500 has on record.

Source: Ned Davis Research

Economic data continues to surprise to the downside

Today we saw broad-based eco weakness: initial jobless claims stayed in a rising trend, housing deteriorated again (NAHB, housing starts, building permits), and manufacturing is still struggling. For those keeping score at home, those are Ls for the labor market, housing market, and manufacturing market – a fairly wide swath of the economy.

These reports align with other economic data that continues to come in below expectations (i.e. hard data “surprising” below wall street forecasts/expectations), indicating our economy is gradually cooling. It also likely suggests the economy is starting to feel the effects of Fed tightening.

Below is the Citi Economic Surprise Index, which rolled over after peaking during the summer in 2023 and flipped outright negative last month. This is the longest continuous stretch of negative U.S. economic data surprises since 2022.

The hope is that the recent weaker-than-expected data could help ease inflationary pressures and drive down bond yields.

Source: The Daily Shot

Servicing the national deficit is expensive

While the primary deficit may be large but stable, net interest costs are exploding.

Interest costs are already 3.1% of GDP, just shy of the all-time high of 3.2% of GDP reached in 1991.

As the chart below indicates, interest costs will continue to remain at elevated levels as a share of GDP (the forecast assumes the 10-year Treasury rate averages ~3.9%).

If interest rates increase by 1% on a persistent basis, interest costs could quickly rise to about 4% of GDP and eventually reach 5% of GDP. If interest rates fall by 1% on a persistent basis, interest costs will still be above Congressional Budget Office's (CBO) pre-pandemic forecast.

Source: Piper Sandler

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

I have started to receive these daily emails and appreciate them. Each item in today’s was worth reading.

One suggestion for improvement would be to discuss the percentage of debt service to federal revenues rather than focusing on the percentage of debt or interest to GDP.

The cost of debt service as a percentage of federal revenues is likely to be the stress factor rather than some relationship to GDP.