Options markets, plus European yields, China manufacturing, Netflix, subprime auto loans, and traders vs. investors

The Sandbox Daily (3.1.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

how market structure changes are impacting volatility

European yields reach new highs

China manufacturing rebounds meaningfully

Netflix is responsible for 15% of global internet traffic

the surge in subprime auto loan delinquencies

traders vs. investors.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.08% | Dow +0.02% | S&P 500 -0.47% | Nasdaq 100 -0.86%

FIXED INCOME: Barclays Agg Bond -0.58% | High Yield -0.28% | 2yr UST 4.882% | 10yr UST 3.998%

COMMODITIES: Brent Crude +1.10% to $84.37/barrel. Gold +0.41% to $1,844.3/oz.

BITCOIN: +1.43% to $23,528

US DOLLAR INDEX: -0.44% to 104.407

CBOE EQUITY PUT/CALL RATIO: 0.69

VIX: -0.58% to 20.58

Quote of the day

“It may take some hard work. But the more you say no to the things that don’t matter, the more you can say yes to the things that do.”

-Ryan Holiday, The Daily Stoic

Market structure changes are impacting volatility

Both Goldman Sachs and Bloomberg have recently reported on the growing popularity among retail investors for “0DTE,” or options contracts with “zero days until expiration.” These are put-and-call options on individual stocks and indexes that expire within 24 hours.

As this graph from Goldman Sachs shows, almost half of the options volume on the S&P 500 is 0DTE. This trading activity rose significantly in prominence after the COVID crash.

Given the extremely limited amount of time until expiration on these options, most of the activity in “0DTE” options is likely due to speculators. In many cases, volume on “0DTE” options spikes before important economic data releases.

Wall Street banks who are on the other side of “0DTE” trades must hedge them. To do so, they buy or short the underlying index as it moves in favor of the options owner. The growing concern is that as “0DTE” option interest grows, dealers must actively hedge larger amounts. If the options trades are correct, bullish or bearish, banks would have to buy or sell aggressively. Such could exaggerate an already significant market move.

It's not unrealistic to consider the daily market moves exceeding 2% and 3%, seemingly commonplace in 2022, was exacerbated due to options speculating and hedging activity.

Source: Goldman Sachs Global Investment Research, Markets & Mayhem

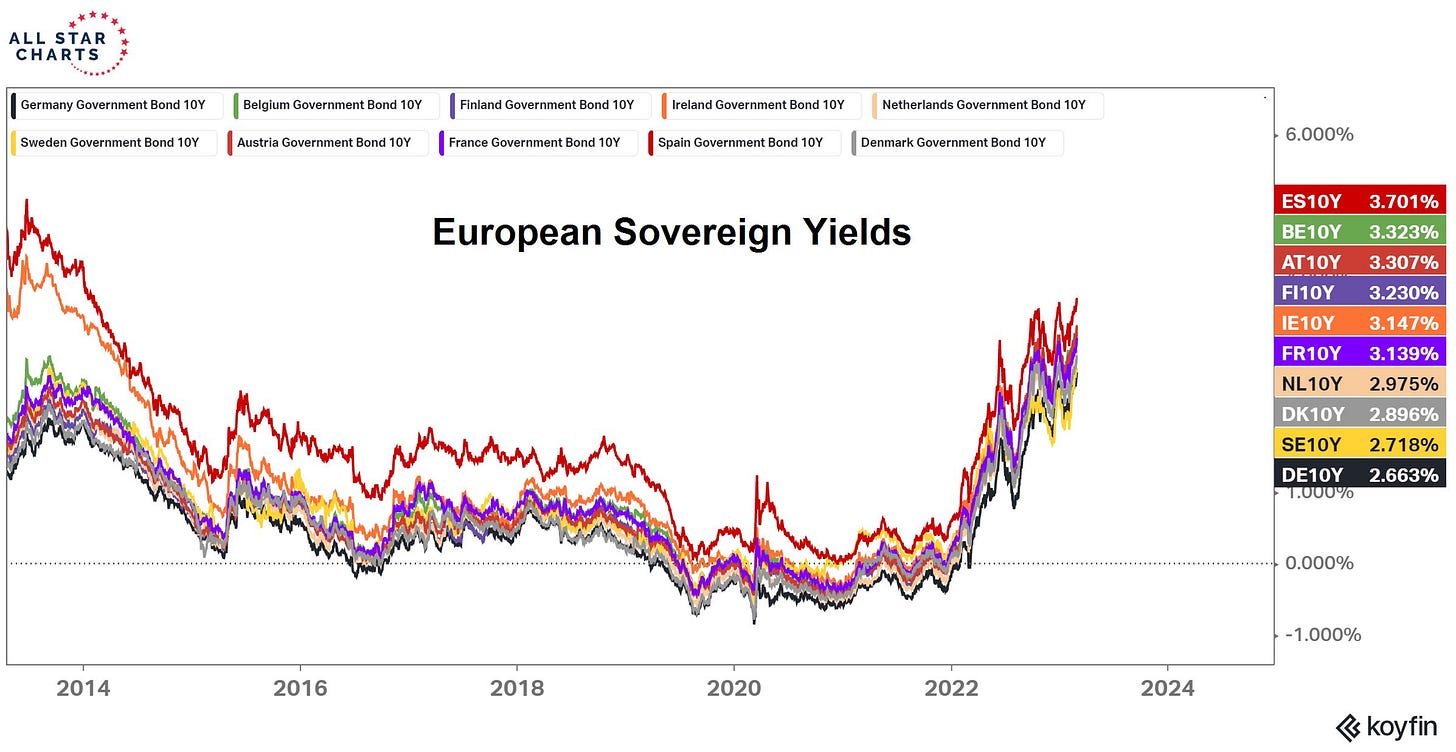

European yields reach new highs

When we look outside the United States, we can clearly see it's a rising interest rate environment around the globe.

While yields are climbing in the U.S., the upward trajectory for European yields is far more pronounced. The chart below displays 10 developed country European sovereign benchmark yields:

All 10 are either challenging or printing fresh multi-year highs. Clearly the rising interest rate environment was global in scope, and Europe often gave a good indication for where U.S. yields were heading.

Remember the negative yielding debt experiment? The one where borrowers could be paid to borrow money when interest rates were held below zero? That ended last month on these rising rates. The pool of negative yielding securities, which peaked at $18.4 trillion in 2020 across 5000+ issues of bonds around the world, is now $0.

Source: All Star Charts, Bloomberg

China manufacturing rebounds meaningfully

China manufacturing expanded at the fastest pace in more than a decade, a function of relaxing zero-Covid policy and the broad reopening of their economy. But this will be interpreted as a negative for the United States because China is now just viewed as a source of inflation in the new “no landing” scenario.

China’s National Bureau of Statistics of China said February’s reading showed continued improvement in the climate for production and business, noting that the total volume of activity “significantly increased” as well.

Next week the National People’s Congress will release its new growth target, a release of great interest to the market and investors.

Source: CNBC

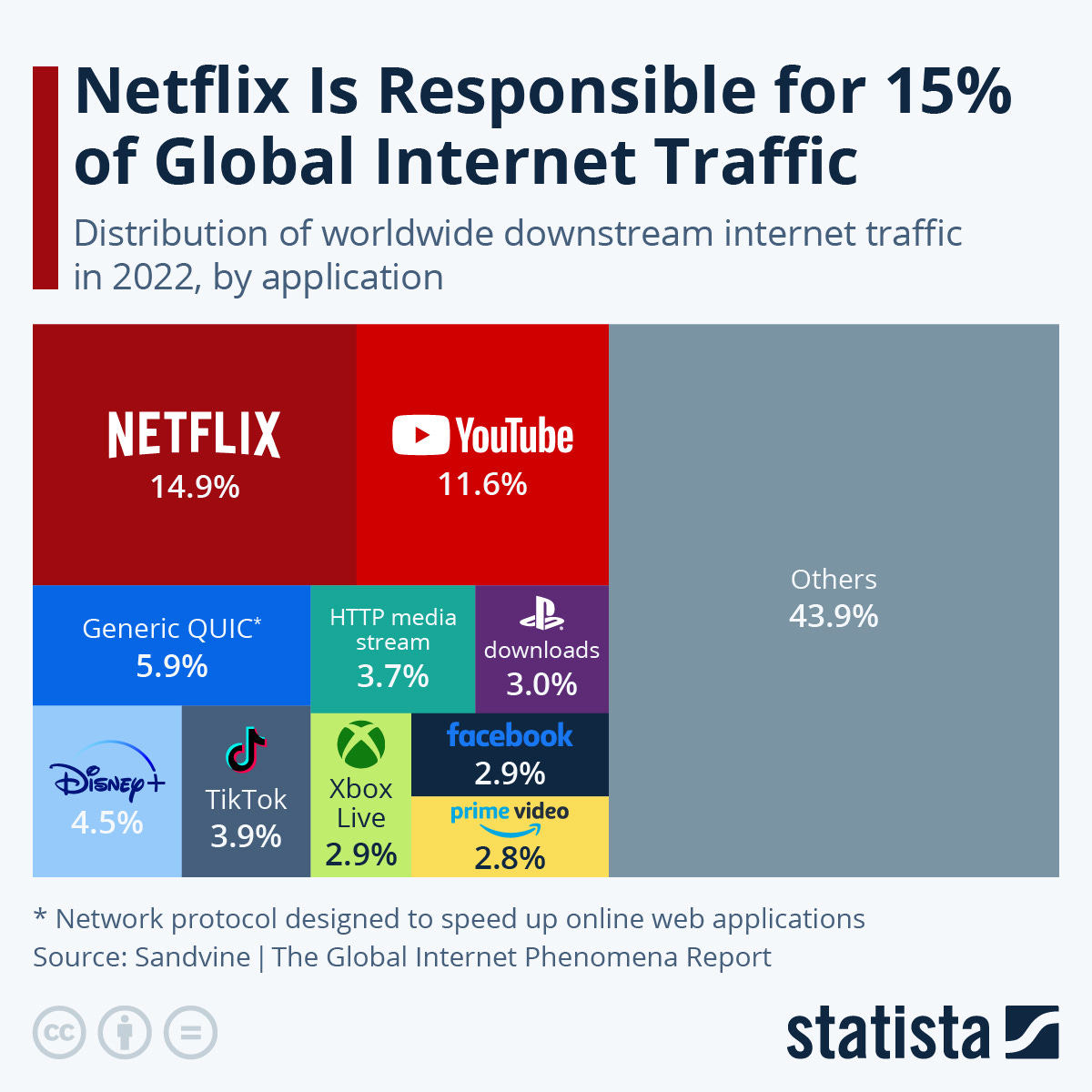

Netflix is responsible for 15% of global internet traffic

A new report by Sandvine has revealed the web applications responsible for the world's most downstream internet traffic.

Underlining the popularity of streaming services, Netflix accounts for the most megabytes with 14.9% of global downstream internet traffic. YouTube, Disney+, and Amazon Prime Video also take a fair amount of market share. It appears that Netflix’s strategy to invest billions-of-dollars in video content has paid off, with titles like the Queen’s Gambit, The Crown, and Squid Games helping to revive some recent hardship.

And here are the top brands occupying each vertical across video applications, gaming, social media, and messaging.

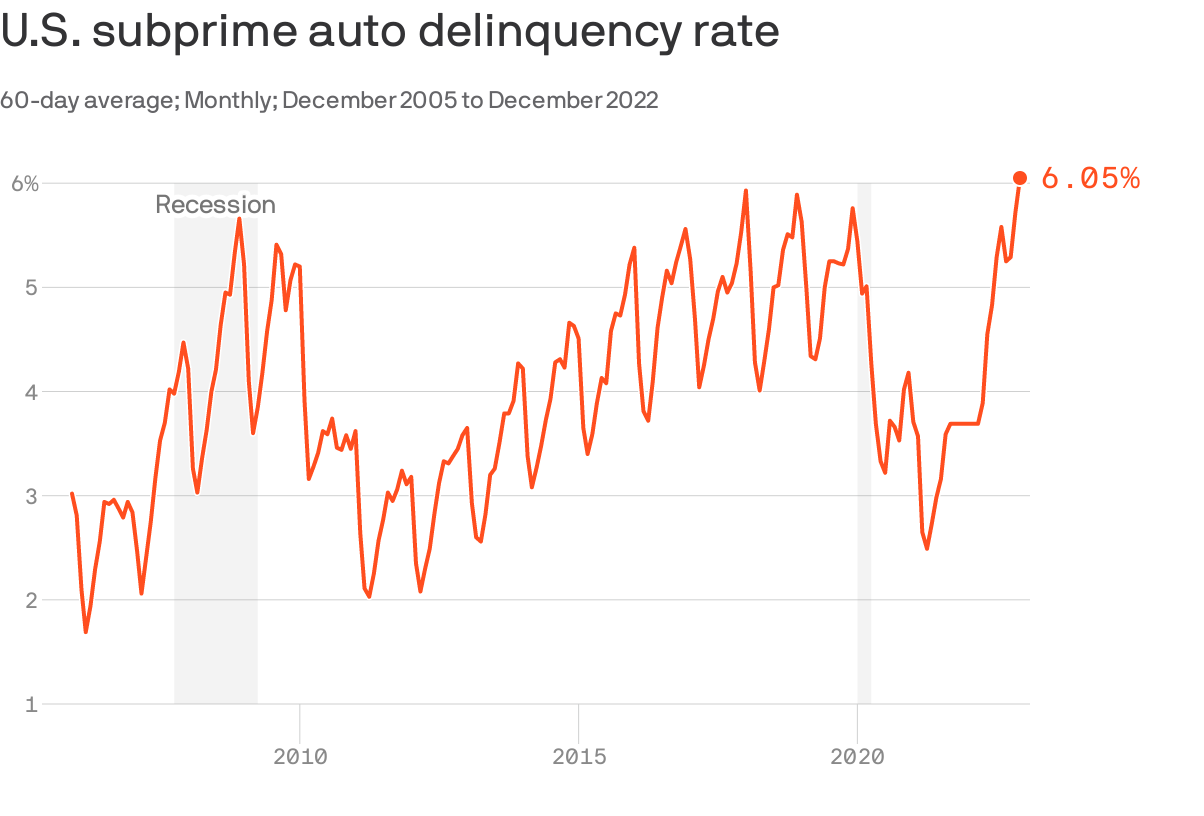

Surging subprime auto delinquencies

Consumers with low credit scores are falling behind on their auto loans at a record rate.

The share of payments on so-called "subprime" auto loans that were at least 60 days delinquent – basically unpaid monthly car bills – rose to more than 6% in December.

The upsurge in subprime delinquencies shows that despite the strength of the job market, cash-strapped American households are under pressure from two years of cost-of-living increases (i.e. inflation) and the end of pandemic-related benefits. This latest uptick reflects a steady weakening of the finances of poorer American households in which inflationary price shocks apply the greatest pressure – another indicator underpinning the bear narrative.

Source: Axios

One simple graphic

Short-term thinking is at the root of most investing problems.

If you can focus on the next five years while the average investor is focused on the next five months, you have a powerful edge. Markets reward patience more than any other skill.

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.