Positioning stretched for large specs, plus cyclicals and 🧁 weekend sprinkles 🧁

The Sandbox Daily (10.18.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

stretched positioning for large speculators

goldilocks economy?

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.66% | S&P 500 +0.40% | Dow +0.09% | Russell 2000 -0.21%

FIXED INCOME: Barclays Agg Bond +0.07% | High Yield +0.24% | 2yr UST 3.948% | 10yr UST 4.077%

COMMODITIES: Brent Crude -1.77% to $73.13/barrel. Gold +1.08% to $2,736.8/oz.

BITCOIN: +2.23% to $68,538

US DOLLAR INDEX: -0.34% to 103.470

CBOE EQUITY PUT/CALL RATIO: 0.77

VIX: -5.65% to 18.03

Quote of the day

“There are two ways of spreading light: to be the candle or the mirror that reflects it.”

- Edith Wharton

Large speculators are net long

Net long positioning for large speculators is near the top end of its post-GFC range.

The Commitment of Traders (COT) report – a weekly publication produced by the Commodity Futures Trading Commission (CFTC) that reports aggregate holdings of different asset managers and leveraged funds in the U.S. futures market – shows that equity positions as a share of open interest currently sits at 30%, evidence that the professional money pool has become increasingly more positive and aggressively positioned throughout 2023 and 2024.

This chart aggregates positions held in the S&P 500, Dow Jones, Nasdaq, and their respective mini futures contracts.

The downside risk to this stretch in positioning is such that there is less firepower on the sidelines to support near-term upside and, should economic or market conditions suddenly weaken, this trade will unwind quickly.

Source: J.P. Morgan Markets

Goldilocks economy?

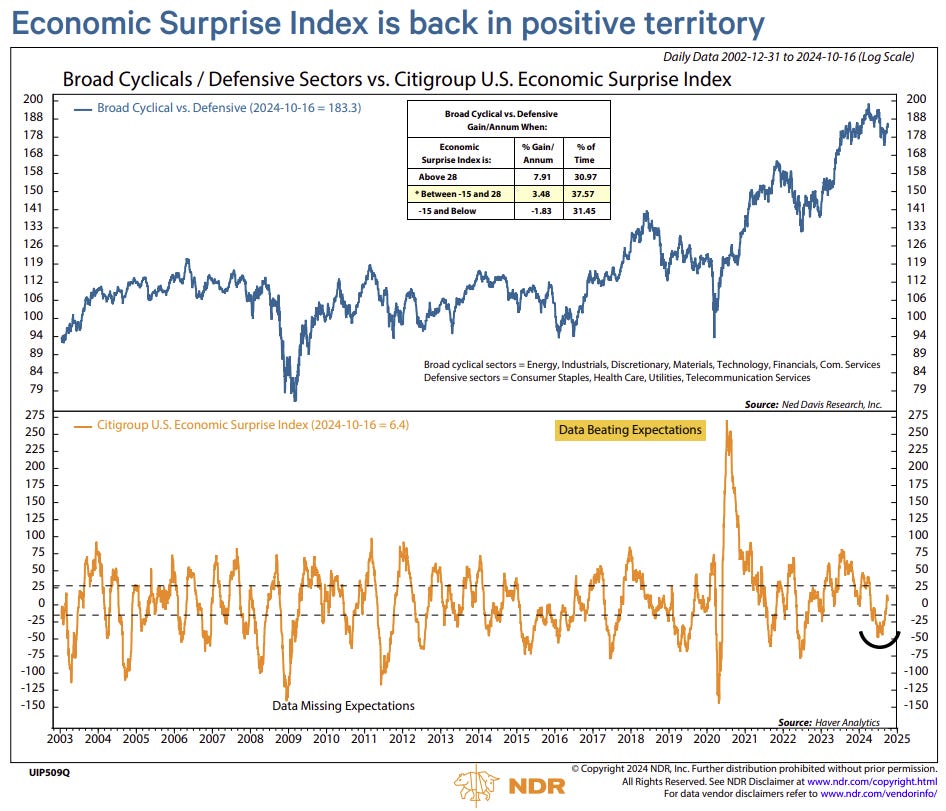

After trending lower for much of the year, the Citigroup Economic Surprise Index has reversed higher and has moved above zero for the first time since May – meaning that most economic data have come in better than expected.

A higher level of surprises has historically been bullish for stocks and cyclical sector leadership.

Source: Ned Davis Research

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

The Intelligent Investor – You’re Not Paranoid. The Market is Out to Get You. (Jason Zweig)

Young Money – Some Thoughts on What Makes New York so Great (Jack Raines)

The Conversation - If You Think Grocery Prices Take a Big Bite Out of Your Paycheck in the U.S., Check Out the Rest of the World (Peter Coclanis)

New York Times Magazine – How Group Chats Rule the World (Sophie Haigney)

Fortune Financial – A Few Thoughts on Diversification Strategies (Lawrence Hamtil)

The Capital Spectator – Tracking the Current U.S. Business Cycle in Four Charts (James Picerno)

Podcasts

Odd Lots with Joe Weisenthal, Tracy Alloway, and special guest Meb Faber – The Big Bear Market in Diversification and Tactical Allocation (Spotify, Apple Podcasts)

The Pomp Podcast – Why Bitcoin Continues to Go Up with guest Phil Rosen (Spotify, Apple Podcasts)

At The Money – Our Complicated Relationship with Cash with guest Dr. Daniel Crosby (Spotify, Apple Podcasts)

Movies/TV Shows

Presumed Innocent – Jake Gyllenhaal, Ruth Negga, Peter Sarsgaard (Apple TV, IMDB, YouTube)

Music

Eminem – Cinderella Man (Spotify, Apple Music)

The Offspring – Gone Away (Spotify, Apple Music)

Morgan Wallen – Love Somebody (Spotify, Apple Music)

Books

Anthony Pompliano – How To Live an Extraordinary Life (Amazon)

Pop Culture

Autism Capital – AI Conversation between President Joe Biden and former President Barack Obama (Twitter)

BBC Radio 1 – Zane Low meets Rick Rubin (YouTube)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: