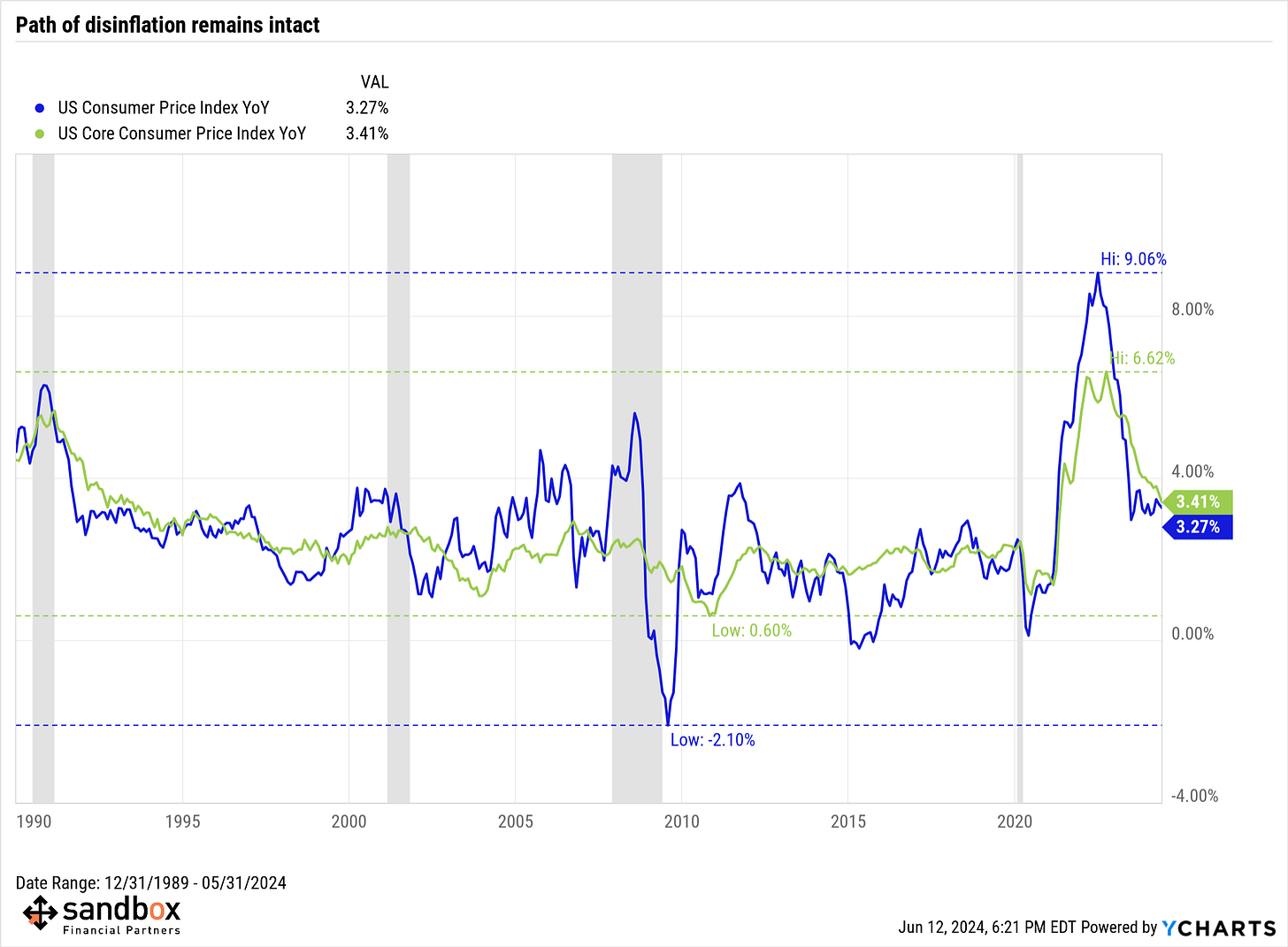

Path of disinflation remains intact

The Sandbox Daily (6.12.2024)

Welcome, Sandbox friends.

Quick publisher’s note before we begin today: The Sandbox Daily is on hiatus at the beach for the remainder of the week and will return to your inbox on Monday, June 17th with our regularly scheduled programming.

Today’s Daily discusses:

inflation’s bumpy ride: April CPI report shows inflation resumes downward trend

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.62% | Nasdaq 100 +1.33% | S&P 500 +0.85% | Dow -0.09%

FIXED INCOME: Barclays Agg Bond +0.47% | High Yield +0.40% | 2yr UST 4.756% | 10yr UST 4.318%

COMMODITIES: Brent Crude +0.66% to $82.46/barrel. Gold -0.60% to $2,340.7/oz.

BITCOIN: +1.67% to $68,438

US DOLLAR INDEX: -0.54% to 104.665

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: -6.30% to 12.04

Quote of the day

“I do not think that there is any other quality so essential to success of any kind as the quality of perseverance. It overcomes almost everything, even nature.”

- John D. Rockefeller

Inflation’s bumpy ride: May CPI report shows inflation resumes downward trend

The center of attention for this week’s eco data was today’s May consumer price index (CPI) report, and it did not disappoint investors.

Core CPI inflation eased from 3.6% YoY to 3.4% YoY, the slowest rate since April 2021and a win for the bulls. U.S. stocks jumped on the report.

Inflation pressures relaxed last month and came in softer than expected, confirming that the economy remains on track for a soft landing and a pleasant surprise for Federal Reserve officials looking for signs that they can start lowering interest rates.

Both CPI and core CPI came in lower than expected in May. Here are the key numbers:

The stickiness in the data continues to largely reside within the Shelter category, as you can see in the darker green bars below.

While the vast majority of categories contributing to inflation have receded, housing has not – although the trend is encouraging over the last 12 months.

Housing accounted for well more than HALF of inflation, again. +0.4% is in line with its 12-month average, but roughly double the monthly price growth prior to the pandemic, which was ~0.2% per month.

Remember, the Shelter component of official CPI is very out of step (strong) with what actual rents in the market are doing today (falling/steady) – due to lags in the collection and reporting of data – which is holding many CPI measures artificially higher.

So, if you remove the stale data from housing, inflation is already below the Fed’s desired 2% target. Core CPI ex-Shelter is at 1.9%; see below.

One big surprise was auto insurance – printing -0.1% MoM in May, slowing sharply from March’s +2.6% – coming in negative for the 1st time since 2021.

While sifting through each category is informative to understand the underlying drivers of inflation, sometimes it’s equally important to understand which way the wind is blowing.

Generally speaking, prices have been coming down for the better part of the last year. Today’s report lends support to this view.

While the Federal Reserve’s preferred measure of inflation is the core personal consumption expenditures (PCE) index, CPI is the next best thing. It certainly factors into Wall Street’s thinking about the Fed’s next move on interest rates.

Although market expectations still favor the next easing cycle to begin in September, the risk remains fewer and/or later rate cuts if inflation pressures persist. And yet, stocks have done remarkably well in 2024 despite higher rates.

Today’s CPI report is certainly encouraging for the Fed but one data point does not make a trend, so it’s premature to make any definitive conclusions as of yet.

What has become crystal clear now to investors is the path of softening price pressures – what’s known as disinflation – remains choppy and protracted, with certain categories proving stickier than most had anticipated. In other words, the path towards inflation normalization is not a straight line down from 9% to 2%.

Sources: U.S. Bureau of Labor Statistics, Walter Bloomberg, Ned Davis Research, J.P. Morgan Markets, Fundstrat, Piper Sandler, Bloomberg, CME Group, Sonu Varghese, Ph.D.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.