Prediction markets: the new oracle

The Sandbox Daily (12.2.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

prediction markets

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.84% | Dow +0.39% | S&P 500 +0.25% | Russell 2000 -0.17%

FIXED INCOME: Barclays Agg Bond +0.13% | High Yield +0.19% | 2yr UST 3.512% | 10yr UST 4.088%

COMMODITIES: Brent Crude -1.17% to $62.43/barrel. Gold -0.77% to $4,241.8/oz.

BITCOIN: +6.21% to $91,806

US DOLLAR INDEX: -0.07% to 99.345

CBOE TOTAL PUT/CALL RATIO: 0.95

VIX: -3.77% to 16.59

Quote of the day

“There comes a time when the risk of doing nothing becomes the greatest risk of all.”

- Syril Karn, Disney’s Andor

Prediction markets are the new oracle

Shayne Coplan, a college dropout turned founder of Polymarket, has declared victory for all prediction markets: “It’s the most accurate thing we have as mankind right now.”

And, in my humble opinion, he’s not exaggerating – just stating the facts.

Out with narrow-minded polls and scripted narratives. In with market-based probabilities.

Polymarket is the world’s largest decentralized prediction market platform where users can buy and sell contracts to bet on outcomes of real-world events – such as sports, politics, and pop culture – where share prices reflect the market’s real-time probability estimates.

Is it perfect? No, not exactly. No system is.

Binary event contracts are often characterized as speculative bets, but more and more market participants are embracing these platforms as genuine tools for expressing a thesis or managing risk.

Polymarket cut its teeth and built its reputation on election outcomes.

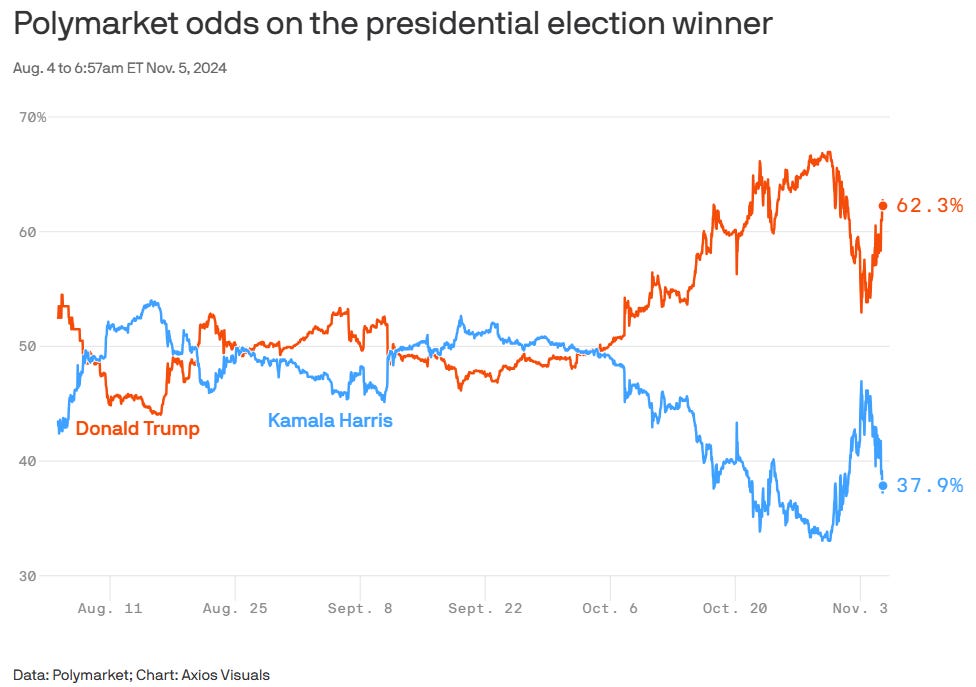

For example, while every legacy media company and poll surveyor and talking head was screaming “dead heat” for the 2024 U.S. presidential election, Polymarket had Trump at nearly 70% weeks before the election.

It’s estimated a whopping $3.6 billion was wagered on Polymarket on one question: who would win the presidency?

As Polymarket CEO Coplan explains: “It is not a poll. Polymarket is trying to predict the outcome. The question people actually want to know.”

Skin in the game beats wishful thinking every single time.

When real money is on the line, the crowd stops lying to itself and starts revealing the cold truth. And now the whole world is waking up to the idea that prediction markets are the new oracle.

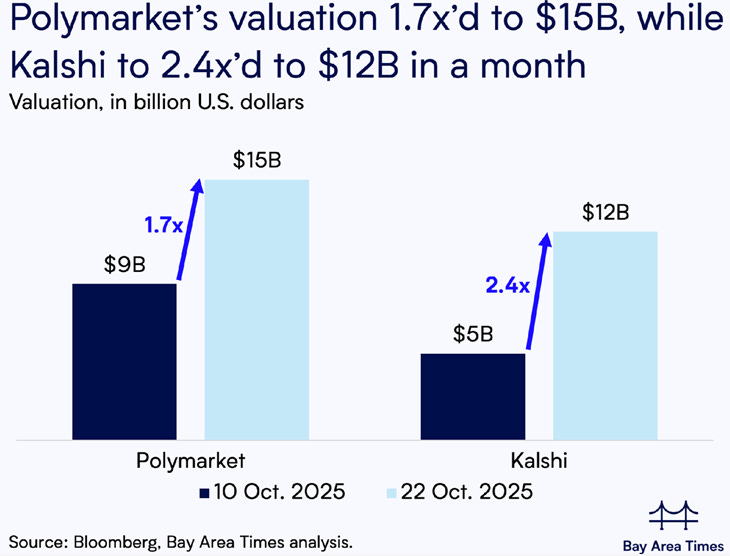

Polymarket’s valuation has climbed from $9 billion to $15 billion as mainstream adoption and platform integrations expand like wildfire.

Competitor Kalshi recently announced it raised $1 billion in a financing round, more than doubling its valuation to $12 billion in just a few months’ time. To get its slice of the pie, trading platform Robinhood launched a similar offering earlier this year.

Some criticize the increasingly blurred lines between investing and gambling and rightfully so.

And yet, humans have always bet on uncertainty – it’s hardwired into us.

The only difference today is technology like Polymarket has erased the boundary between “markets” and “bets” – good or bad.

Prediction markets are engraining themselves into the social fabric of the public consciousness as interest continues to mount. They strip away ideology and delusion. In its place, a platform that gives a voice to the people and provide signal.

Every trade becomes a datapoint. Every datapoint is a belief. And every belief gets priced instantaneously into the market.

This is a paradigm shift that will ripple out for many years to come.

Sources: Reuters, Bay Area Times, Polymarket, Axios, 60 Minutes

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)