Private Credit has watchdogs concerned. Should you be?

The Sandbox Daily (2.10.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

systemic risk from private credit?

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.24% | S&P 500 +0.67% | Dow +0.38% | Russell 2000 +0.36%

FIXED INCOME: Barclays Agg Bond +0.03% | High Yield +0.20% | 2yr UST 4.279% | 10yr UST 4.501%

COMMODITIES: Brent Crude +1.86% to $76.05/barrel. Gold +1.63% to $2,934.8/oz.

BITCOIN: +1.52% to $97,251

US DOLLAR INDEX: +0.26% to 108.325

CBOE TOTAL PUT/CALL RATIO: 0.79

VIX: -4.41% to 15.81

Quote of the day

“Don't call me lucky. I failed more times than you tried.”

- Unknown

Systemic risk from private credit?

Higher and differentiated returns have led to a flurry of investors entering the Private Credit market over the last 10-15 years.

At the same time, this fast-growing segment of the financial system has caught the attention of regulators, many of whom are worried it may lead to greater systemic risk for our banking system.

Are these concerns over a Private Credit systemic issue warranted?

But first, let’s back up a minute.

When a company needs to secure financing for general operations, it can:

go to a local bank (often a community or regional presence)

access the public credit markets, or…

seek financing through a non-bank lending institution → this is known as “Private Credit”

Having many different financing avenues available for businesses is good for economic growth, job creation, and financial stability.

Since the Global Financial Crisis (GFC) ended in 2009, regulations expanded and capital reserve requirements grew to the point that the demand for credit far outstripped the supply available from banks. As a result, Private Credit filled the void and the industry has undergone explosive growth.

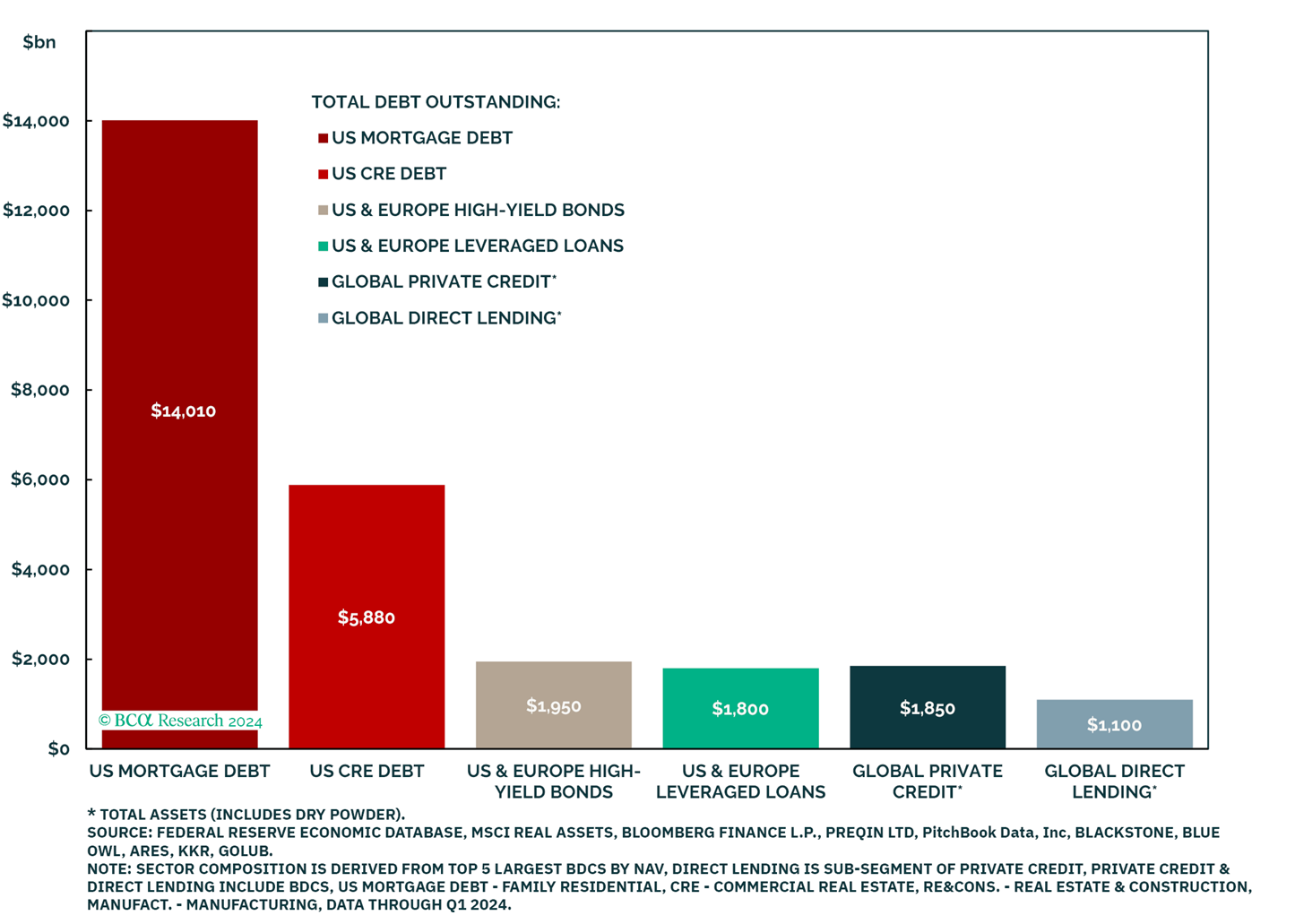

Over the last twenty years, Private Credit has grown from 1.7% of the total credit market up to 6.6%.

Unlike the systemic risk witnessed during the GFC, where the collapse of the U.S. residential real estate market triggered widespread losses through leveraged subprime loans and interconnected derivatives, Private Credit does not yet pose a comparable threat.

At $1.5-$2T, the market size of Private Credit is just a fraction of the U.S. family residential mortgages outstanding at $14T. Also, keep in mind the total market cap of the global bond market is estimated to be $150T.

Another important consideration here are the composition of the lenders themselves.

Lenders form very close relationships with its borrowers, build in stronger covenants to their contracts, and administer more sophisticated risk management controls. This roadmap leads to low default measures for the Private Credit market.

Another common yet overblow concern is the belief that Private Credit will trigger a liquidity event.

The Private Credit market's stability is anchored by its institutional investor base and fund structures, with over 80% of loan assets held in closed-end vehicles. Unlike banks, which can face forced liquidations due to deposit flight (à la the regional banking crisis in 2023), these institutional investors are structured to hold positions to maturity.

Contrary to common perception, Private Credit typically represents less than 5% of institutional portfolio assets. This is important because in a time of a liquidity crunch, other levers will be pulled.

The expanding footprint of private credit – and the associated migration of trillions of dollars of assets from bank to nonbank balance sheets – represents opportunity for asset managers and investors alike.

Careful monitoring of short-term risks is still necessary and prudent, particularly in the event of an economic downturn in which a range of loans across different sectors of the credit market become distressed.

Yet, the foundational elements for Private Credit to pose systemic risk to the market – as measured by size, default rates, and liquidity – seems unfounded at this point.

Sources: Apollo, Bloomberg, BCA Research, McKinsey

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: