Policy uncertainty should lead to higher volatility

The Sandbox Daily (1.9.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

policy uncertainty should lead to higher volatility

Let’s dig in.

Blake

Markets in review

No market data to report today as the United States declared a national day of mourning to honor former President Jimmy Carter.

Quote of the day

“Well done is better than well said.”

- Benjamin Franklin

Policy uncertainty should lead to higher volatility

The U.S. economy remains on solid footing as we head into 2025, supported by a steady consumer, easing inflation, relief from higher/restrictive interest rates, and a pickup in the corporate earnings cycle.

With trend GDP growth expected, the fundamental underpinnings that support economic expansion are robust and well known. However, a number of wild cards patiently await in the shadows that could determine the trajectory of the economy and financial markets over the next year.

President-elect Donald Trump is set to resume his seat in the White House on January 20, and with his arrival comes a number of policy unknowns that will directly impact the consumer, global trade, and economic growth. These include tariffs, immigration, extension of the 2017 Tax Cuts and Jobs Act (TCJA), deregulation, and the budget deficit – to name a few.

Markets have noticed the looming policy uncertainties, too. Since the election results were announced, volatility has been drifting higher and the VIX index now resides at 18.1.

We’ve seen this script with the President-elect before. When policy uncertainty rose in Trump’s first term, the VIX rose alongside it.

Whether it’s the transition from the Biden-to-Trump administration, ongoing tariff overtures, port strikes, or the looming budget deficit/debt ceiling negotiations, there are numerous risks to keep investors on high alert. This backdrop could prevent any meaningful gains given elevated volatility, however we know that markets often climb the wall of worry.

The markets will have to contend with plenty of the Trump wild cards throughout the year. Depending on how each evolves, volatility will ebb and flow.

Take tariffs, as one example.

From the Trump 45 administration we witnessed the impact of the 2018-2019 trade war on inflation (below, left exhibit) as well as the tightening of financial conditions that prompted an immediate about-face and easing in Fed policy.

Much about the current cycle is different, but the 2018-2019 analog shows that policy risks from tariffs are at a minimum two-sided.

Goldman Sachs wrote that expected “policy changes under the incoming Trump administration will weigh on growth in 2025.”

The drag on growth from reduced immigration and tariff orders are likely to materialize more quickly than the boost from tax cuts, thus depressing growth in 2025 before a offset boost returns in 2026.

For now, there are too many unknowns. The market will have to wrestle with the uncertainty and await its answers. As we know, the stock market does not do well with uncertainty.

Once the President’s agenda comes into greater focus and the gap between proposed policy and enacted policy narrows, markets should breathe a sigh of relief and move past the uncertainty as it refocuses on economically-oriented variables of the business cycle.

Historically, after some early indigestion in the months immediately following the election, equities tended to rally over the course of the year as election and politicking uncertainty subsided – although it should be noted that first-years under the Republican party have been less than desirable. Below is the average S&P 500 progression for the first year of the Presidential Cycle.

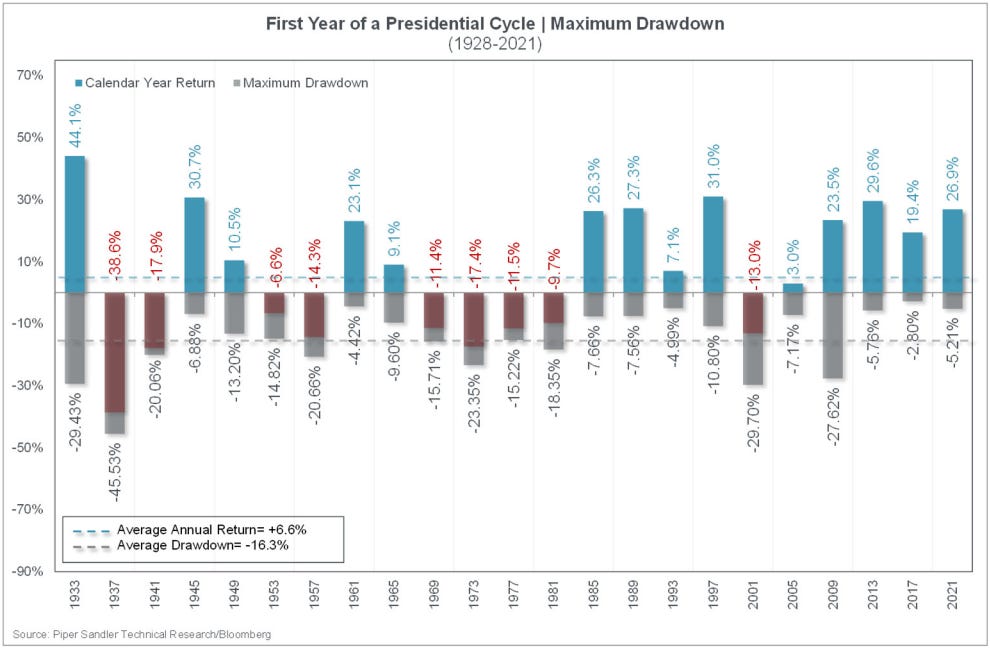

Over the last 100 years, annual returns during the first year of a Presidential Cycle have averaged +6.6% for the S&P 500, with the average maximum drawdown within the year of -16.3%.

Investors should brace for higher volatility in 2025 as the economy works its way through the new political climate and associated wild cards with the 119th United States Congress.

Source: Goldman Sachs, Piper Sandler, All Star Charts, iCapital

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: