Post-election rallies, plus consumer sentiment and room to run higher?

The Sandbox Daily (11.11.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

post-Election rally (all systems go)

consumer sentiment is climbing but oddly low

still room to run?

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.47% | Dow +0.69% | S&P 500 +0.10% | Nasdaq 100 -0.05%

FIXED INCOME: Barclays Agg Bond -0.22% | High Yield -0.11% | 2yr UST 4.252% | 10yr UST 4.306%

COMMODITIES: Brent Crude -2.63% to $71.93/barrel. Gold -2.43% to $2,629.2/oz.

BITCOIN: +10.81% to $89,267

US DOLLAR INDEX: +0.46% to 105.485

CBOE EQUITY PUT/CALL RATIO: 0.81

VIX: +0.20% to 14.97

Quote of the day

“The measure of intelligence is the ability to change.”

- Albert Einstein

Post-election rally

The S&P 500 has eclipsed the 6,000 mark, while the Dow Jones Industrial average breezed past 44,000. Meanwhile, bitcoin is stacking one win after another, probing $89,000 as of this writing.

History favors a post-Election Day equity market advance into year-end, often with SMID-caps leading the way higher.

Since 2000, equity markets historically have rallied over this final stretch to the year. On average, the Russell 2000 small-cap index has returned approximately 3.9%, with a 73% hit ratio, outpacing its large-cap counterpart as the S&P 500 returns approximately 3.5%, higher ~80% of the time.

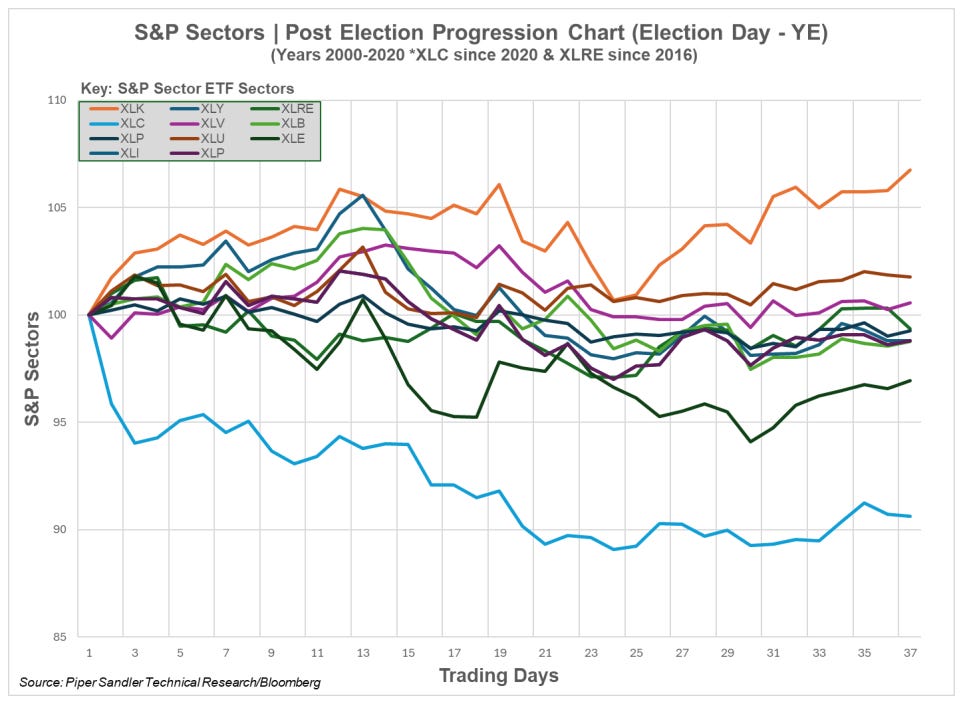

The chart below shows each of the eleven S&P 500 sector ETFs and their post-election 37-day progressions into year-end; data for XLC and XLRE are a bit more limited with more recent origination dates.

If we’re looking to history as a guide, Technology is the strongest performer, while Energy and Communications have been weakest.

Source: Piper Sandler

Consumer sentiment is climbing but remains disconnected from reality

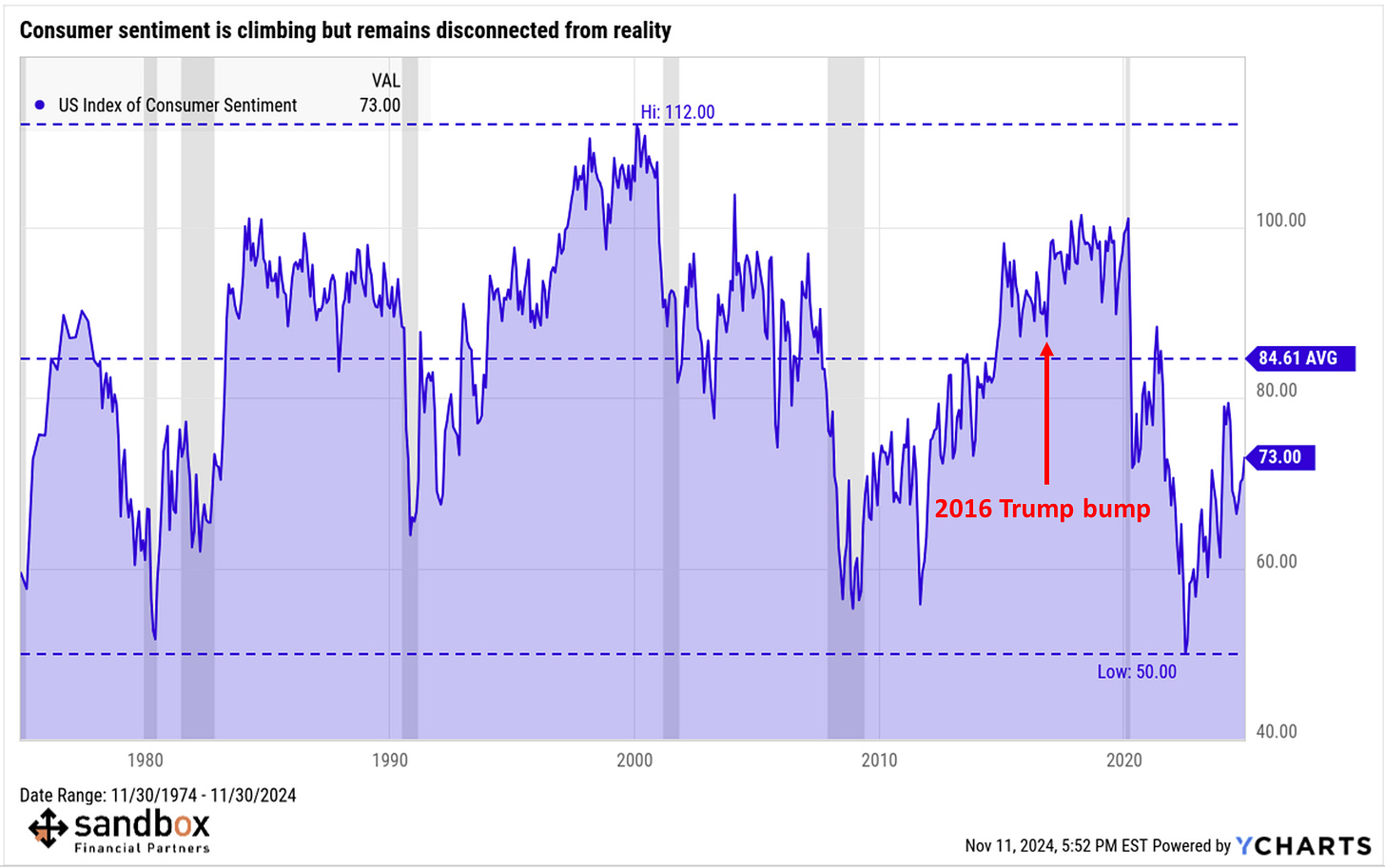

The Reuters/University of Michigan Consumer Sentiment Index jumped 2.5 points in the preliminary November survey to a higher-than-expected reading of 73.0. It was the biggest increase since January, taking the index to its best level in seven months.

It’s important to note that the survey was conducted before Election Day and therefore does not reflect election results.

If President-elect Trump’s previous victory in 2016 is any guide, consumer sentiment should continue rising into year-end. This bodes well for consumer spending and economic growth in the near-term.

And yet, despite so much going well with the economy, job market, and asset prices, the current Consumer Sentiment reading of 73 remains well below the recent 50-year average of 84.6. The current reading is also firmly below any previous periods of excessive optimism that can often signal local/major tops.

This would imply other factors are at play keeping a lid on broader consumer sentiment. Perhaps the recent tick higher in unemployment, five years of inflation stacking, and multi-decade high mortgage rates are weighing on the attitudes and feelings of the general consumer.

Also keep in mind the “consumer” class and “investor” class are not one and the same.

Source: St. Louis Fed

Still room to run?

The last week was dominated by Donald Trump's re-election bid to the 47th President of the United States, which was followed by a strong pro-risk, reflationary shift across assets in the U.S. It was hard to miss; even grandma noticed the accounts hook higher.

Immediate relief to market uncertainty, driven by a swift and clear election outcome, propelled a sharp reset across several protection measures (VIX, MOVE, put/call), while strong outperformance of equities over bonds brought about feelings of exuberance across many investors.

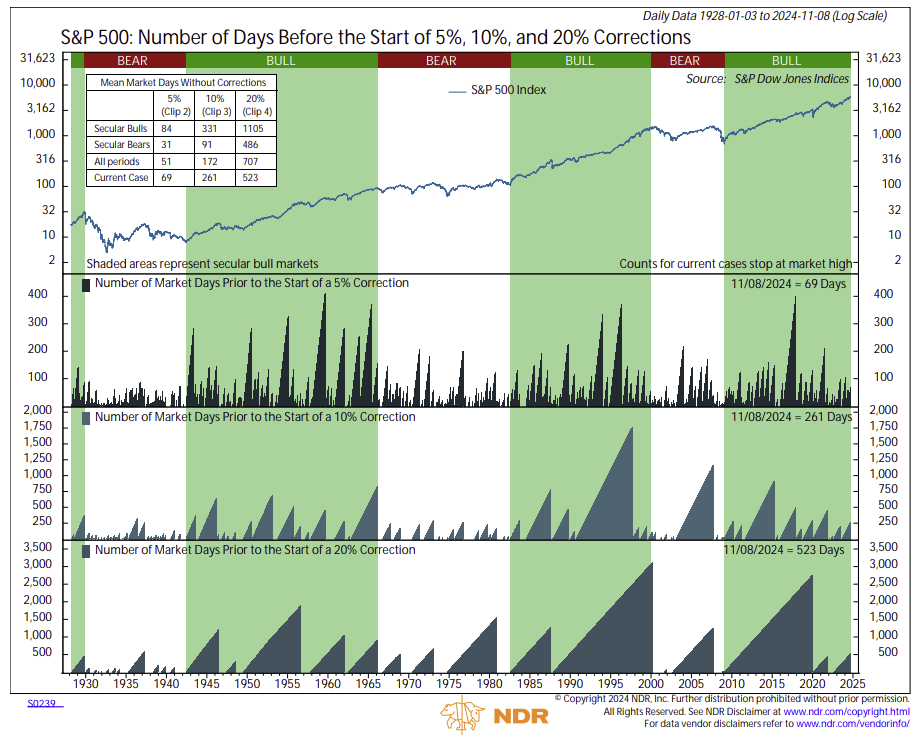

With many internal measures reaching overbought conditions, many are wondering how much longer the market can run until we need a breather.

It has been 69 days, 261 days, and 523 days since the S&P 500 last experienced drawdowns of 5%, 10%, and 20%, respectively.

While the chances of a 20% bear market, or perhaps even a more textbook correction of 10%, seem remote, a 5% pullback does seem to be a reasonable and probable outcome based on historical cycles of time.

Source: Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: