Overcoming recency bias: the investor’s mental trap door

The Sandbox Daily (8.5.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

overcoming recency bias

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.60% | Dow -0.14% | S&P 500 -0.49% | Nasdaq 100 -0.73%

FIXED INCOME: Barclays Agg Bond +0.03% | High Yield -0.05% | 2yr UST 3.721% | 10yr UST 4.204%

COMMODITIES: Brent Crude -2.99% to $67.59/barrel. Gold +0.24% to $3,434.6/oz.

BITCOIN: -0.72% to $113,843

US DOLLAR INDEX: -0.01% to 98.772

CBOE TOTAL PUT/CALL RATIO: 0.90

VIX: +1.88% to 17.85

Quote of the day

“Don't let the urgent things keep you from the important things.”

- The Eisenhower Matrix

Overcoming recency bias

My first year in the investment industry was not so great.

After graduating the University of Michigan in the spring of 2007, I entered the workforce on the eve of the Global Financial Crisis.

Bear Stearns? Gone.

Lehman Brothers? The same.

AIG? Life support.

Mortgage fraud? Rampant.

Job losses? Everywhere.

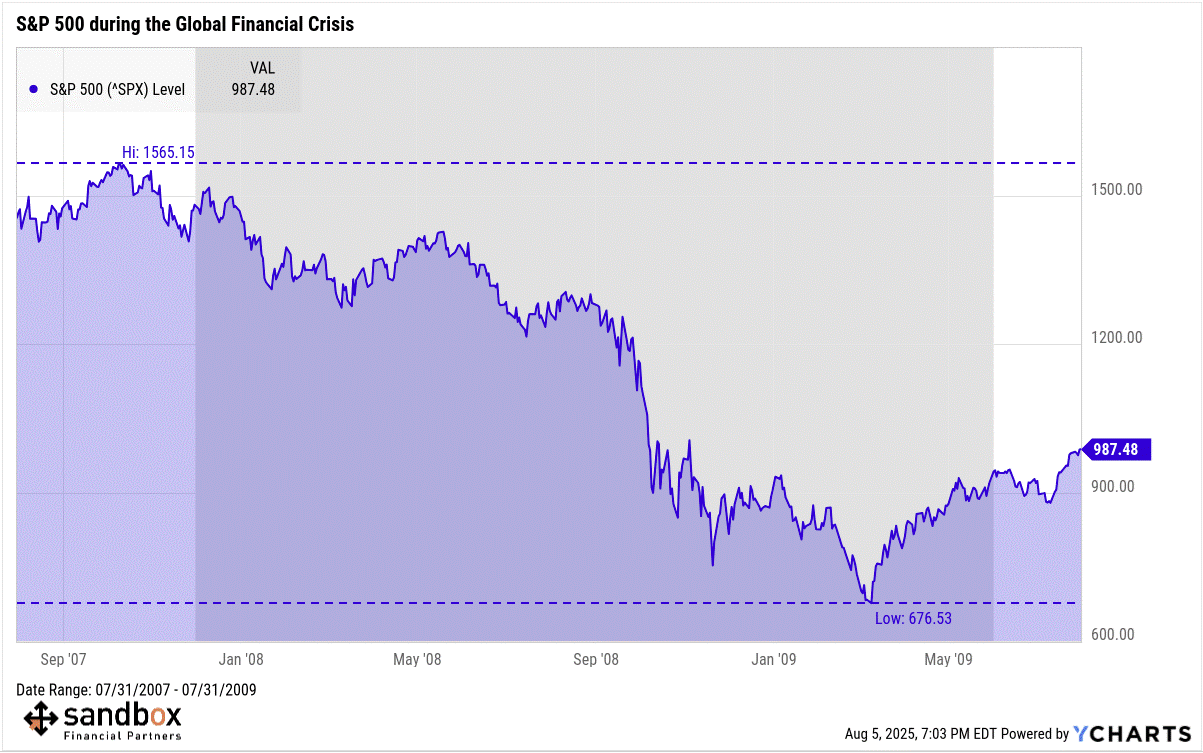

All told, the S&P 500 lost nearly 57% from its peak in October 2007 to the trough in March 2009. And yet, that experience provided me a valuable lesson I’ll never forget – the power of recency bias.

Recency bias is the mind’s tendency to place too much emphasis on recent events and trends when making investment decisions, while downplaying or ignoring the relevance of historical data and long-term patterns.

When things are terrible – as they were during the early days of my career – it’s hard to imagine how or when things might ever get better.

On the other hand, when markets are rising, it’s hard to imagine what might cause that positive momentum to slow down.

Recency bias causes the mind to look backward, to assume that what happened yesterday will happen again tomorrow. That’s a problem because it can lead investors into doing the opposite of what would be best or optimal.

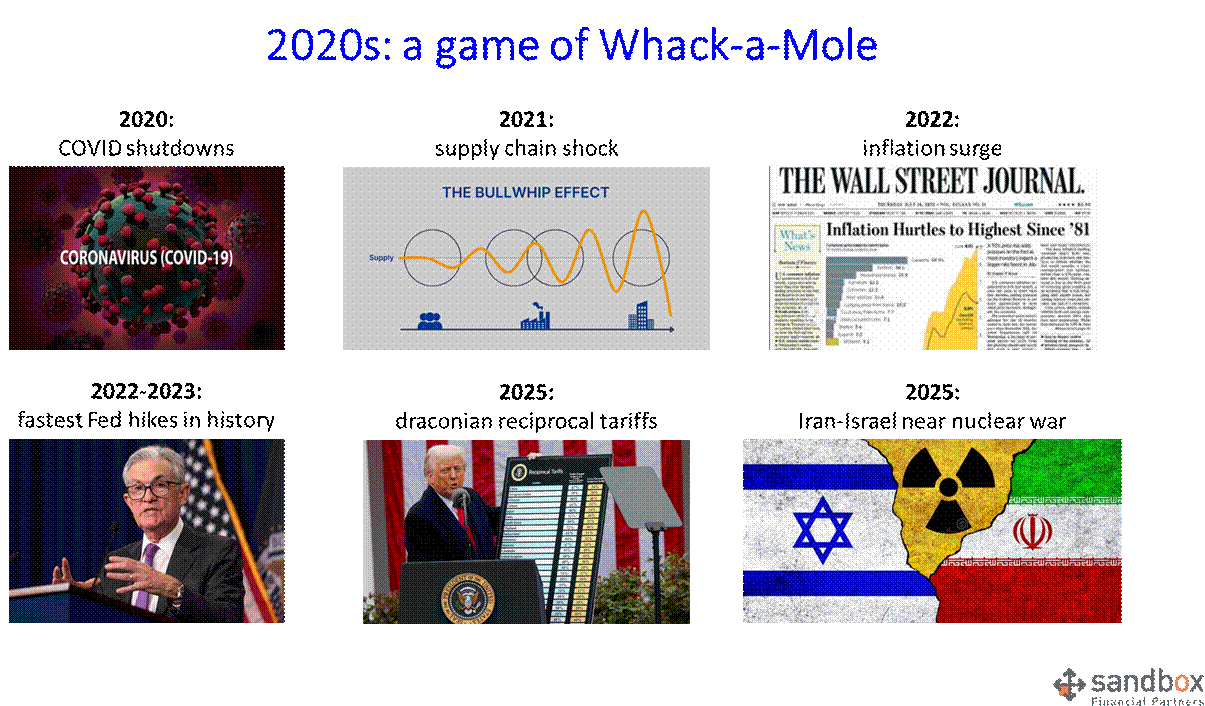

Consider what we’ve experienced over the past five years:

In 2020, when covid-19 was first identified in the United States, the stock market dropped -34% in just five weeks. But, after the Federal Reserve stepped in with its bazooka, the market rebounded and ended the year in positive territory. For the full year in 2020, the S&P 500 actually rose +18%. Not bad for a generational worldwide pandemic.

The bullwhip effect in 2021 triggered a major supply chain shock when soaring demand for goods collided with closed factories and clogged ports. Retailers over-ordered, manufacturers scrambled, and shortages turned to gluts – amplifying disruptions across every link of the global supply chain.

Between 2021-2022, inflation surged to 50-year highs. Too many dollars chasing too few goods. Stimulus checks, broken supply chains, and everyone wanted everything all at once.

In 2022 and 2023, the Federal Reserve slammed on the proverbial brakes as inflation readings became more and more problematic, raising interest rates at the fastest pace in history. All told, after 11 hikes and 525 basis points of tightening, the damage for investors was done, with both stocks and bonds dropping double digits at the same time – a very rare occurrence.

In the spring of 2025, the Trump administration haphazardly rolled out its tariff policy that crashed the stock market and the bond market, sending policy uncertainty to levels never seen before.

A few months later, as rhetoric escalated between Iran and Israel and air strikes were exchanged, markets panicked at the very real possibility of nuclear war.

In the end, markets climbed the wall of worry as it always does. For the 2020s – despite these yearly blowups – the S&P 500 is higher by 95%.

In many instances, it was hard to see how things could improve. Just when investors least expected it – earnings better than expected, offsides positioning, ChatGPT, that Nvidia quarter – whatever the reason, stocks would take off.

This describes just the past five years, but it’s a microcosm of investors’ experience nearly every year.

Just as one trend or narrative appears to be well entrenched, something changes – upending expectations and sending us in a different direction entirely.

It’s times like these that recency bias can lead us astray.

So, what can we do to overcome it?

The easiest and simple answer is to ignore the news. In fact, several studies have shown investors who receive less news and data and trade less end up doing far better with their investments than those who overly pursue their market and account activity. Having less information helped them avoid the confounding effects of recency bias. While avoiding the news cycle seems straightforward at the surface level, unfortunately it’s unrealistic for many investors because it’s simply impossible to tune out the noise.

So, what else can be done?

My best recommendation is to study history. Look back at charts of the stock market over the past 100 years and study different cycles. Understand different economic and market regimes. With exception to the few episodic market meltdowns of 30% or more, most downturns turn out to be buying opportunities. As my former boss at UBS would say: never let a good crisis go to waste.

Another important consideration is to document your investment plan before the emotions creep in. When markets decouple, become the level-headed coach you need in the moment. More Mike Krzyzewski, less Bobby Knight. Document asset allocation targets. Include rebalancing guidelines. Record the key index levels in which you have to buy more shares, no matter what. Enter trailing stops on certain positions. Identify the low-conviction, riskier holdings that should be reduced or eliminated. Whatever the plan is, written guidelines often help investors overcome recency bias when it’s needed most.

Finally, consider the diversification present across your investment portfolio. Boring? Absolutely! But, maintaining a portfolio comprised of different asset classes and strategies will help moderate the ups and downs along your journey, and this can make it easier to avoid overreacting to near-term struggles.

The key with recency bias is to avoid fighting yesterday’s battles.

Focus less on where the market has been and more on where the market is going.

I’ll be the first to acknowledge this isn’t easy. Even the best investors sometime get it wrong.

And, above all, stay on target.

Sources: YCharts, Sports Illustrated

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)