Price impact from tariffs remains elusive

The Sandbox Daily (12.8.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

price impact from tariffs remains elusive

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 -0.02% | Nasdaq 100 -0.25% | S&P 500 -0.35% | Dow -0.45%

FIXED INCOME: Barclays Agg Bond -0.16% | High Yield -0.25% | 2yr UST 3.579% | 10yr UST 4.168%

COMMODITIES: Brent Crude -2.02% to $62.46/barrel. Gold -0.50% to $4,221.8/oz.

BITCOIN: -0.45% to $90,838

US DOLLAR INDEX: +0.12% to 99.108

CBOE TOTAL PUT/CALL RATIO: 0.75

VIX: +8.11% to 16.66

Quote of the day

“Happiness is when what you think, what you say, and what you do are in harmony.”

- Ghandi

Price impact from tariffs remains elusive

While tariffs were the primary driver of stock market volatility in 2025, their economic effects have been decidedly mixed.

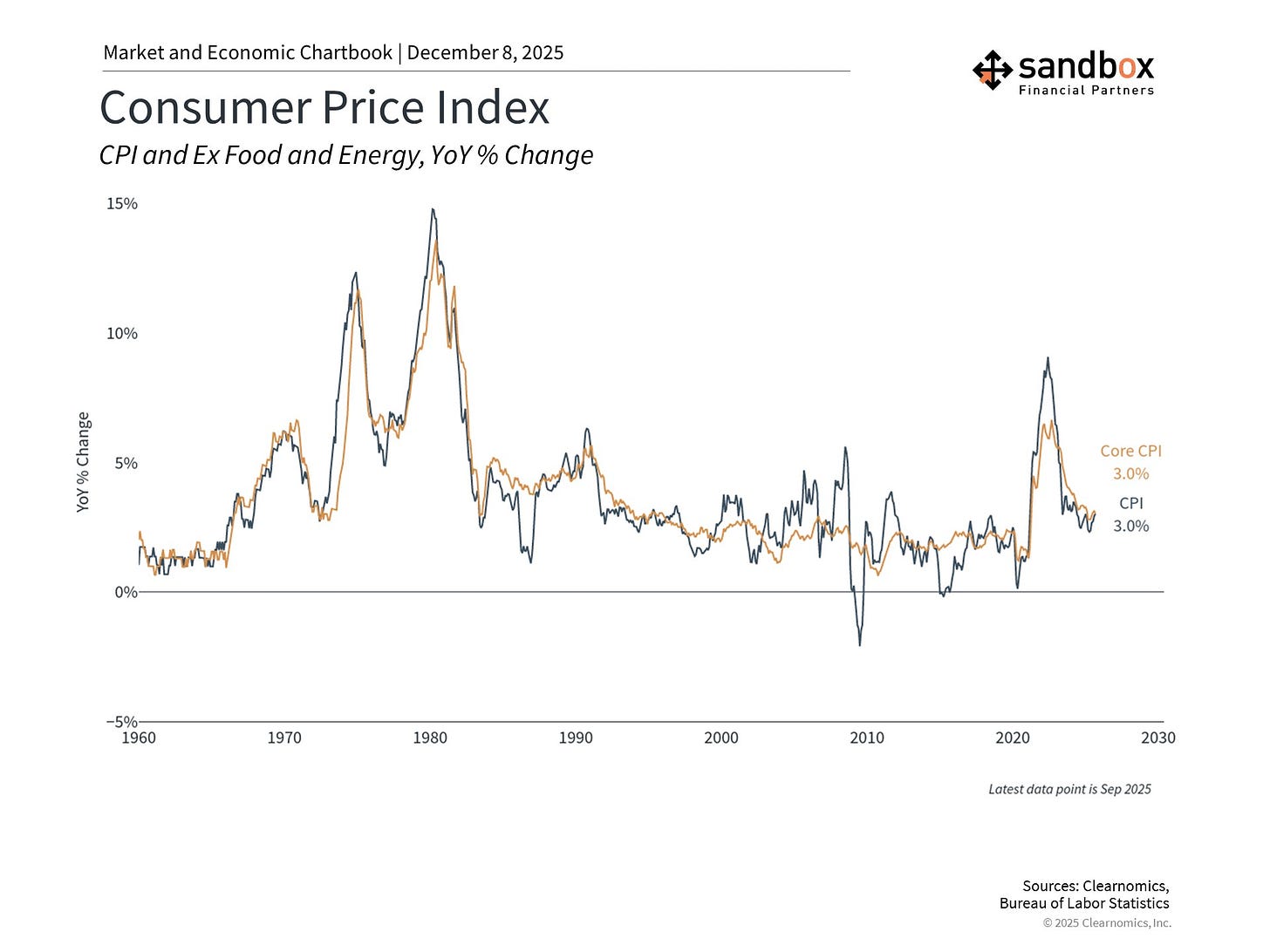

In fact, one of the ongoing puzzles is how little the immediate impact of tariffs have had on inflation and growth.

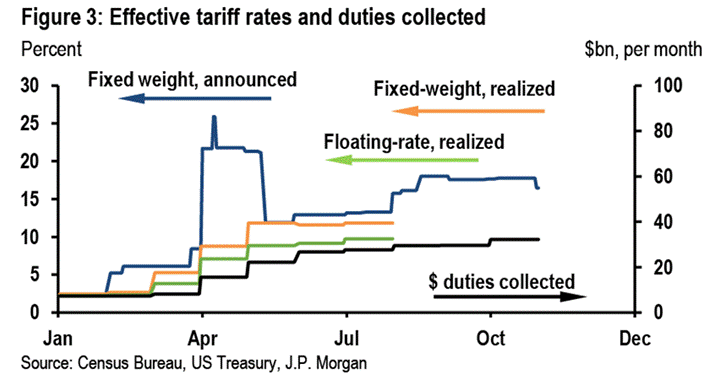

Despite tariff costs increasing ten times their average level compared to prior years, measures such as the Consumer Price Index have ticked up only slightly.

There are several possible explanations as to why tariffs have not had their anticipated effect.

First, many of the announced tariffs were quickly paused or scaled back.

Second, many companies absorbed the initial cost of tariffs by keeping their prices steady and importing goods ahead of tariff announcements.

Finally, strong consumer spending, fiscal stimulus, and healthy growth in AI-related sectors helped offset any negative impact on overall growth.

It’s also worth noting that the Supreme Court may rule in 2026 on the legality of the economic justification used for these tariffs.

For investors, both rounds of trade negotiations (2018, 2025) highlight the fact that tariffs are part of this administration’s playbook to pursue their economic agenda. Tariffs are little more than a bargaining chip.

Rather than reacting to these tariffs as a shift in the world order, most investors are best served by looking past them as their impact on day-to-day market activity remains subdued.

Sources: J.P. Morgan Markets, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)