Productivity remains a key growth driver in the United States

The Sandbox Daily (10.9.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

AI and labor productivity

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.15% | S&P 500 -0.28% | Dow -0.52% | Russell 2000 -0.61%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield -0.29% | 2yr UST 3.599% | 10yr UST 4.144%

COMMODITIES: Brent Crude -1.63% to $65.17/barrel. Gold -1.95% to $3,991.2/oz.

BITCOIN: -1.93% to $120,936

US DOLLAR INDEX: +0.50% to 99.405

CBOE TOTAL PUT/CALL RATIO: 0.76

VIX: +0.80% to 16.43

Quote of the day

“Don’t sweat the small stuff. And it’s all small stuff.”

- Richard Carlson

Productivity remains a key growth driver in the U.S.

From a productivity perspective, the U.S. economy remains in the early innings of AI adoption.

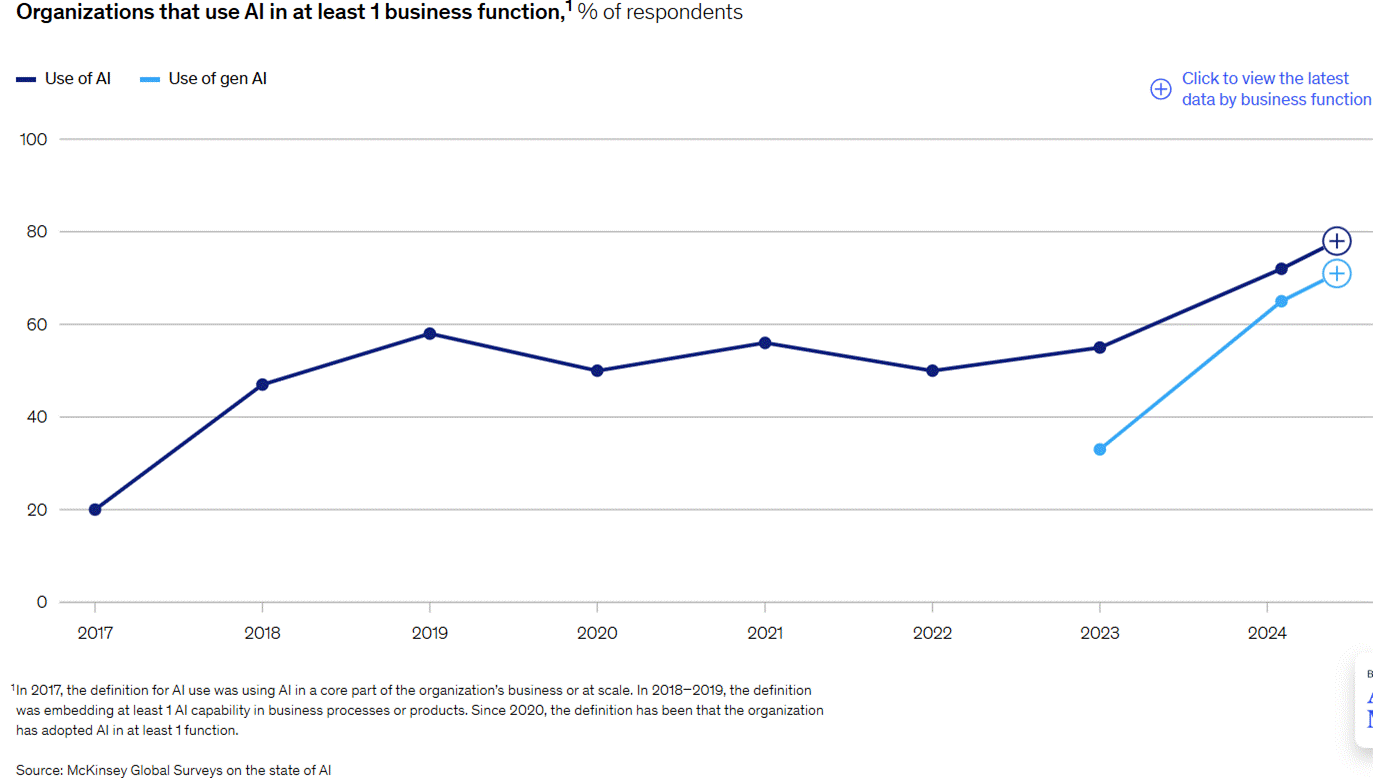

Surveys show that many companies are experimenting with AI. A 2024 McKinsey survey showed that nearly 80% of companies had used AI in at least one business function.

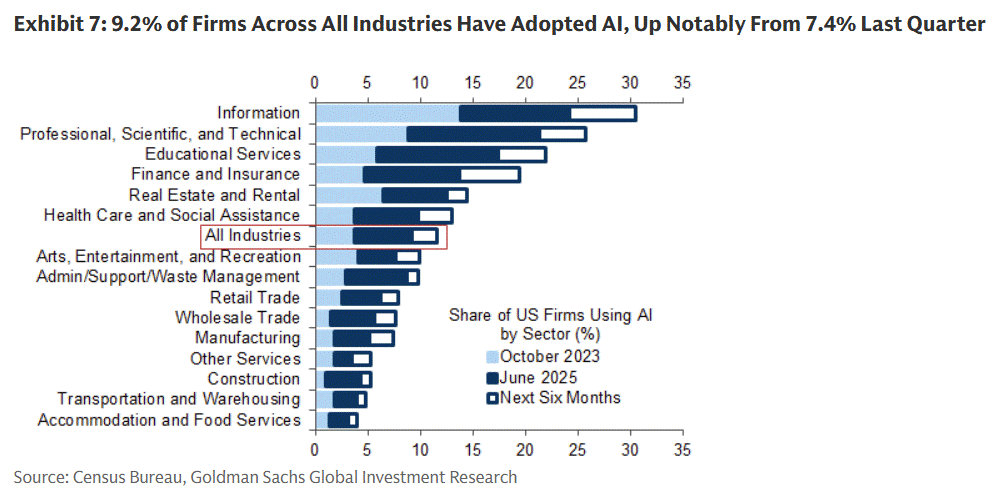

But, based on the Census Bureau survey, only 9% of U.S. companies currently use AI to produce goods and services, versus 7% in Q1.

AI adoption is higher among large firms (15% for firms with 250 employees or more) and in select industries (Information, Finance, Science, etc.).

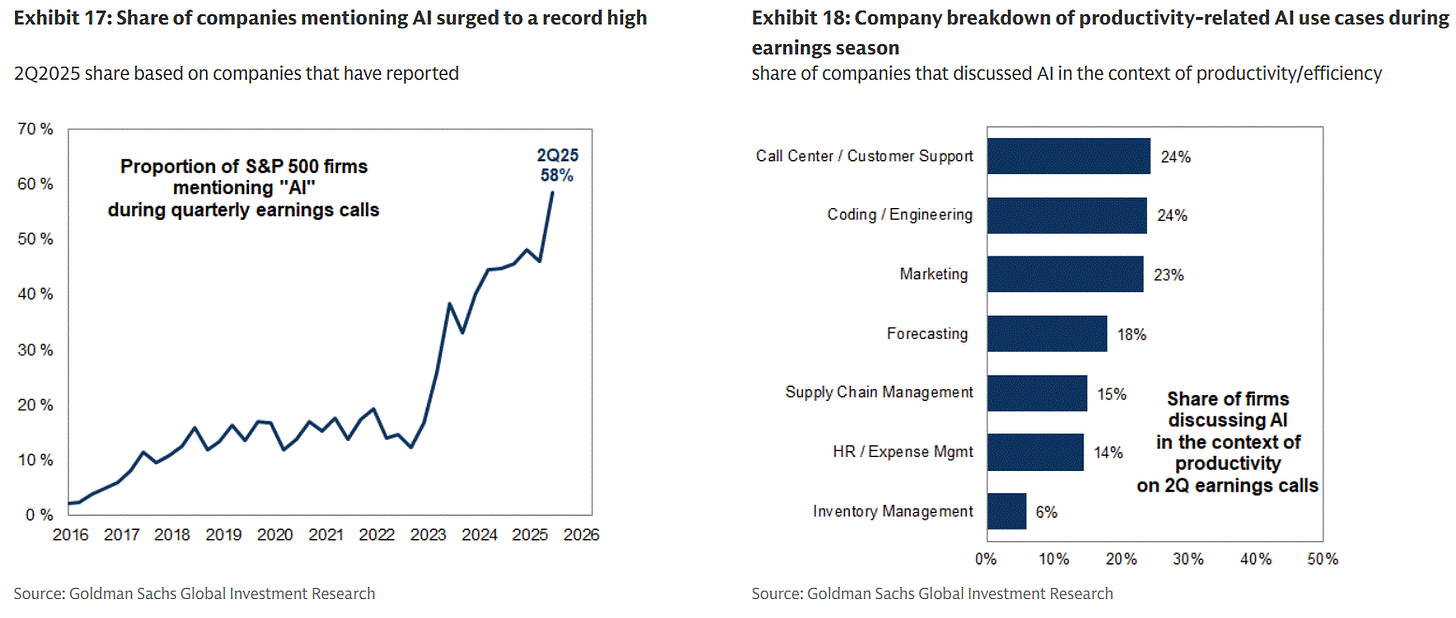

Company commentary shows that many S&P 500 firms are starting to describe specific AI use cases in their businesses.

In the most recent earnings season, nearly 60% of companies in the S&P 500 mentioned AI on their earnings calls. Of the companies mentioning AI, 24% discussed using AI within the context of call centers and customer support, 24% related to coding and engineering, and 23% mentioned marketing.

Quantifying the impact of AI remains limited as its still early innings. Few companies are formally reporting/linking the technology to near-term margins or earnings.

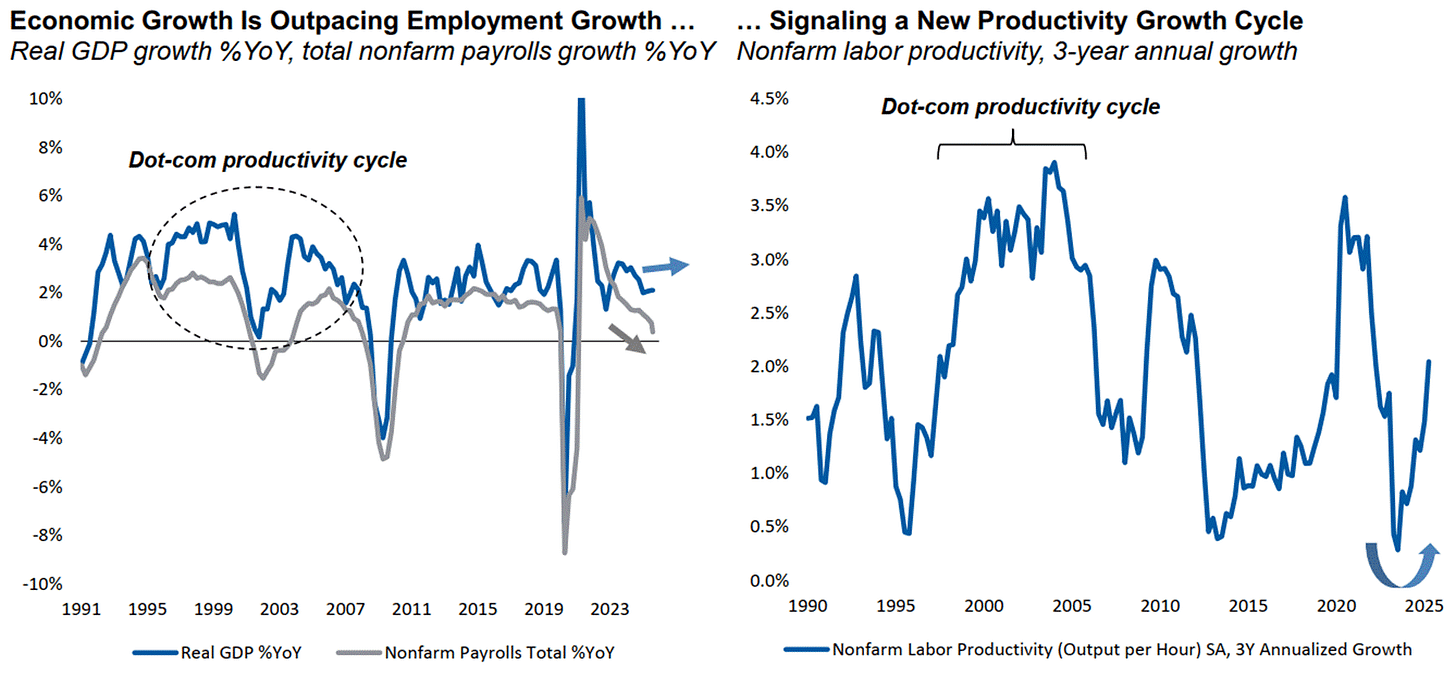

What we do know is broader-based economic growth has outstripped various measures of employment growth, which indicates continued growth in labor productivity – most likely from technological gains in which AI is a contributing factor. To what degree remains to be seen.

This is what economists call “total factor productivity,” or TFP for short. The basic idea being that because new technologies allow workers and firms to produce more for a given set of inputs, economists think of TFP as the contribution of technological innovation to output.

Remember, higher productivity increases economic potential growth, which in turn can support higher profit margins and valuation multiples.

Sources: McKinsey, Census Bureau, Goldman Sachs Global Investment Management, Eaton Vance

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)