"Over time, the market correlates to the direction of earnings, and earnings is driven by the path of economic activity."

The Sandbox Daily (11.6.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Q3 earnings season takedown

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.84% | S&P 500 -1.12% | Russell 2000 -1.86% | Nasdaq 100 -1.91%

FIXED INCOME: Barclays Agg Bond +0.37% | High Yield +0.04% | 2yr UST 3.562% | 10yr UST 4.087%

COMMODITIES: Brent Crude -0.08% to $63.48/barrel. Gold -0.12% to $3,988.3/oz.

BITCOIN: -3.06% to $100,606

US DOLLAR INDEX: -0.50% to 99.707

CBOE TOTAL PUT/CALL RATIO: 0.85

VIX: +8.27% to 19.50

Quote of the day

“I have nothing in common with lazy people who blame others for their lack of success. Great things come from hard work and perseverance. No excuses.”

- Kobe Bryant

Earnings season takedown

Earnings season is the heartbeat of the market. It’s a real-time pulse check on both the economy and investor sentiment.

Every day, a new round of results tells us 1) how the companies that drive economic growth are performing and 2) how markets are reacting.

As Tony Dwyer always put it, “over time, the market correlates to the direction of earnings, and earnings is driven by the path of economic activity.”

That relationship has been on full display this quarter. Strong corporate results should continue to anchor market momentum and power this market higher into year-end and 2026.

With 82% of S&P 500 companies having reported, the story of Q3 2025 earnings is coming into focus. And it’s a good one.

Here are six key takeaways from earnings season thus far:

Earnings scorecard

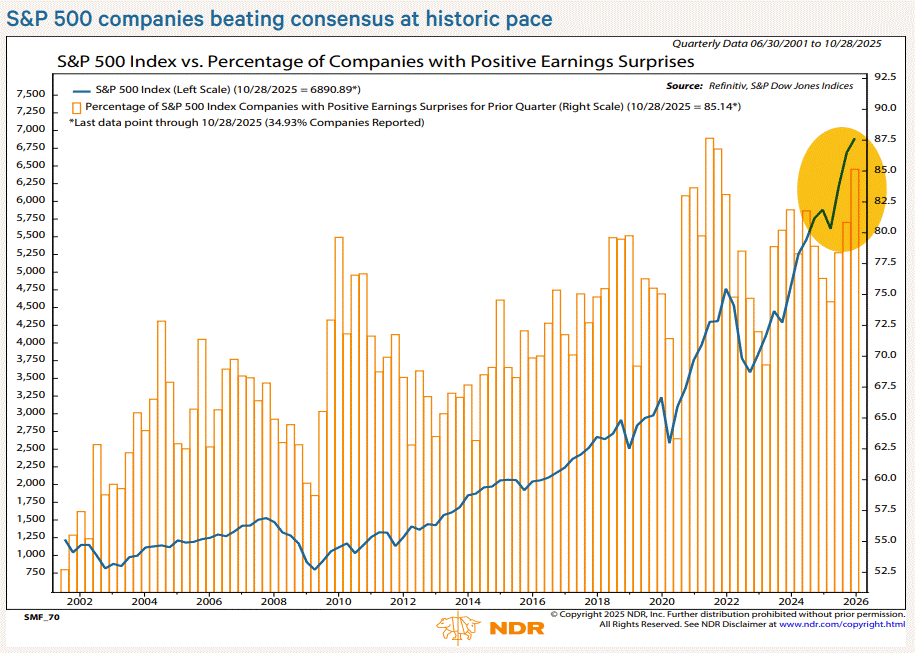

84% of companies are beating their estimates, well above the 10-year average of 75%.

If that figure holds, it will mark the highest beat rate since Q2 2021 (87%).

Earnings growth

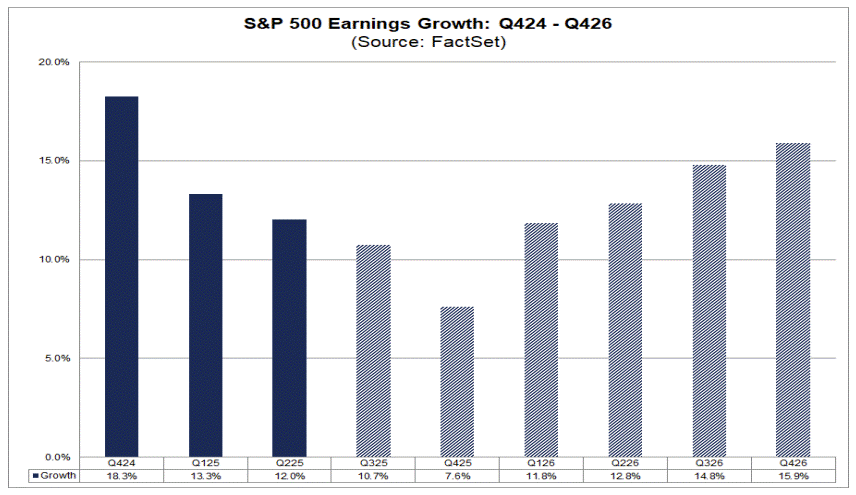

Expectations heading into the quarter were for roughly 7-8% earnings growth.

The actual blended rate (realized + remaining estimates) is closer to +11%, marking the 4th straight quarter of double-digit EPS growth.

Earnings expectations

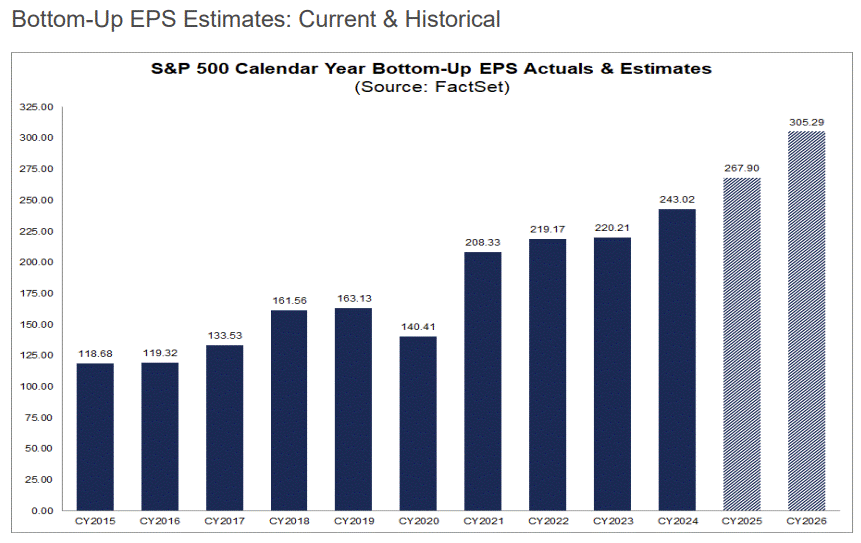

Analysts expect the earnings momentum to continue, projecting double-digit growth in 4 of the next 5 quarters.

From Q4 2025 through Q4 2026, forecasted YOY EPS growth for the S&P 500 stands at 7.6%, 11.8%, 12.8%, 14.8%, and 15.9%.

Valuation multiple

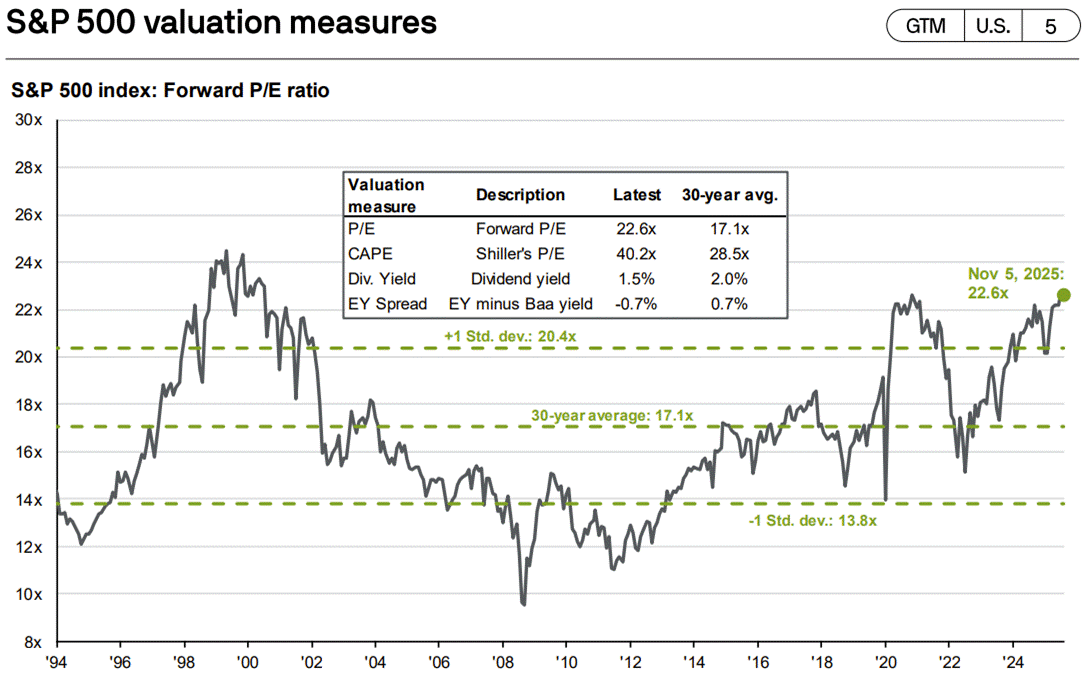

The S&P 500’s forward multiple sits at 22.6x, putting it in the top 5% of historical readings.

Since April 8 (“Liberation Day” lows), the S&P 500 is higher by 38.3%, while forward 12-month EPS estimates have risen just 7.1%. In other words, price, not profits, has driven a key driver of this rally.

I like what Nick Colas of DataTrek had to say earlier this week in the Morning Brief: “While it has recently become fashionable to call a top in US equity valuations, history says it takes a macro catalyst to change investor perceptions.”

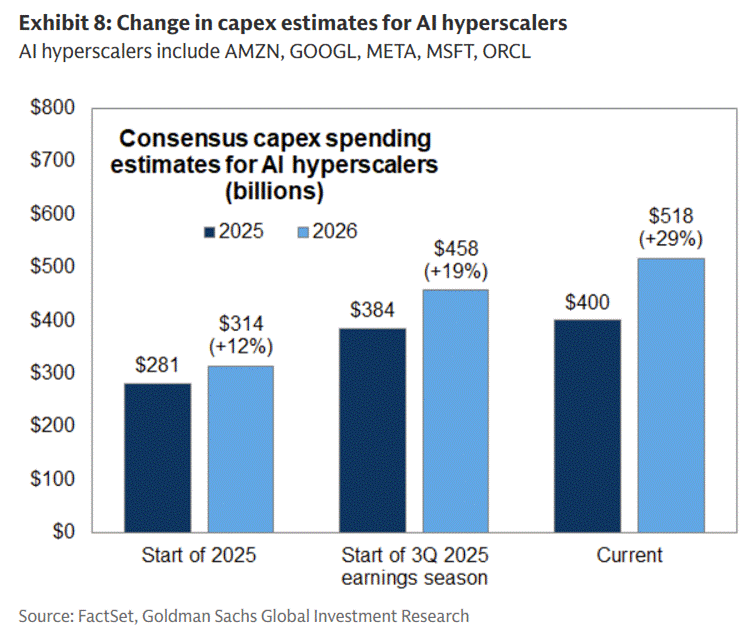

Mega-cap AI CapEx continues to expand

The hyperscalers’ AI investment spree continues to accelerate.

Looking ahead to 2026, consensus CapEx estimates have jumped from $314 billion at the start of the year to $518 billion today based on what Corporate America has told us – that projects to a 29% increase year-over-year.

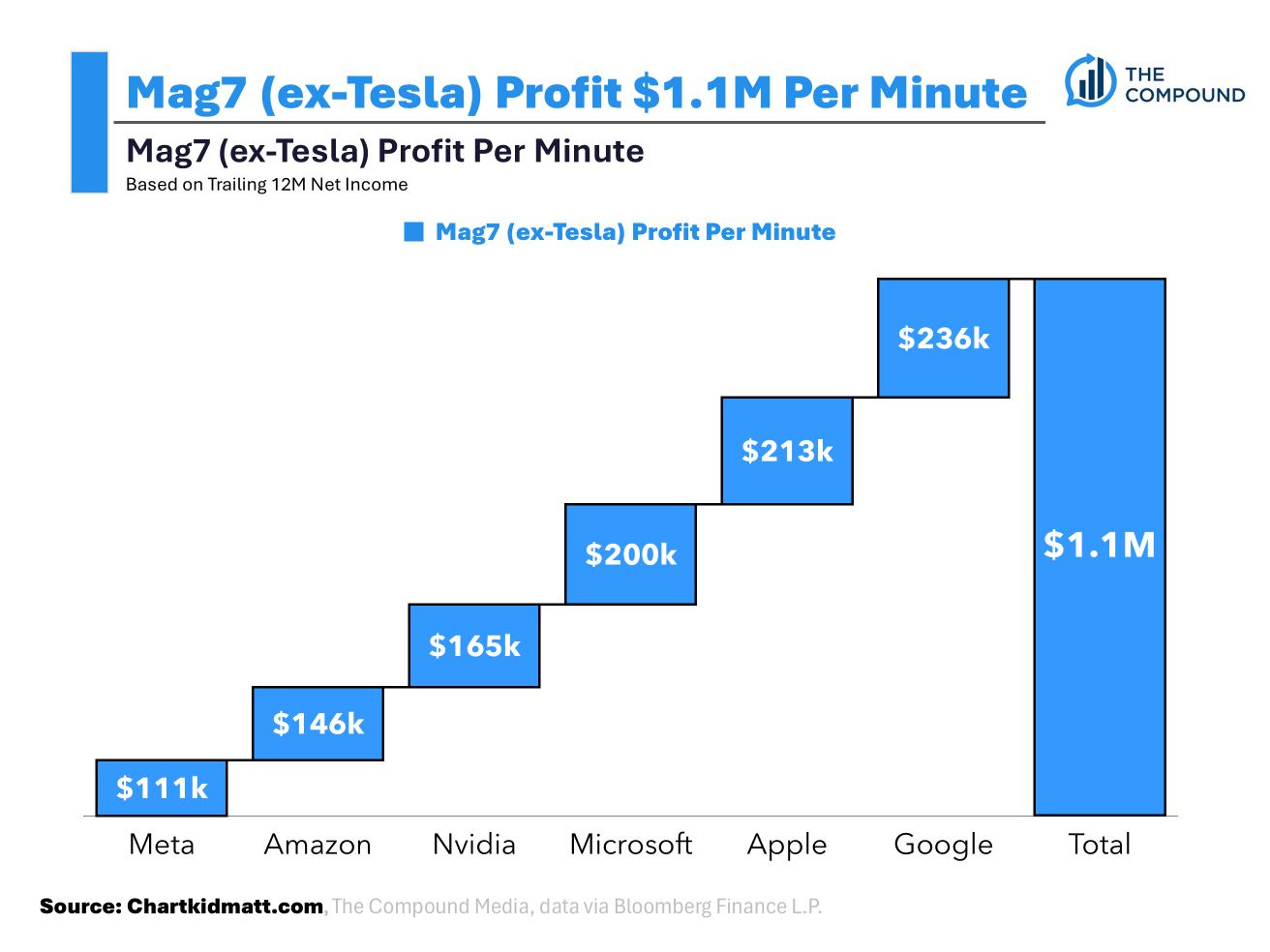

Fun Mag-7 stat

Together, the Magnificent 7 now generate $1 million in net income every minute.

Earnings remain the market’s true north star.

As long as profit growth remains this steady, the market rally has foundational support to push higher.

Sources: Ned Davis Research, FactSet, JPMorgan, Goldman Sachs, Matt Cerminaro

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Great succinct piece highlighting both the strength in earnings (easy to quickly forget how we were told tariffs were really going to bit Q3 earnings in particular) and the high valuations of the market. Usually the bulls will solely focus on the former, while the bears only on the latter. More nuance and honesty is needed to see the complete picture. Thanks for providing that in a concise update. Good work!