Picking a new Fed chair: a key decision of Trump 2.0 approaches

The Sandbox Daily (12.15.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed leadership changes could shape policy direction in 2026 and beyond

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.09% | S&P 500 -0.16% | Nasdaq 100 -0.51% | Russell 2000 -0.81%

FIXED INCOME: Barclays Agg Bond +0.10% | High Yield +0.05% | 2yr UST 3.501% | 10yr UST 4.168%

COMMODITIES: Brent Crude -0.92% to $60.56/barrel. Gold +0.09% to $4,334.2/oz.

BITCOIN: -3.84% to $85,744

US DOLLAR INDEX: -0.06% to 98.253

CBOE TOTAL PUT/CALL RATIO: 0.91

VIX: +4.83% to 16.50

Quote of the day

“Nothing is enough for the man to whom enough is too little.”

- Epicurus

Fed leadership changes could shape policy direction in 2026 and beyond

With Fed Chair Jerome Powell’s term ending soon (May 15, 2026), the White House is expected to name a replacement in the coming weeks.

This decision creates an opportunity for the White House to shape the central bank’s leadership and direction over the economy and financial system for the foreseeable future.

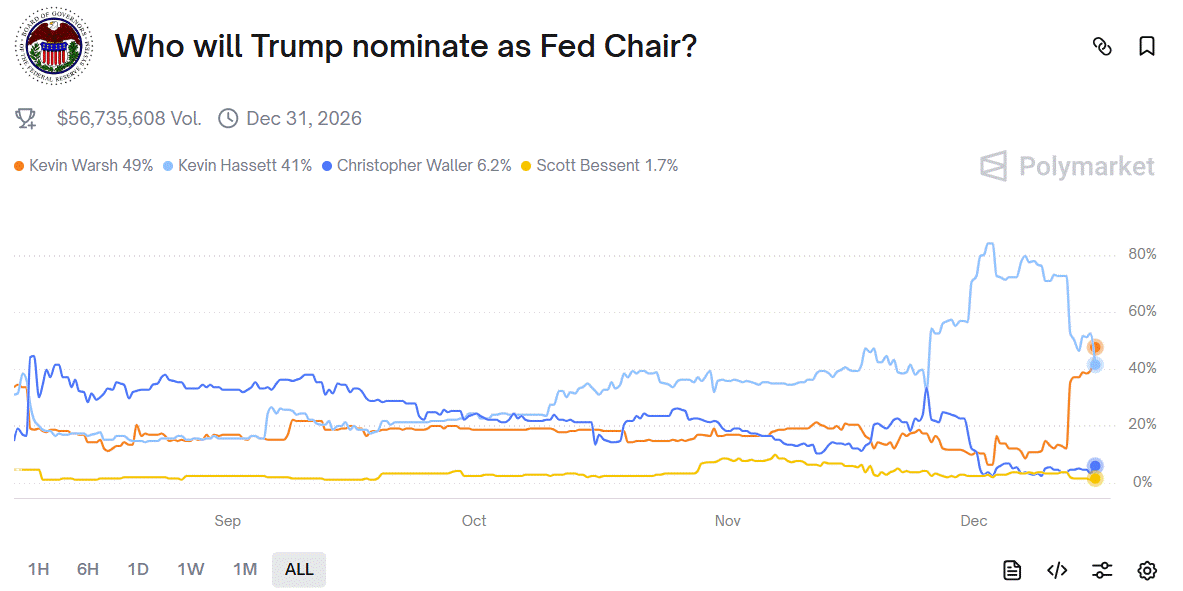

At the moment, the frontrunners include Kevin Warsh, a former Fed governor, and Kevin Hassett, Director of the National Economic Council at the White House. Much could change between now and the final decision, as odds for the frontrunner have shifted in just the past few months.

The thinking is President Trump wants to name someone who shares his preference for cheap money. Over the years, Trump has not been shy about advocating for rock-bottom interest rates, even when stubborn inflation called for higher policy rates.

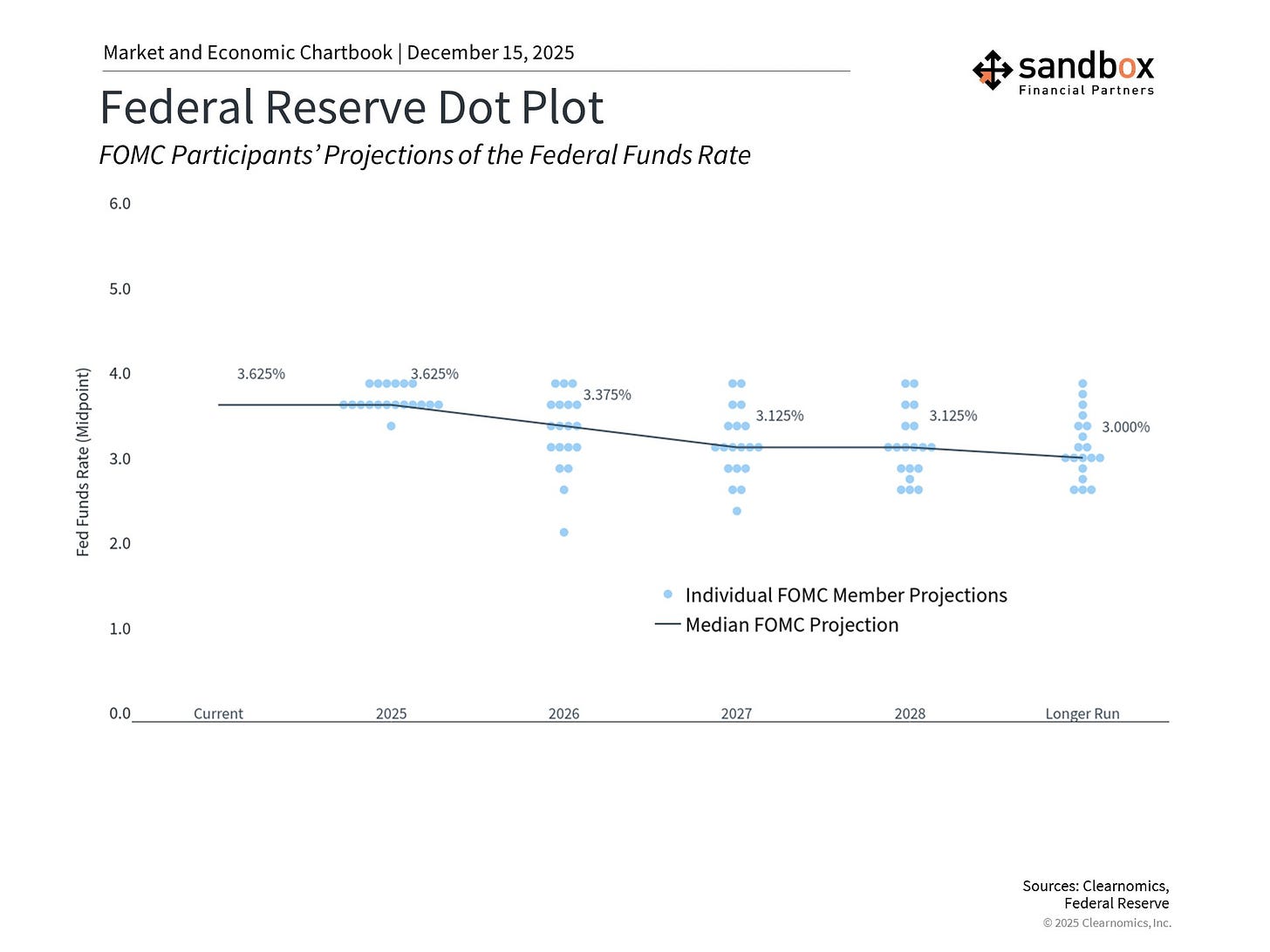

As seen below, the FOMC’s latest Summary of Economic Projections suggest the Fed may cut rates only once in each of 2026 and 2027.

Whomever does receive the nomination, it’s important not to overreact to the change in in leadership.

While the Fed Chair wields influence over policy direction and represents the FOMC at its press conference, the committee includes twelve voting members with diverse views. This includes the New York Fed President, seven Fed governors, and four regional bank presidents which rotate annually.

Historically, the Fed has tried to work toward consensus. So, even a Chair aligned with the administration’s policy goals will need to sway other committee members with economic and policy arguments.

Taking a broader perspective is valuable here since this won’t be the first or last time the Fed has changed leadership.

At risk of stating the obvious, the economy has grown steadily across different Fed Chairs appointed by both political parties over its long history. It’s also important to remember that Jerome Powell was nominated by President Trump during his first term and remained Fed Chair during President Biden’s term.

What matters more than any individual Chair is whether monetary policy remains appropriate for economic conditions. Again, the Fed is often reacting to shocks outside of its control, rather than directly steering the economy.

While there’ll be many headlines around Fed leadership in the coming months, what truly matters is the overall path of the economy.

The next Fed Chair may generally prefer lower interest rates, but this will depend strongly on whether the job market remains weak and if inflation continues to stabilize.

What investors want depends on who you ask. The stock market is famously fickle.

Short-term oriented traders love rate cuts because they make stocks more attractive and boost confidence. So in some ways, they might love a very dovish pick who favors ultra-low rates.

But in the medium to long-run, Wall Street investors want stability and credibility at the helm of the Fed. They want someone running the Fed who can put out the next fire, preventing a financial scare from turning into a full-blown meltdown.

The real risk is that Trump picks someone who the bond market doesn’t trust.

And, for you at home, the key is to maintain a portfolio aligned to your financial goals and investment strategy rather than react to the day-to-day news flow around the Fed.

Sources: Polymarket, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)