Playing offense and defense

The Sandbox Daily (4.7.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

playing offense and defense

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.19% | S&P 500 -0.23% | Dow -0.91% | Russell 2000 -0.92%

FIXED INCOME: Barclays Agg Bond -1.27% | High Yield -0.86% | 2yr UST 3.779% | 10yr UST 4.195%

COMMODITIES: Brent Crude -1.63% to $64.51/barrel. Gold -1.12% to $3,001.4/oz.

BITCOIN: -0.08% to $78,892

US DOLLAR INDEX: +0.47% to 103.503

CBOE TOTAL PUT/CALL RATIO: 1.18

VIX: +3.69% to 46.98

Quote of the day

“We are the sum total of every decision we have made in our lives.”

- Jared Dillian in Decisions

Playing offense and defense

Concerns that an escalating trade war will lead to a recession have quickly spread around the globe.

The possibility of retaliatory tariffs is on everyone’s minds, with China responding with counter-tariffs and increasing the odds of a worst-case trade war scenario. Markets in Asia and Europe have declined alongside U.S. stocks, and there has been a “flight to safety” as bond prices catch a bid.

In sports as well as investing, a winning strategy requires a combination of both offense and defense.

Defense involves maintaining a portfolio that can withstand different phases of the market cycle. Stock market uncertainty and unexpected life events are inevitable, so always being ready to play defense is important.

Offense, on the other hand, involves taking advantage of market opportunities that emerge from changing conditions. The irony is that while periods of market uncertainty may be unpleasant, they also represent times when asset prices and valuations are the most attractive.

Ultimately, portfolios that are tailored toward financial goals need both offense AND defense.

So, let’s dig into how you can position in today’s market environment to both protect from risk and take advantage of opportunities.

Portfolio balance and financial planning are key cornerstones

Two of the key principles of long-term investing are diversification and maintaining a long-time horizon.

In the chart above, you can see the range of historical outcomes across stocks, bonds, and diversified portfolios. It also shows how these ranges change when time horizons are increased. For example, it’s easy to see that over just one-year periods, the stock market can vary significantly, from up 60% in 1983 to down -41% during the Global Financial Crisis (GFC).

Moving beyond just one-year periods and a stock-only portfolio underscores why these are powerful ways to think about investing and financial planning. Diversifying might reduce the maximum returns an investor can experience, but it also reduces risk. This is evident in the sample “balanced” portfolio consisting of 60% stocks and 40% bonds. So far this year, the S&P 500 is ~13% lower, but a 60/40 mix of these indices has declined only ~5%.

After all, the goal is not simply to grow a portfolio at the fastest but most volatile rate, but to have the highest possible probability of achieving your financial goals. A diversified portfolio historically has a much narrower range of outcomes, allowing investors to better plan toward their goals.

Similarly, extending your time horizon by even a few years can have a significant impact on the range of outcomes. History shows that, since World War II, there has not been a 20-year period in which any of these assets and portfolios have experienced annual declines, on average. The same is true over 10-year periods for many diversified asset allocations. Clearly, the importance of thinking long-term has merit.

Volatility and dislocations = opportunities

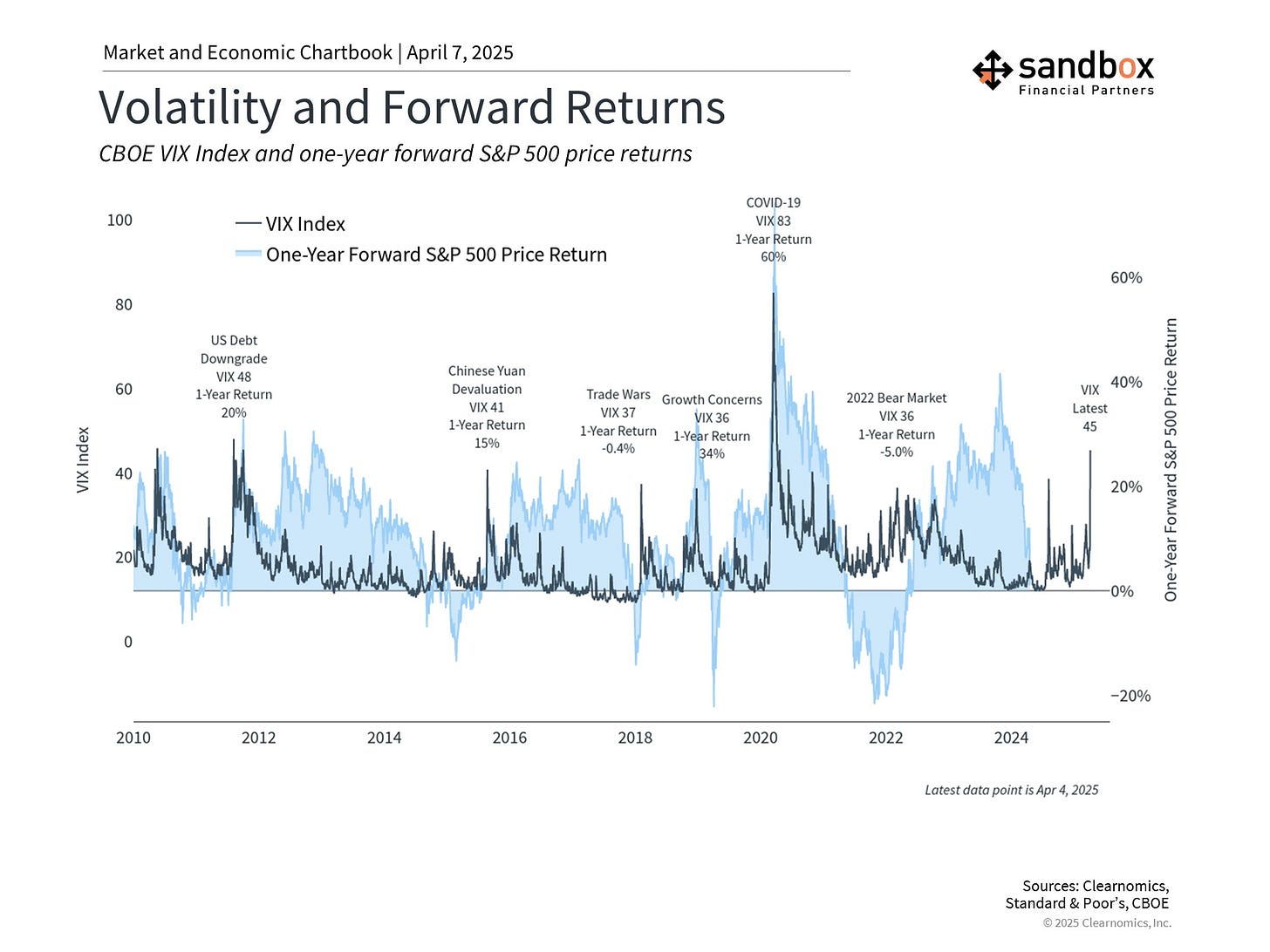

As you can see above, the VIX index – often referred to as the stock market’s “fear gauge” – can spike from time to time. These peaks correspond to sharp drops in the market, such as in 2008 or 2020. These are times when markets are most nervous and, in many cases, investors feel as if the situation would never stabilize.

The same chart overlays the forward returns of the S&P 500 over the next year. While there’s never any certainty about returns over any single year for the stock market, it’s clear that the greatest market opportunities often emerge when investors are the most worried.

It's important to note that this is not an argument for market timing.

Even when the VIX is high, there is no guarantee that markets will rebound quickly. Instead, investors should view this as additional support for taking a longer-term perspective to work through gyrations over the immediate days and weeks. Market downturns often occur when valuations are the most attractive, and thus it can make sense to shift toward – not away – from these assets.

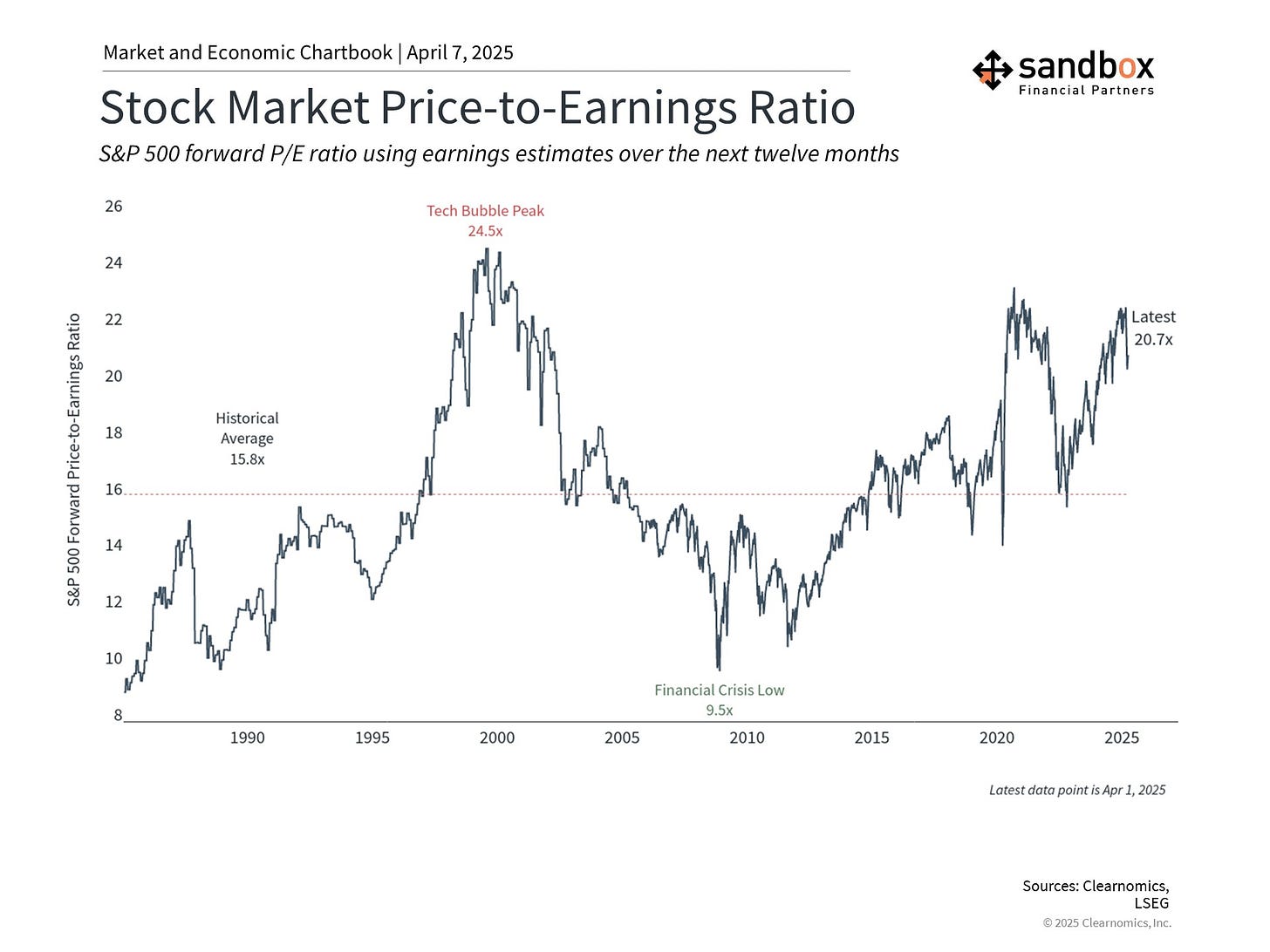

Valuations are retreating from expensive levels

Valuations are more attractive today after multiple years of huge stock market returns.

Are they low enough? Maybe, maybe not. If we’re heading for recession, then multiples need to come in further – which means more downside for stocks ahead.

While it’s still unclear where corporate earnings will settle (lower) after accounting for tariffs, the price-to-earnings ratio of the overall S&P 500 has declined to 20.7x. If you remove FAANG, the multiple is closer to 17x as sectors like Information Technology, Communication Services, and Consumer Discretionary have seen multiples decline more amid the broader pullback.

Bottom line?

Offense and defense are both important in times of market uncertainty.

They help investors manage risk, while simultaneously allowing them to take advantage of attractive opportunities that may emerge from short-term periods of market fear.

In the long run, holding an appropriate portfolio that balances risk and return is still the best way to achieve financial goals.

Source: Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: